Last week we heard from the US Federal Reserve and for the seventh straight month, the central bank left interest rates unchanged. In December 2015, the Fed hiked the short-term Fed Funds rate for the first time in nine years. At that point, they told markets to expect three to four more rate hikes in 2016. Since there will be no August meeting of the FOMC, eight months of opportunities to increase interest rates have now passed, and the Fed Funds rate remains at the same level it was at on December 31, 2015.

Earlier in the year, the US central bank cited Asian and European contagion from weak economies as a reason to exercise caution and leave interest rates unchanged. In June, the pending Brexit referendum and a weak May labor report were the reasons monetary policy remained unchanged. At the most recent meeting, the statement struck more of a hawkish tone leading many to believe that a rate hike would come in September or December. However, a contentious Presidential election season may provide yet another series of reasons to leave rates unchanged.

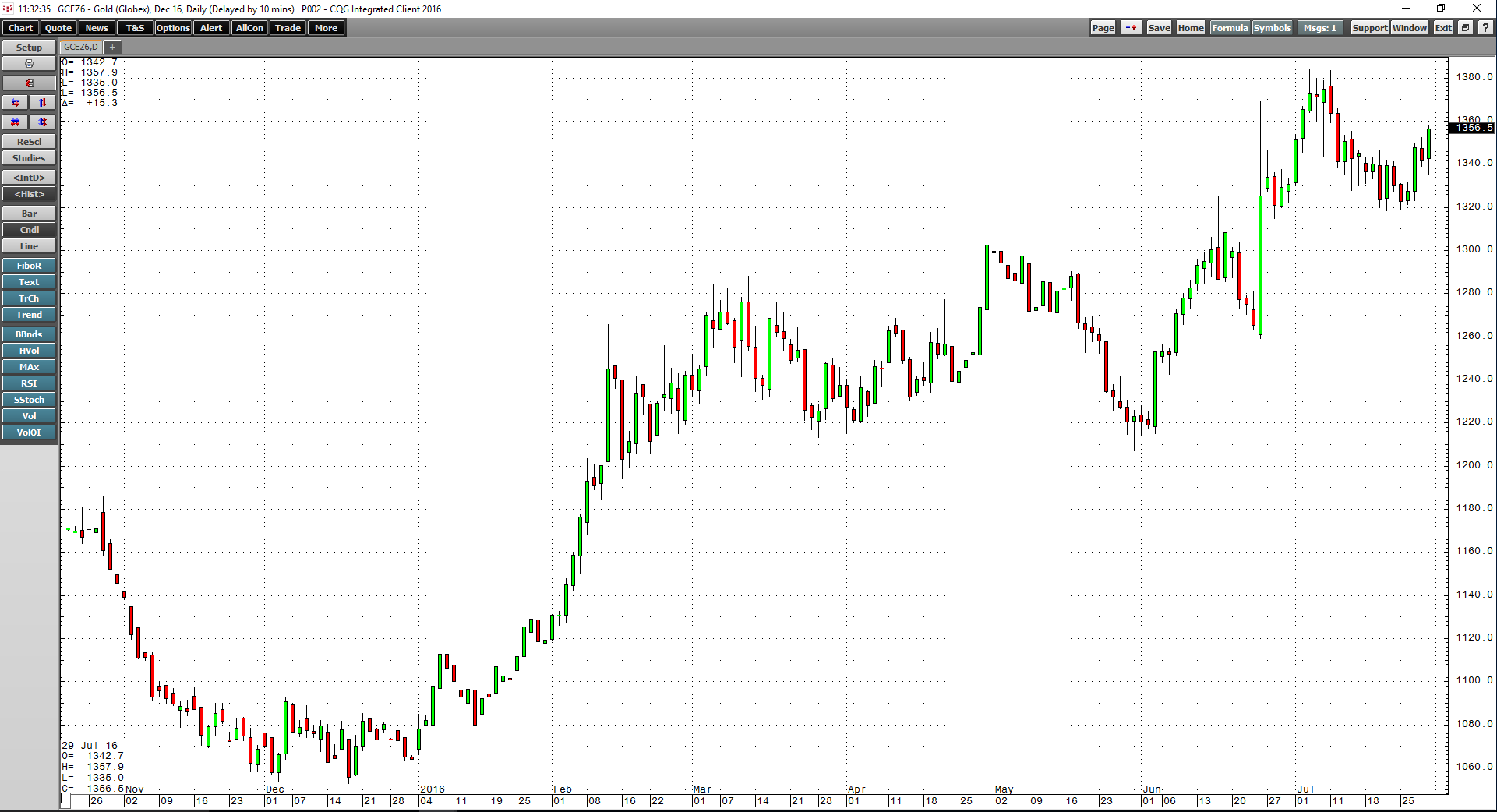

All of the elements necessary to increase interest rates were present at the July meeting. US economic activity grew at a moderate pace. The labor market strengthened on both the job and wage fronts. While inflation remains below the target 2% rate, many commodity prices made significant technical lows in late 2015 and early 2016 and have now been making higher lows and higher highs. It is probable that some raw materials extended to low and uneconomic levels. Perhaps most significantly, precious metals prices entered a bull market with gold and silver rallying in dollar terms as well as in all currencies. Platinum and palladium have followed their precious cousins higher. These metals are traditional harbingers of inflationary pressures. The economic landscape in the United States would seem to warrant a Fed Funds rate greater than 25-50 basis points.

In the aftermath of the Fed inaction, the price of gold rallied, and the dollar moved lower.

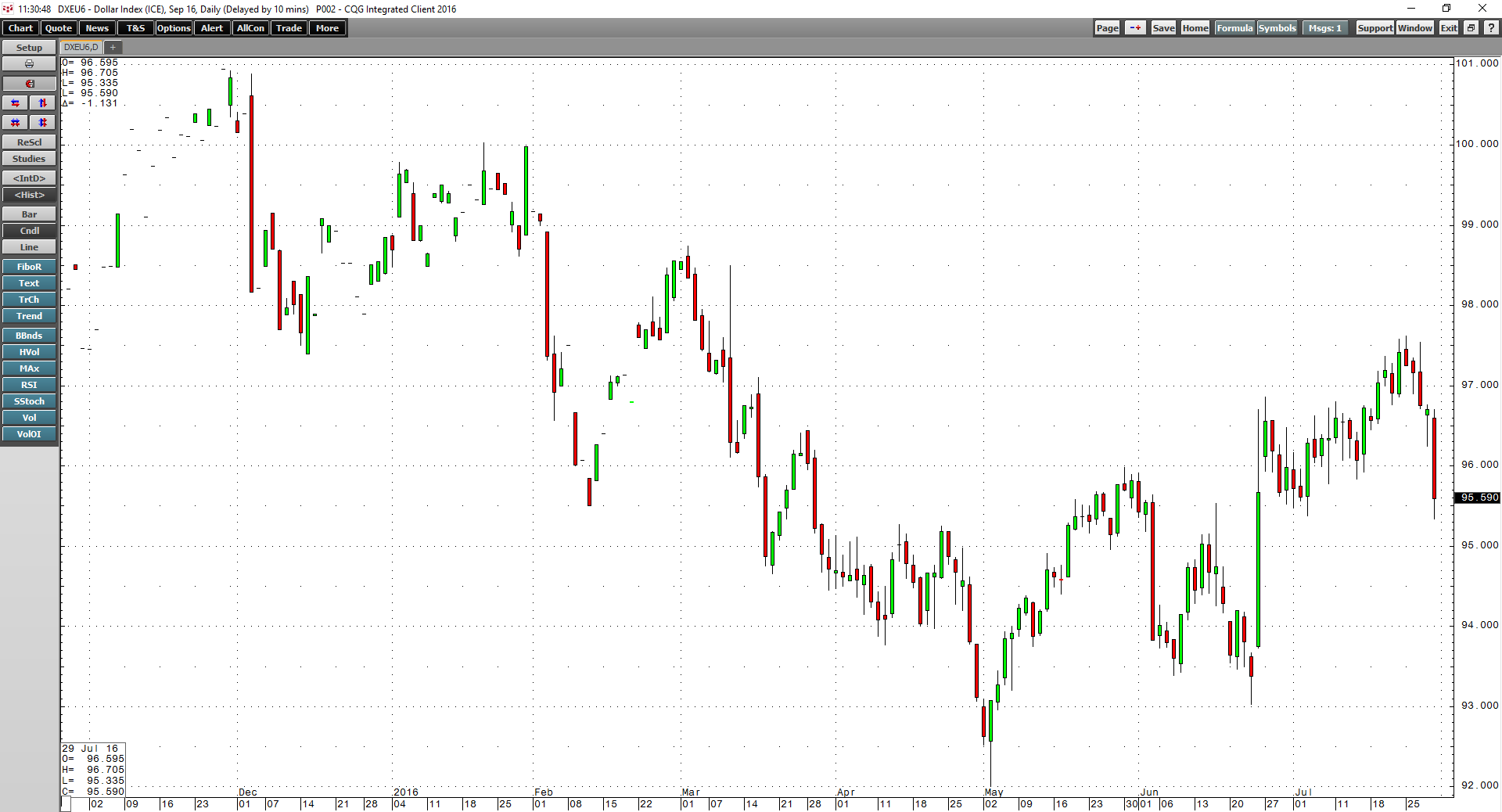

The dollar index futures contract moved from highs of 97.62 on July 25 before the FOMC meeting to around the 95.5 level to end the month, a decline of 2.2%.

Meanwhile, gold has appreciated from $1319.30 on July 25 to close July at the $1356 level, an increase of 2.8%. Gold opened 2016 at $1060 and is almost $300 higher as it has entered a bull market on longer-term charts.

Central bank policy around the globe has been accommodative since the financial crisis of 2008. A continuation of QE in Europe and Japan, historically low interest rates around the world, and the potential for a new tool, helicopter money, has caused a general debasement of paper foreign exchange instruments. We are trained to evaluate the strength or weakness of currencies by measuring them against one and other. However, the trend that has not been visible to the naked eye is that the value of all of these means of exchange has moved appreciably lower against gold and other hard assets. There are three reasons why the Fed and other central banks around the world may have set the path for higher commodity prices in the weeks and months ahead.

Reason One

It has become clear that interest rates are not rising anytime soon. The Fed, ECB, Bank of Japan, the Chinese central bank, and other monetary authorities have become addicted to a low rate environment. Intending to stimulate borrowing and spending and inhibit saving, the central banks have created a two-tier system. An increase in the regulatory environment has caused lending standards to tighten dramatically, and only those who do not need loans can borrow at historically low interest rates. The availability of cheap capital has caused companies to buy their shares, and equity price trends have juiced the stock market as trend-following investors, hungry for any yield or growth, have turned to stocks as they offer the only chance for capital growth. Stock valuations are at historically high levels.

Low-interest rates are inherently bullish for commodity prices; they lower the cost of carrying inventories. Therefore, a continuation of current central bank policy is a bullish factor for commodity prices.

Reason Two

Fed inaction has caused the dollar to weaken from recent highs. A lower dollar is typically bullish for commodity prices as the dollar is still the world’s reserve currency.

Even when the dollar was higher before the results of the July FOMC meeting were known, precious metals were strong. In a revealing departure from the historical norm of a strong dollar and lower precious metals prices, gold is higher today than it was in May 2014 when the dollar index was below 80.

Reason Three

On a longer-term basis, accommodative central bank policy around the world is inflationary. More paper currency in the system debases the value of currency instruments. Commodities are finite goods, and global population continues to grow exponentially. The bear market period between 2011 and 2015 in raw material markets has caused production output to decline, and inventories will begin to drop in many staple markets. We will eventually see more money chasing the commodities that fulfill basic human needs. The prices of most raw materials have risen from multiyear lows. Low interest rates and the decline in the value of all paper money could feed a commodity rally that will take prices to new all-time highs due to the side effects of accommodative monetary policy.

From the period of 2011-2015, it was appropriate to initiate commodity trades in the futures market by selling first and covering on price dips as prices made lower highs and lower lows. Central bank policy and the reaction by the prices of many commodities, including gold, may be telling us that it is now time to buy price dips and take profits on rallies as the commodities markets have shifted to higher lows and higher highs. Central banks set this path long ago, and the Fed signaled no change to this policy last week. Actions rather than words are necessary to battle the rising specter of inflationary pressures and central banks may be caught behind the curve.