Natural gas was one of the dogs of 2016. The commodity's price reached a low of $1.6110 per MMBtu in March, the lowest price since 1998. There were many reasons for the price swoon. Discoveries of quadrillions of cubic feet of gas in the Marcellus and Utica shale regions of the United States and fracking technology led to a condition of oversupply. Additionally, last winter the weather across the US was warm, leading to lower demand during peak season. In the lead-up to last winter, inventories rose to all-time highs at over 4 trillion cubic feet. Speculative and fundamental shorts pushed the price lower as weak demand helped create an environment of lower highs and lower lows in the NYMEX futures market. At the same time, the bear market in crude oil was a depressive factor for gas. However, each year brings new opportunities and challenges to all commodity markets, and there are at least four factors that may affect natural gas in the coming year.

Stockpile Trickle and a New Demand Vertical

Last November natural gas stocks rose to all-time highs. During the winter and spring season, inventories remained historically high, rising to over 50% above the previous year’s level and above the five-year average according to the Energy Information Administration. However, massive stocks and low prices created a perfect bearish storm for natural gas producers who watched as profit margins shrunk. For many, output became a losing proposition.

During the injection season over recent months, natural gas production slowed dramatically. As of August 26, the total number of natural gas stocks stood at 3.401 trillion cubic feet. While that figure is still 7.5% above the level seen at that time of the year in 2015 and 10.9% above the five-year average, the rate of growth of inventory has been declining rapidly over recent months. By late August 2015, 1.729 trillion cubic feet had flowed into stockpiles around the US. In 2016, that number was only 933 billion cubic feet, a decline of 46% in the rate of the energy commodity flowing into storage facilities.

At the same time, the first shipments of natural gas in liquid form recently left US ports for destinations where the price of gas is much higher, creating a new demand vertical for the commodity. Courtesy of Cheniere Energy (LNG), US natural gas production is now available for export. Exportation and declining output is a formula for a potential price recovery in the months to come. With the price below $3 per MMBtu, a level that remains uneconomic for many producers, the market may become tighter as supply declines and demand rises.

The Weather is Always a Question Mark

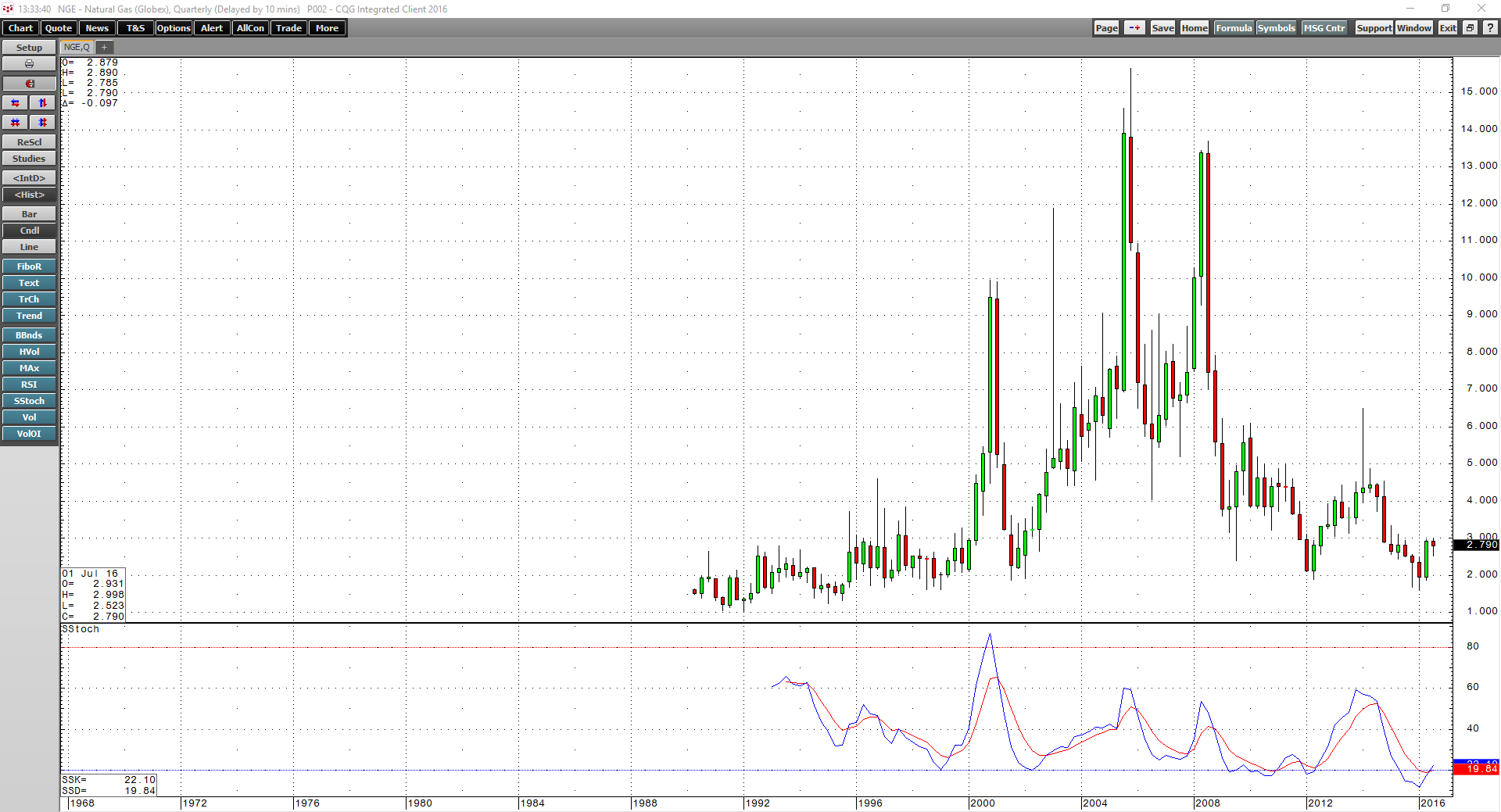

The winter season is the peak demand time for natural gas. The last time we witnessed a significant price rally in this volatile commodity was during the winter of 2014. The price of nearby natural gas futures peaked at almost $6.50 per MMBtu as frigid temperatures gripped the US.

As the weekly chart of NYMEX natural gas futures highlights, the cold-weather rally in early 2014 gave way to lower highs and lower lows. The warm winter season that followed caused demand to decline and a profitable bonanza for speculative and fundamental bears in natural gas followed.

Each year is a new adventure for commodities that are sensitive to weather conditions. Just because the winter of 2015-2016 was warm does not mean that the 2016-2017 season will be the same. The coming winter will determine heating demand, but many market participants continue to be bearish for the same reasons that made them boatloads of money over past months.

Speculators are Accustomed to Selling Every Rally

Some speculators bet on lower prices in 2015 and 2016 because of massive reserves. Output of the energy commodity plus warm temperatures provided a double whammy as their calls for lower prices were right on the money.

There are still many speculators that believe that the bear market in natural gas will take price back down below $2 per MMBtu and may even once again challenge last March’s lows in the months ahead.

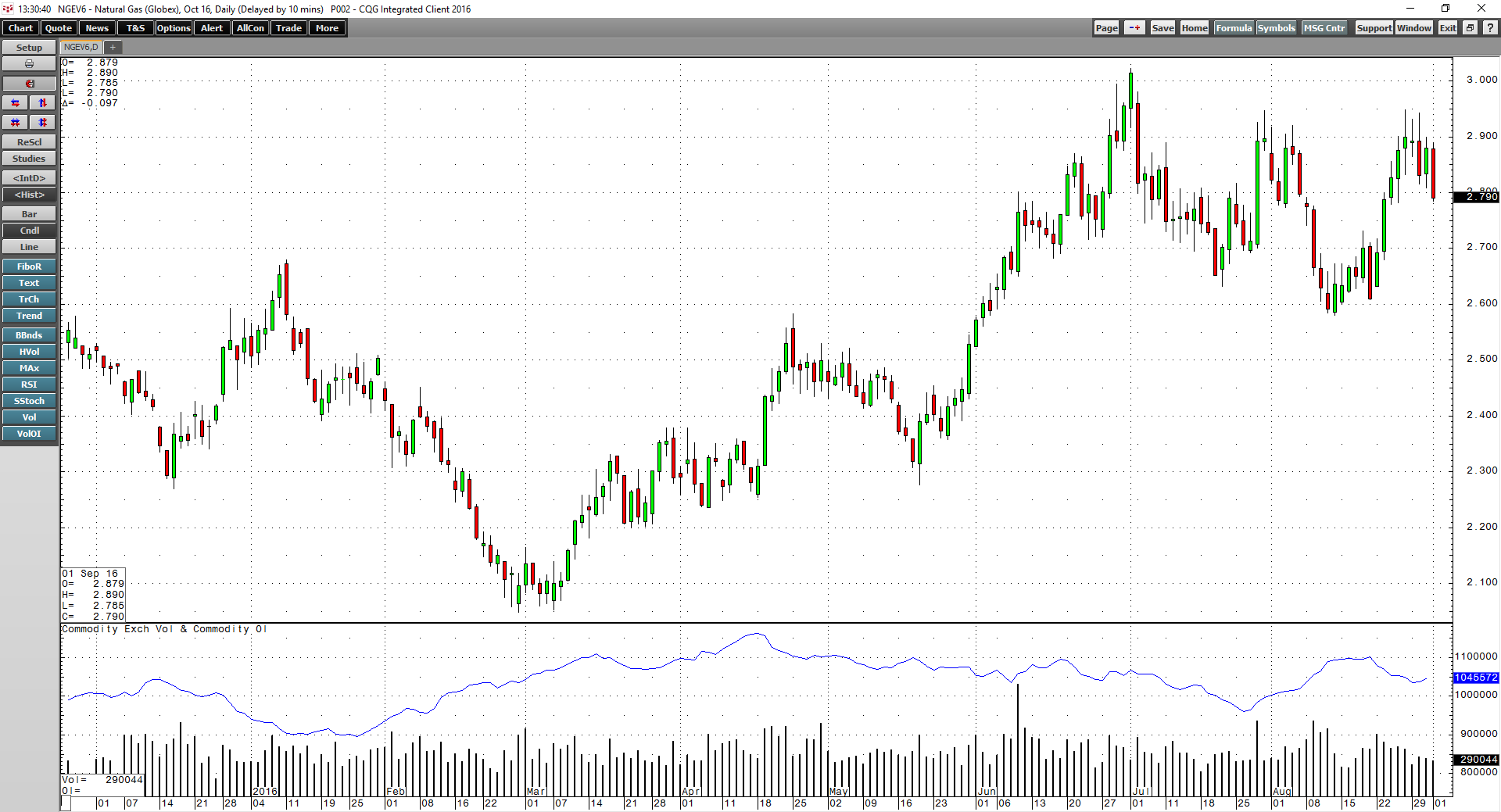

As the daily chart illustrates, each time the price of the energy commodity turns lower, open interest rises in a sign that the speculators become aggressive short-sellers. Most recently, after an attempt to challenge technical resistance at the $3 level, open interest increased to almost 1.1 million contracts. When the price rejected $3 and moved down to the $2.50s, open interest declined to 960,000 contracts. As the price increased from that low, it is possible that shorts became scale-up sellers as open interest once again rose. The price action in natural gas and open interest flows suggest that bears view every rally as an opportunity to sell the energy commodity short. However, on a long-term basis, the slow stochastic, a momentum indicator, may be telling us that this strategy could be running out of steam.

The NYMEX natural gas futures quarterly chart dating back to 1990 shows that the slow stochastic has crossed and turned higher in oversold territory, meaning that downside momentum may have run out of steam on a long-term basis. The price range since the first natural gas futures contract traded on NYMEX has been $1 to over $15 per MMBtu. At a price below $3, it is clear that gas is closer to lows than highs. While new discoveries and efficiencies of production likely mean that we will not see prices rise to levels over $10 again, the price remains close to lows from a historical perspective. One of the factors that could push prices higher over the months and years ahead is purely political.

Politics May Change the Market

During the Presidential primary season, one of the most important issues that Bernie Sanders campaigned on was the environment making him a staunch advocate of anti-fracking legislation. Clinton has adopted this position, so a Clinton election could change the game for natural gas production in the US. Increased regulation will make production costs rise and output will likely decline.

Last winter was a time to sell every rally in natural gas and cover those positions on price dips that took the price of the energy commodity to the lowest level in eighteen years. However, the winter of 2016-2017 could present an opportunity for the bulls. A significant decline in stockpile builds, and a price that makes output uneconomic for many producers could mean that the slightest whiff of a cold winter might cause a surprise rally. However, term structure still seems to favor the shorts. The premium for deferred natural gas prices through the coming winter means that those with short positions have the luxury of rolling their risk in a contango. Shorts are still able to buy back the nearby month at a discount to the next futures contract, pocketing the difference. Anyone wishing to take a long position has to pay the contango to play, making it an expensive speculation. Therefore, timing is of paramount importance when entering the natural gas futures market on the long side.

Technicals and fundamentals in the natural gas market are looking a lot better these days as the summer comes to an end. However, natural gas can be the most volatile commodity in the world, and the rising potential of a rally could be worth the cost of the contango. The shorts that profited last winter may wind up fueling a rally in the months to come.