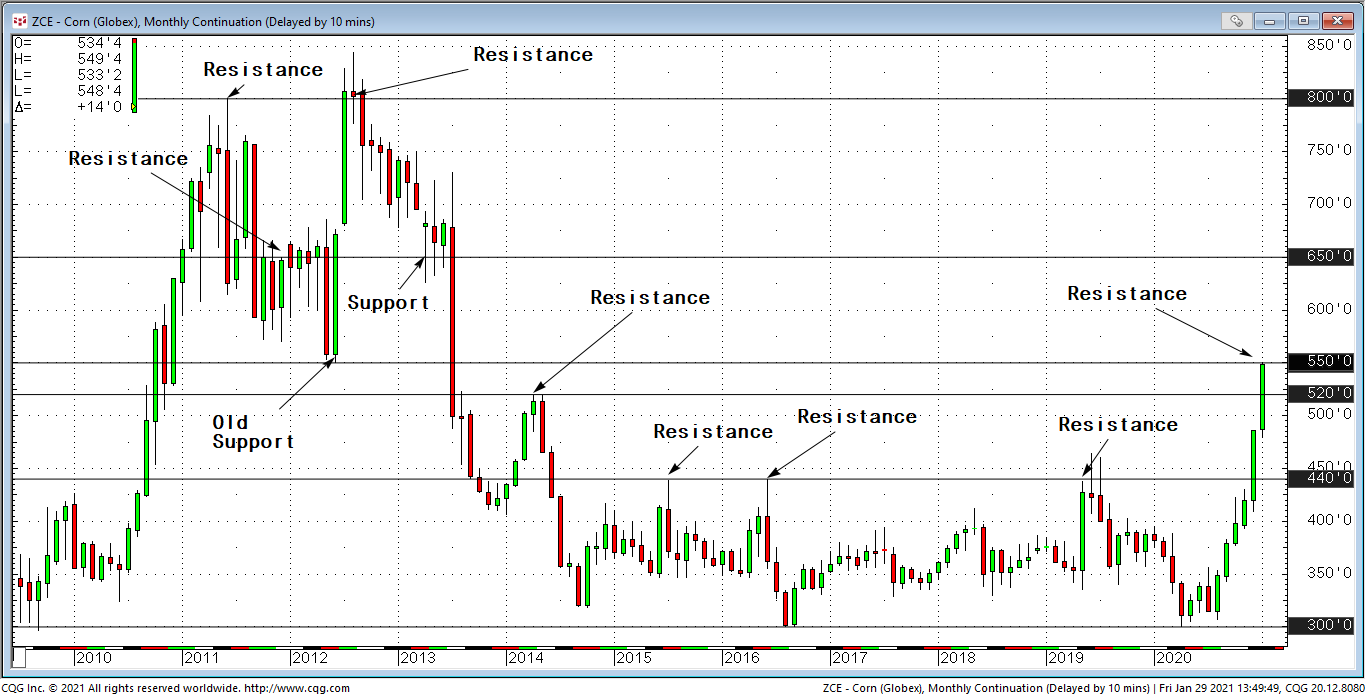

Most commercial hedgers begin their analysis and hedge decisions with a look at the long-term trend and this means a monthly continuation chart (aka rolling front-month futures chart). As of January 29, 2021., this is what that chart was showing farmers (as well as those holding physical corn in their bins):

Learn more about CQG's solutions for commercial grains

Based on this chart corn has clearly broken $4.40/bu. resistance levels of 2015, 2016 and 2019 and is now oscillating between $5.20 resistance of 2014 and old 2012 support levels at $5.50. Drilling down to the actively traded March 2021 futures contract merely confirms this story:

But now let’s look at December 2021 futures (representing the new crop, which of course will be planted in Spring, 2021):

As we can see, the $4.40/bu. level is again our primary focus with the market oscillating between $4.40 as resistance and support over and over again.

So how should commercial hedgers play this, “tale of two markets”. My answer is, two different strategies: a slightly more aggressive hedge for corn, “in the bin” (maybe between 60-70% hedged with short futures). And simultaneously a much less aggressive hedge for December 2021 new crop (maybe only 30-40% at this $4.40/bu. level) using a bear collar (aka “synthetic short futures”) which could be accomplished with a combination of long $4.20 puts/short $4.60 calls.

|

Price range |

Percent hedged |

Instrument |

Duration |

|

>$8.00 |

95% |

Short futures |

18 months |

|

$6.50-$8.00 |

75-85% |

Short futures |

12 months |

|

$5.20-$6.50 |

60-70% |

Short futures |

10 months |

|

$4.40-$5.20 |

40-50% |

Bear Collar |

6 months |

|

$3.50-$4.40 |

30-40% |

Long put (or Bear Collar) |

4 months |

|

$3.00 |

20% |

Bear put |

3 months |

About the Author: Mr. Richard Weissman is one of the world’s foremost authorities and thought leaders in the fields of derivatives, risk management and technical analysis. He is the author of Trade Like a Casino: Find Your Edge, Manage Risk and Win Like the House (Wiley, 2011) which was a finalist for the 2012 Technical Analyst Book of the Year Award.

As President of Weissman Consulting LLC Richard provides state-of-the-art training and consulting solutions for traders, risk managers and professionals supporting traders and risk managers. He can be reached at: richard@weissmanconsulting.com