Natural gas futures began trading on the CME’s NYMEX division in 1990. Over the past thirty-two years, the price has traded from a low of $1.02 to a high of $15.65 per MMBtu. Wild price swings are nothing new for the natural gas futures arena, but the price action moved into a bearish trend from the 2005 high to the June 2020 low that took natural gas from $15.65 to the lowest price since 1995 at $1.432 per MMBtu.

The NYMEX futures market reflects the natural gas price at the Henry Hub in Erath, Louisiana. Other delivery points trade at significant premiums for discounts, but the NYMEX price is a benchmark for the US energy commodity. After making lower highs and lower lows for a decade and a half, natural gas volatility returned with a vengeance in 2021 and 2022. In April, the price exploded to the highest level in a dozen years before correcting. The natural gas market has evolved, and price variance is making a comeback. Volatile markets create many opportunities for nimble traders with their fingers on the pulse of markets, but the potential for massive profits always comes with the risk of devasting losses.

The highest price since 2008

The bull market in natural gas began in June 2020 when the price fell to $1.432 per MMBtu, the lowest price since back in 1995.

As the quarterly chart highlights, natural gas futures moved from a twenty-five-year low less than two years ago to a fourteen-year high in April when the price reached $8.065 per MMBtu. Quarterly price momentum and relative strength indicators were trending higher above neutral readings. Quarterly historical volatility at over 65% was at the highest level since 2007.

The monthly chart shows nearby natural gas futures traded from $5.055 to $8.065 per MMBtu in April. The $2.01 range was nearly four times the 51.8 cents range in April 2021 and even wider than the 45.3 cents range in April 2020. The last time the energy commodity traded in an over $2 range during April was in 2008, the last time natural gas futures eclipsed the $10 per MMBtu level.

Inventories are low

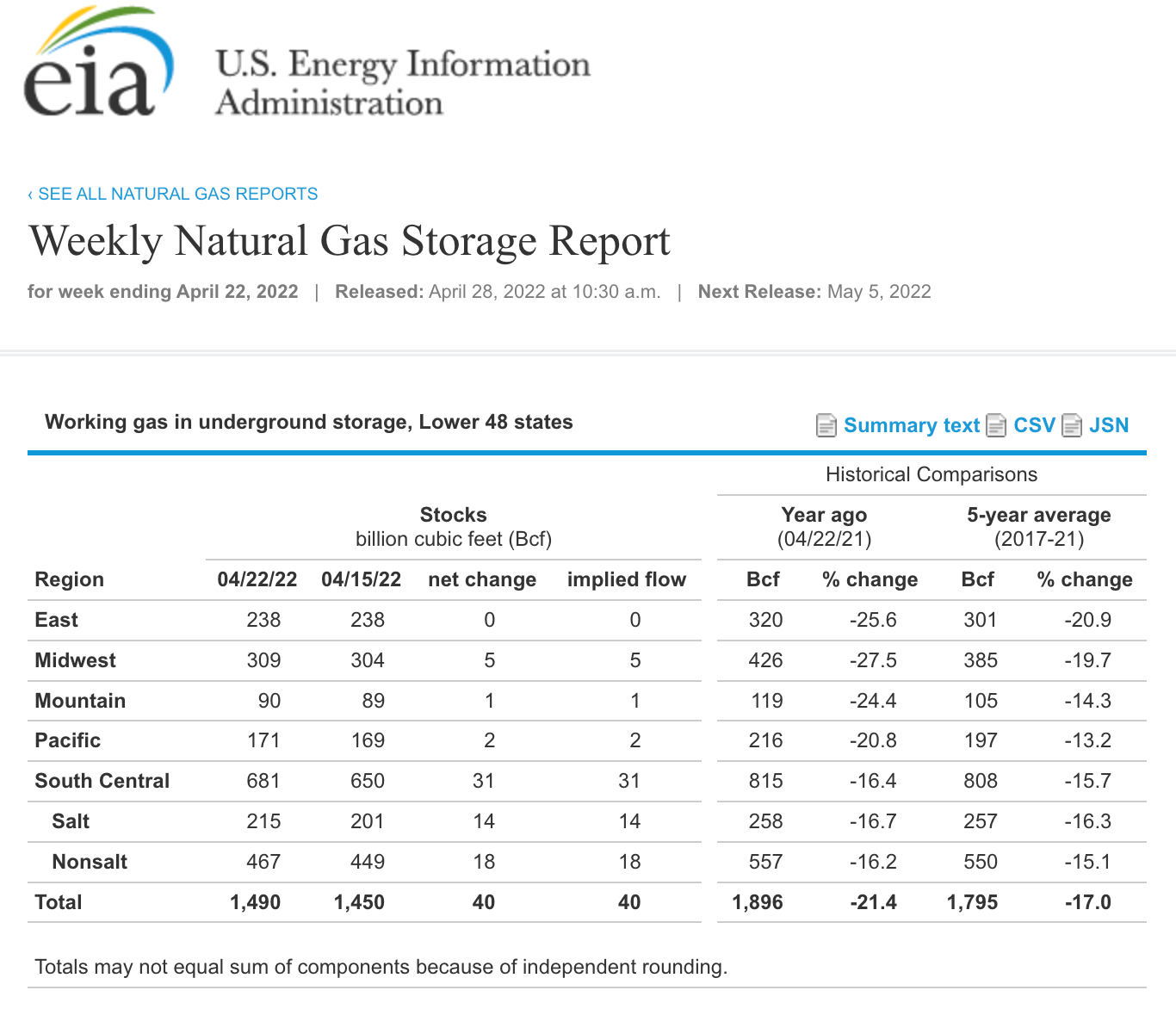

The most recent inventory report from the Energy Information Administration showed that natural gas in storage across the United States was below last year’s level and the five-year average for late April. We are at the beginning of the 2022 injection season in the US, with stockpiles at low levels.

Source: EIA

As the chart shows, natural gas in storage across the US was 21.4% below last year’s level and 17% under the five-year average for the week ending on April 22, 2022.

Asian demand is robust, and Europe looks to the US to replace Russian supplies

Natural gas in Asia has been trading at multiples of US prices for years, supporting the burgeoning US LNG export market. Cheniere Energy (LNG), a leading exporter, has been sold out for years, if not decades, with long-term contracts to supply Asian consumers. LNG shares have soared due to the growing demand for LNG exports.

The chart highlights LNG’s bullish trend that took the shares to a record high of $149.41 in March, with the price at the $135.81 level at the end of April.

Meanwhile, Europe has been dependent on Russian natural gas supplies. During the final week of April, Russia banned natural gas exports to Poland and Bulgaria and threatens to do the same to other “unfriendly” European consuming countries. Europe will turn to the US for LNG supplies when US stockpiles are low.

Seasonality makes no difference as the market has matured

Over the past years, the natural gas price has tended to peak as the market moves towards the peak demand season during the winter months. The price declined during the spring when natural gas began flowing into storage during the injection season that starts in March.

Liquefied natural gas has changed the natural gas market as it now travels beyond the pipeline network to regions where the price is significantly higher. The war in Europe and Russian sanctions and retaliation only exacerbate the demand in 2022. Moreover, the US energy policy addressing climate change has supported alternative and renewable fuels and inhibited the production and consumption of fossil fuels. While natural gas demand is booming, supplies are not keeping pace under the current administration. At the end of April 2022, seasonality does not matter in the natural gas market as the price is at the highest level since 2008.

Expect lots of volatility over the coming months

Nearby June NYMEX natural gas futures settled at the $7.244 per MMBtu level on April 29, 2022. At the end of April 2021, it was less than half the current price at $2.941. On the final trading day in April 2020, nearby futures were at the $1.938 per MMBtu level. The last time natural gas closed April at over $7 per MMBtu was in 2008, when the price moved over the $10 level.

The natural gas futures arena has a long history of high volatility. The energy commodity was in a bearish trend of lower highs and lower lows from the 2005 $15.65 peak to the June 2020 $1.432 per MMBtu low. After a decade and a half of falling prices, the natural gas market has broken out to the upside, and natural gas can be as explosive on the upside as it is combustible in its raw form. Expect a continuation of explosive and implosive moves in the natural gas futures arena with seasonality an afterthought.