We are now in the heart of the planting season for the 2021 crop year. Last April, prices were languishing at lows. Nearby CBOT corn futures traded to a low of $3.0025 per bushel. Soybean futures bottomed at $8.0825, while CBOT wheat reached $4.6825 per bushel. What a difference a year has made.

The rally in the grain and oilseed futures began in August and has barely looked back. As the seeds go into the ground in 2021, prices are at multi-year highs, and the trends remain bullish. In April 2021, instead of reaching lows, corn, soybean, and hard red winter wheat futures on the CME’s CBOT division are at multi-year highs, with new peaks coming at the end of April. Grain prices defy gravity as we head into the all-important growing season that determines if there will be enough supplies to satisfy the ever-growing demand.

Soybeans head for the July 2013 high

On April 30, soybean futures completed the eleventh month of consecutive gains.

The monthly chart highlights the steady rise and bullish price action in April that took the price to a high of $16.0875 on the nearby futures contract during the final week of the month. Price momentum and relative strength indicators are at overbought readings as the price reached its highest level since July 2013. Monthly historical volatility at 13.24% reflects the steady rally with few price spikes. The next upside target is the $16.30 high from nearly eight years ago.

Soybeans exploded higher on the back of massive Chinese demand and bottleneck supply problems in Brazil. The oilseed futures are at the highest price at the start of a crop year in modern history. The year the beans reached the $17.9475 record peak, they traded to a high of $15.09 per bushel in April.

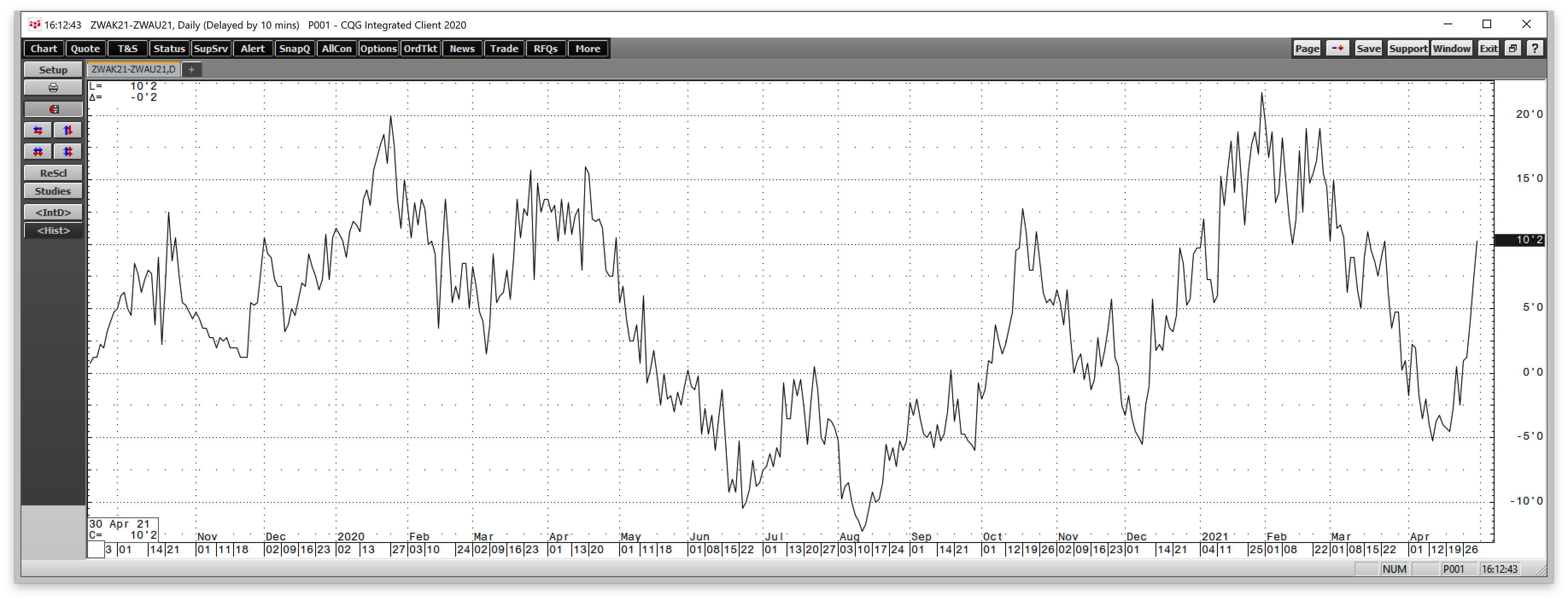

The chart shows the spread between soybeans for delivery in May 2021 versus the new crop November 2021 contract. The $2.3175 backwardation signifies that the market expects increasing supplies, but that could be a leap of faith at the start of the crop year.

Corn blows through $7 per bushel

Corn is a leading food product for animals and humans and is also a critical ingredient in biofuel. Corn is the primary ingredient in US ethanol production. Corn futures exploded higher in April.

The monthly chart shows that corn for nearby delivery reached a high of $7.4625 during April’s final week. The last time the price reached the current level was in March 2013. In 2012, when corn reached a record $8.4375 peak, the price traded to a high of below $7 in April. The 2012 high came in August. In 2011, the April high was at $7.8375 per bushel as corn reached just below the $8 level in June that year.

Price momentum and relative strength were at overbought conditions on the long-term chart at the end of April. Monthly historical volatility jumped to over 35%, given the price spike higher during April.

As in the soybean futures market, the term structure between corn futures corn delivery in May 2021 and the new crop December contract was in steep backwardation at the end of April. The $1.77 per bushel premium for nearby corn is a sign the market expects ample supplies by the harvest season. However, that is a leap of faith based on cooperative weather conditions and energy prices over the coming weeks and months.

CBOT wheat break to the highest price since early 2013

The action in the wheat futures arena was equally bullish in April.

The monthly CBOT soft red winter wheat futures chart illustrates the dramatic move to the upside in April. The price reached the highest level since February 2013 at $7.73 per bushel. Monthly price momentum and relative strength indices were rising and approaching overbought territory at the end of April. Monthly historical volatility turned higher to over the 25% level, given April’s wide price range. The last time wheat futures traded higher than April’s peak during the same month was in 2011.

The spread between CBOT wheat for delivery in May 2021 versus September 2021 shows a small 10.25 cents per bushel backwardation for the period. The flat curve is a sign the market expects elevated wheat prices over the coming months.

Bull markets rarely move in a straight line

The breathtaking rallies over the past month increase the potential for significant price downdrafts. Bull markets rarely move in straight lines, and corrections can be brutal. The higher prices rise, the more the odds of severe selloffs. Bull market corrections tend to shake the confidence of those holding long positions, causing speculative longs to scramble for an exit simultaneously.

The bull market in grains began in April 2020 continues to roar higher on its first anniversary. Risk is always a function of reward in any market. The risk profile in the grain and oilseed futures is now at its highest level in many years as we head into the all-important 2021 growing season across the fertile US plains and other growing regions worldwide.

Three considerations for the coming months during the 2021 crop year

Grains and oilseeds are the agricultural commodities that feed the world. Meanwhile, as the US and other nations begin to address climate change with energy policy shifts towards alternative sources, they are also energy commodities as they are the input for biofuels. The three most significant factors over the coming months as the crops grow are:

- The weather is the most critical issue determining if there are enough beans, corn, and wheat supplies to meet worldwide requirements. A poor crop in 2021 because of weather issues could push prices to record highs. A bumper crop could cause a massive price correction.

- The macro-economic strain created by a tidal wave of central bank liquidity and government stimulus weighs on money’s purchasing power. The erosion of currency values is fundamentally bullish for agricultural commodity prices. A sudden pivot to tighten monetary policy could send prices lower. It would strengthen currency values, but that seems unlikely given the dovish path of the US Fed and a continuation of stimulus increasing the debt levels.

- Finally, demand may be an ever-growing factor given population growth. However, the outbreak of the 2020 global pandemic is an example of how demand can evaporate in the blink of an eye. Any unforeseen events could have a substantial impact on prices on the up or downside.

Grain and oilseed prices are defying gravity as we head into May, and they are not the only commodities rising to multi-year or all-time highs. Crude oil made a significant recovery, closing at the end of April above the $63.50 per barrel level on the nearby NYMEX futures contract. Ethanol rose to its highest price since 2014. Copper, the bellwether industrial commodity that is a building block for infrastructure, rose to a high above $4.55 in April, closed not far off the decade-high on April 30, is a stone’s throw away from the 2011 record peak at $4.6495 per pound. Lumber and palladium prices made all-time highs in April. Coffee and sugar futures traded to the highest level since 2017.

The bull market in commodities supports the rallies in grain prices as we head into May, and the growing season will determine if supplies will satisfy requirements. Any shortfalls could mean the explosive price action has more room to run on the upside.