Crude oil is the energy commodity that powers the world. Over the past six months, the international oil market provided a rollercoaster of volatility for market participants. A ride to the downside from October through December last year led to a price recovery that has taken the price of nearby NYMEX futures to the $65 level and pushed the price of the Brent benchmark crude oil futures to over $72 per barrel.

While the oil market is still in recovery mode, there are signs that two-way volatility could return to the energy commodity over the coming weeks.

The path of least resistance of the price of crude oil is a complicated mixture of fundamental, technical, macroeconomic, and geopolitical factors. We could be in for a bumpy ride given the factors facing the oil market as we head towards May.

Oil took an elevator lower in Q4 2018

The fourth quarter of 2018 was ugly for the crude oil market. The selling began in October after months of tweets by US President Trump warning Saudi Arabia and allies within OPEC to pump up their volumes to slow the ascent of the energy commodity which traded to a high at $76.90 per barrel on the nearby NYMEX futures contract.

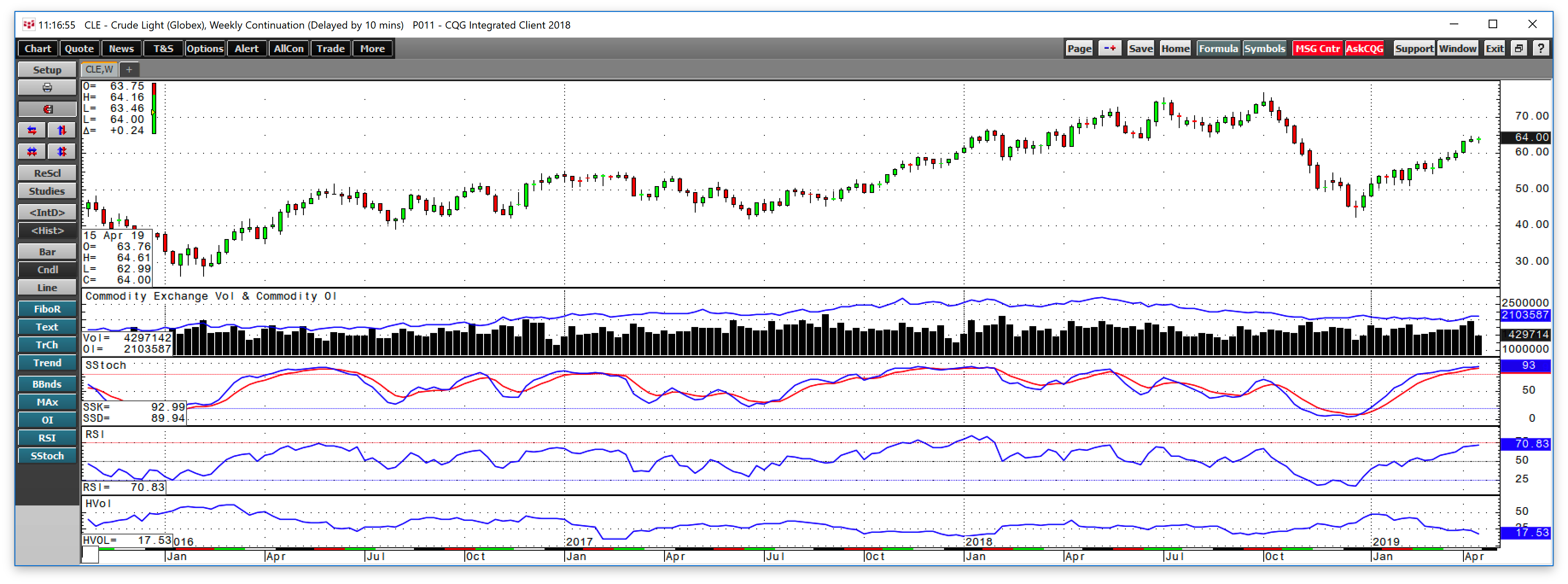

As the weekly chart highlights, crude oil began a deep corrective move that took the price to a low at $42.36 per barrel in late December. A series of serendipitous events took the price of the energy commodity lower. After the worldwide condemnation of the Saudis over the murder of Saudi national and Washington Post columnist Jamal Khashoggi in Turkey at the hands of Saudi security forces, the Saudis cooperated with the US and sold more crude oil.

Moreover, the US decision to grant exemptions to eight countries that purchase the energy commodity from Iran caused additional selling to hit the market. At the same time, the ongoing trade dispute between the US and China that has weighed on the Chinese economy slowed demand for oil. As the winter season approached, which is the weak season for demand, the price continued lower. The fall in the stock market during the final quarter of 2018 created what became an almost perfect bearish storm for the crude oil market.

US production rose to over 12 million barrels per day which exceeds the output from Saudi Arabia or Russia. The low price of crude oil caused OPEC together with the Saudis to trim production by 1.2 million barrels per day at their winter meeting in response to the falling price. At the end of December, at just over $42 per barrel, the price decline stopped dead in its tracks. Crude oil took an elevator ride to the downside in Q4, but it found a bottom and has been recovering since.

A recovery in the price put crude oil on the staircase to the upside so far in 2019

The price of crude oil got off the elevator in late 2018, and back on the stairs to the upside.

The weekly pictorial illustrates the ascent of the price of the energy commodity that has taken the price above the 50% retracement level of the move from $76.90 to $42.36 per barrel which was at $59.63. The price eclipsed that level in March and continued to add to gains reaching a high at almost $65 per barrel in April. Meanwhile, Brent crude oil moved to over $72 per barrel as it continues to trade at over a $7.90 premium per barrel. As the chart shows, the slow stochastic, a price momentum indicator, has risen into overbought territory and relative strength also displays an overbought condition. Both metrics fell into oversold territory in late 2018. At the same time, open interest fell from 2.22 million contracts when crude oil was on its high in early October to the 2.10 million level as of Thursday, April 18. The decline in the number of open long and short positions in the NYMEX WTI futures market is a sign that market participants have been less aggressive with risk positions given the recent price volatility in the oil market. As of April 18, the prices of both WTI and Brent crude oil futures were sitting within a stone’s throw of their recent highs.

Three reasons lead me to believe that we could be in for a period of wider two-way price variance in the oil market over the coming weeks.

Reason one - OPEC/NOPEC threats and capitulation and the upcoming meeting in Vienna

A piece of legislation sitting in the US Congress could lead to sanctions and outlaw OPEC as the cartel engages in anti-trust and price-fixing activities. Congress has been threatening to enact this legislation for years, but given the President’s repeated demands for increased output, he could sign the bill into law if it passes through both houses of the legislature.

In response to the NOPEC legislation, the Saudis recently said that it could cause them to choose to price crude oil sales in currencies other than the US dollar. The dollar is the reserve currency of the world and the benchmark pricing mechanism for crude oil around the world. The choice to move to euro or other currency pricing could detract from the dollar’s role in the global financial system. After the threat, Saudi officials denied that they were considering the move, but where there is smoke, there is often fire, and one of the top producers could be sending a message to Washington DC through the rumor mill.

At the same time, it will not be long before the oil ministers of OPEC gather in Vienna, Austria for their next biannual meeting where they will decide on production policy. With the price of crude oil appreciably higher, and production from Venezuela and Libya declining because both nations are political basket cases, the chances are rising that the cartel could abandon their production cuts which could put more oil into the market. The Russian oil minister recently said that they might support increasing production quotas given the price action in the market in 2019. We could see an increase in price variance in the oil market in the leadup to and the aftermath of the upcoming OPEC meeting which will take place for members on June 25, and for the cartel and Russia and other nonmembers on the following day. The Russians continue to play a dominant role within OPEC as a mediator between the Iranians and Saudis.

Reason two - A critical decision on Iran in Q2

In May, the exemptions on those countries that purchase crude oil from Iran will expire. India has already petitioned the US government for an extension, and at the current price level, it is likely that President Trump will extend the exemptions for at least six months. However, the uncertainty of the US administration’s position when it comes to exemptions could lead to a period of volatility in the market. If President Trump decides to expand sanctions and end the period of exemptions for Iran, it would likely cause more tightness in the crude oil market and could raise the political temperature in the Middle East. Conversely, an extension and a continuation of the status quo would allow the oil to flow keeping somewhat of a lid on prices. Uncertainty over US policy could lead to an increase in two-way price volatility in the oil market.

Reason three - Trade issues could determine demand

China is the world’s most populous nation and the demand side of the equation for most commodities, and crude oil is no exception. Optimism has been rising when it comes to the potential for a new framework for trade that would end the protectionist policies that have caused US tariffs on the Chinese and retaliation by the Asian nation on US exports. The trade dispute has weighed heavily on China’s economy. With 1.4 billion citizens and economic growth at 6.6% in 2018 and 6.4% in Q1 2019, a trade deal could turn the tide on the slowdown and cause demand for crude oil to increase. Therefore, the outcome of the current negotiation will likely cause volatility in the oil market. If talks were to breakdown, the price of oil and many other commodities that China purchases could move to the downside. However, a trade deal would likely cause a wave of buying. The current consensus is that a trade deal will emerge sooner rather than later as both sides have expressed optimism over the progress of talks.

Meanwhile, the recent move by Chevron to purchase Anadarko could be the beginning of a period of consolidation in the oil market. It is possible that the other leading producers including Exxon Mobile will be looking to purchase smaller companies to create economies of scale and increase their market share.

The price of crude oil was $12.90 per barrel below its early October high on April 18, and there are more than a few issues facing the market that could cause a wider price ranges over the coming weeks and months. Volatility is an investor’s nightmare, but at the same time, it creates a paradise of opportunities for nimble traders with their fingers on the pulse of markets. When it comes to crude oil, the Middle East is home to over half the world’s reserves which always presents the potential for wild price swings if violence flares and impacts production, refining, or logistical routes in the region. Crude oil is the commodity that powers the world, and its price action over the coming weeks and months could impact markets across all asset classes.