An election is always a time of uncertainty; however, when an incumbent’s term ends and the election for a new and unknown leader occurs, it often leads to an increase in volatility. The 2016 election was one of the most contentious, hard-fought, and divisive in modern history. On November 8th, the United States elected a real estate developer, businessman, and media star as the forty-fifth President of the nation. The election results were a shocker, but in hindsight, a continuation of the surprise from the Brexit vote in late June. The shock comes from the fact that almost everyone got the election result wrong.

Almost everyone got everything wrong

In the UK, pollsters expected that the nation would remain within the EU; they were wrong. In the US, the pollsters expected that Hillary Clinton would be elected; they were wrong. Market analysts warned that if Donald Trump won, the stock market would tank along with the dollar, and the price of precious metals would explode higher; they were wrong.

In a year of consistency and surprises, the only constant has been how wrong conventional wisdom has been. On the last day of the month, conventional wisdom was that OPEC would not cut production; they did.

The Trump rally in stocks

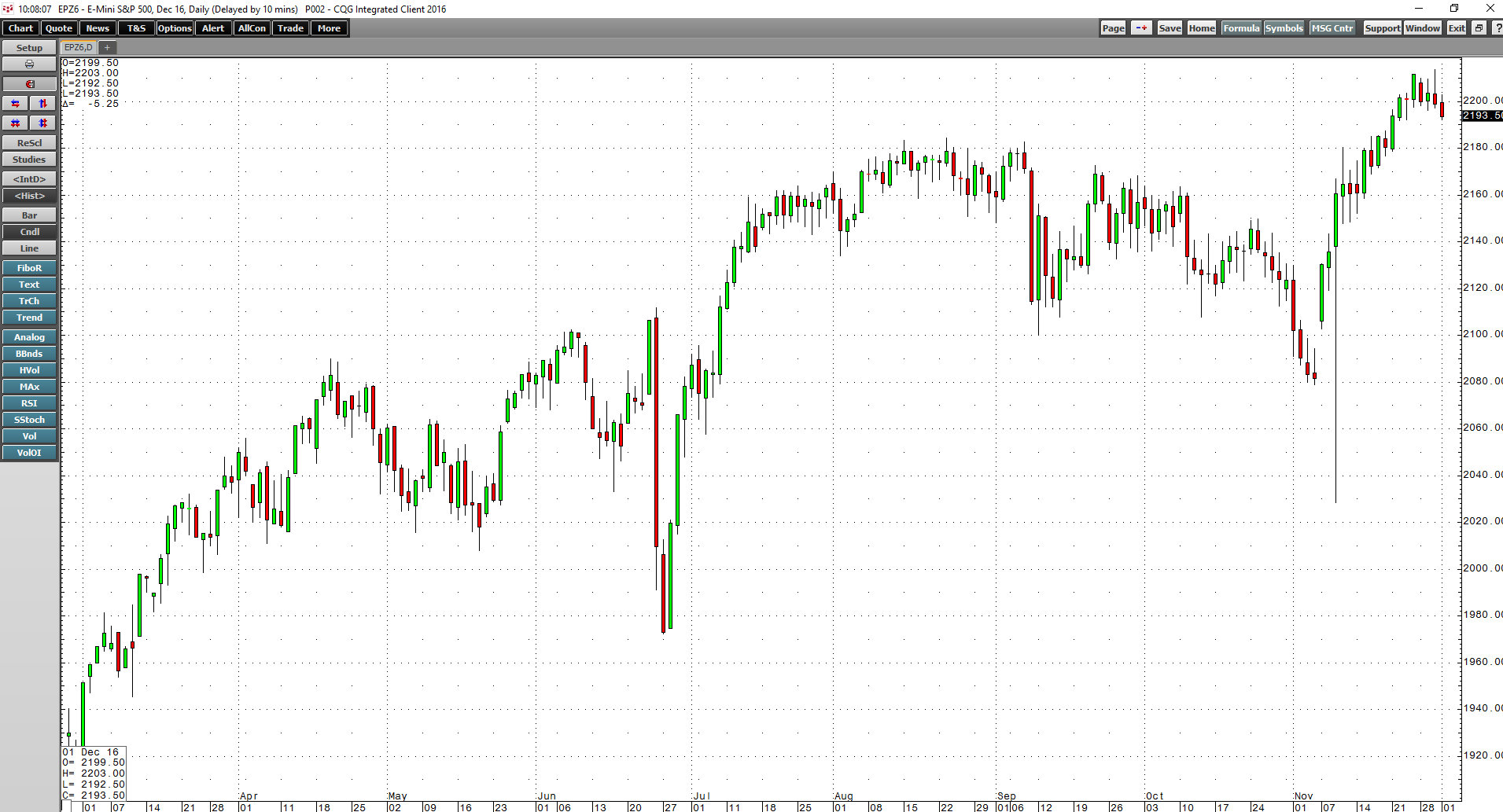

On the night of the election, as the Republican candidate began to pile up states, the knee-jerk reaction of stocks was to move lower in a big way.

As the daily E-Mini S&P 500 index chart highlights, it traded to lows of 2028.50 on the night of November 8th, but closed the next day's session at 2160.50 close to the highs. The index then rallied over the following weeks, reaching a high of 2211.75 on November 25th and closing the month at just under the 2200 level. The Dow Jones Industrial Average appreciated to above 19,000 - a new record high.

The prospects for fewer regulations on financial markets and banks and lower corporate taxes propelled stocks higher. Meanwhile, the dollar exploded higher.

As the December dollar index futures weekly chart illustrates, the greenback rose to new highs of 102.12 on November 21st, in the aftermath of the election. The dollar is now trading at the highest level since 2003 after the technical breakout move to the upside. At the same time, interest rates have moved higher in a move that started in July long before the election. The market is now almost unanimously agreed that the Fed will hike rates by 25 basis points at their upcoming December meeting.

Higher interest rates and a strong dollar make sense; however, the rally in the stock market at the same time is unusual as a bearish bond market tends to lead to lower equity prices. Therefore, a divergence has developed between stocks and bonds. Furthermore, a strong dollar is historically problematic for stocks as it causes multinational companies to suffer as US goods become less attractive and competitive on the world market - another divergence.

Industrial commodities explode higher

Higher interest rates and a strong dollar tend to be bearish for commodity prices. The dollar is the world’s reserve currency and the benchmark pricing mechanism for most commodities. When the dollar rallies, commodity prices rise in other currencies around the world and demand tends to decline, causing raw material prices to drop. When interest rates rise, it costs more to carry commodity inventories. However, when it comes to industrial commodity prices, history and conventional wisdom have been turned on their heads since the election.

The COMEX copper futures weekly chart shows that despite a stronger dollar and rising interest rates, copper broke out of a long-term bear market trend on Election Day. Copper had been making lower highs since 2011, and on November 8th, it finally moved above technical resistance and made a higher high for the first time in over five years. Copper is not the only raw material market that responded to the election of the incoming President. Aluminum, nickel, lead, zinc, tin, iron ore, coal, and many other metals and mineral prices have moved higher over recent weeks.

During the campaign, President-elect Trump called for a massive infrastructure rebuilding project in the United States. Given his experience as a real estate developer, the incoming President promised to become the builder in chief with the biggest project since the Eisenhower administration in the 1950s. Building infrastructure requires raw materials. Since the election gave the new President both houses of Congress, the likelihood is that his project will sail through the legislative branch and become a reality soon into his first term.

Precious metals go the other way

The one sector of the commodities market that responded to market action in other asset classes appropriately has been the actively traded precious metals. While many market analysts predicted gold would explode, it went the other way, falling from $1341 on the February futures contract on election night to just over $1170.

As the monthly chart of COMEX gold futures highlights, the post-election price destruction caused the slow stochastic, a momentum indicator, to turn lower and the price put in a bearish key reversal trading pattern on the monthly pictorial in November.

While the monthly silver chart did not put in the same bearish technical chart pattern, momentum also shifted to the downside.

The same goes for platinum, which struggled to rally after the election and then fell dramatically to the $900 per ounce level. Only one precious metal rallied after Election Day, and that was because it is not so much a precious as an industrial metal.

The NYMEX palladium futures weekly chart shows that the metal has rallied for five straight weeks, adding to gains after the election. While gold, silver, and platinum all depend on investment demand, palladium is an industrial metal that is reliant on the automobile industry for use in catalytic converters in gasoline-powered engines.

2017 is going to be a very interesting and volatile year in markets

We have seen a great deal of divergence in markets following the US election. A continuation of the rally in stocks, now known to many as “The Trump Rally” will depend on the new President’s ability to deliver on promises made during his campaign. However, the move in the dollar was long overdue given interest rate differentials between the US, Europe, and Japan. Meanwhile, with rates going higher, the dollar may have more upside room in 2017.

Many of the new President's policies could have an inflationary effect on the US economy; therefore, it is possible that the Federal Reserve will pick up the pace when it comes to their tightening cycle next year. The 2016 year was a year of uncertainty and fear. A lot of trepidation in markets surrounded the Brexit referendum and the US election. With the results of both known, certainty has returned to many markets, but the volatility of 2016 is likely to continue as divergence rules in the aftermath of the election.