The silver bulls had reason to cheer in May as the second-leading precious metal and highly speculative silver futures market reached a significant milestone.

Technical resistance for the continuous COMEX silver futures contract was at the February 2021 $30.35 high. Silver futures rose above the level to the highest price in over a decade.

The case for higher silver prices is compelling as the precious metal is a highly speculative financial and industrial commodity. The technical break could mean that a herd of speculators will descend on the silver market, as the upside targets now are at the 2011 and 1980 peaks.

A technical breakout

Nearby COMEX silver futures remained below the $30 per ounce level for over three years until breaking out to the upside in May 2024.

The monthly chart highlights silver's $30.35 February 2021 peak, which stood as technical resistance until May 2024. At the most recent high, the continuous futures contract reached $32.50 and was above the $31.50 level in late May. Silver traded at its highest price since December 2012, an over-decade high.

Silver is far more volatile than gold

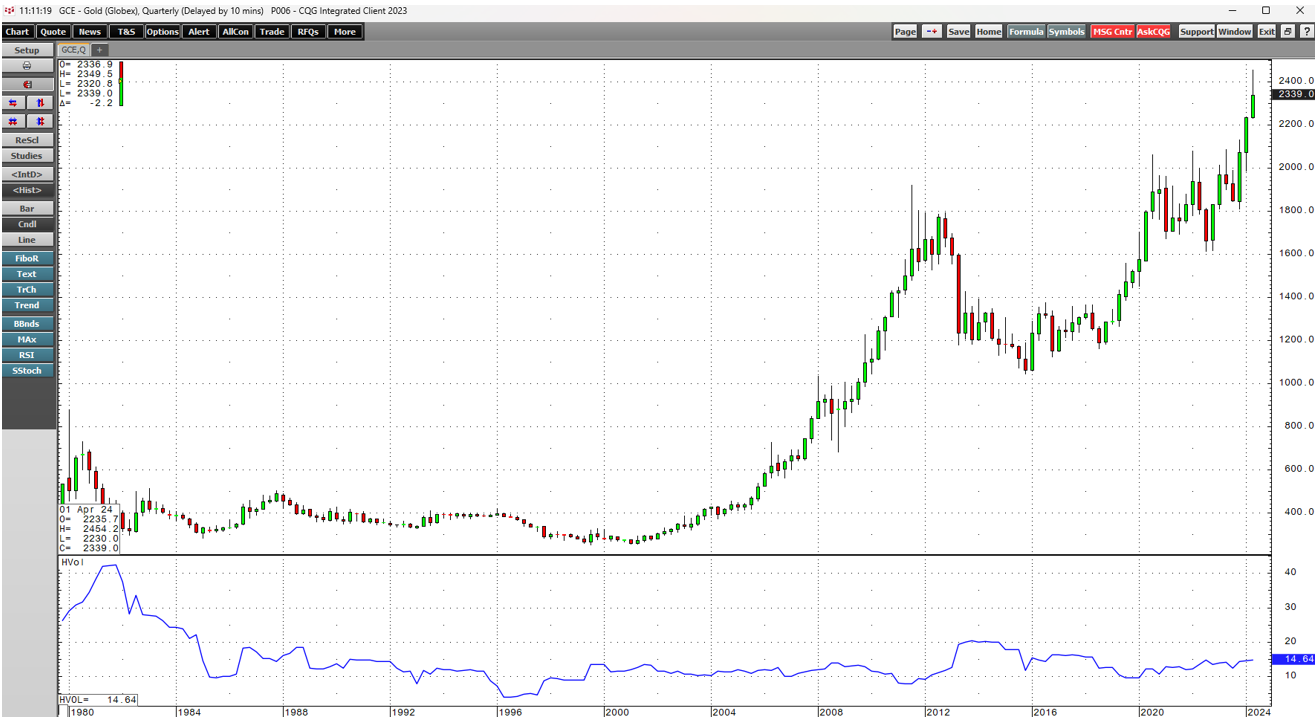

Gold is the leading precious metal that has been in a bullish trend for a quarter of a century.

The quarterly chart highlights gold's two-and-one-half-decade ascent. Meanwhile, quarterly historical volatility at 14.64% tends to be more volatile than currencies but less volatile than most commodities, making gold a hybrid asset.

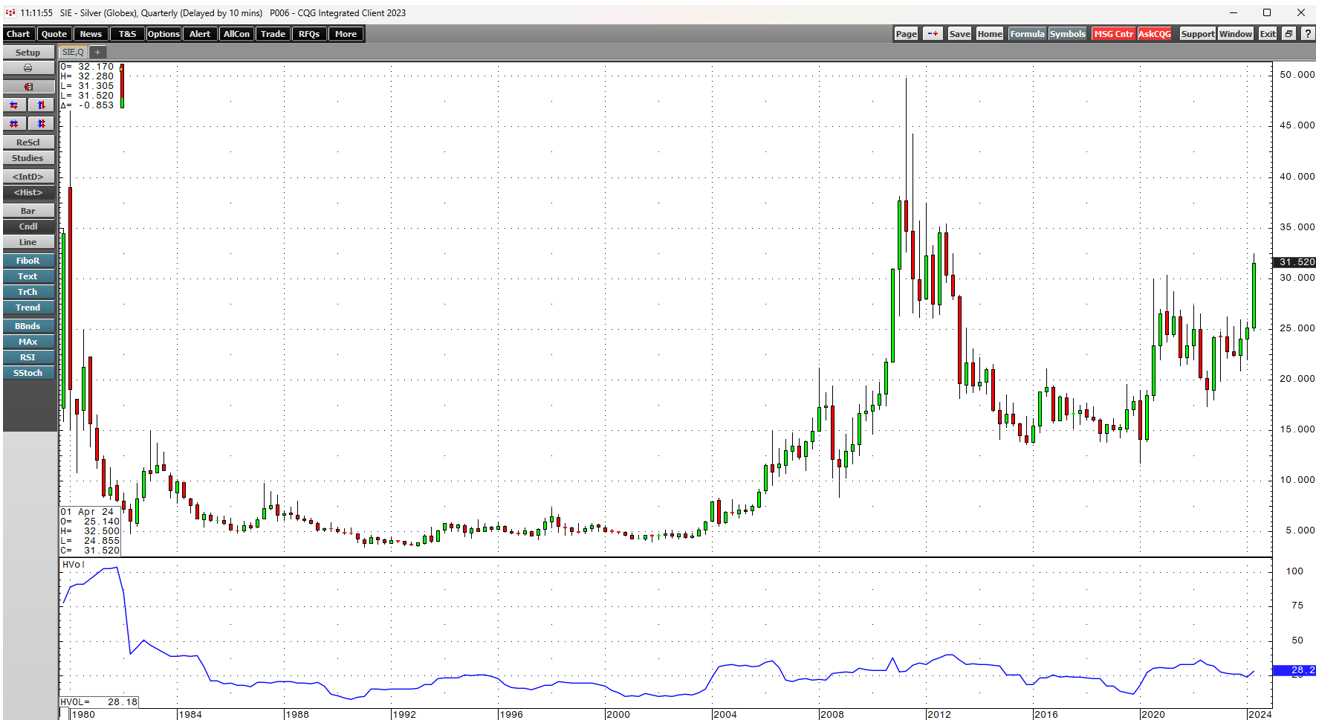

The quarterly silver chart illustrates a more extreme and choppy trading pattern, leading to a nearly double price variance metric at 28.2% compared to gold.

Silver's boom-and-bust price action led to a rally from $1.79 per ounce in 1972 to $50.36 in 1980. The price fell to a $3.5050 low in 1991 and rallied to a lower $49.82 peak in 2011. The latest correction took silver to 11.74 per ounce during the pandemic-inspired 2020 selling.

Over the past decades, silver has made lower highs and higher lows, which is a long-term consolidation pattern. Support is at the 2020 bottom, with the technical resistance at the 1980 high.

Speculative interest is likely to push silver highs

Speculators flock to the silver market for three compelling reasons:

- Silver is less expensive than gold on a per ounces basis and tends to follow the path of least resistance of gold prices in the long term.

- Gold and silver have been means of exchange for thousands of years, long before fiat currencies.

- Silver's penchant for volatility means a technical break on the up, or downside causes trend-following traders and investors to hop on a trend.

The recent technical breakout in silver could set the stage for a rally that challenges the 2011 and 1980 highs.

The fundamentals and the technical case of the precious metal

While technical factors often cause market participants to flock to a market, silver fundamentals only complement the upside break and make for a compelling case for more gains.

- Global silver consumption in 2023 was around 36,000 metric tons. While consumption declined 6% from 2022, it significantly outpaced production.

- In January 2024, The Silver Institute, projected the fourth consecutive year of a "structural market deficit" in silver. The Institute projected a deficit of 176 million ounces (5,475 metric tons) after a deficit of 194 million ounces (6,035 metric tons) in 2023.

- The deficits and a technical upside break in the silver market will likely lead to increasing investment and speculative demand, which could drive the shortfall between supply and demand even higher over the coming weeks and months.

- Investment demand is the critical factor for the path of least resistance of silver prices, and the technical breakout could turbocharge investment demand.

The bottom line for silver in late May 2024 is that technical and fundamental factors have aligned, making for a robust case for higher prices.

Levels to watch in the silver market

The May 2024 technical bullish breakout in the silver market has changed the market's dynamics and expectations.

The monthly chart shows technical resistance for the silver futures market at the most recent $32.50 high. Above there, the targets are $35.445, the October 2012 high, $37.48, the February 2012 high, $44.275, the August 2011 peak, and $49.82 per ounce, the April 2011 high. The April 2011 peak is a gateway to a challenge of the January 1980 $50.36 record high.

Meanwhile, technical support now stands at the March 2022 $27.31 high, a resistance level from March 2022 through March 2024 that has become technical support for the silver bullish trend.

Even the most aggressive bull markets rarely move in straight lines. However, gold, copper, cocoa, and orange juice futures have recently reached new record peaks. A herd of speculative and investment silver buyers could add silver to the list over the coming months, as the precious metal could be set for a dramatic rally.