Commodities are highly volatile assets. Price often below rational, logical, and reasonable levels. In April 2020, nearby NYMEX crude oil prices fell to negative $40.32 per barrel. Anyone holding a long position without storage capacity had to sell at any price during the delivery period. In May 2021, lumber futures rose to over $1700 per 1,000 board feet. Before 2018, the price never traded above the $500 level. Picking tops or bottoms in commodities futures markets can be a fatal mistake. Prices can remain irrational and move to unreasonable levels for longer than most market participants can stay solvent. Oil and lumber prices were unsustainable at their respective low and high, but they moved to levels that no one saw coming.

In early 2020, commodity prices, and markets across all asset classes, plunged as the worldwide pandemic caused panic. Since then, the monetary and fiscal policies have ignited inflationary pressures. Moreover, pandemic-related supply chain bottlenecks and labor issues have pushed commodity prices higher. Gold was the first commodity to reach an all-time high in 2020. Over the past months, other raw materials have followed. In November 2021, wheat and coffee futures have been the latest commodities to move to new multi-year highs.

The bullish relay race in commodities continues

Things got a bit ugly in markets across all asset classes on Friday, November 26. An outbreak of another COVID-19 mutation in South Africa rippled through markets at the start of the 2021 holiday season. The potential for curtailed travel and new lockdowns caused crude oil’s price to plunge.

The chart shows nearby NYMEX January crude oil futures fell by over 13% on November 26, the most significant correction since April 2020 when the energy commodity fell below zero for the first time. After an anemic bounce on November 29, crude oil fell again on November 30, reaching a low of $64.43, and closed the eleventh month of the year at $66.18 per barrel.

Bull market corrections can be downright nasty. When it comes to crude oil, so long as the price remains above the $60 level, the bullish trend since early 2020 will remain intact. Oil tends to take the stairs higher and an elevator shaft lower during selloffs. Copper, another bellwether commodity, experienced a downdraft on November 26.

The daily chart shows that March COMEX copper futures fell 17.95 cents on November 26 and put in a bearish key reversal pattern on the daily chart. March copper made a lower low on November 30 and settled at the $4.28 per pound level.

Many other commodities and markets across all asset classes moved lower in late November as the US showed signs of inflationary data seriously.

The Fed and administration wake up

The November FOMC meeting marked a shift in monetary policy as the US central bank began tapering its quantitative easing program. The Fed reduced monthly purchases by $10 billion in US government debt and $5 billion in mortgage-backed securities. Chairman Powell presided over the November meeting, unsure if he would remain at the head of the central bank in February 2022.

Despite pressure from the progressive wing of his party, President Biden nominated Jerome Powell for a second term on November 22. In a move to throw a conciliatory bone to progressives, the President promoted Fed Governor Lael Brainard to the Vice-Chairman post. Progressives favored replacing the sitting Chairman with an economist more sensitive to instituting climate change and social equity policies in the financial sector. The administration realized that a change at the Fed with CPI running hot at the highest level in three decades was unadvisable. Treasury Secretary and former Fed Chair Janet Yellen supported a second term for Chairman Powell.

The bottom line is that after calling inflationary pressures “transitory” over the past months and blaming rising prices on supply chain bottlenecks and other pandemic-related factors, the administration woke up and realized the central bank is behind the curve in controlling rising prices. As the Fed Chairman and Treasury Secretary appeared before the Senate banking committee on November 30, Chairman Powell volunteered that he is likely to support accelerating QE tapering as inflation is not “transitory,” and poses structural threats to the economy.

Wheat - A highly political commodity makes new multi-year highs

Crude oil may have declined by 13% on November 26, and many other commodity prices are well off their 2021 highs, but November saw new multi-year peaks in two commodities; wheat and coffee.

Wheat is the primary ingredient in bread, a worldwide nutrition staple. While most market participants consider crude oil the most political commodity, history shows that the title should go to the wheat market. When governments cannot feed their people because of supply scarcity or prices rise beyond the level that citizens can pay, leaders have lost their grip on power. The French Revolution began as a break riot and cost the last Queen of France her head. More recently, bread riots in the early 2010s after wheat moved to a record high in 2008 and made a lower high in 2012 caused a political change to sweep across North Africa and the Middle East. Bread riots in Tunisia and Egypt set the stage for leadership changes. Governments have two primary jobs, feeding citizens and keeping them safe. When they cannot meet those minimums, civil unrest has historically toppled and replaced leaders. Therefore, wheat is a highly political commodity when the price rises and shortages develop.

Russia is the world’s leading exporter of wheat, and the CBOT soft red winter wheat futures contract is a global pricing benchmark. Meanwhile, concerns over the future of an independent Ukraine have also pushed wheat prices higher as the country is a leading producer and Black Sea ports are main logistical hubs for the grain. In November 2021, CBOT wheat futures rose to a new nine-year high.

As the monthly chart shows, CBOT wheat rose to $8.6325 per bushel in late November, a level not seen since December 2012. In 2012, CBOT wheat futures reached $9.4725 per bushel, and in 2008, it traded at the all-time $13.3450 per bushel high.

Wheat was one of the two commodities that held the bullish torch in the asset class in November 2021. Nearby wheat futures retreated to below $8 on November 30.

Coffee percolates to a decade high

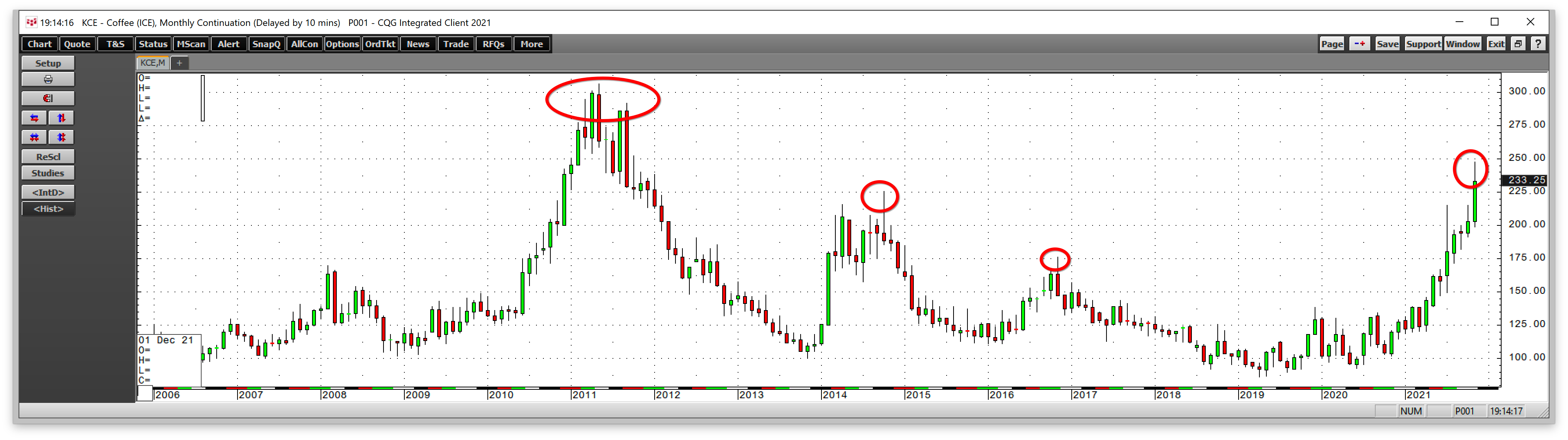

Brazil is the world’s leading Arabica coffee bean producer and exporter. A July frost pushed the price above its first technical resistance level at the November 2016 $1.76 per pound high. Coffee futures had traded below $1 per pound in July 2020.

The monthly chart highlights the ascent of coffee’s price, surpassing the next resistance level at the October 2014 $2.2525 high in November and rising to a high of $2.4755 on the nearby ICE futures contract. Coffee futures pullback to below the $2.35 per pound level on November 30.

Coffee and wheat were the two commodities that reached new multi-year highs in November 2021 in a continuation of a rally in the raw materials asset class that began when gold reached a record $2063 per ounce in August 2020.

The supercycle in commodities continues, and higher highs are on the horizon

In May 2021, lumber, copper, and palladium prices reached all-time highs. Meanwhile, prices of energy commodities, agricultural products, metals, and minerals have moved steadily higher since the early 2020 lows.

Goldman Sachs’ commodity analyst Jeffrey Currie believes commodities are in a supercycle driven by the recovery from the COVID-19 pandemic and monetary and fiscal stimulus policies boosting the demand. Currie believes this supercycle could be “multi-year, potentially a decade.”

Commodities are highly volatile assets that tend to take the stairs higher and an express elevator to the downside during corrections, as we witnessed in crude oil on November 26. However, if Jeffrey Currie is correct, the price should find a bottom at a higher low and continue its ascent over the coming months.

The price action in commodities has been like a relay race with one raw material futures market handing the baton to another. In November 2021, wheat and coffee held the torch. In December, we will likely see others emerge. The bottom line is that with inflation at a three-decade high, the bull market in commodities reflects the decline in fiat currencies’ purchasing power. Expect the rally to continue. Holding your nose and buying those ugly dips in commodities could be the optimal approach to the asset class for the coming months and years. Moreover, each quarter the world adds approximately 20 million people, increasing the addressable market for the materials that provide power, nutrition, shelter and everyday essentials for people worldwide.