The first major war in Europe since WW II broke out in February with Russia’s invasion of Ukraine. At the beginning of March, the Ukrainian military and citizens continued to hold off the Russian invaders from conquering the country, but not without a growing toll of death and destruction.

The military conflict threatens Ukraine, surrounding countries, and the world as Russia is a nuclear power. The US and Europe have responded with arms support for Ukraine and severe economic sanctions. Russia will likely retaliate by nationalizing businesses and embargos as it is one of the world’s leading commodity-producing and exporting nations.

The world has gone from one crisis to the next. As the global pandemic moves towards an endemic stage, the worst geopolitical tensions in over three-quarters of a century will impact people worldwide. Russia’s commodity production threatens shortages will likely increase prices when pandemic-related inflation has already lit a bullish fuse.

Wheat feeds the world

Wheat is the commodity that is the primary ingredient in bread, a nutritional staple. Russia and Ukraine account for around one-third of the world’s annual wheat supplies. Aside from the potential for embargos on Russian wheat, Ukraine is Europe’s breadbasket. With the Russian military storming across the country as the 2022 crop year approaches, acreage that typically yields wheat and other agricultural products is becoming mine or battlefields as the Ukrainians fight to stop the Russian onslaught.

The CBOT soft red winter wheat futures market is the most liquid wheat exchange and a global benchmark for the grain. On February 24, the day of Russia’s invasion, the nearby contract rose to the highest price in fourteen years.

The chart shows that the CBOT wheat futures contract rose to a high of $9.5125 per bushel in late February, above the 2012 high, and a price not seen since 2008.

The longer the battle for Ukraine and hostilities between Russia and the West continues, the higher wheat prices could rise, with the upside target at the 2008 all-time peak at $13.3450 per bushel. Rising wheat prices will only feed rising global inflation and cause severe food shortages.

Crude oil powers the world

In 2016, Russia became the most influential non-member of the international oil cartel. In 2022, Moscow approves, coordinates, and cooperates with OPEC’s production policy. After years of suffering from increasing US production, the green shift in US energy policy handed the pricing power in the petroleum market back to OPEC+, the plus being the Russians. The change in global crude oil dynamics caused crude oil’s price to rise since the 2020 low. The Russian invasion pushed the price above the $100 per barrel level for the first time since 2014 as Russia exports oil to Europe and the US.

The monthly chart shows that nearby NYMEX WTI crude oil prices briefly probed above $100 per barrel on February 24. WTI crude oil is the pricing mechanism for approximately one-third of the world’s crude oil producers and consumers. The nearby Brent futures, the benchmark for European, Russia, North African, and Middle Eastern crude oil, rose to $105.79 per barrel on February 24. While both crude oil futures pulled back, the trends of higher lows and higher highs remain firmly intact.

The Russians may use crude oil as a geopolitical tool, which could send the price to the 2008 high at nearly $150 per barrel or higher over the coming weeks and months. Unless US production increases, the potential for higher prices is rising.

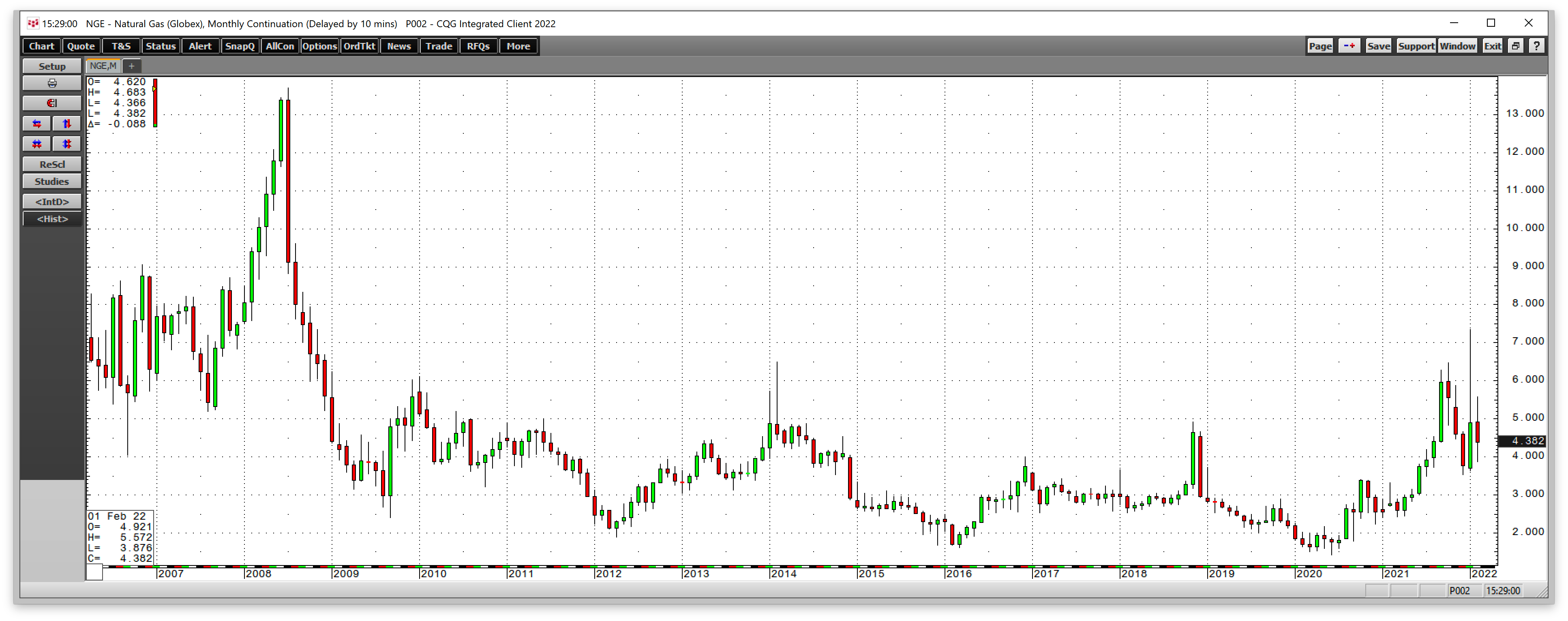

Natural gas - A more global commodity

Over the past years, NYMEX natural gas futures were a wholly domestic market as the gas traveled within the North American pipeline network. Massive discoveries of natural gas in the Marcellus and Utica shale regions of the US and technological advances in extracting gas from the earth’s crude made the US a leader. Liquefying natural gas for export to areas where the price was multiples of the US price created a burgeoning LNG business. US liquid natural gas now travels by ocean vessels to Asia and Europe.

Meanwhile, the shift in US energy policy increased regulations on fracking for gas and oil, limiting production. In 2021, Asian and European natural gas prices soared, making it a challenge for US exports to keep pace with the demand. Russia is a leading natural gas exporter, and Europe is dependent on the Russians for natural gas supplies. The war in Ukraine and Europe’s support for the Ukrainians and sanctions are likely to cause Russia to curtail or stop gas exports to NATO countries as natural gas becomes a geopolitical tool in the environment of tit-for-tat sanctions and retaliation. As natural gas has become a more global commodity, the NYMEX futures for delivery in Erath, Louisiana, are becoming more sensitive to the geopolitical landscape. In February 2021, the high in MYMEX natural gas futures was $3.316 per MMBtu.

The monthly chart shows the nearby NYMEX natural gas futures contract traded to the highest price since 2008 in January 2022 at $7.346 per MMBtu. At the $4.40 level at the end of February, the prices were over 32.5% higher than the February 2021 high.

As tensions mount with Russia, the European natural gas market will likely tighten, and Europe will turn to the US for supplies, pushing NYMEX prices higher.

Platinum group metals - Critical for the environment

Platinum group metals production comes from two countries, South Africa and Russia. Platinum, palladium, and other PGMs are critical metals in automobile, petroleum, petrochemical, and other catalytic converters because of their density and heat resistance. The catalytic converters clean toxins from the environment. Embargos on Russian PGM exports to the west would cause severe shortages.

The weekly chart shows that nearby NYMEX platinum futures rose to the highest price since July 2021 at $1132 per ounce on February 24. NYMEX palladium reached $2711 per ounce on the same day, also the highest level since last July.

Platinum group metals are a byproduct of Russian nickel production in the Norilsk region of Siberia. Sanctions and embargos could lead to shortages of rare precious metals over the coming months.

Other commodities that Russia and Ukraine impact

Russia is also a significant producer of aluminum, petrochemicals, coal, fertilizers, nickel, and other metals, minerals, and crops. Ukraine exports steel, coal, fuel and petroleum productions, chemicals, barley, corn, and wheat.

The war in Ukraine will impact the world even if the conflict remains within Ukraine’s borders. There was lots of saber-rattling at the end of February, raising the temperature and risk of a nuclear war. Meanwhile, the significant economic impact will cause supply shortages and rising commodity prices, fueling inflation that is already at the highest level in over four decades. The US Fed has told markets it will be addressing inflation with monetary policy, but the war could make those efforts toothless over the coming weeks and months.

The bull market in commodities continues to make higher lows and higher highs as we move into March. As the 2022 crop year gets underway in the northern hemisphere, the commodities that feed and power the world face geopolitical problems that make the weather secondary to tensions that look likely to create shortages.