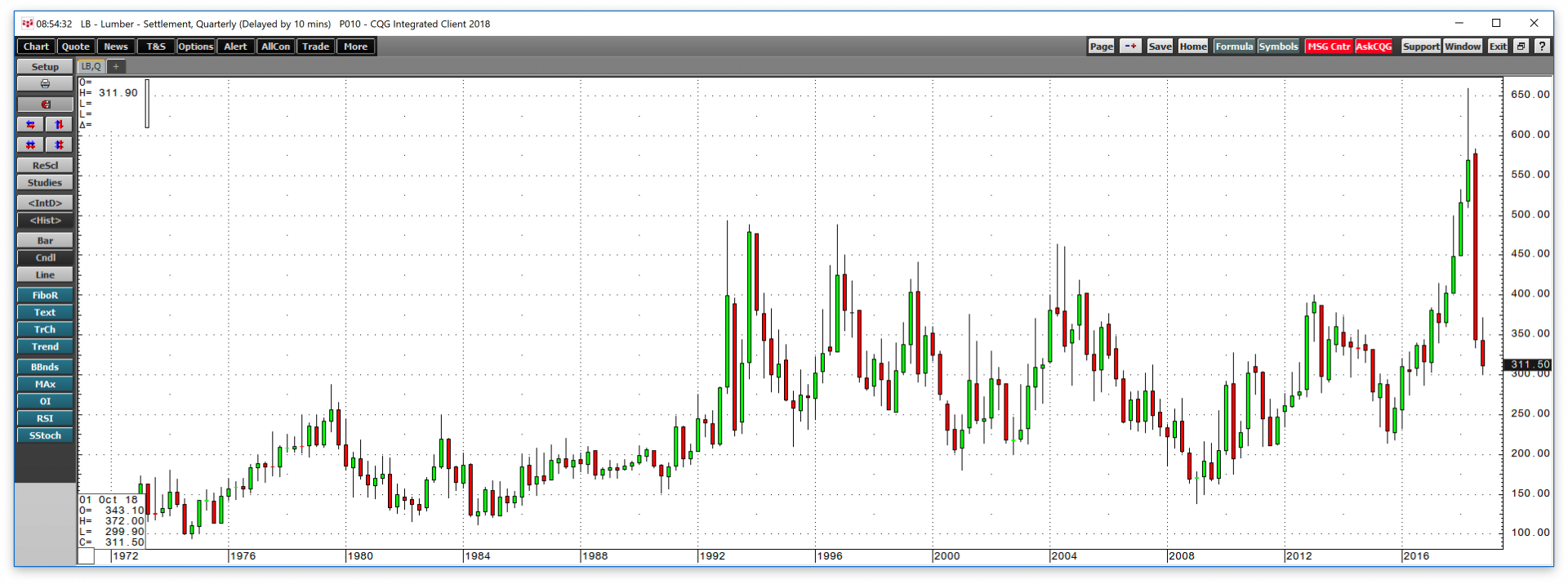

There are many lessons that we can learn from the price action in commodities markets. Commodities tend to rise to prices where output increases, inventories build, and demand declines. At lofty levels, prices peak and reverse. The most recent example was in the wood market where the price of lumber futures rose to a new all-time high at $659 per 1,000 board feet in May 2018 on the back of new home construction and economic growth in the United States.

As the long-term quarterly chart highlights, the futures found a high in May, and by the end of October, just five months later, the price was trading at less than half the level. Lumber hit the top of its pricing cycle in May and the price plunged.

There are two recent examples of markets that fell to levels where it is likely that output declined, inventories began to decrease, and demand increased. In September of this year, the sugar and coffee markets hit their lowest levels in over a decade. Based on the price action in October, sugar and coffee fell to prices that turned out to be unsustainable.

Commodity fundamentals are a powerful force, and they tend to drive prices to extremes where opportunities abound.

A brutal bear market in sugar

In August 2015, the price of sugar hit a low of 10.13 cents per pound which turned out to be a significant bottom for the sweet commodity that is a staple in many foods people all over the world consume each day.

As the monthly chart illustrates, the price of sugar rose steadily in the wake of the August 2015 bottom reaching a high at 23.90 cents per pound in October 2016 which turned out to be the top of the pricing cycle in the sugar market. Sugar futures fell over the next two years, and when they moved below the August 2015 bottom in August 2018, it looked like the technical break to the downside that took the price to its lowest level since 2008 would lead to more selling. In late September, sugar futures that trade on ICE hit a low of 9.83 cents, which turned out to be a bottom.

Recovery in the sweet commodity

Hindsight is twenty-twenty, but the upside potential for sugar outweighed the downside risk when the price probed below the 10 cents per pound level. One of the reasons why sugar found itself at the lowest price in a decade was that the Brazilian real suffered a significant decline in value against the U.S. dollar in 2018. Brazil is the world’s leading producer of free-market sugarcane, and the fall in the local currency eased the blow of lower sugar prices in U.S. dollar terms. However, aside from the currencies impact on the price of the soft commodity, sugar fell to a price that discouraged new production, and where demand likely increased because of the historically inexpensive price level.

As the weekly chart shows, the price under the 10 cents per pound level turned out to be unsustainable, and in October the price of sugar recovered to a high of 14.24 cents per pound, a rise 44.9 percent in less than one month.

Brazil is also the leading producer of Arabica coffee beans, and the coffee futures market experienced the same price action as sugar in September and October.

Coffee drops below $1 for the first time in a dozen years

In November 2016, the price of Arabica coffee beans that trade on ICE hit a high at $1.76 per pound which turned out to be the top end of the pricing cycle for the soft commodity. Coffee did nothing but make lower highs and lower lows throughout 2017 and most of 2018.

The weekly chart shows that every rally in the coffee futures market from November 2016 through mid-September 2018 was an opportunity to sell. Coffee reached a low of 92 cents per pound during the week of September 17, which was the lowest price for the commodity since 2006 and the first time it traded below $1 per pound in a dozen years. However, the bullish key reversal trading pattern in the coffee futures market on the week that coffee hits its low was an ominous bullish sign.

Lows lead to percolation

Just like in the sugar market and many other commodities that hit the bottom end of their pricing cycles, coffee found a low in mid-September, and the recovery took the price appreciably higher in October on a percentage basis.

As the daily chart displays, coffee futures rose to a high of $1.2550 per pound on October 19, a rise of 36.4% from the lows that came less than a month before the price of coffee decided to take off to the upside. The bullish reversal on the weekly chart ignited the price of coffee futures, which have been percolating to the upside.

The lessons from lumber, sugar, and coffee

Commodities are cyclical assets. Prices rise to highs where economic fundamentals create tops, and they fall to lows where bottoms form. The price action following a bottom or top can be highly volatile as we witnessed in the lumber, sugar, and coffee futures markets over recent weeks and months.

It is virtually impossible to buy bottoms and sell tops in markets. Speculative action tends to take prices below equilibrium prices on the up and the downside in futures markets. However, when markets rise or fall to price levels that change the supply and demand fundamentals, the most attractive opportunities arise. When looking at opportunities at the top or bottom of a cycle, traders often must take contrarian positions as trend-followers who live by the mantra the trend is your friend tend to be on the other side of the trade. The latest lesson from the commodities market is that a contrarian view based on fundamentals and historical data in the lumber, sugar, and coffee futures markets paid off handsomely.