The raw material markets made a comeback in the second quarter of 2020 after the global pandemic caused a deflationary spiral taking the prices of most assets lower in Q1. The commodity asset class consisting of 29 of the primary commodities that trade on US and UK exchanges moved 17.77% lower in Q1 than the level at the end of the year that ended on December 31, 2019. In Q2, it recovered by 13.75% and was 10.63% lower over the first six months of this year. In 2019, the asset class gained 10.98%. In 2018 the asset class lost 6.82% of its value.

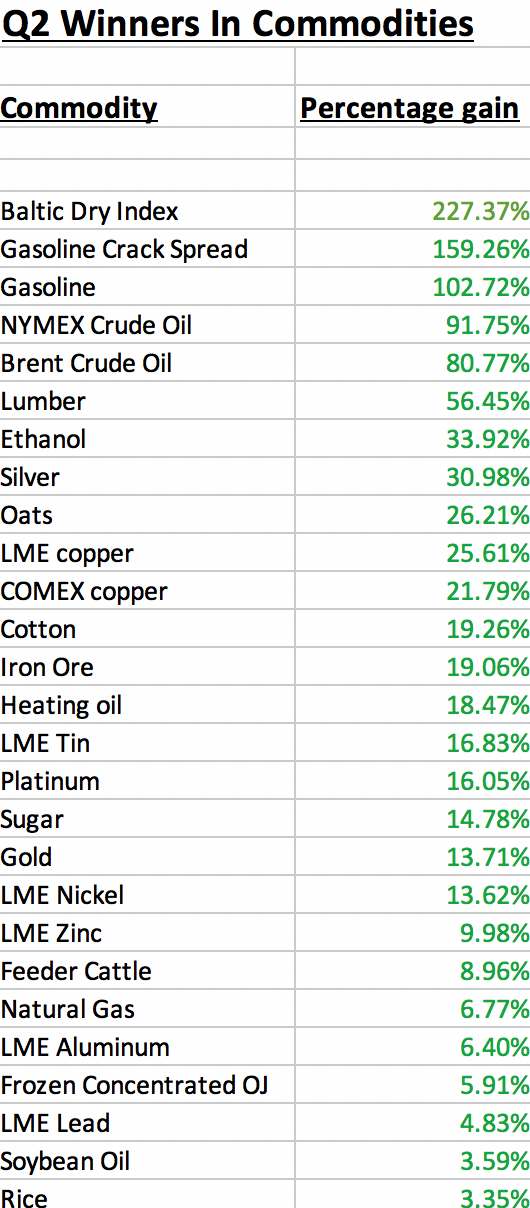

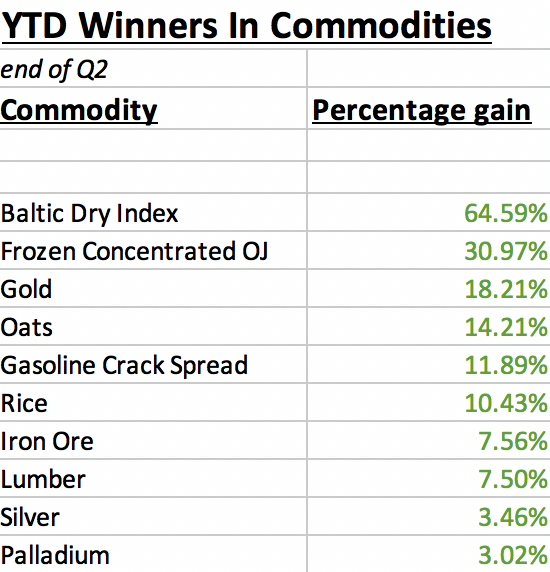

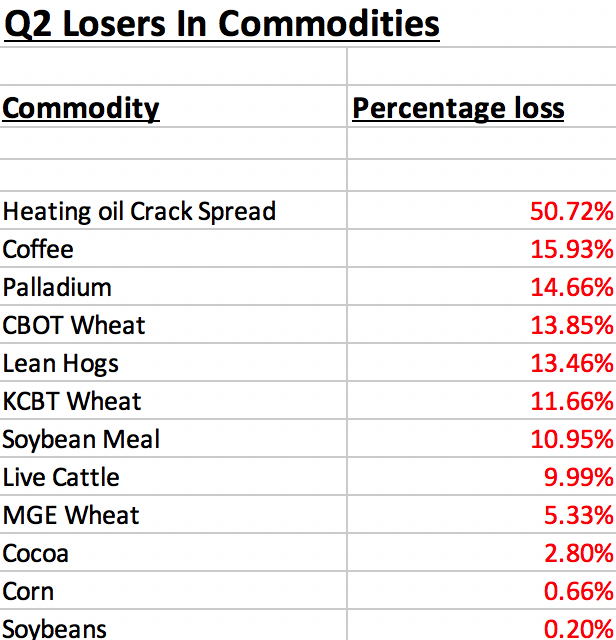

The overall winner of the 29 for the first quarter was gasoline that posted a gain of 102.72% in Q2 with NYMEX crude oil in second place with a 91.75% gain. The biggest loser for the quarter was the ICE coffee market that fell 15.93% with Palladium in second place on the downside with a 14.66% loss in Q2. The price of nearby CBOT wheat futures fell 13.85% over the period. In a sign of the recovery in the commodities sector, the Baltic Dry Index moved 227.37% higher in Q2. Over the first six months of this year, frozen concentrated orange juice futures led the way on the upside with a.30.97% gain, followed by gold with was up 18.21% at the end of June. The biggest loser on the year was heating oil futures, down 37.46% over the six months, and lean hogs with a 36.75% loss. NYMEX crude oil was a close third with a 35.69% loss since the end of 2019. The biggest loser during one quarter often turns out to be a leader on the upside during the next quarter.

The U.S. dollar is typically a significant factor when it comes to commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index posted a 1.76% loss in Q2 but was still 1.35% higher for the year. The dollar index was 0.34% higher in 2019.

The Fed pushed the Fed Funds rate to zero in the wake of the global pandemic. Quantitative easing is back, and more substantial than ever in the US and Europe as central banks seek to stabilize markets until scientists can develop treatments and a vaccine for the virus. The market action was a symptom of the virus, unlike in past risk-off periods where economic events were the root cause. The Fed continued to signal that interest rates would not rise anytime soon in Q2.

A myriad of complex factors on a macro and microeconomic basis dictate the price direction for the commodities market over the coming three months and beyond. The pandemic continues to be the most significant factor facing markets across all asset classes. That will continue for quite some time, perhaps years as the economic fallout could be the most significant in history. However, the US election could cause turbulence in markets during the second half of 2020.

Winners outnumber losers in Q2 in commodities

During the period from April through June 2020, all of the commodity sectors except animal proteins posted gains. Twenty-seven products posted gains with nineteen double-digit percentage increases. The list of gains are as follows:

Over the first half of 2020, the following ten commodities posted gains:

The losers in Q2 in commodities

Only twelve commodities posted losses in the second quarter of 2020 as the market experienced a rebound from the price carnage in Q1:

While winners outnumbered losers in Q2, the year-to-date performance continued to display losses in 29 of 39 products:

Digital currencies post gains

The CFTC has defined digital currencies as commodities. The cryptocurrency asset class that was all the rage in 2017 plunged in 2018. In 2019, the digital currencies made a comeback, but the risk-off conditions weighed on many of the members of the asset class in Q1. In Q2, they made a comeback. The market cap of the asset class as a whole moved from $181.094 billion at the end of Q1 2019 to $259.705 billion on June 30, up 43.41% for the three-months and 35.31% higher over the first six months of 2020. Bitcoin rose 41.84% in Q2 and was 26.41% higher so far in 2020. Ethereum posted a 68.67% gain in Q2 and 72.85% higher so far this year. The number of tokens rose from 5,285 at the end of Q1 to 5,688 on June 30, a rise of 7.63%. The market cap of the digital currency asset class reached a peak of over $800 billion in late 2017. The rising number of tokens has diluted the asset class over the past two and one-half years. Bitcoin, the leader of the pack, almost kept pace with the market cap in Q2 but underperformed over the first half of the year.

Issues to look forward to in Q3 2020

The economic costs of the global pandemic will be staggering, which will influence markets over the coming months and years. When it comes to commodities, lower prices so far in 2020 are leading to production declines. As prices reach levels where production falls, inventories are likely to begin to drop as the raw materials are the products that feed, clothe, power, and shelter over 7.66 billion people on our planet. Even after the tragic loss of life from the global pandemic, the population will continue to grow. Economic stagnation is likely to remain in the aftermath of the virus. The stimulus will weigh on the value of fiat currencies and boost government debt levels around the world. The decline in the purchasing power of fiat currencies could eventually cause commodity prices to skyrocket, causing periods of stagflation, an economic condition that is difficult to manage. Many markets made comebacks in Q2, which could become a launchpad for the future. If the price action after 2008 repeats, we could see a bull market in the raw materials asset class in the coming months and years.

The US election will take the center of the stage alongside the coronavirus during the second half of 2020. During Q3, the contentious exchanges between Democrats and Republicans are likely to rise. Simultaneously, the civil discord in the US will make the election period the most turbulent since 1968.

I expect price variance in markets across all asset classes to remain at very high levels throughout Q3 and beyond. Trading rather than investing could provide optimal results. Approach all risk positions with a plan, stick to stops, and take profits when they are on the table. Fundamental and technical indicators may not work as well as in the past, given the dramatic changes in economies and behaviors around the world. Look for commodities and stocks that are likely to continue to attract demand in the current environment. Be cautious when taking positions home overnight or over weekends. Follow the trends in markets and try to ignore the news cycle. If we learned anything in 2020, markets often divorce from new items and trends are a better indicator of market direction than reactions to the daily ups and downs of the news cycle.

Most importantly, stay safe and take care of the vulnerable. Believe in science, as it will eventually come up with the solution. As we head into Q3, the number of cases is rising again, but healthcare professionals have learned a lot over the past months. Remain cautious, but optimism will help us all get through the most challenging period for the world of our lifetimes.