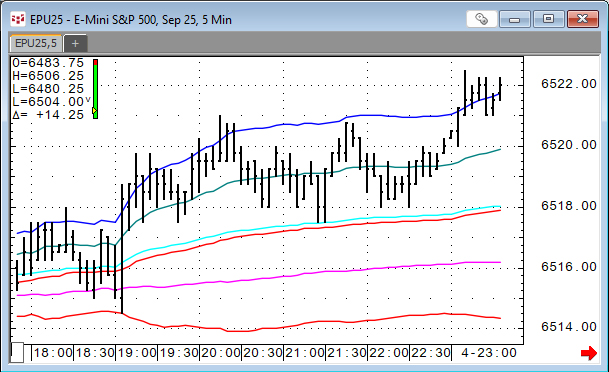

VWAP is the volume weighted average price for a futures contract plotted as a line on the price chart. The calculation is the sum of traded volume times the price divided by the sum of the traded… more

Studies

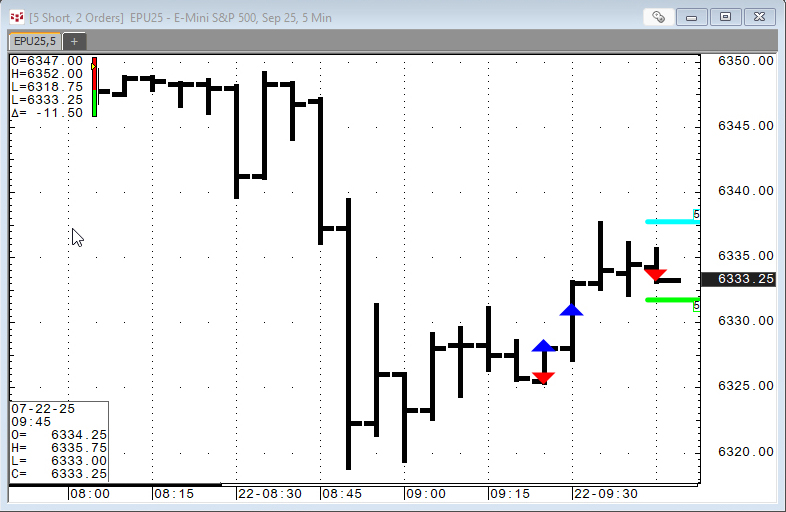

This set of studies provides the Order Display study (indications on a chart for filled and working orders), open trade equity, current position, and profit and loss account… more

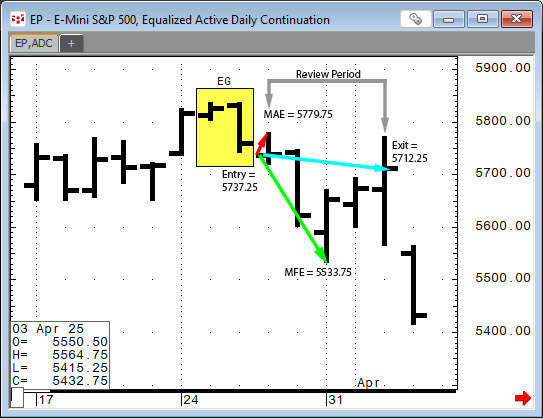

This post provides a guideline to reviewing the outcomes of a pattern recognition approach to the markets.

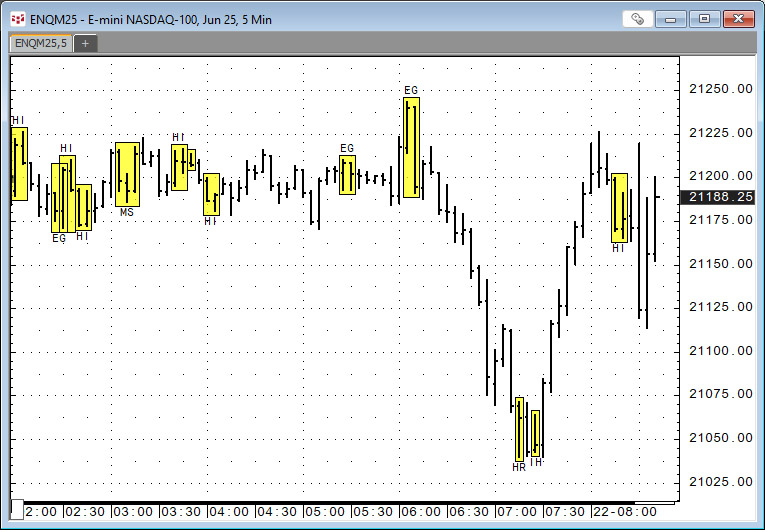

Two recent posts on Workspaces discussed CQG's Candlestick Formations Study.

… more

A recent post "CQG Primer: Candlesticks Formations Study" introduced this study available in CQG IC and QTrader. The study is a collection of fifteen conditions. The Candlestick formations appear… more

CQG IC and QTrader offer the Candlestick Formations study.

The Candlestick Formations study is a collection of conditions. Candlestick formations appear as overlays on the chart in the… more

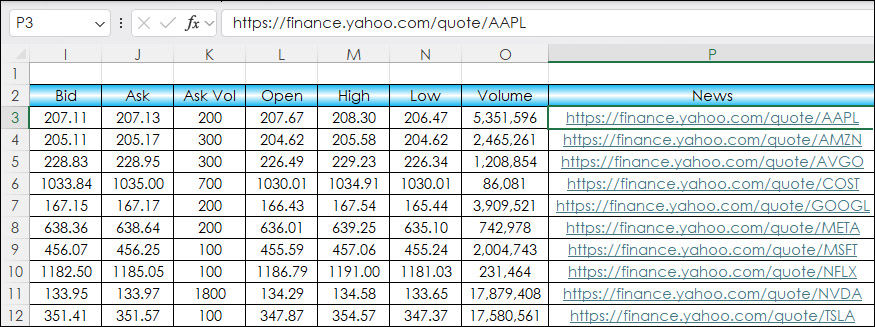

This post details adding HTML News Links to an Excel dashboard for monitoring equities and ETFs.

The news source is Finance.Yahoo.com. An example link for Microsoft is https://finance.yahoo.… more

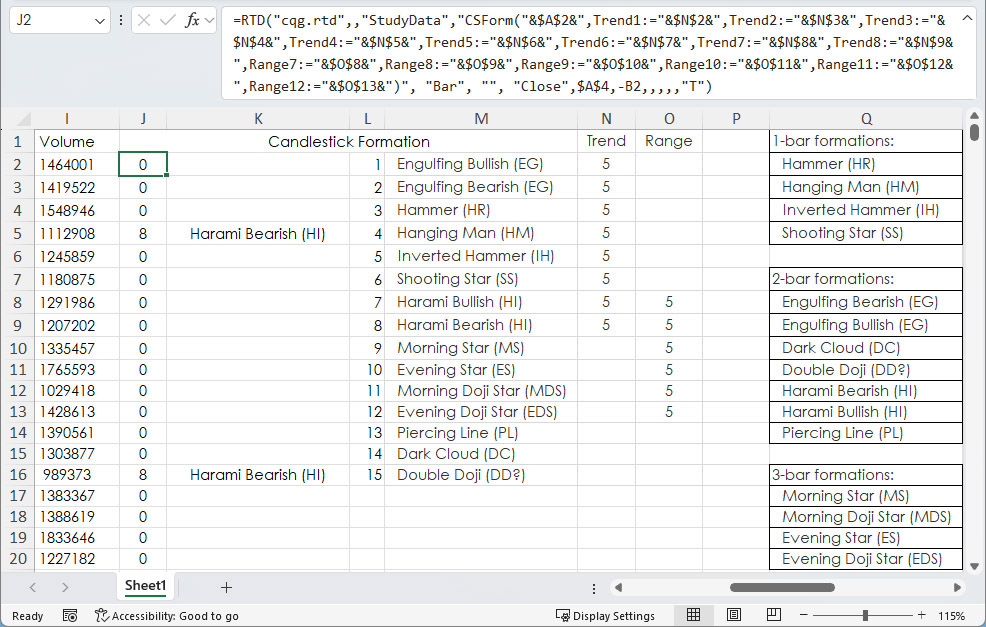

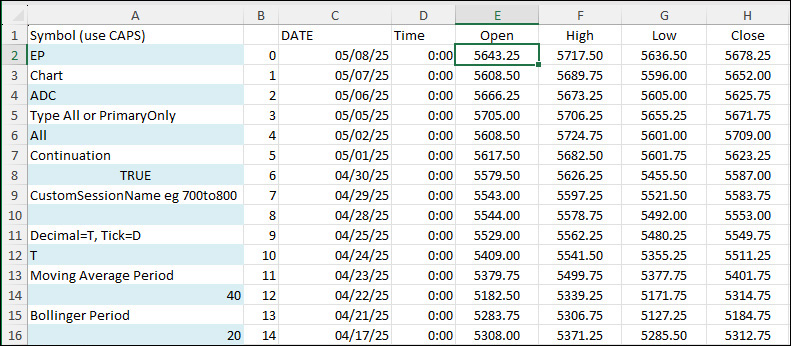

This post offers a downloadable sample Excel spreadsheet for pulling in historical data and study values from CQG IC or QTrader using RTD formulas.

The Data consists of:

Open, High, Low,… moreThis post details the different techniques for pulling Depth-of-Market (DOM) data into Excel.

There are three ways:

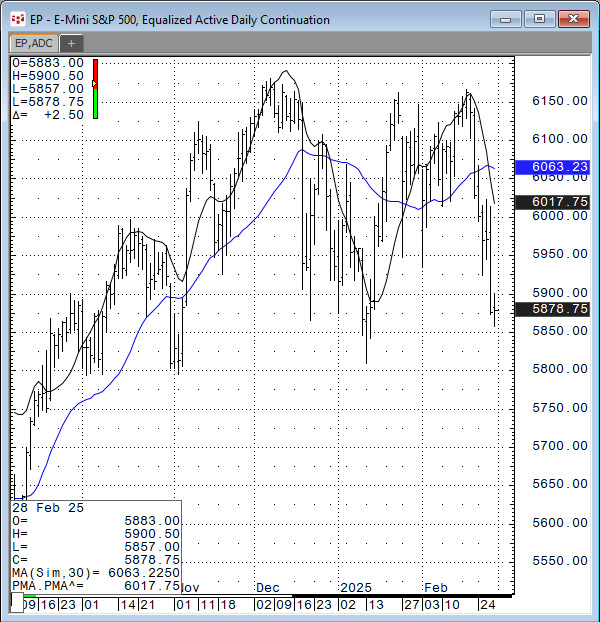

C&P RTD formulas for Level 1 DOM data from the various quote… moreIn the March 2025 issue of Technical Analysis of STOCKS & COMMODITIES magazine John Ehlers, President of MESA Software, presented "A New Solution, Removing Moving Average Lag."

The… more

The PriceToDollar function converts the prices of the particular market to their value. For example, below the E-mini S&P 500 futures contract's last price is 6003.75. And 6003.75 multiplied… more