Sometimes it is not necessary to write a complex trading system when you want to accomplish something minor in the trading environment. For example, CQG provides built-in trailing stop orders that may be placed a defined number of ticks away from the market.

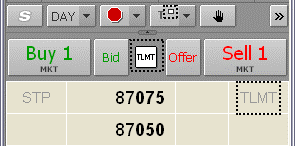

To enter trailing limit orders, click the Trailing Order drop-down arrow and select Trailing Limits:

Notice the order type indicator and watermarks change:

Then place your order.

Instead of using a fixed distance to the market, I had a request to base the trailing stop on the lows of a candlestick chart. In order to accomplish this, I wrote a very simple study with two curves providing the previous bar's high and low on a chart.

Curve 1 is simply:

High(@)[-1]

Curve 2 is simply:

Low(@)[-1]

Let’s assume I placed a manual long trade as marked on the chart above, and I want a stop loss order to trail the blue markers on the chart.

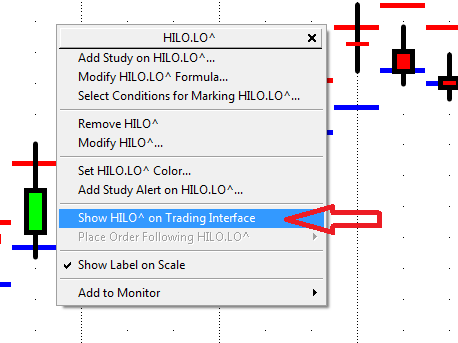

To begin, right-click one of the lines representing the HILO study and select Show HILO on Trading Interface:

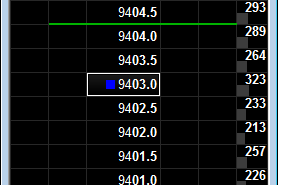

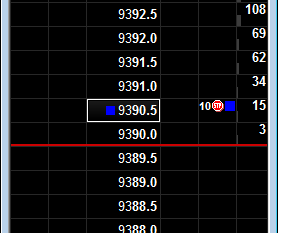

On the trading interface, the two levels are represented as colored dots:

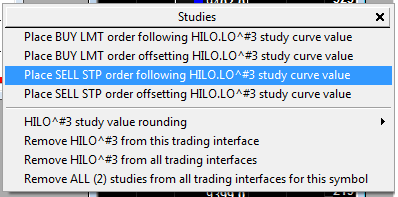

Now right-click the dot and place a sell stop order on the curve:

The order is now placed and if the value changes on the next bar, the order will follow automatically.

A pack with HILO Study is attached.