The nearby NYMEX crude oil futures price reached a fourteen-year high in March 2022 after Russia invaded Ukraine. After running out of upside steam at $130.50 per barrel, the continuous contract fell to $63.57 in May 2023, where it reached a bottom.

Crude oil consolidated around the $70 level in June before taking off on the upside in July and early August. At nearly $83 per barrel on August 6, NYMEX futures are within striking distance of a price that will negate the bearish trend that had pushed prices lower for fourteen months.

Close to a technical breakout

NYMEX crude oil futures have made lower highs and lower lows since trading at a fourteen-year $130.50 high in March 2022.

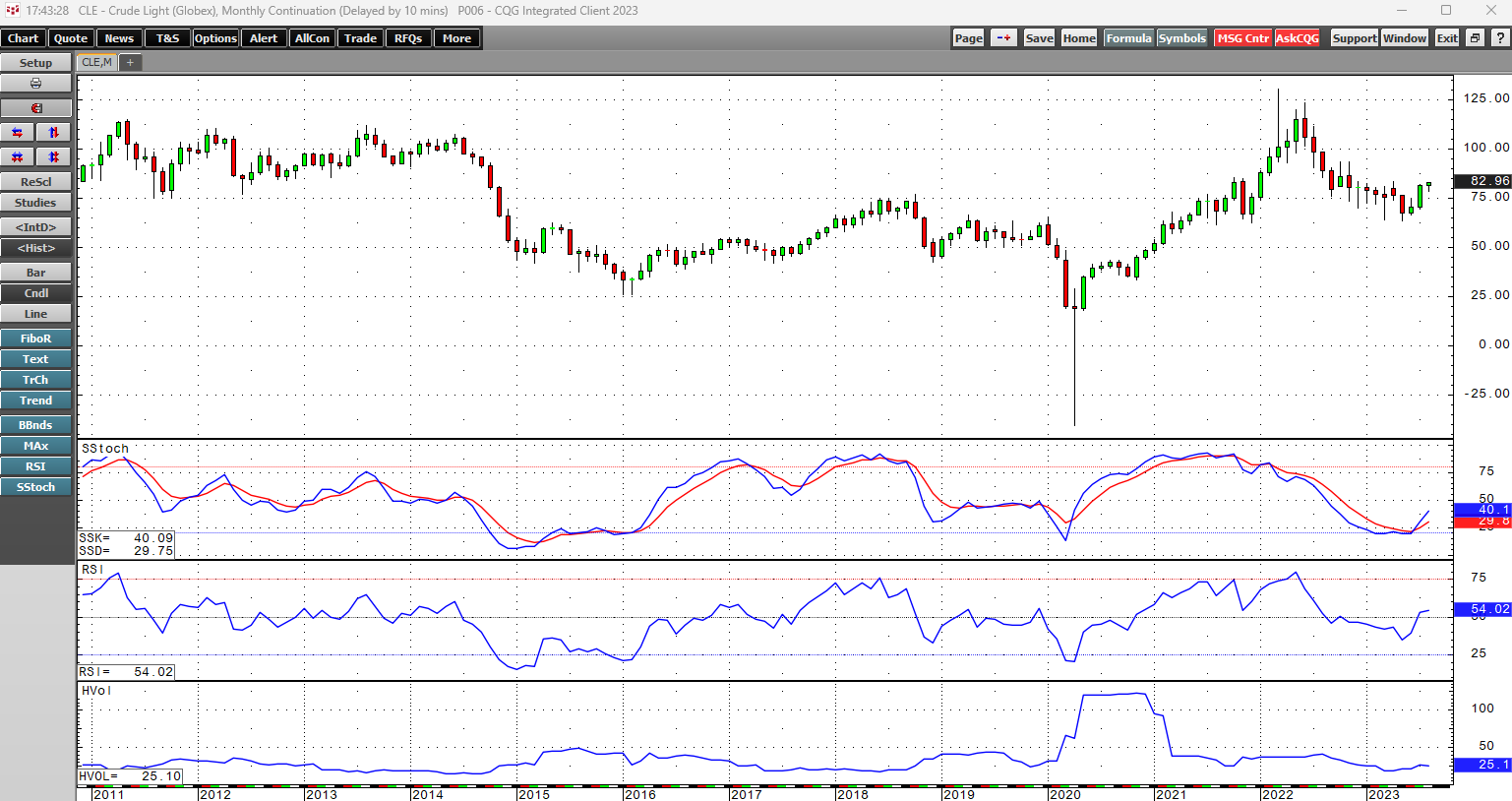

The monthly chart highlights the bearish pattern over the past seventeen months. The NYMEX crude oil futures reached a $63.64 low in May 2023.

The most recent lower high was in April 2023 at $83.53 per barrel. On August 6, the price reached $83.30, only 23 cents shy of the latest lower peak. A break above that level will end the bearish pattern and could lead to follow-through technical trend-following buying. The slow stochastic and relative strength index suggest that crude oil prices have been in a bullish trend since the May 2023 low. Monthly historical volatility at just over 25% has been moving higher.

Saudi Arabia extends production quotas

Saudi Arabia is the most influential member of OPEC, the international oil cartel. The Saudis require a price above the $80 per barrel level to balance the domestic budget.

Meanwhile, Saudi Arabia has cut production, citing global economic concerns and weak demand from China. Last week, the Saudis extended the production cuts through September, sending oil prices higher.

OPEC has become a far more influential factor in global oil prices since U.S. energy policy shifted from supporting production to addressing climate change. The Biden administration’s policy is to increase alternative and renewable fuel output, inhibiting hydrocarbon production and consumption. The U.S. shift handed more pricing power to the Saudis and other OPEC members. The cartel’s mission is to achieve the highest possible petroleum prices that balance worldwide supply and demand.

An economic weapon for Moscow

Since 2016, Russia, one of the world’s three leading oil-producing countries in 2023, has been the most influential non-OPEC member, cooperating with the cartel’s production policies. Production decisions have been a function of negotiations between Riyadh and Moscow.

In 2022, Russia’s invasion of Ukraine, sanctions on Russia, and Russian retaliation made crude oil production policy a weapon for Moscow. The war pushed prices to the highest level since 2008 at over $130 per barrel. Moreover, gasoline and distillate fuel prices rose to all-time highs.

As the war in Ukraine continues to rage, crude oil has become an economic weapon for Russia, with cooperation from Saudi Arabia, as the alliance between China, a top consumer, has bifurcated the world’s leading nuclear and economic powers.

SPR - A missed opportunity

In response to the highest oil prices since 2008, the Biden administration released an unprecedented level of the United States Strategic Petroleum Reserves to put downward pressure on oil and oil product prices. The sales pressured prices that fell to below $64 per barrel, less than half the level at the high, on the recent low. However, the U.S. SPR fell from over 600 million barrels in late 2021 to 346.8 million barrels as of July 28, the lowest level in four decades.

In October 2022, the U.S. Administration released a Fact Sheet stating, “The Administration intends to repurchase crude oil for the SPR when prices are at or below about $67-$72 per barrel, adding to global demand when prices are around that range.”

The weekly chart illustrates the NYMEX oil price dropped into and below the administration’s target buying range in March, May, and June 2023. While the October 2022 Fact Sheet stated intentions to purchase oil to replace SPR sales, the Department of Energy continued to sell, pushing the reserves lower. At above $82 per barrel in early August, the price is far above the target range, causing the administration to withdraw the plans to buy six million barrels for the SPR earlier this month.

The trend in crude oil futures has turned higher, and the SPR has decreased over the past months. The administration’s target zone now provides fundamental support for oil prices, while OPEC and Russia seem determined to push prices higher toward the $100 per barrel level or higher. As prices rise, the administration has few bullets left to combat rising oil prices, with the SPR at its lowest level since the early 1980s.

Levels to watch

Crude oil is a highly volatile energy commodity. The price imploded as the global pandemic wreaked havoc on the worldwide economy and exploded with Russia’s invasion of Ukraine.

The chart highlights the move to a record low below zero in April 2020 that established a bottom and led to the rally to $130.50 in March 2022, $16.77 shy of the 2008 $147.27 record high.

Technical support for crude oil stands at $63.64, the recent low, but the administration’s plan to buy for the SPR could result in higher fundamental support and a higher low. On the upside, the first resistance level is nearby at $83.53. Above there, the November 2022 $93.74 high is the next upside target. While $100 is a psychological barrier, $123.68, the June 2022 high, and $130.50, the April 2022 high, are the next significant technical upside levels.

The trend is always your best friend in markets across all asset classes. Crude oil’s path of least resistance turned high in May at under $64 per barrel, and fundamental and technical factors support the end of the bearish trend and a continuation of higher highs over the coming weeks and months.