The trading range in crude oil has been narrow since the middle of December 2016. From high to low since December 19, the price of active month NYMEX crude oil futures have traded in a range of only $4.53 per barrel. Considering that there were sessions since June 2014 where the daily trading range was wider than $5, crude oil has gone to sleep, and has been a very boring commodity to watch and trade. However, that has not deterred oil market devotees from playing in the world’s most liquid commodity market, no pun intended. In fact, open interest has increased to the highest level in history during this period of static trading. The problem facing the energy commodity these days is that there are bullish and bearish fundamental factors at play, and many market participants on the consumer and producer side are very happy with the current price level.

OPEC Provides Support

OPEC shocked the market when it cut output for the first time in nine years at their November 30 meeting. The cartel said it would cut production by around 1.8 million barrels per day starting on January 1, 2017. So far all signs are that the members of the cartel are living up to their promise.

Russia, currently the world’s leading oil-producing nation, assisted OPEC in 2016 by acting as a mediator between differing factions within the cartel. The difficult relationship between Saudi Arabia and Iran made it almost impossible for the two nations to agree on anything. The Saudis insisted that all member nations do their part when it came to a production cut. Iran refused to cut output, stating it was their sovereign right to increase the number of barrels produced by the nation on a daily basis after years of suffering economic hardship under sanctions. After a meeting in Doha, Qatar early in 2016 when oil traded at the lowest price since 2003 and another get-together in Algeria in August, the Russians helped OPEC set the table for a deal. Leading up to the November 30 meeting, feverish negotiations and arm twisting resulted in an accord. The price of oil responded by moving back above the $50 per barrel level in early December.

US Production Provides Resistance

When the price of crude oil sank to $26.05 per barrel on February 11, 2016, almost all shale production in the United States was uneconomic; the market price was below the production cost for a barrel of US crude. In the middle of February 2016, the total number of oil rigs in operation in the US fell to 413. After the OPEC deal and above a $50 per barrel price, this decline changed and oil began to flow once again from the US. As of February 24, the rig count according to Baker Hughes stood at 602, 202 higher than the previous year.

Over recent weeks, oil inventories, as reported by the American Petroleum Institute and the Energy Information Administration, have been growing. During the first week of February, both said that the build was at least 9.5 million barrels over the prior week. While OPEC production cuts have provided support for the price of the energy commodity, the increase in US production has put a cap on the price. US producers are using the current price level to lock-in or hedge future production so spreads on the forward curve have narrowed and open interest has exploded higher over recent weeks.

Open Interest is Huge

Open interest is the total number of open long and short positions in NYMEX crude oil futures and it has been climbing, reaching a new record high since the OPEC announcement.

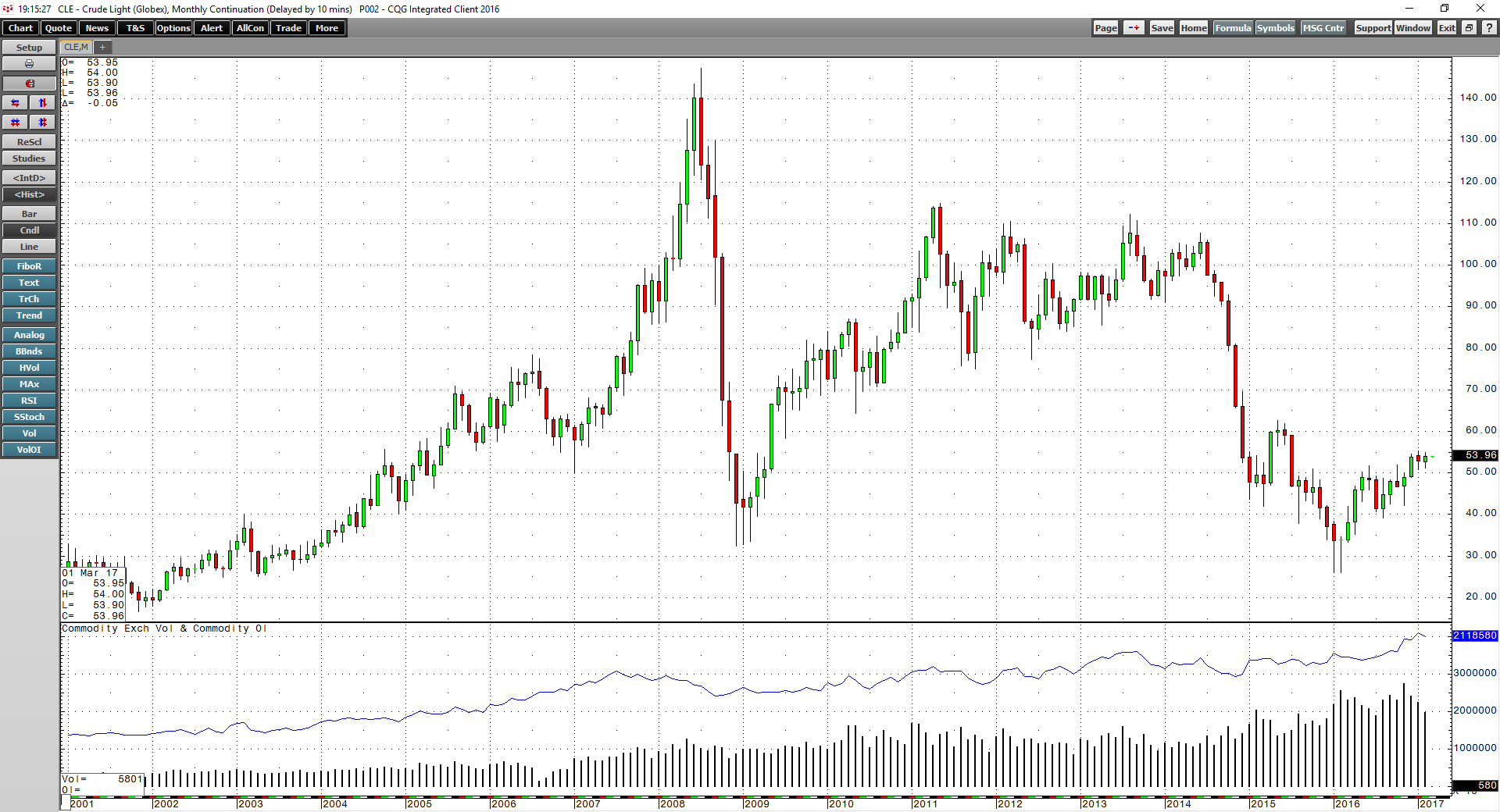

As the monthly crude oil chart shows, open interest rose to an all-time high of over 2.18 million contracts in January, at a time when the market was trading within the current narrow range. The positive trend over recent months has attracted speculative activity on the long side of the market but producer hedging has also increased dramatically as shale producers lock in prices that are once again above their total cost of production.

As the chart of the June 2019 minus June 2017 NYMEX crude oil spread illustrates, it has moved from a contango of $4.31 per barrel on November 10, 2016 to a backwardation of $0.50 as of the end of February. The same spread in the Brent oil futures was trading at over a $1.15 backwardation. In a backwardation, deferred prices are lower than nearby prices. Tightening spreads and backwardation in crude oil are the result of producer hedging and a perception that increasing demand could cause supply issues in the future.

A Trading Range That May Not Change for a Long Time but There is Always the Chance for a Shock

The current trading range in crude oil that has existed for over ten weeks has been a real snoozer.

As the chart highlights, weekly historical volatility has dropped to around 8.46%, the lowest in many years. However, this could be good news for many market participants.

When it comes to producers, the price is more than double the level it was trading at one year ago. For one of the world’s biggest producers, Saudi Arabia, a prolonged stable price above $50 will likely enhance their attempt at an IPO of Aramco in 2018. While the price is more than double since last year’s low, it is still around half the level it was trading at in June 2014, before all of the selling started. Therefore, the consumers of the world can also find a silver lining in the current price level.

In many ways, crude oil in a range of $50-55 per barrel is a sweet spot for most market participants these days. However, history tends to repeat itself in commodities markets and when it comes to crude oil there is always a chance of a shock to the system. With historical volatility at the lowest level in years, put and call options on futures have become dirt cheap and offer buyers the unique opportunity to buy shock insurance and remain in positions with limited risk.

Crude oil is in a deep slumber these days and open interest is close to an all-time high. The Middle East, the region with the majority of the world’s oil reserves, also remains one of the most volatile regions in the world. Cheap options could be an excellent way to prepare for the unexpected over the coming months.