Natural Gas

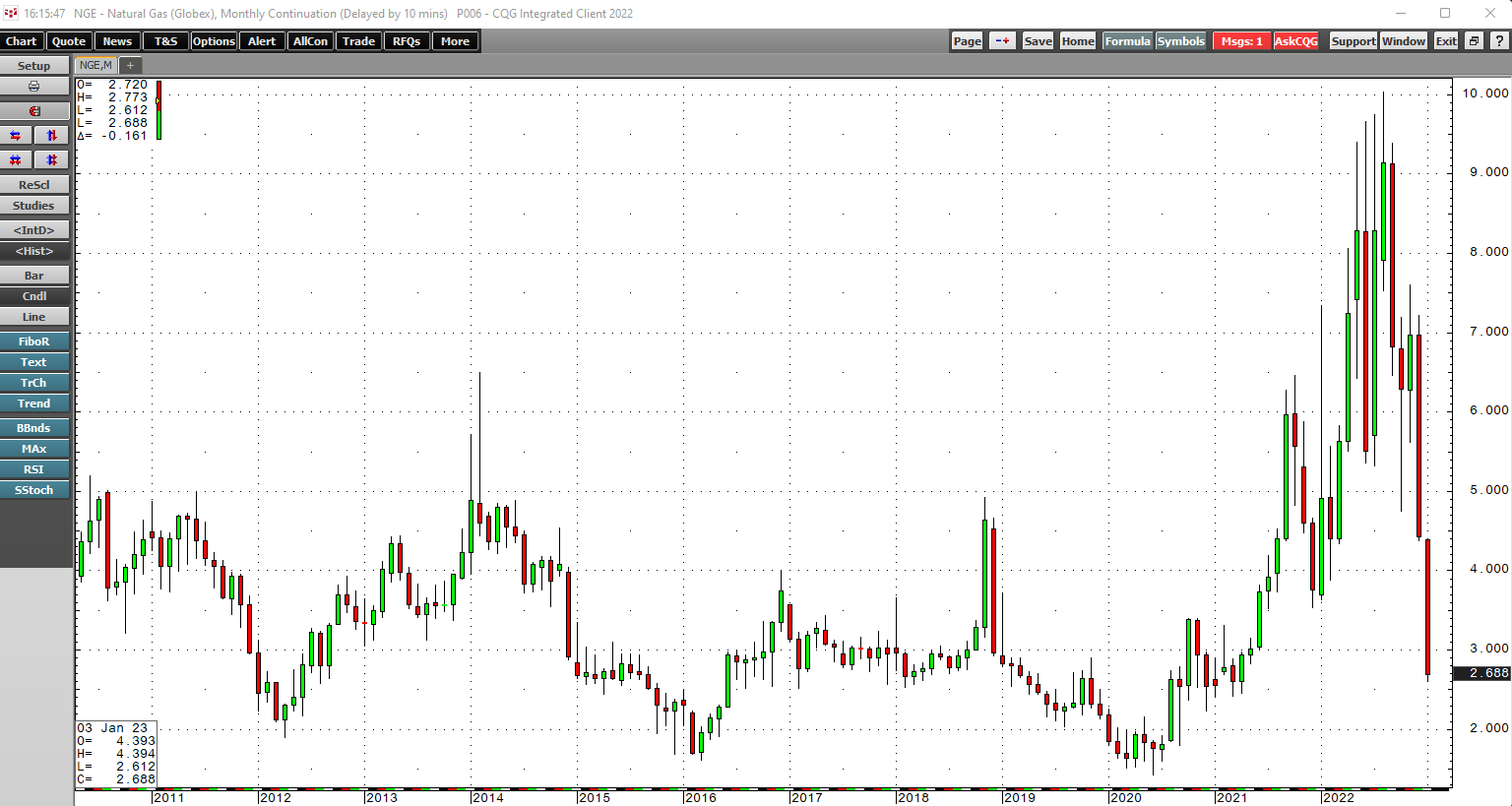

In August 2022, nearby NYMEX natural gas futures prices rose to the highest level since 2008 at over $10 per MMBtu. The rally caused by the war in Ukraine lifted European prices to record highs,… more

In 1990, the New York Mercantile Exchange, a leading energy futures market, introduced futures contracts on U.S. natural gas for delivery at the Henry Hub in Erath, Louisiana. The price opened at… more

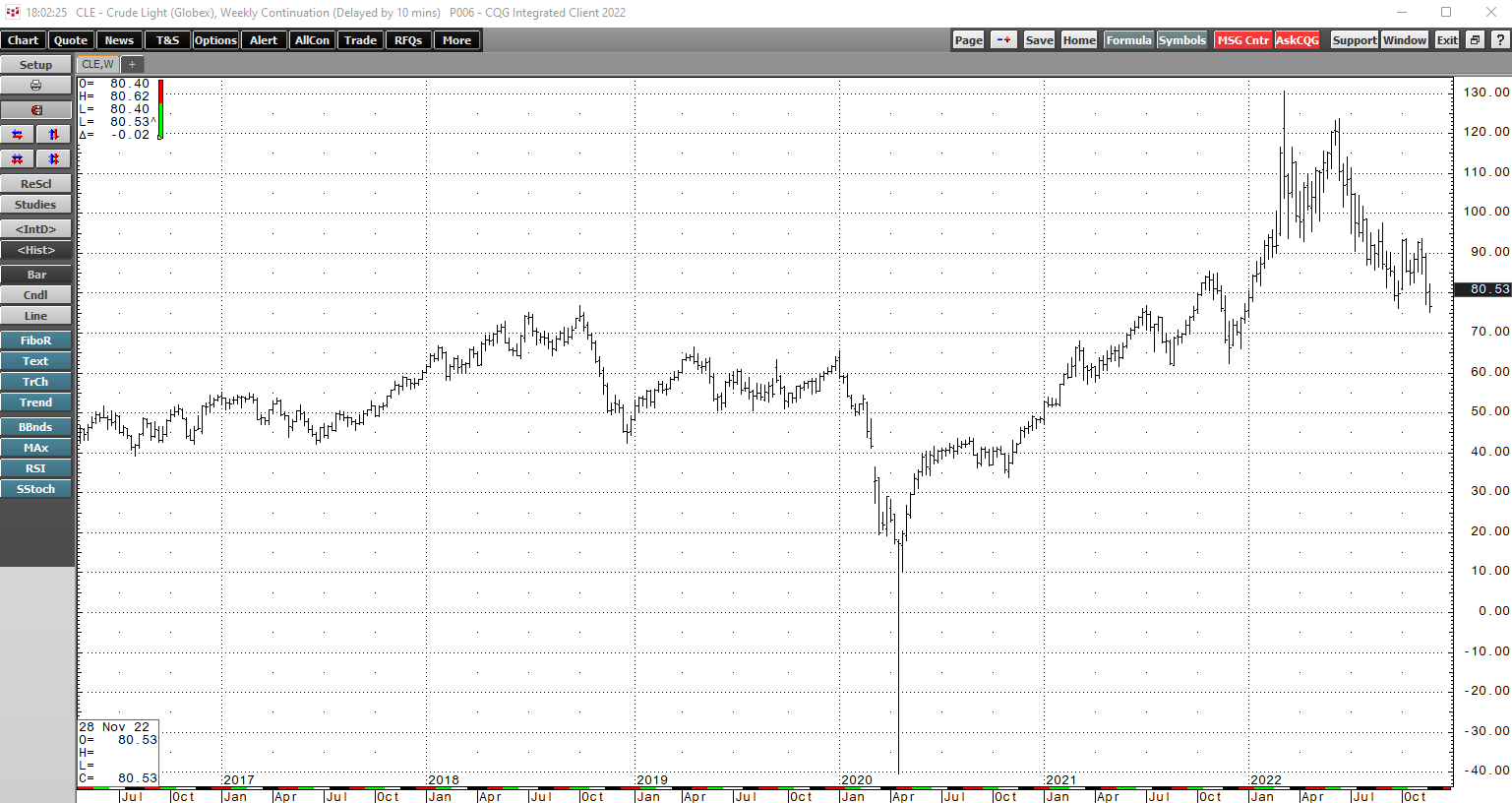

As markets head into the final month of 2022, market participants continue to face uncertainty as the war in Ukraine continues, the Fed is battling the highest inflation in decades, gridlock in… more

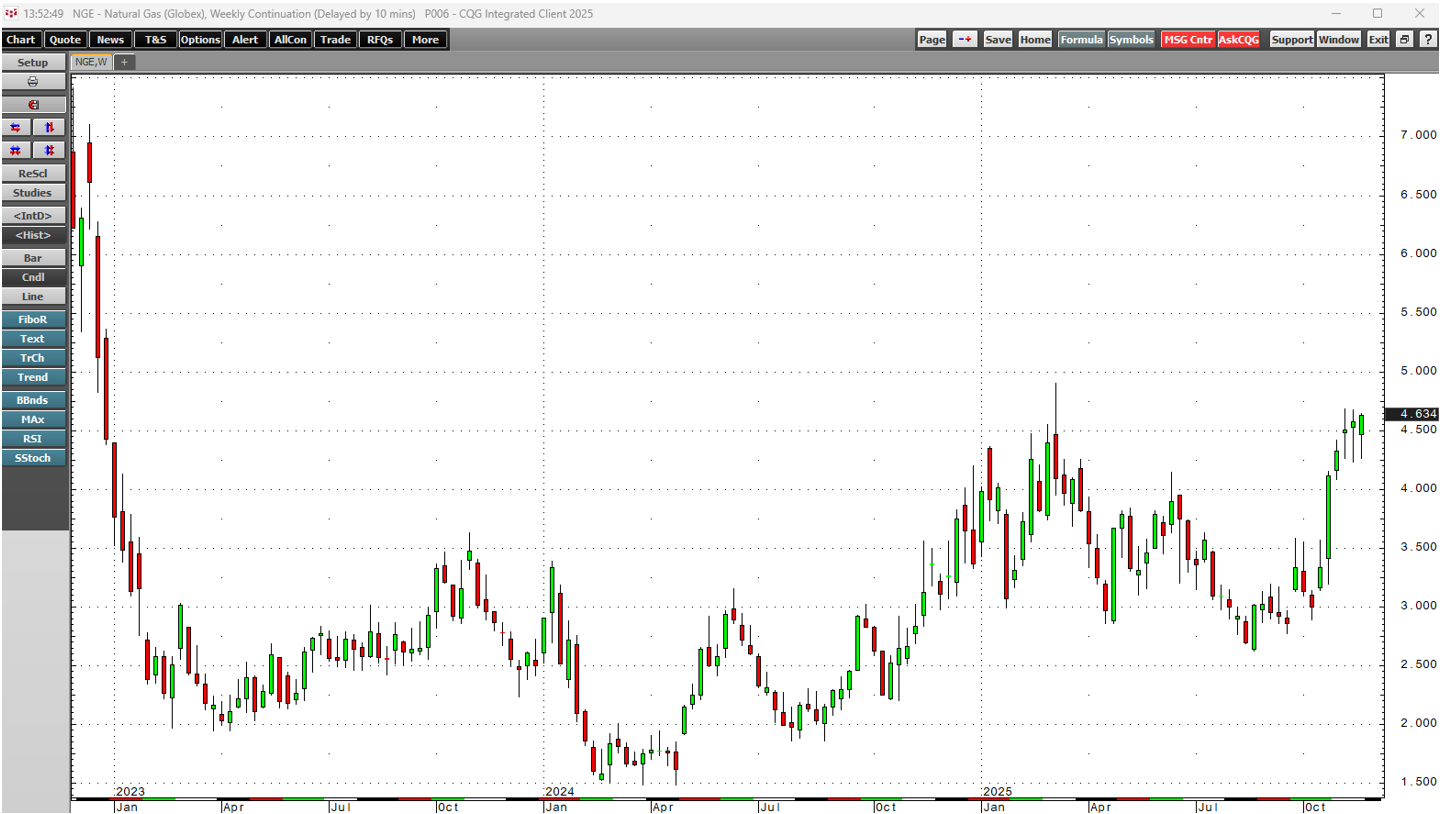

Natural gas futures began trading on the CME’s NYMEX division in 1990. Over the past thirty-two years, the price has traded from a low of $1.02 to a high of $15.65 per MMBtu. Wild price swings are… more

The first major war in Europe since WW II broke out in February with Russia’s invasion of Ukraine. At the beginning of March, the Ukrainian military and citizens continued to hold off the Russian… more

The raw material markets asset class moved higher in the fourth quarter of 2021 after posting gains throughout the year. The commodity asset class consisting of 29 of the primary commodities that… more

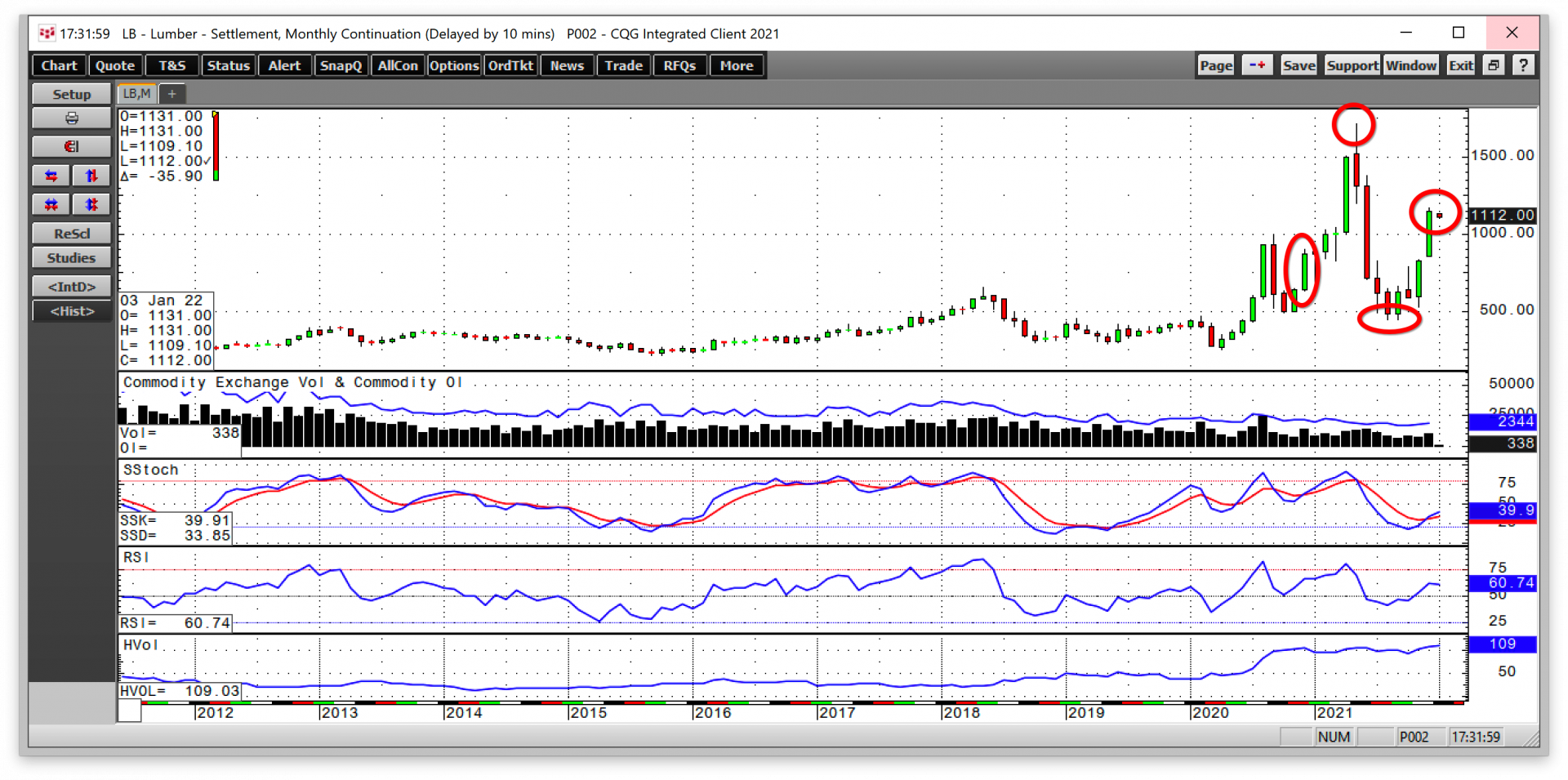

Commodity prices have been trending higher since reaching lows in March and April 2020. Over the first six months of 2021, a composite of the asset class was up over 20%. In May, lumber, copper,… more

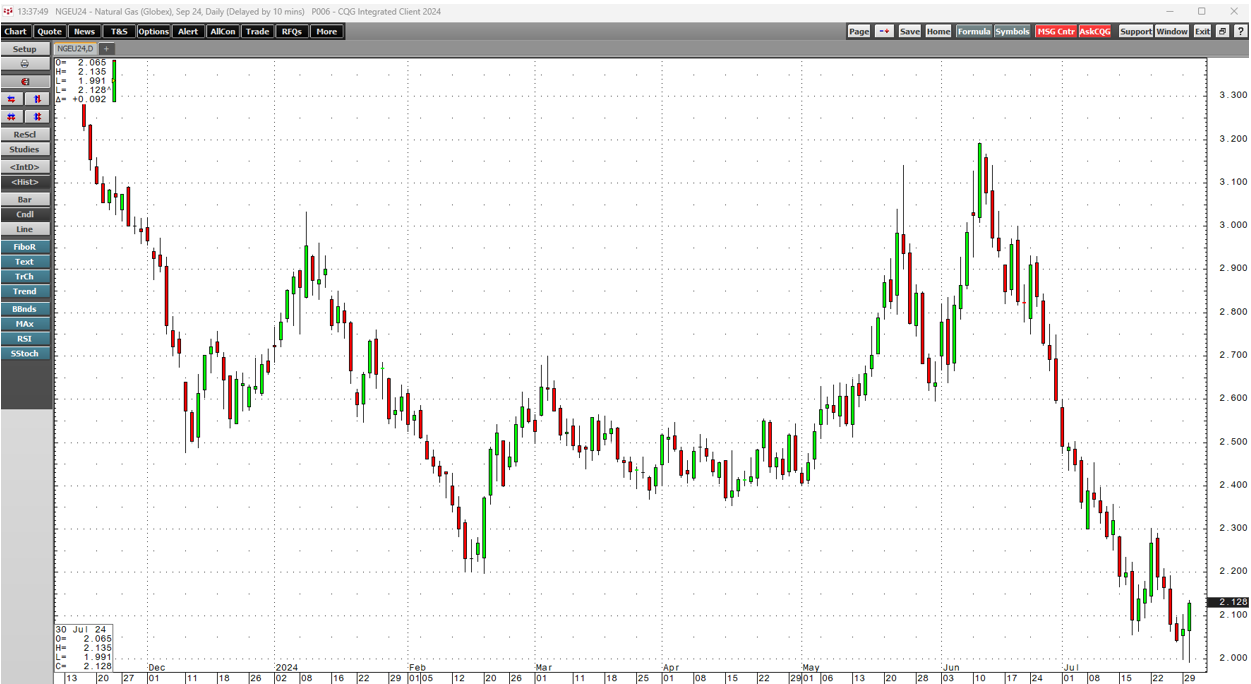

In late June 2020, the nearby natural gas futures price fell to its lowest level in twenty-five years when it reached $1.432 per MMBtu. Days after the low, Warren Buffett announced that Berkshire… more

This Microsoft Excel® dashboard has three tabs. The first tab displays today’s market quotes, volume, and open interest data. If the last price is matching the open price, then the open price… more