Everything was humming along in the equities and commodities markets in mid-February. The S&P 500 made its latest record high on February 20. On the same day, the price of crude oil traded to a high of $54.66 per barrel on the nearby April futures contract after probing below the $50 level earlier in the month. Copper was still above $2.60 per pound after a recovery from under the $2.50 level. A host of other markets were firm, even though the fatalities and cases of Coronavirus in China were mounting.

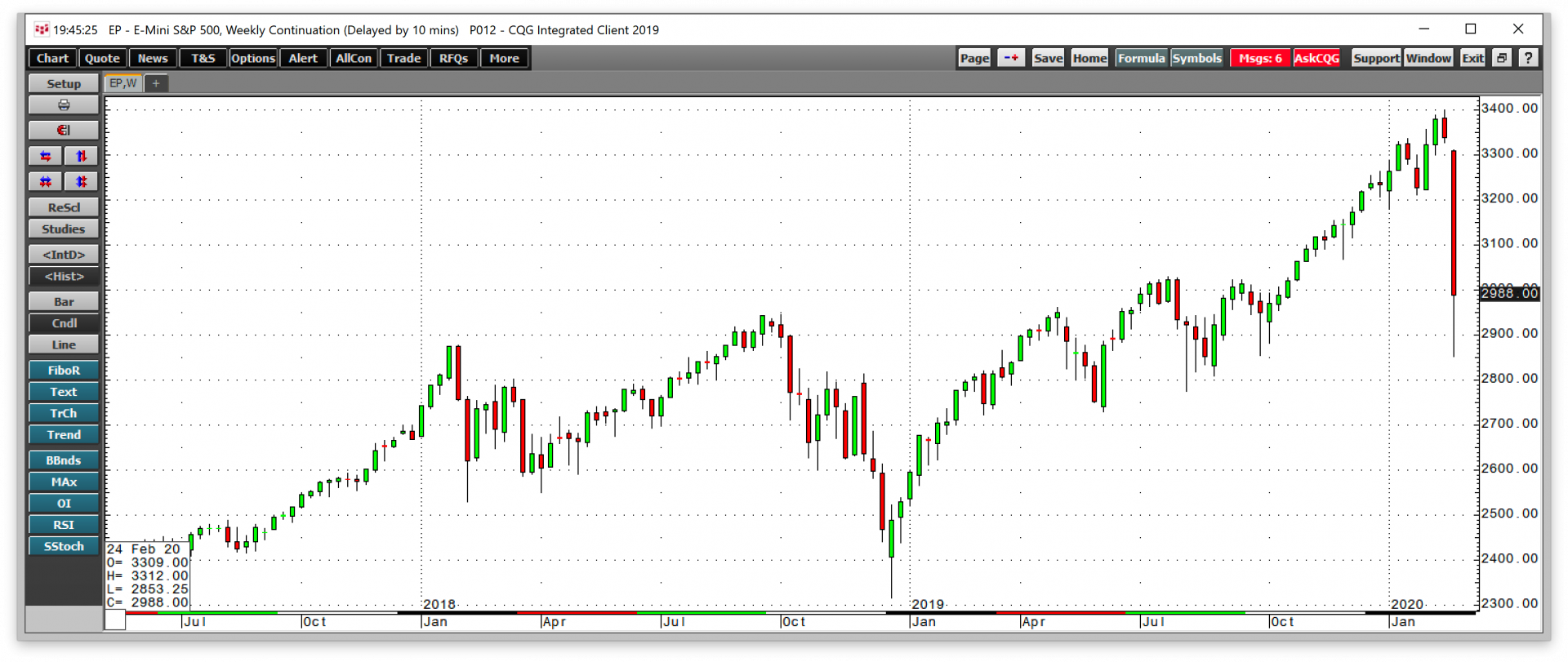

At the start of the last week of the month, markets tanked. The DJIA moved over 1,000 points lower on Monday, February 24, and raw material markets were lower across the board. The only markets that posted gains were US bonds, gold, and silver as traders and investors sought safe-haven assets. By the end of the week, the price carnage was ubiquitous; only bonds stood up as the safety zone.

As we move into March, the threat of a continuation of risk-off conditions and elevated levels of volatility threaten markets across all asset classes. The landscape became a nightmare for investors. At the same time, it created a paradise for nimble traders with their fingers on the pulse of markets.

Coronavirus replaces trade concerns and politics creep into market action

Most analysts are placing the blame for the worst price action in markets across all asset classes since the 2008 financial crisis on the outbreak and spread of Coronavirus. On Monday, February 24, reports of cases in South Korea, Iran, and Italy ignited the market implosion, according to most pundits. However, what most are not citing was news from the political arena. The winner of the Nevada caucus on Saturday, February 22, was Senator Bernie Sanders. While markets came down with a case of the virus during the final week of February, they also may have suffered from a second-degree “bern.”

Vermont Senator Bernie Sanders won an overwhelming victory in my home state of Nevada, putting him at the top of the pack in the race to capture his party’s nomination. The Senator, a self-proclaimed Democratic Socialist, is a champion of sweeping changes in US policy when it comes to taxes, the environment, and many other policy areas. A choice between Senator Sanders and incumbent President Trump would pit Democratic Socialism against Capitalism in the upcoming November contest. We could see a significant impact on markets across all asset classes as prices reflect both the economic and political landscapes.

Last weekend, South Carolina held its nominating contest. Former Vice President Joe Biden, a moderate Democrat, held a commanding lead in the polls going into the primary. March 3 is Super Tuesday, with lots of delegates up for grabs. If Senator Sanders puts more distance between himself and challengers, the odds of him being the nominee will rise. A continuation of the risk-off environment could depend on a combination of the spread and severity of the virus as well as the results of the Super Tuesday contests.

Meanwhile, US Fed Chairman Jerome Powell told markets that the central bank is prepared to unleash emergency stimulus, if necessary, during the final trading session of February. The only good thing about last week in markets was that leap year, February 29, fell on a Saturday, which meant the markets were not open for business and could not continue to decline.

The weekly chart of the E-Mini S&P 500 tells all one needs to know about the final week of February during leap year in 2020.

Crude oil moves towards the 2018 low

After falling to a low of $49.31 per barrel on February 4, the price of nearby NYMEX crude oil futures recovered to a high of $54.50 on February 20, where they ran out of steam on the upside.

The weekly chart highlights the decline that took the price of the energy commodity to a low of $43.85 per barrel on February 28. Crude oil reached a low that was only $1.49 above the late 2018 low last Friday. Price momentum and relative strength indicators were in oversold territory at the end of the week. The open interest fell while the price was rising and rose while it was falling, which is a bearish sign for the crude oil futures market. Weekly historical volatility rose from below 20% at the end of 2019 to over 42% at the end of February as the energy commodity took the stairs higher and an elevator to the downside. OPEC may have no choice but to increase production cuts when they meet in early March.

Copper falls to $2.50 per pound- A delayed and ugly reaction in gold and silver

Metals also had an ugly week as risk-off conditions gripped markets.

The price of copper fell from $2.8860 after the trade deal between the US and China to the $2.55 per pound level last week. Copper moved lower each day during the final week of February.

Gold initially moved higher on Monday, February 24, as flight to quality buying lifted the yellow metal to a new and higher high of $1686.60 on the continuous futures contract. As risk-off conditions descended on the gold market, the price was $100 lower on the final day of the month, losing over $75 per ounce on February 28 alone.

Silver rose to $18.92 on February 24, and by the end of the week, the price was below $16.40, as the volatile precious metal experienced one of its worst weeks in years. Platinum and palladium slumped on Friday, making it an awful day for precious metals bulls.

Weakness in agricultural products at the wrong time

We are moving into the time of the year, where uncertainty peaks for many agricultural products. Grain prices had been edging higher on the back of the "phase one" trade deal between the US and China. However, the leading grain markets were not immune to the risk-off conditions in markets.

Soybean futures fell from highs of over $9.40 at the start of the year to below the $8.90 per bushel level at the end of last week.

Nearby corn futures fell from the 2020 high of $3.94 to below $3.70 per bushel at the end of February.

Wheat plunged from over $5.90 to below $5.30 at the end of last week. Most agricultural commodities, including animal protein futures, fell, except for coffee futures, which posted a modest gain during the final week of February.

The weakness in agricultural commodities came at the wrong time of the year as there are no guarantees that the weather will cooperate, and supplies will be sufficient to meet the ever-growing level of global demand.

Bonds move higher - The Fed to the rescue

The bond market took off to the upside during the risk-off adventure.

The weekly chart of the nearby 30-Year US Treasury bond futures contract moved from 155-05 at the start of this year to over 171 at the end of February. The potential for central bank stimulus was at a high at the end of last week after the Chairman’s comments on Friday.

As we head into March, Coronavirus and US politics present unique challenges for investors and traders. I will be watching the Fed, the progress of the virus, primary election results, and OPEC over the coming days and weeks. Expect lots of volatility in markets across all asset classes. Approach all risk positions with a plan and keep those stops tight. Volatility creates lots of opportunities, but markets are likely to keep traders and investors on their toes. The VIX index closed February at over the 40 level, the highest since early 2018. On the final day of the month, it traded to a peak of 49.48 in a sign that seatbelts and crash helmets are a good idea as we head into March.