While the United States and Europe are addressing climate change with green energy policies, India and China, the world's most populous countries, have not joined the green revolution. Moreover, crude oil remains the most ubiquitous energy commodity powering lives worldwide. Burning natural gas and coal continues to generate electricity and provide power.

Crude oil and other hydrocarbons are on the ballot in the November 2024 U.S. election, which could determine petroleum prices over the coming years. Nearby NYMEX WTI crude oil futures are below the $80 per barrel level, which could be the calm before a volatile storm over the coming months.

Crude oil prices have declined - the U.S. SPR remains low

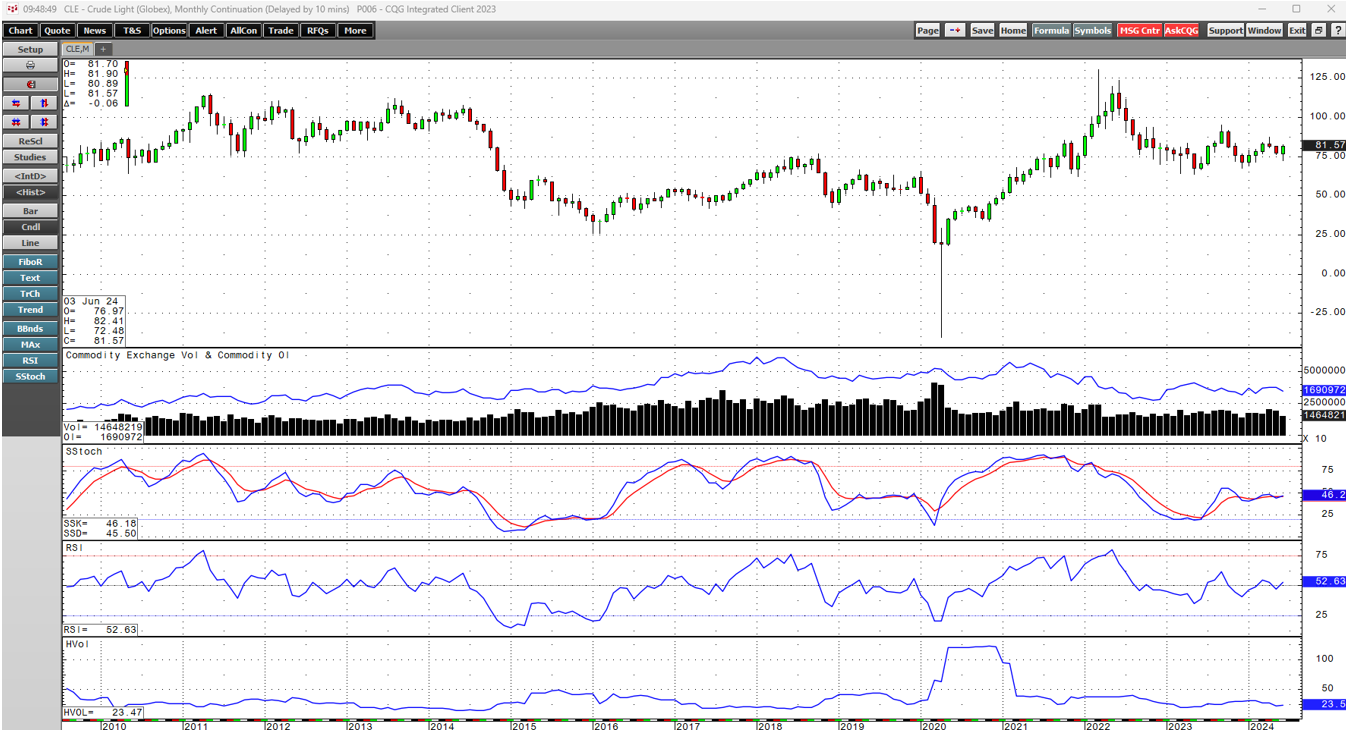

After reaching a 2024 $87.67 high in April, the continuous NYMEX crude oil futures contract declined.

The chart highlights the pattern of lower highs since NYMEX crude oil futures reached their highest price since 2008 when Russia invaded Ukraine in early 2022. Over the past years, the trading range has narrowed from $33.42 in 2022 to $31.39 in 2023 and $18.39 per barrel so far in 2024. The narrowing range signifies price consolidation. While crude oil has made lower highs since early 2022, the lows have been higher since May 2023.

The U.S. administration sold unprecedented crude oil barrels from the Strategic Petroleum Reserve to cap petroleum prices since the beginning of the war in Ukraine. At 370.9 million barrels as of June 14, the U.S. SPR is 43.5% below the June 2020 656 million barrel peak. While the administration has been slowly replacing SPR barrels, it does not have the same availability to sell the energy commodity if the price spikes higher over the coming months.

The potential for a significant bottom before November volatility is rising

The May 2023 $63.64 per barrel low appears to be a significant bottom in the NYMEX crude oil futures as the price has made higher lows over the past year. The oil market is now entering the peak driving season, where gasoline demand tends to increase, supporting oil prices. OPEC+ recently extended its production cuts into 2025. Even though U.S. production is at 13.2 million barrels per day as of June 7, the potential is for higher prices over the coming months.

Another four years of the current administration would likely support prices

With the future of U.S. energy policy on the November 2024 ballot, the winner of the Presidential contest is a significant factor for crude oil's path of least resistance. The incumbent administration favors inhibiting fossil fuels and supporting alternative and renewable fuels, leaving OPEC+ in a dominant pricing position as the world relies on crude oil for power.

A return to the $40 level under the former President

The opposition Republican party and the former President favor a "drill-baby-drill" and "frack-baby-frack" approach to establishing U.S. energy independence and increasing revenues through exports. A Republican victory in November could increase U.S. output and global supplies, pushing oil prices lower over the coming years. Crude oil could decline to the $40 per barrel level or lower if the former President wins a second term.

Trading crude oil over the coming months is the optimal path

Trading crude oil will likely be optimal over the coming months as the uncertainty of the U.S. election makes it a virtual coin toss. The polls are within the margin of error, making U.S. energy policy uncertain. The most direct routes for a risk position in crude oil are the CME's NYMEX WTI futures and the Brent futures trading on the Intercontinental Exchange. Market participants seeking exposure to the world's leading energy commodity without venturing into the margined and leveraged futures arena can employ the U.S. Crude Oil ETF (USO) and the U.S. Brent Crude Oil ETF (BNO) that track WTI and Brent futures prices, respectively.

I favor the upside over the coming months, but all bets are off later this year as the U.S. election will be the most significant factor for the path of crude oil's price over the coming years.