The second quarter of 2016 is now in the books. It was a quarter of fear of uncertainty, volatility, and gains for commodities. Overall, a composite of the 29 primary commodities that trade on futures markets moved 10.75% higher. So far in 2016, the composite is up 12.67%. When I include iron ore, lumber, and the Baltic Index, the gain for Q2 amounts to 12.94% and 15.25% over the first half of the year. Many commodities posted double-digit gains, and only a few raw materials moved lower.

Wheat, cattle, and soybean oil slipped lower during Q2, but that was it for the downside. The biggest gains were in natural gas, the Baltic Dry Index, and sugar, which all gained over 30%. Gold, silver, high-quality government bonds, and the Japanese yen all moved higher in a flight to quality and all added to gains from Q1. The best performing commodity sector in Q2 was energy, which moved over 25% higher. Precious and base metals, grains, soft commodities, and meats all posted gains. In the equity markets, the DJIA was up 1.38% in Q2 with the S&P 500 up 1.9% and the NASDAQ down 0.56%. The dollar index gained 1.72%, but commodities bucked the long-term historical relationship between the dollar and raw material prices.

The Dollar and Commodities Diverge

We are trained to measure currency values by looking at one foreign exchange instrument against others. We often refer to the dollar as strong or weak when it moves against other currencies like the euro, pound, yen, or other currencies. Gold has had a dual role over the course of history; it is a commodity, and it is a currency. Gold tends to have an inverse price relationship with the dollar. In Q2, gold appreciated by 7%. The stronger dollar and higher gold amount to a historical divergence from the norm.

The yellow metal has been both a metal or a commodity and a means of exchange or currency for thousands of years. Central banks classify their gold holdings as foreign exchange reserves. Gold’s performance could be a statement about global accommodative central bank monetary policy as it tells us that all currency values are declining against the precious metal. Historically low interest rates in the US and around the globe have caused currencies to lose value as an asset class. Moreover, the over 60% appreciation in Bitcoin, a cryptocurrency, over Q2 is another sign that alternative means of exchange are attracting capital as faith in fiat currencies has decreased around the world.

Therefore, even though the dollar strengthened over Q2, gold and most other commodity prices shrugged off the greenback and rallied as the dollar and all paper currencies have declined as an asset class.

Gains Everywhere

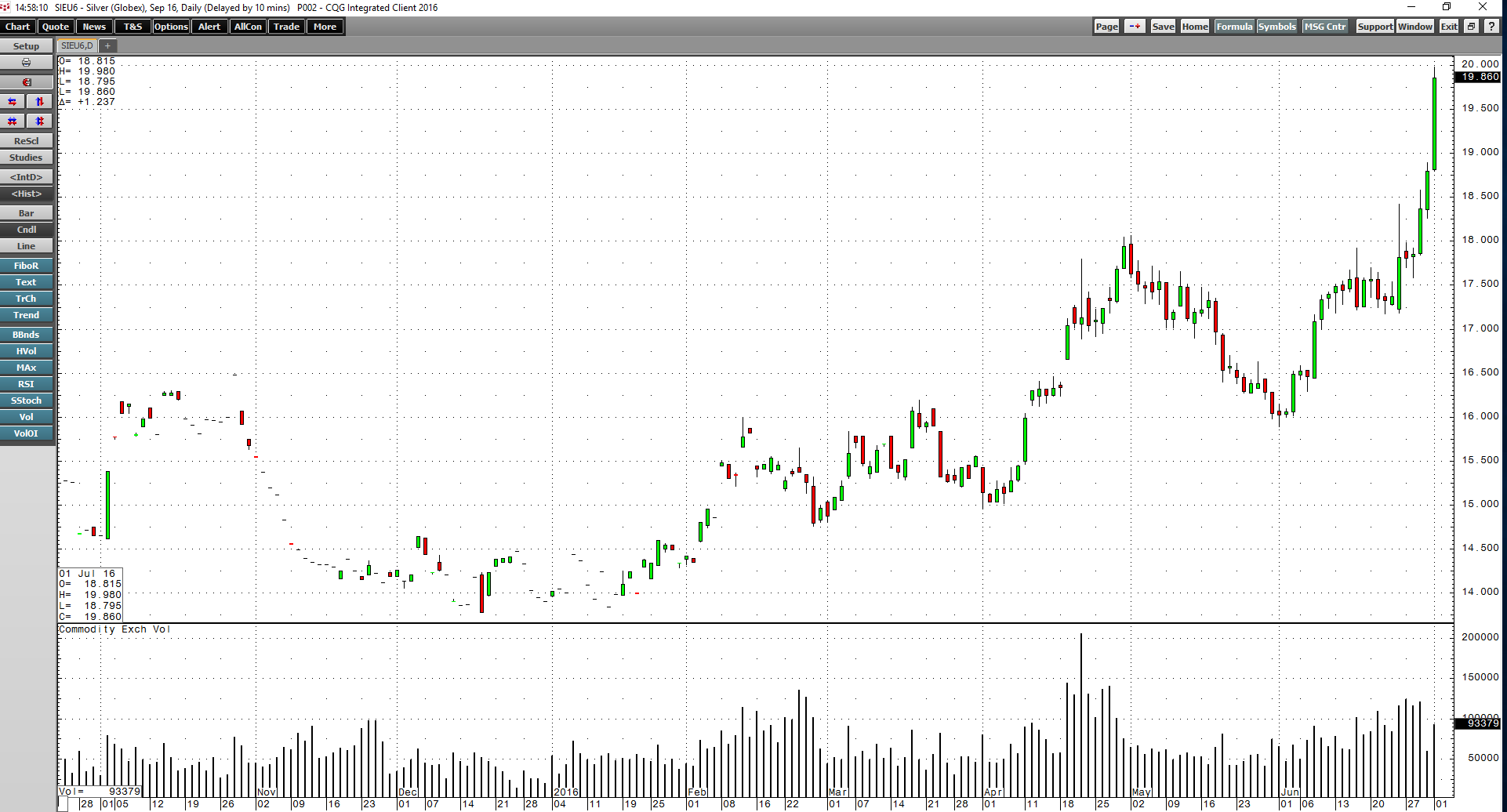

Precious metals gained 9.6% in Q2, led by silver, which posted gains of over 20%. The precious metal sector is up over 20% so far in 2016. Base metals were up 7.5% in Q2 and are now 11.07% higher in 2016. Strong performances from nickel and zinc offset weak gains in copper, which rose less than 1%.

In the grains market, soybeans and soybean meal led the way, adding 29% and nearly 50% respectively in the quarter. While corn was up around 2%, wheat fell with CBOT, KCBT, and MGE wheat all posting declines due to large inventories and prospects for another year of abundant crops. Oats and rice both moved to the upside, and the grain sector appreciated by 8.24% in Q2 and is now up 2.42% on the year.

Natural gas led the charge in energy with better than a 49% gain as inventory injections slowed. NYMEX and Brent crude oil were both up over 26%. Heating oil moved over 25% higher but gasoline only managed a 3.78% gain. The gasoline crack spread moved significantly lower over the second quarter, which is a concern for oil demand in the US as we move forward into Q3. Ethanol posted a double-digit gain and outperformed corn, which means that processing margins by ethanol producers in the US increased.

Soft commodities all moved higher, led by sugar, which gained over 32% - the price of the sweet commodity has doubled since August 2015, and sugar is now above 20 cents per pound. Coffee, cotton, cocoa, and FCOJ all posted gains in Q2.

While live and feeder cattle moved to the downside because of increasing feed prices, lean hog futures surged by almost 22% as demand for pork from China increased. The beef markets moved lower as surging soybean meal could cause animal protein producers to bring cattle to processing plants early rather than pay for expensive feed.

Precious Metals Could Be Signaling Problems for Currency Markets

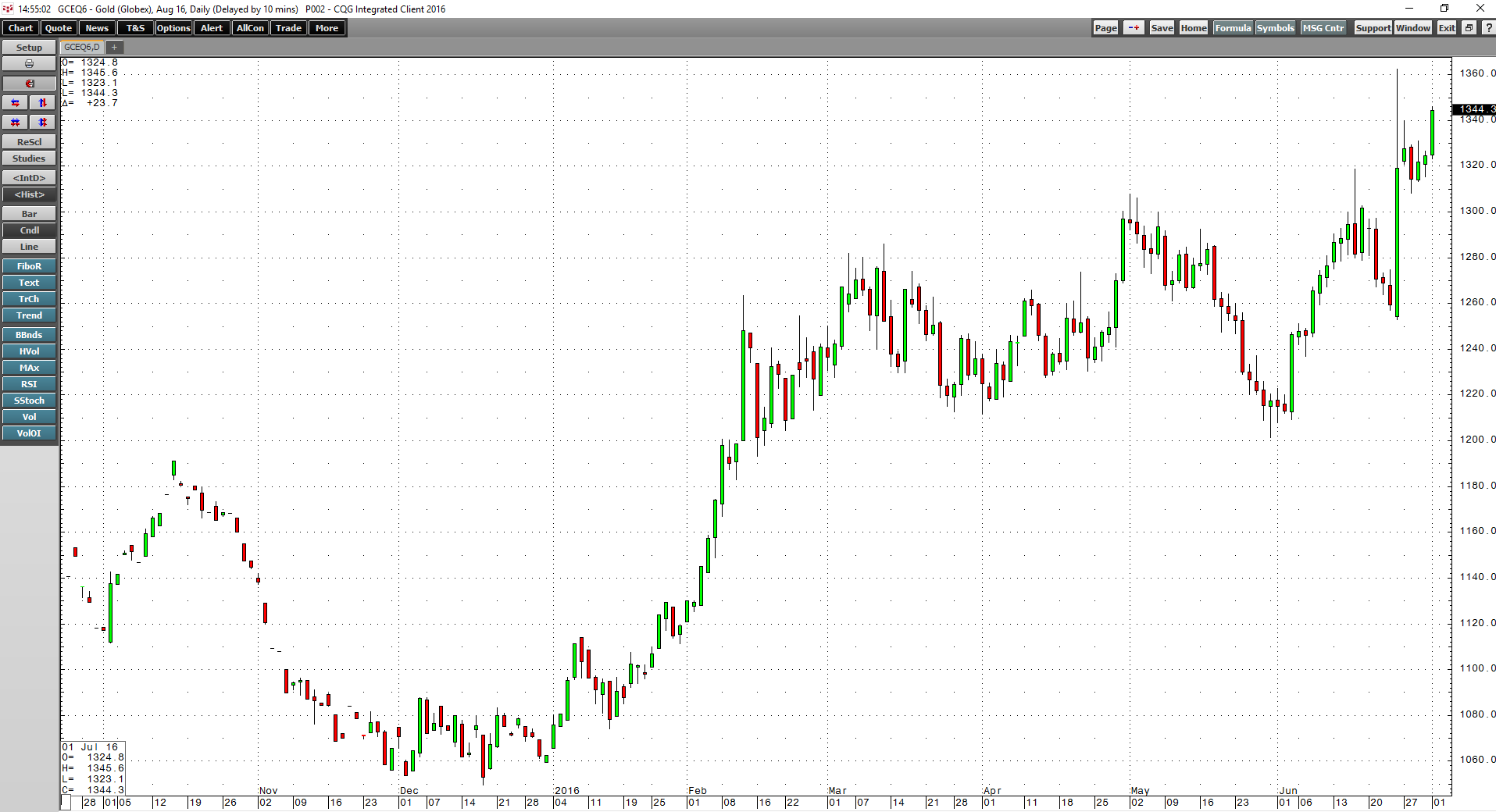

Gold has been a leader in the commodity sector in 2016; it moved higher out of the gate at the very beginning of the year.

Gold was up 24.56% on the year as of the close of business on June 30. Silver lagged gold in Q1, but it caught up in the second quarter and was up by almost 35% in 2016 at the end of June.

On the first day of July, silver continued to surge, posting a gain of more than $1.00 on the session on heavy pre-holiday weekend volume.

The price action in gold and silver could be telling us a lot about the future direction of other raw material prices these days.

Commodities are Hard Assets

Many raw materials moved to the lowest prices in years in late 2015 and early 2016. Crude oil fell to $26.05 in February of this year, while copper dipped below $2 per pound. Sugar traded to just over 10 cents last August, and soybeans were under $9 per bushel. In less than a year, all of these commodities have moved higher. In the case of crude oil and sugar, they have reached levels that are double the price of their recent lows. Commodities are hard assets. The current environment of uncertainty around the world has given new life to many commodities after over four years of bear market trading conditions.

Throughout history, when faith in paper currencies declines, many investors turn to staples that are hard assets. Additionally, population growth means that more people chase these finite goods each day. The period of low prices caused production declines as output costs fell to or below market prices and inventories increased. Slowing production will lead to declining stockpiles, which are supportive of prices for the future.

Q3 May Be Volatile

Meanwhile, the world economy is an unprecedented era where money is so cheap that interest rates are close to or below zero. Easy money is highly inflationary, but economic conditions remain stagnant as growth has become elusive despite the stimulus provided by the world’s central banks.

On the political side, the Brexit vote in the UK at the end of June highlights dissatisfaction with current government policy. The real test will come for the US in November during one of the most contentious Presidential elections in the nation’s history. Markets are a reflection of the economic and political landscape and with the current environment of uncertainty and fear; commodities and all asset classes are likely to become volatile in the weeks and months ahead.