These upcoming events will impact commodities:

- Election Day on November 8

- OPEC meeting on November 30

- Fed Funds rate decision in mid-December

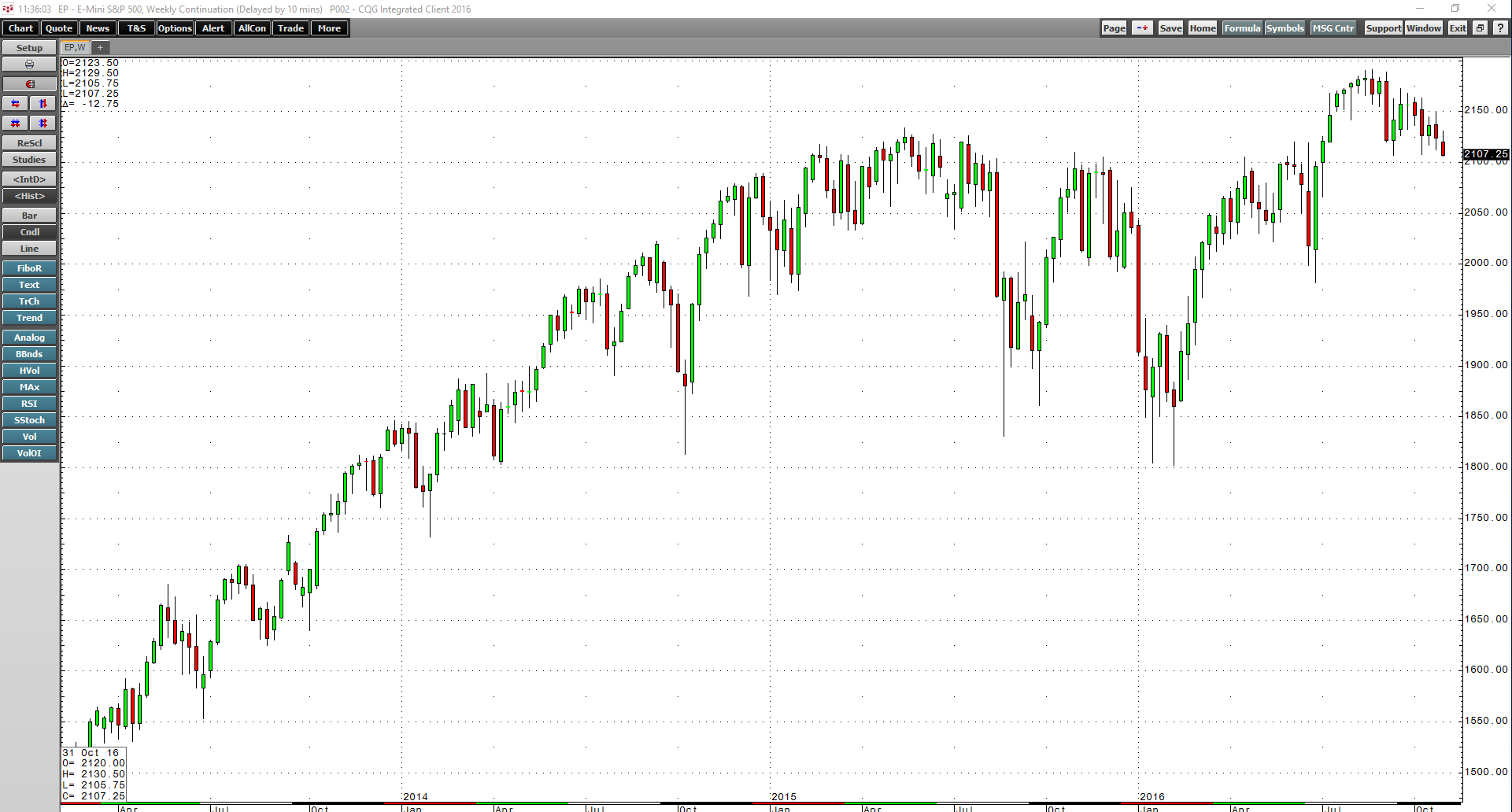

It has been a busy year, beginning with a tumultuous sell off in the Chinese equity markets that dropped the S&P 500 11.5% lower during the first six months of the year.

As the weekly chart of the E-Mini S&P 500 Index highlights, stocks recovered over the following months and are now higher for the year.

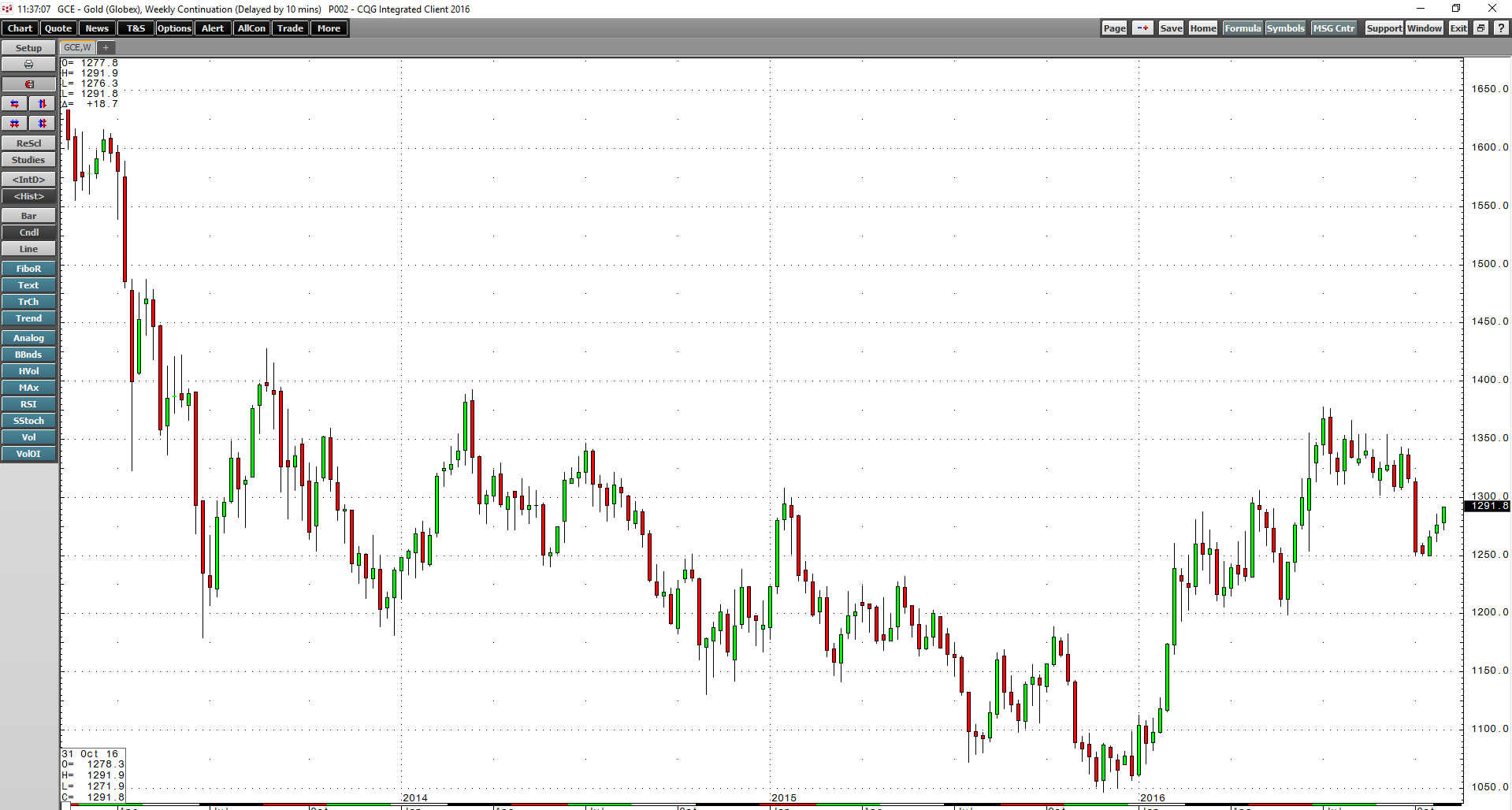

Precious metals took off to the upside, shrugging off a bear market that began in 2011 and ended with lows in late 2015.

The weekly chart of COMEX gold futures shows that the bear went back into hibernation after gold traded to lows of $1046 in December 2015 and silver followed the lead of its precious cousin.

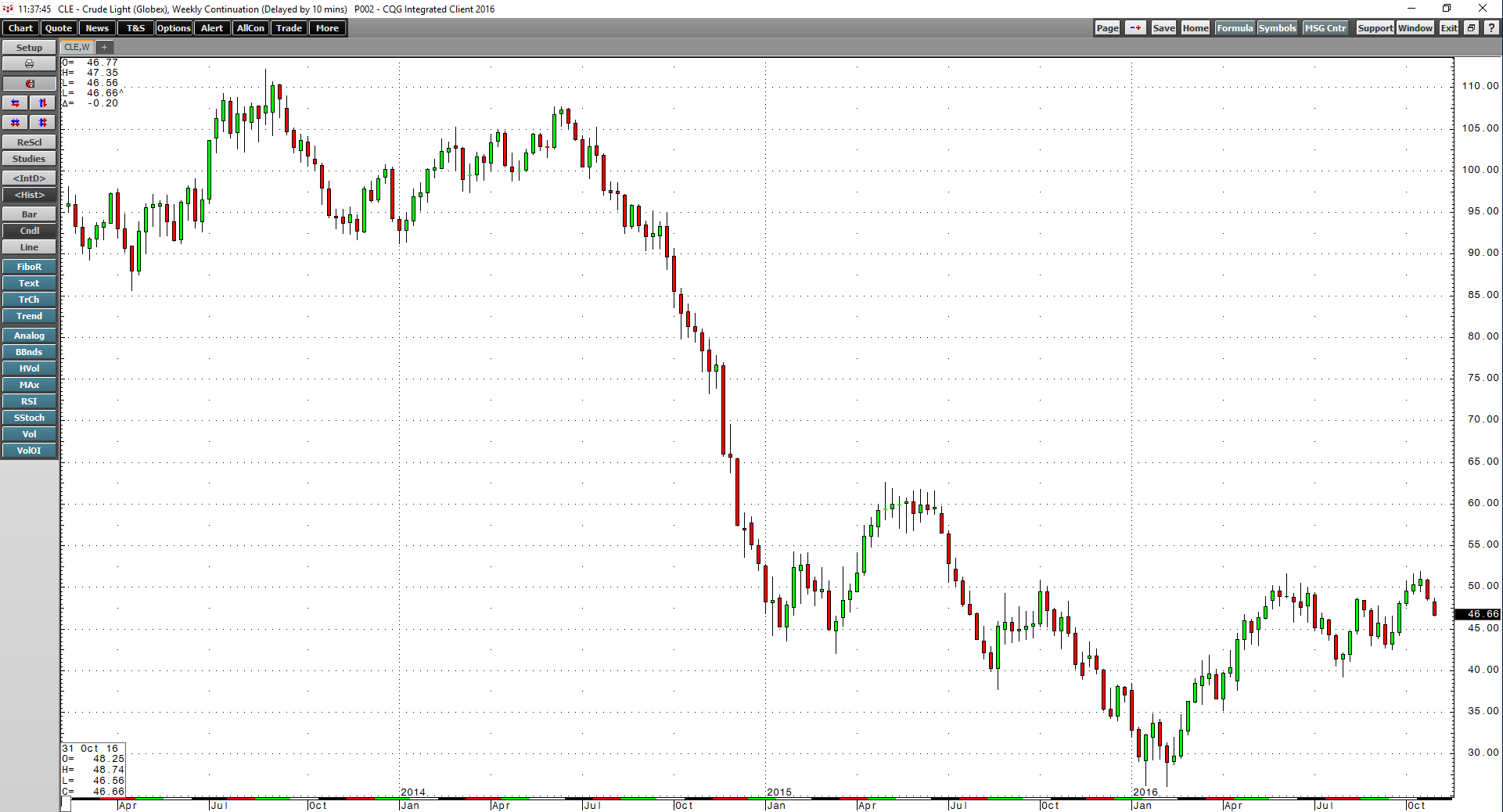

The price of crude oil fell to the lowest level since 2003 when it traded to $26.05 per barrel on February 11th of this year.

NYMEX crude oil has almost doubled since the lows of the year. Other commodities experienced lots of volatility throughout the year. Natural gas fell to $1.6110 on the nearby futures contract in March when huge inventories and a warm winter season pushed the price to the lowest level since 1998. Meanwhile, the price of sugar more than doubled over the course of the year, rising from 10.13 cents per pound in August 2015 to 24.10 cents at the end of September.

NYMEX crude oil has almost doubled since the lows of the year. Other commodities experienced lots of volatility throughout the year. Natural gas fell to $1.6110 on the nearby futures contract in March when huge inventories and a warm winter season pushed the price to the lowest level since 1998. Meanwhile, the price of sugar more than doubled over the course of the year, rising from 10.13 cents per pound in August 2015 to 24.10 cents at the end of September.

After the Asian contagion had caused volatility across all asset classes at the beginning of the year, the surprise result of the Brexit referendum in late June caused frenetic trading conditions. All the while, the US Federal Reserve, who had promised 3-4 interest rate hikes in 2016, has not moved, and the Fed Funds rate remains at the same level as on December 31, 2015. The continuation of short-term rates has fueled stock prices and kept the cost of carry for many commodities close to historical lows.

With only two short months remaining in the year, there are three events to look forward to that will continue the market volatility through the end of 2016.

Election Day

In one week, the US electorate will go to the polls to elect the 45th President of the United States. This election season has been nothing short of a three-ring circus and feels like it has lasted forever, and given the evolution of American politics, the 2020 election season will start on November 9, the day after the election.

The two candidates provide voters with clear choices for the future of the US and its position in the world. Differences in trade and energy policies, regulation and taxation, health care, America’s position in the world, and many other issues will come to a head when either Hillary Clinton or Donald Trump ascends to the highest office in the land. While Clinton leads in the polls going into Election Day, the British referendum has taught markets that only the final vote tally counts. Therefore, the potential for volatility over the next week and after the election remains high because of the divisive nature of the contest.

Oil’s Moment of Truth

In late September, OPEC did something it has not done in years.: it shocked markets by announcing that it reached an agreement in principle, with the assistance of the Russians, to freeze or cut production at their biannual meeting in Vienna on November 30. The price of oil has appreciated since the announcement as it is a departure from the cartel’s previous policy of increasing output to force high-cost shale production from the market. Meanwhile, over recent weeks, several OPEC member nations have requested exemptions from any production freeze or cut, shedding a degree of doubt on whether the cartel will ultimately come to an agreement to stabilize the price of the energy commodity that is both verifiable and efficient.

While the market has been dubious about OPEC’s ability to come to any middle ground agreement, declines in oil inventories in the US over recent weeks have kept the price of NYMEX oil close to the $50 per barrel level. The weeks leading up to the OPEC meeting and aftermath of any decision that announces a deal or no deal will add volatility to the energy commodity in the weeks ahead.

The Fed and Cheap Money Policies

Finally, the US Federal Reserve will meet in the middle of December to decide whether the Fed Funds rate will increase in 2016. The GDP numbers at the end of last week are supportive of a rate hike as they continue to show moderate economic growth. However, the dollar index has broken out to the upside recently.

As the weekly chart of the US Dollar Index illustrates, the greenback broke above the 98.595 resistance last week and could eventually be heading for the 100.60 resistance, the November 2015 highs. A stronger dollar could choke US economic growth as it makes exports less competitive on world markets and could cause a decline in earnings for many American corporations. If the dollar keeps moving higher and breaks above the 100 level before the Fed meets next month, a decision to hike rates will become challenging. A higher Fed Funds rate would likely add fuel to the dollar rally given growing interest rate differentials between the US currency and other foreign exchange instruments like the euro, Swiss franc, Japanese yen, and British pound. The Fed meeting will be another source of volatility over coming weeks as higher rates tend to be bearish for stocks, bonds, and commodity prices. The long bond has been moving steadily lower since July. While the Fed controls short-term rates, market forces determine medium and longer-term bond prices, and all signs are that interest rates have already begun to rise.

This year has been a volatile year where trading rather than investing has yielded optimal results given the variance in markets across all asset classes. The three significant events that await markets before the end of the year promise a continuation of volatility, and as we move in 2017, the economic and political landscape continue to offer evidence of volatile market conditions as far as the eye can see.