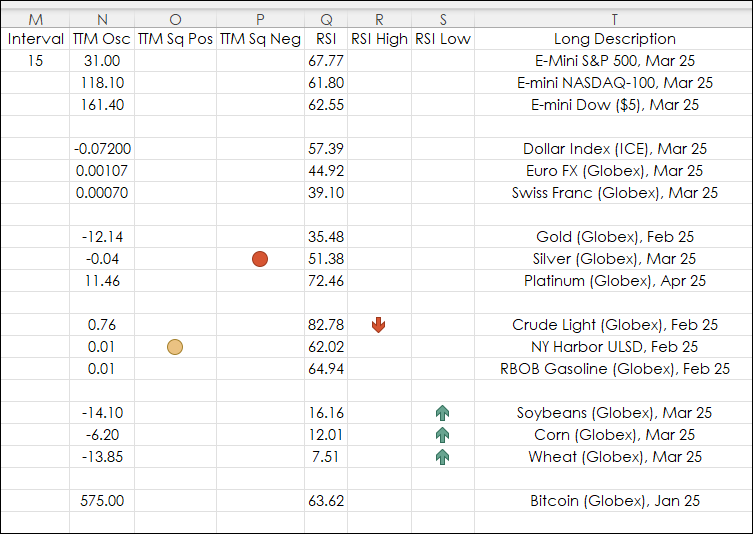

This recent post "Quote Spreadsheet 2.0 TTM Squeeze and More" provided a page installed via a CQG PAC that included a CQG QSS V2 for monitoring the markets. The benefit of the Quote Spreadsheet 2.… more

Excel

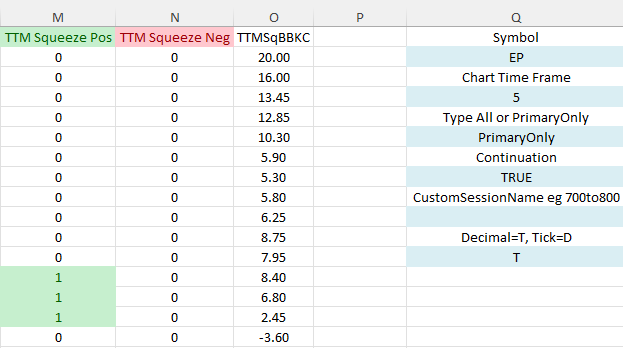

This post "TTM Squeeze Indicator" detailed the TTM indicator, which is a combination of measuring volatility and momentum. The volatility is a condition where the Bollinger Bands contract and move… more

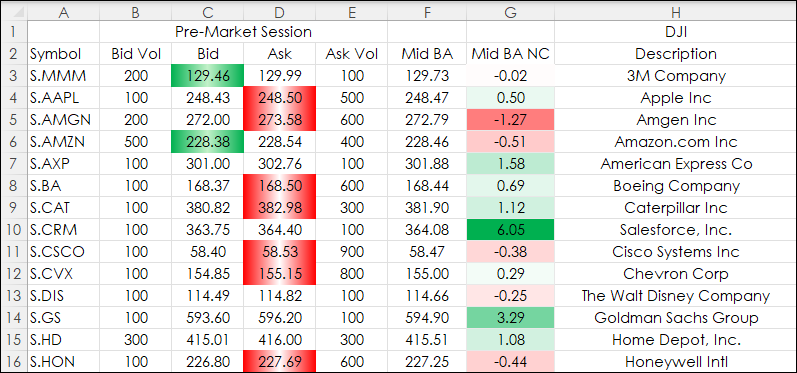

Recent posts detailed observing market data during pre-, current, and post-market sessions. The post View Pre and Post Sessions for Stocks detailed the steps to displaying a chart that included… more

This post, View Pre and Post Sessions for Stocks, detailed creating a custom session in CQG IC or QTrader to view on a chart pre-market and post market Bid and Ask activity for stocks.

… more

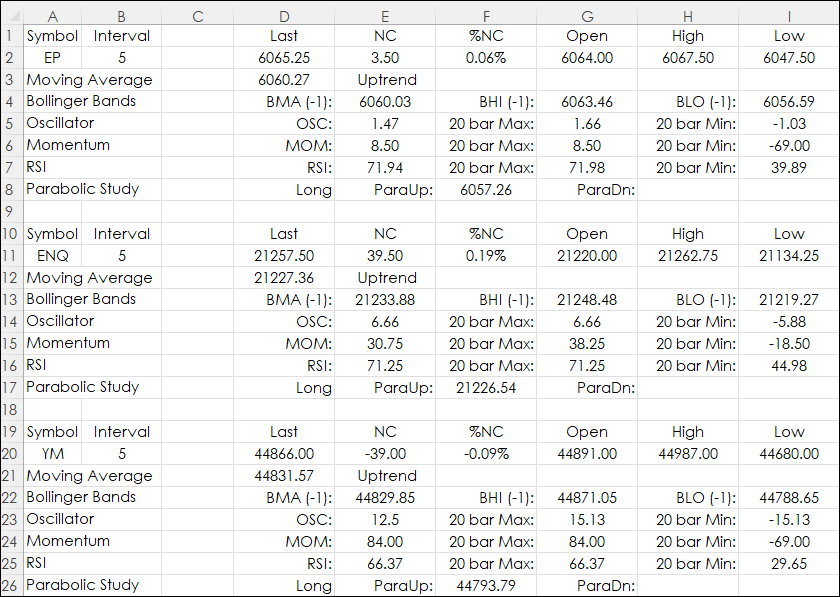

Excel users with RTD links to both market and study data can design a real-time dashboard that can monitor a portfolio of instruments and the status of various studies. This is the topic of this… more

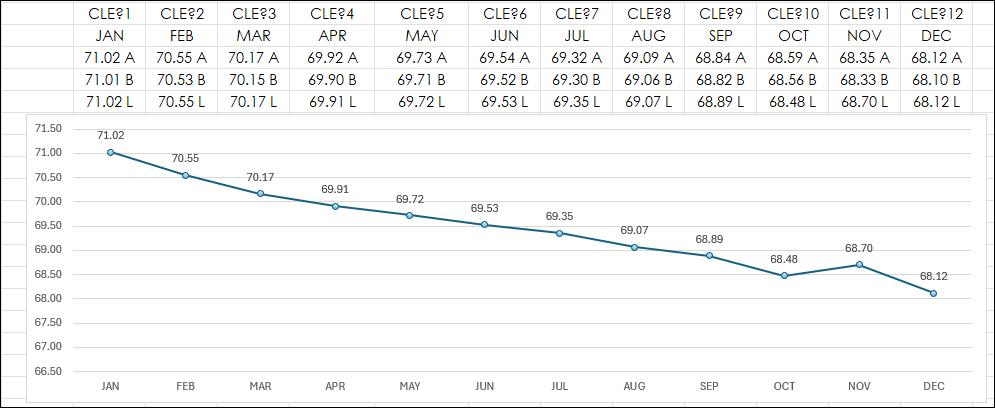

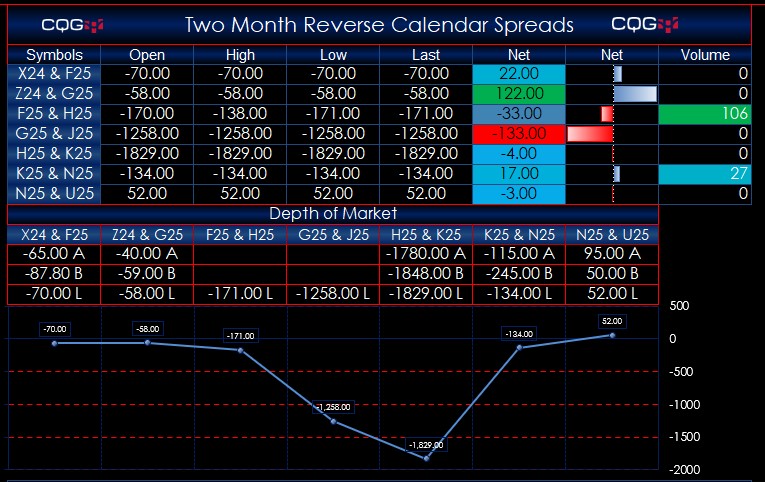

Traders who look to forward curves for analysis can create forward curves using Excel RTD calls. This post details some ways to create forward curves and some "tricks" to make the forward curves… more

The forward curves dashboard displays futures contracts White Maize (symbol: WMAZ), Yellow Maize (symbol: YMAZ), Wheat (symbol: WEAT), Soybeans (symbol: SOYA), and Sunflower Seeds (symbol: SUNS),… more

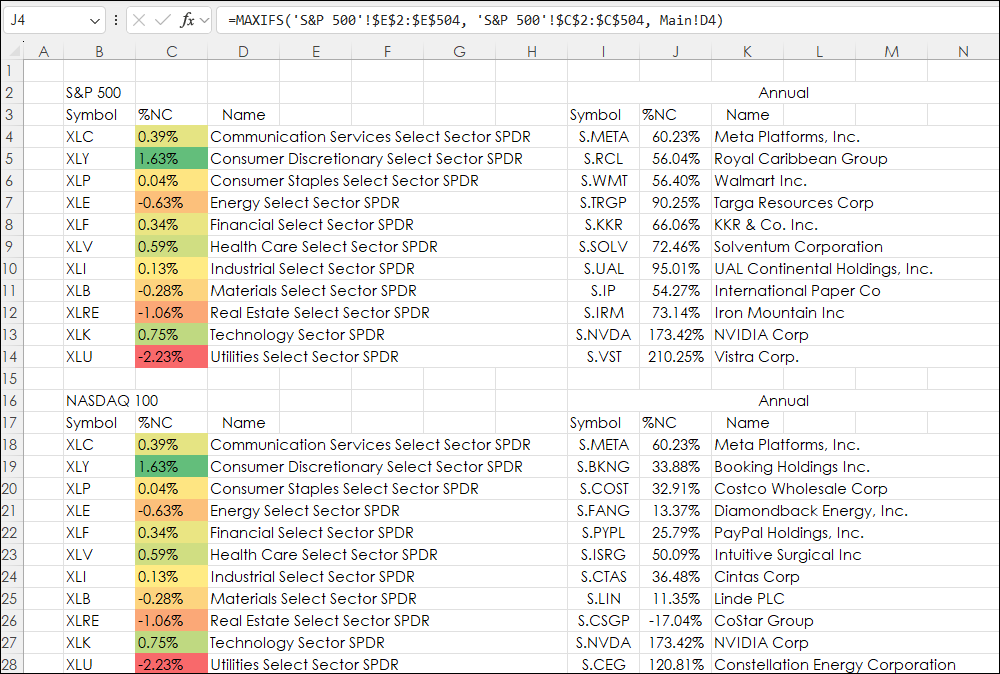

The Excel MAXIF function returns the maximum value from a range of cells and a criteria range. For example. The downloadable sample at the bottom of this post is determining the best performance… more

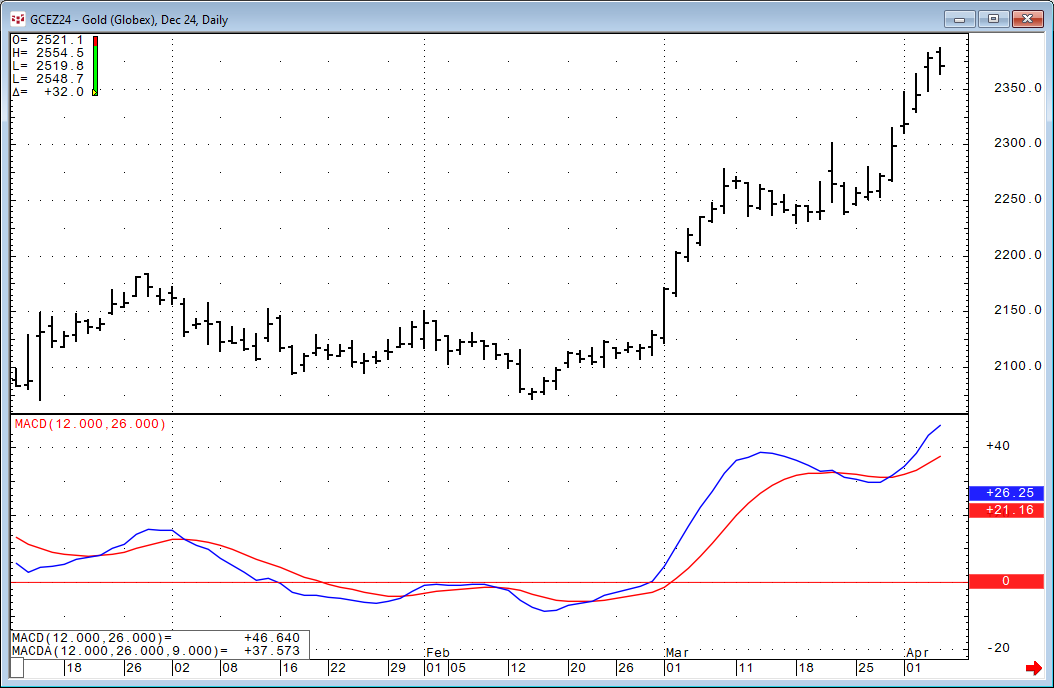

The Moving Average Convergence/Divergence indicator (MACD) was invented by Gerald Appel over 40 years ago. The study is an unbounded oscillator with two lines: MACD and MACDA.

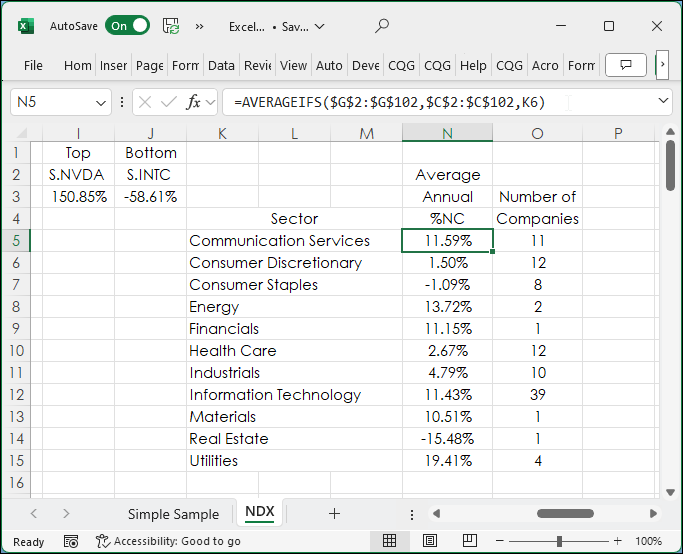

MACD =… moreThis posts details the use of two Excel functions: AVERAGEIFS and COUNTIFS. To start, a simple example of using the AVERAGEIFS function is presented.

In the image below column cells A2:A10… more