The dollar index moved lower by 2.66% in the third quarter of 2017, and commodities prices moved higher with four of the six major sectors posting gains. Out of the 29 commodities that I follow, 20 posted gains during the three-month period that ended last Friday, September 29. Commodities watched as the dollar declined, but the prospects for higher interest rates likely kept the market in check. A weak dollar tends to be bullish for raw material prices, but higher real interest rates increase the cost of carrying inventories of commodities.

A Winning Quarter

During the period from July 1, 2017 through September 29, 2017, the base metals sector with four out of six nonferrous metals posted double-digit gains and all of these nonferrous metals moved to the upside, being the big winner in the commodities asset class. Zinc led the sector with a 14.97% gain, and nickel came in a close second with a rally of 14.2% for the three-month period. The energy sector, led by gains in heating oil and Brent crude oil, came in second with a gain of 9.29% for the third quarter. Precious metals moved 3.68% higher while soft commodities posted a gain of 2.92%.

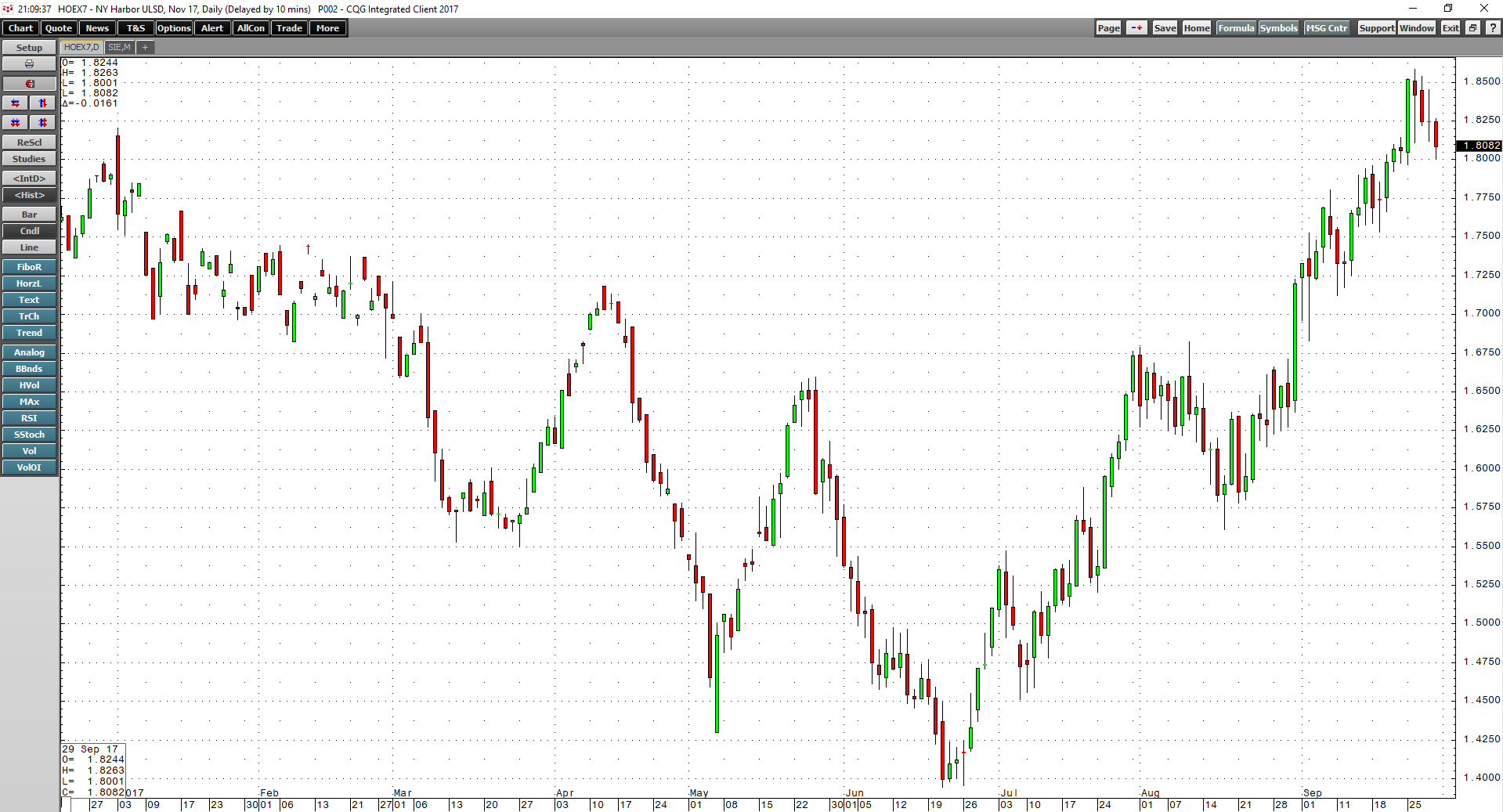

The big winner in Q3 was heating oil futures, which climbed 21.94% over the three months.

As the daily chart of NYMEX heating oil futures highlights, the price of the oil product rallied steadily throughout the third quarter.

Lots of Winners

Brent crude oil appreciated by 17.63%, zinc moved 14.97% higher, followed by nickel, which was up by 14.2%. Other winners with double-digit gains included FCOJ futures, NYMEX crude oil, aluminum, palladium, and LME copper futures.

With only nine losers out of 29 commodities, it was a good quarter for the raw materials sector. Chinese buying caused rallies in many industrial commodities, and the Baltic Dry Index, a benchmark for freight rates around the world, moved over 51% higher. While the dollar moved only 2.66% lower, an asset that is not quite a currency and not quite a commodity turned in the most impressive performance as Bitcoin appreciated by another 64.68% over the three-month period.

Few Losers, but One Huge One

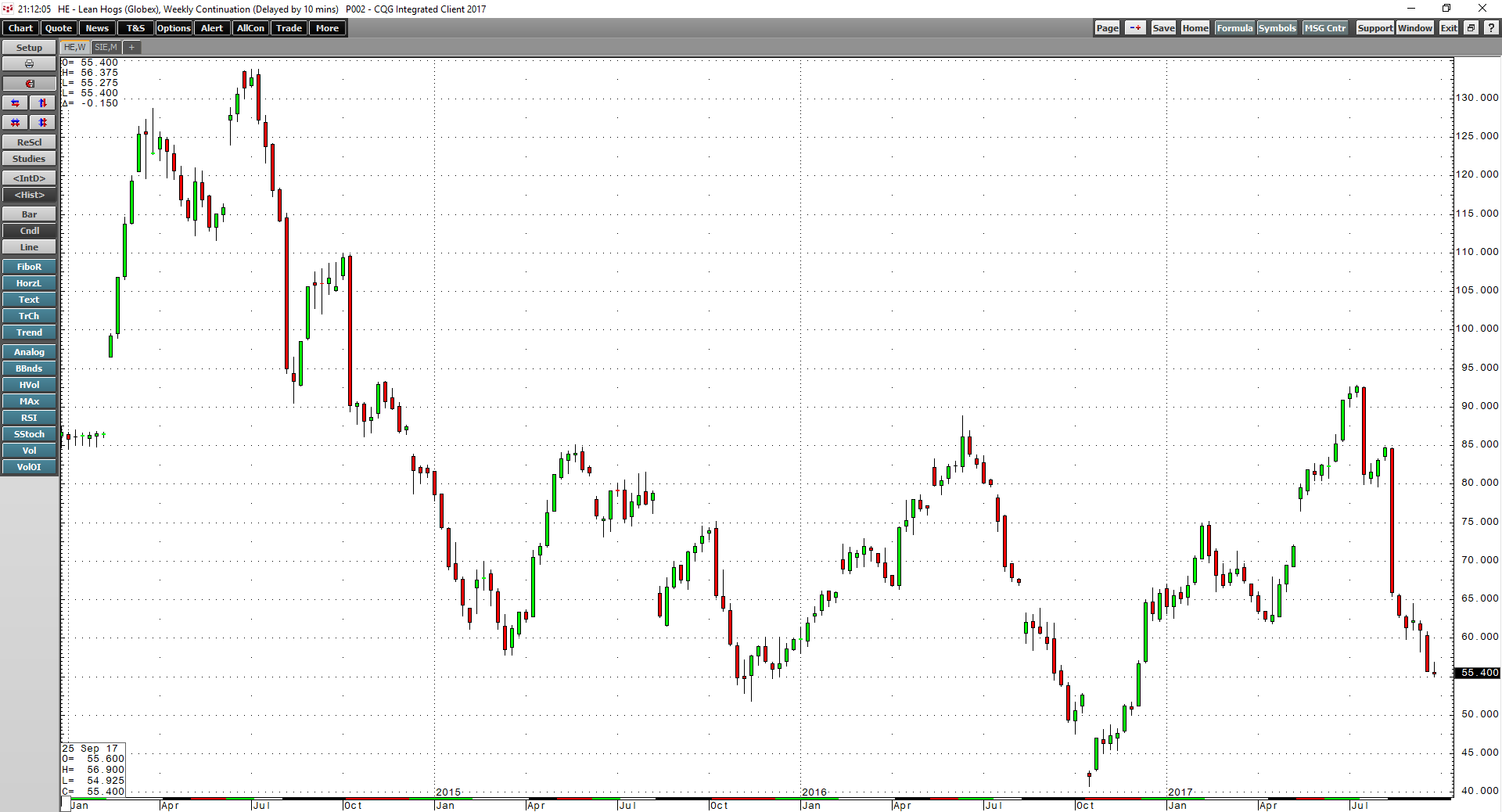

The biggest loser was also the commodity that moved the most over the course of the three-month period. On October 2016, lean hog futures fell to the lowest level in almost a decade and a half. However, the price of pork then rallied sharply. With the end of the 2017 grilling season, lean hogs lost 39% of value in Q3.

As the weekly chart of lean hog futures illustrates, the price fell from over 90 cents to under 60 cents on seasonal factors and abundant supplies.

The animal protein sector was the worst performer, falling 14.1%. Live cattle futures declined by 6.19% while feeder cattle managed a 2.91% gain in Q3. Grains, the leader in Q2 on drought scares in the Dakotas and Montana at the end of June, was a laggard in Q3 as rains washed away all bullish sentiment. The grain sector fell by 4.53% in Q3, with the biggest winner from Q2 suffering the most significant decline as MGE wheat dropped 18.53%. KCBT wheat lost 13.4% of value. The other wheat futures markets moved to the downside as oats and CBOT wheat dropped 13.36% and 12.28% respectively. Other notable losers were cotton futures, which shed 8.27%, corn, which lost 4.12%, and sugar, which soured by 1.96%. Natural gas, ethanol, and platinum all lost less than 1%. Platinum continues to be the weakest link in the precious metals sector.

Q3 Highlights

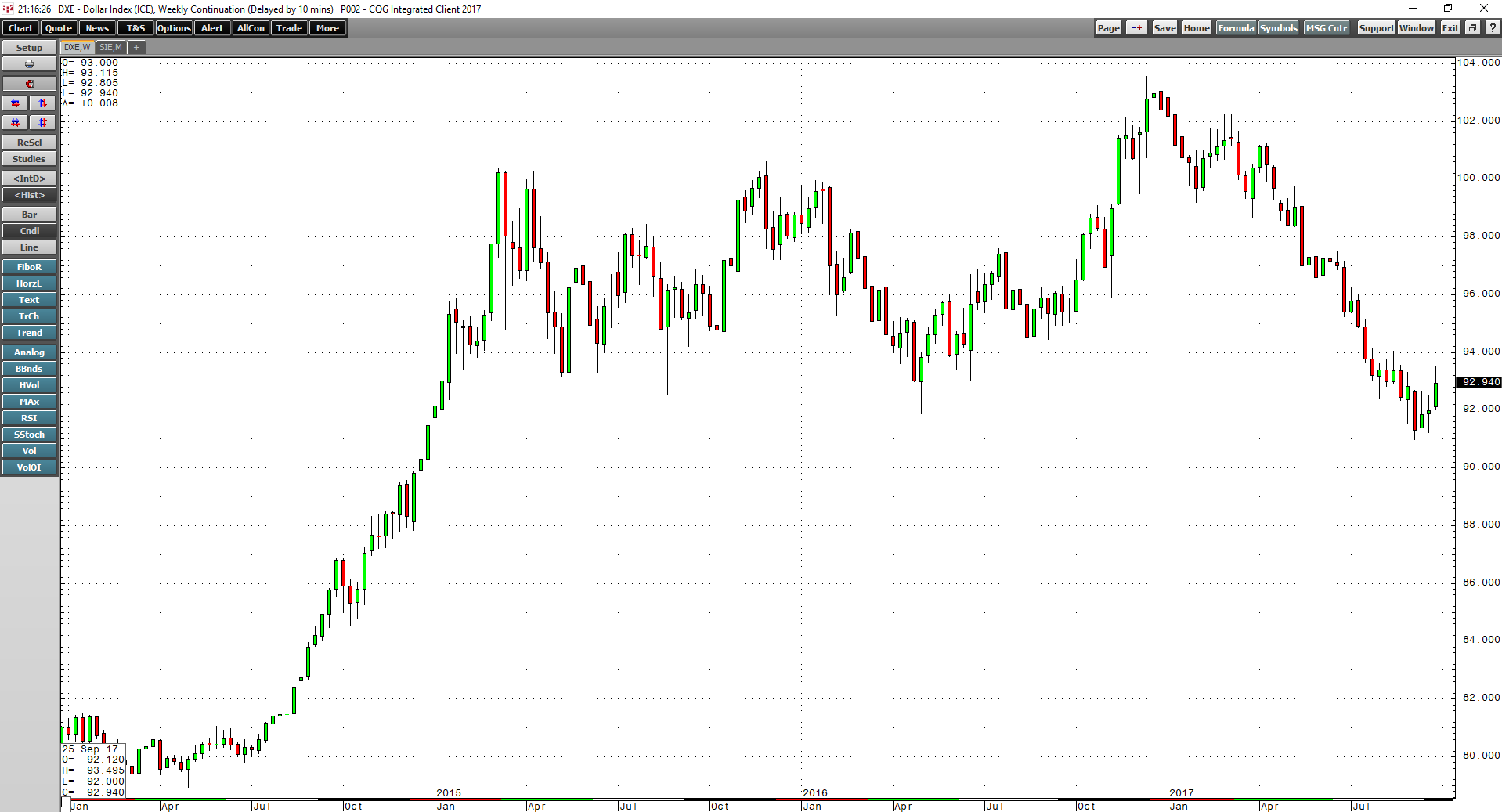

There were lots of events on the economic and geopolitical landscapes that impacted markets in Q3. The dollar continued to fall over the course of the quarter. In January 2017, the dollar index traded to its highest level since 2002, but it has been all downhill since.

As the weekly chart of the dollar index shows, the greenback challenged and fell below critical support at the May 2016 lows of 91.88 in September. While the dollar recovered at the end of the quarter, it remained close to the lows. China was a significant buyer of industrial raw materials, which resulted in base metals’ spectacular performance in Q3.

The US Federal Reserve told markets that rates would increase again by 25 basis points, with the hike likely coming at the December meeting. Additionally, the Fed indicated that the market should expect another three hikes in 2018. Moreover, balance sheet normalization or the reduction of the swollen legacy of quantitative easing will commence in October at a rate of $10 billion per month rising each quarter by another $10 billion. The quantitative tightening will reach a maximum of $50 per month in the future. The most hawkish thing the Fed told markets was that the process of QT, or quantitative tightening, would not be data dependent. The tightening cycle resulting in higher rates means that the cost of carrying long commodities positions will increase in the months ahead.

The Trump administration has yet to have a major piece of legislation pass through both houses of Congress. Health care reform failed to garner support, and now the administration is focusing its efforts on tax reform, which could be even more challenging. Gridlock in Washington continues to stand in the way of legislation that would provide fiscal stimulus, which could continue to weigh on the value of the dollar as we head into Q4. At the same time, the ECB is likely to move from an accommodative stance towards tightening as economic growth has been moderate and the political fears and uncertainty following Brexit in 2016 have disappeared. The election of a pro-EU leader in France and re-election of Chancellor Merkel in Germany have cemented the future of the Union and euro currency, which could bolster the euro in coming weeks and months.

When it comes to the geopolitical landscape, there are many issues that will continue to impact markets. North Korea powered with nuclear weapons has caused periods of fear and uncertainty in markets. Meanwhile, the US relationship with Russia and trade issues with China could impact markets over coming months, as could the economic and political situation in Venezuela. In the Middle East, the boycott of Qatar by the Gulf States, the conflict in Syria, the Israeli-Palestinian issue, and the actions of Iran in the region are all factors. These matters are likely to impact markets across all asset classes as we move forward into the final quarter of the year.

Significant Events on the Horizon

The dollar has declined by over 9% so far in 2017, and the composite of 29 commodities that trade on the US futures exchanges are up just under 2.9% on the year. In 2016, the dollar rallied by 3.6% and commodities were up over 13.4% higher. Therefore, it is likely that the currency market is playing catch-up with the commodities market. While there are so many potential issues that can impact commodities markets in Q4, there are three events to keep an eye on in addition to all of the current problems facing the world: In China, President Xi will lead the Party Congress in October, which will spell out the economic path of the world’s leading commodities consumer. At the end of November, OPEC will convene in Vienna, Austria to decide the future of production cuts and quotas, which the cartel extended to the end of Q1 2018 at their meeting in May. In December, the FOMC will likely hike rates in the US during their final meeting of the year, which is becoming a habit for the central bank since it increased the Fed Funds rate at their December meeting in both 2015 and 2016.

Commodities tend to be the most volatile asset class of all, and the current economic and geopolitical landscapes could make the final three months of the year a rollercoaster in markets across all asset classes.