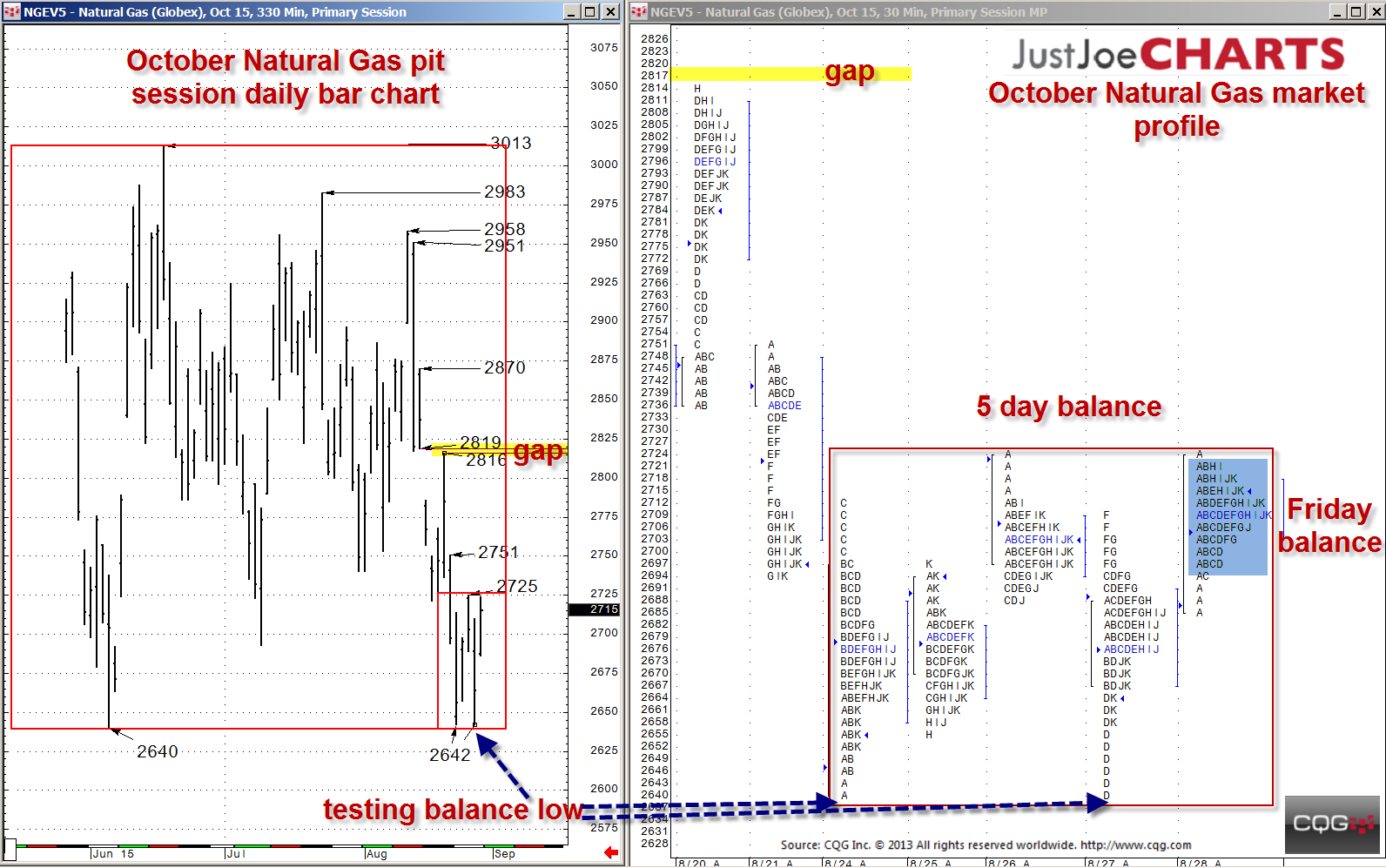

Since May 2015, October natural gas has been rotating within a 2640-to-3013 balance bracket. During that time, the market has traded up near the top and down near the bottom of the range several times. However over the past five days, the market came within two ticks of the 2640-balance low on two different days. Additionally, the market has formed a small five-day balance of 2642-to-2725. When a volatile market like natural gas is contained within a balance for a period of time, the following are the two most likely scenarios when the market tests the extreme of the balance range:

- Trade outside the range and accelerate

- Trade near or outside the range, fail, and then begin a rotation to the opposite end of the balance range

The current five-day balance is worth monitoring. If the market gains acceptance above the five-day balance, it may begin a rotation back to the top of the balance range, with the 2816-to-2819 gap as the first target. If the market trades below Friday's daily balance range, it may retest the 2640 balance low. At that point, the gameplan should be waiting to see if the market gains acceptance below the 2640-balance low, or fails.