This post details steps using the Excel CQG RTD Toolkit Add-in to pull in open interest data for an options series based on the same expiration. These same steps can be used to pull in other… more

Workspaces

This post offers a downloadable CQG PAC for IC and QTrader and Excel dashboard that includes two custom studies that track a market's performance by measuring the price difference between the… more

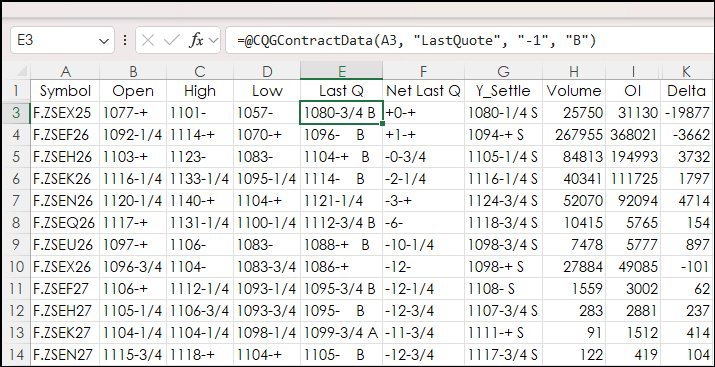

A popular quote display for following a group of contracts in a particular commodity is the CQG All Contracts display. This post details the steps to replicating this display in Excel.

First… more

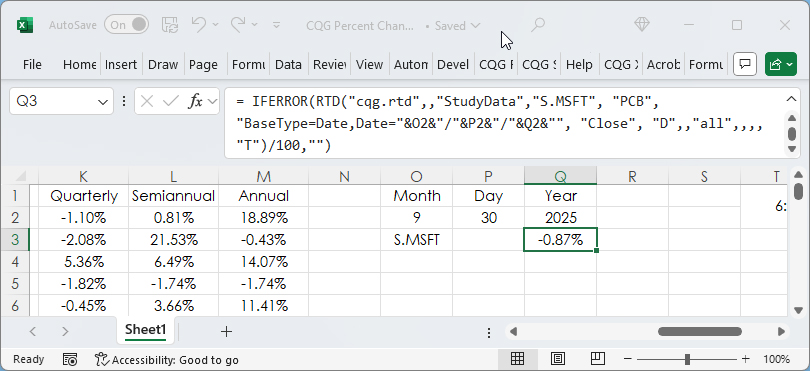

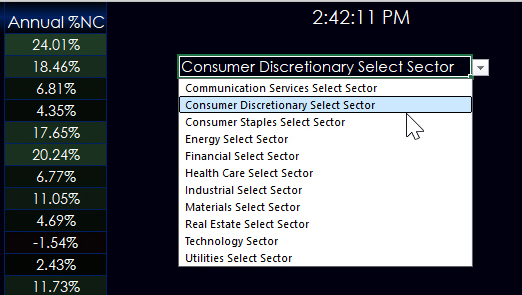

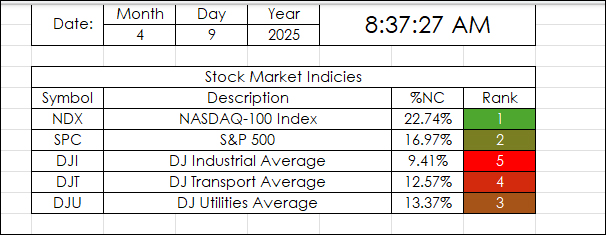

Percent Net Change is a key technique for comparing market performance among a group of markets. This post is an overview of the various Excel RTD formulas available for calculating percent net… more

This post builds upon the previous post: Excel 365 TRIMRANGE Function.

That post detailed how to build a quote display using the TRIMRANGE function to automatically manage working with… more

Microsoft Excel 365 offers the TRIMRANGE function which excludes all empty rows and/or columns from the outer edges of a range or array. This post details how this function is useful for designing… more

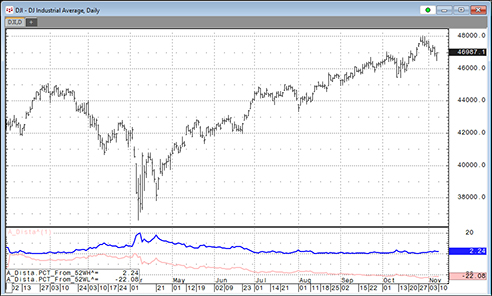

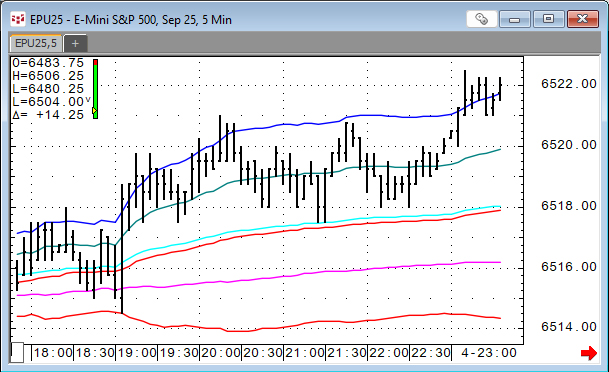

VWAP is the volume weighted average price for a futures contract plotted as a line on the price chart. The calculation is the sum of traded volume times the price divided by the sum of the traded… more

This Excel Dashboard uses RTD Calls to pull in the Net Percent Change of a collection of markets by a particular date.

For example, April 9, 2025:

"Markets News, April 9, 2025: Dow… more

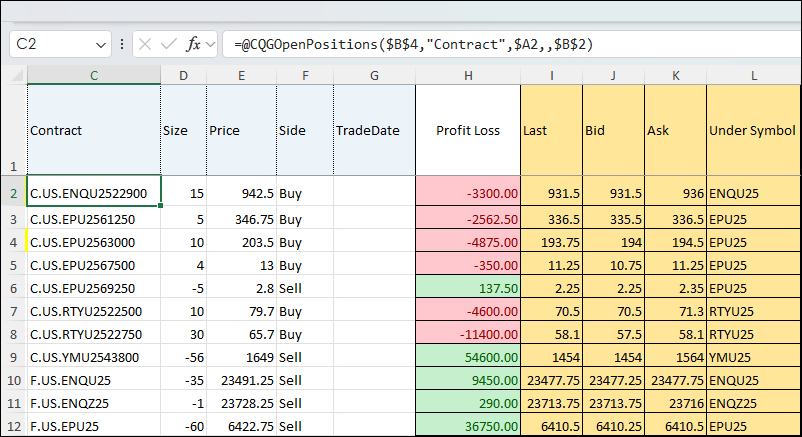

This spreadsheet built by CQG Product Specialist Jim Stavro uses RTD calls to pull in open futures and options positions as well as "Greeks" using RTD formulas.

To use the spreadsheet, CQG… more

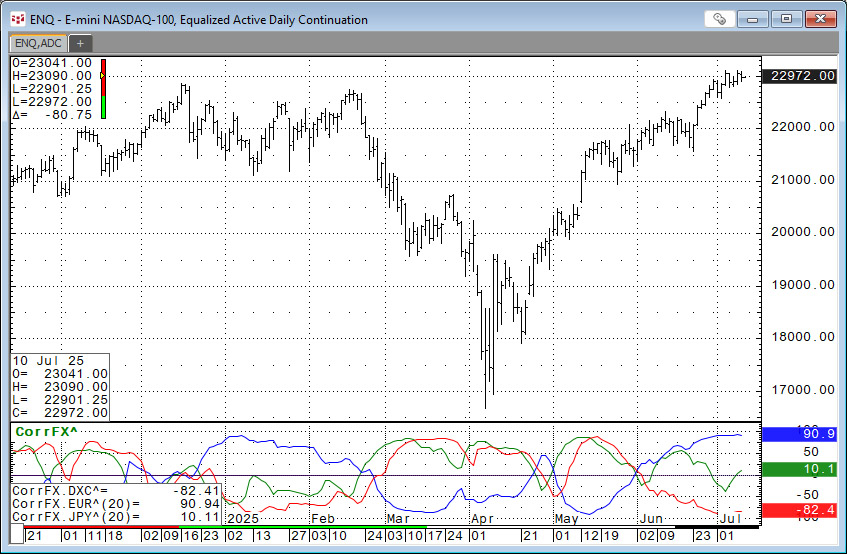

This function is available in the Add Study window and in the Formula Toolbox.

The function measures the strength and direction of the price movement of two symbols over a defined number of… more