There is a Gateway release planned for the weekend of Friday, June 28th. As always, the release will be seamless to CQG Customers.

In addition to enhancements and maintenance, this release includes an exiting new feature: New FCM Contract Controls in CAST called Dynamic Default Market Limits. This new feature will allow FCMs to disable specific contract months or even entire commodities from trading. Default is nothing is enabled which means nothing will change any of your acct setups until this is enabled.

More Details and How to Access the New Features

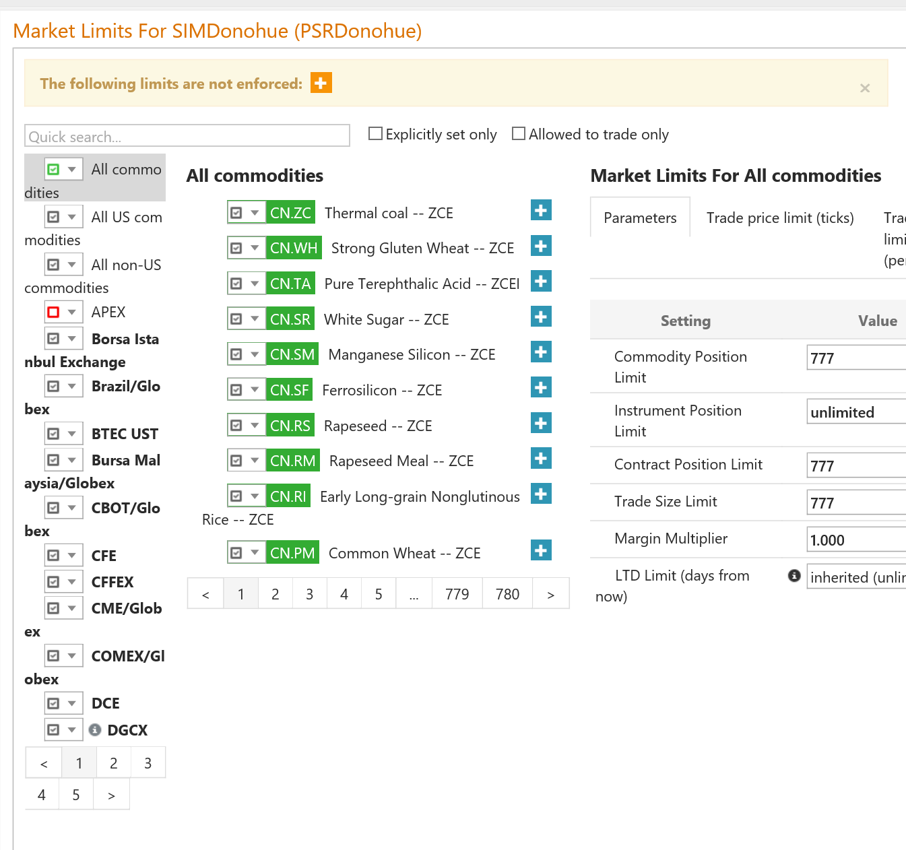

Visual Changes to Market Limits

- Green and red for enabled and disabled

- New coloring of light gray to represent an inherited setting

- Inheritance means that FCMs can now control accounts’ enablements from the FCM Dynamic Default Market Limits level.

In the image below:

- All commodities is green because it is checked, allowing all products to be tradable

- APEX for example has been specifically excluded and is thus marked red

- The remaining settings are Gray/Enabled because they have been marked tradable by the All Commodity Checkbox

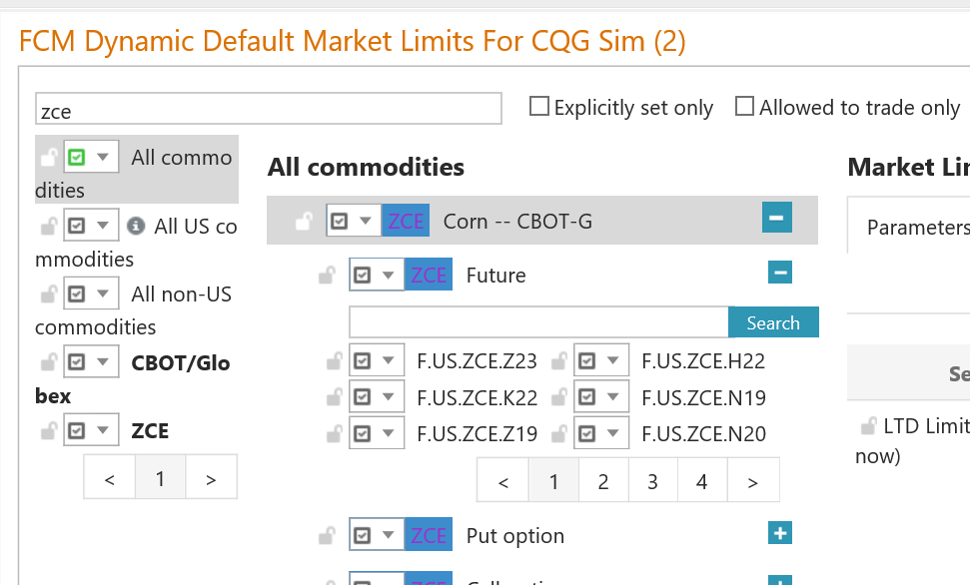

Dynamic Default Market Limits

- Can be enforced per account or FCM wide

- This is a new feature that lets CAST users disable specific contract months or even entire commodities from trading.

- Click the plus next to each instrument (blank search to show all available months)

- Contract must be set to Red/Disabled AND locked to enforce FCM wide

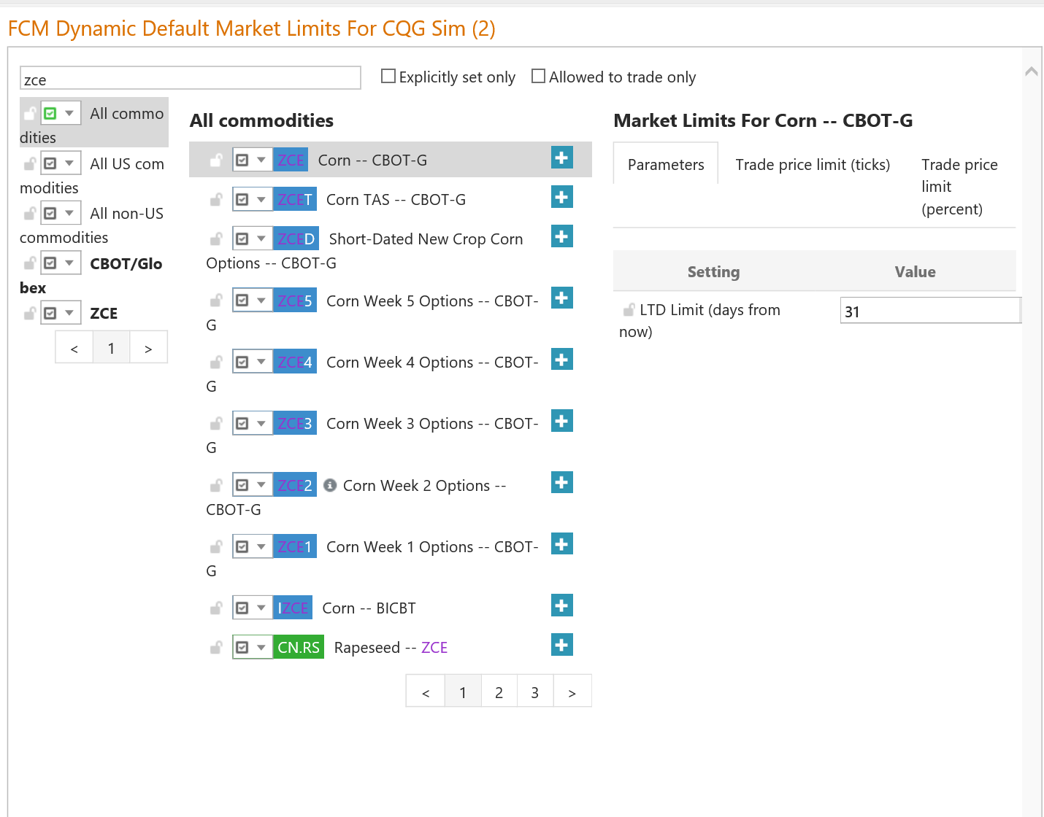

LTD Limits

- LTD limits an account to only trading contracts that expire within a set number of days into the future

- Also called tenor limits

- Setting to 31 for example would only allow trading in contract months that expire within 31 calendar days.

- Can be set on any tier of limit (all, exchange, commodity, instrument, or month)

For any questions or concerns, please contact the FCM Desk at fcmdesk@cqg.com or (312) 939-1590.