Over the past few weeks, I’ve asked several options pros with over forty years’ experience about a specific options strategy that I developed for speculators which has limited downside risk and unlimited upside potential (like a long call option or long put), yet is accomplished for a small credit (like a deep out-of-the-money short option position). The universal response to my question is that this strategy has no specific “name” per se, which means I need to name it. As a result, I’ve decided to name this strategy the Covered Credit Collar or CCC for short.

I developed this strategy for a consulting client who, as a speculator, wanted to place a directional bet with unlimited upside (similar to long futures) but didn’t want to get stopped out of their long position during a correction. When I said, “It sounds like you want a long call option.” He retorted, “I hate wasting money on option premiums.” At that point I asked if he’d be willing to write an at the money put against a long out-of-the-money call and then limit the risk by buying a deep out-of-the-money put against it. When I told him we could structure the whole position for a credit he said, “That’s the speculator’s dream strategy.” Well, I don’t know about a dream strategy, but it is a robust way of expressing a directional opinion with limited risk and unlimited reward.

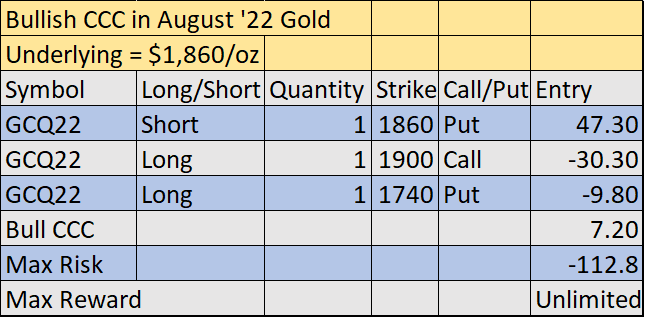

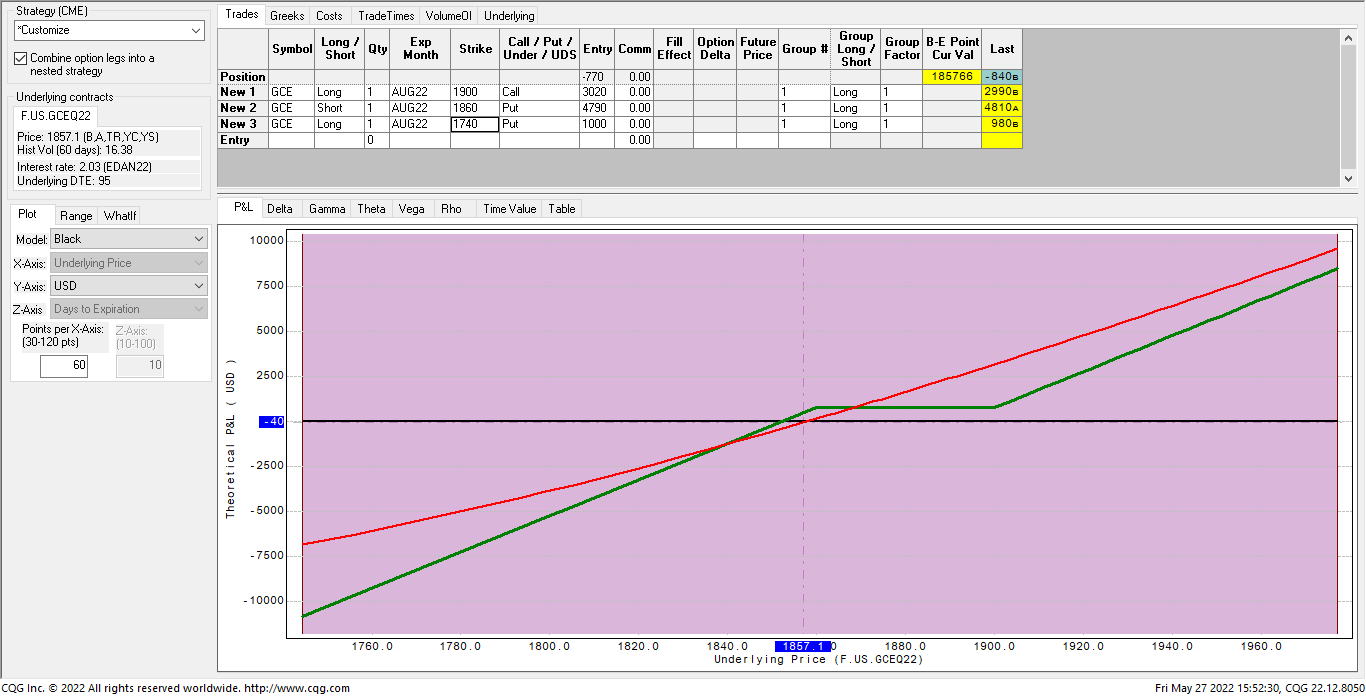

Let’s say that the speculator is bullish on August, 2022 COMEX Gold which is trading around $1,860/oz. Using the CCC structure they could execute the following:

- Sell the 1860 Put for a credit of $4,730.00

- Buy the 1885 Call for a debit of $3,030.00

- Buy the 1740 Put for a debit of $980.00

What could go wrong? Obviously if we are dead wrong on direction and gold drops to $1,740/oz or lower we would lose $11,280.00 per spread. That stated, it is very different than buying gold futures at $1,860 and watching it drop to $1,500 and losing $36,000.00. On the other hand, once the market rallies above $1,900/oz the potential for gains are exactly like being long futures. Finally, if the market settles anywhere between $1,860-$1,900, we keep the $720.00 credit (which is very different than buying the $1900 call and losing $3,030.00.

If you’d like to see how we use technical analysis to futures and options strategies visit our website: www.weissmanconsulting.com