The commodity markets moved lower in Q3 but were still marginally higher than the level at the end of 2021. The commodity asset class consisting of 29 primary commodities that trade on US and UK exchanges moved 6.87% lower in Q3 2022 and was 0.70% higher through the first nine months of this year. Rising interest rates and a strong US dollar weighed on commodity prices in the third quarter.

The overall winner of the 29 for the third quarter was the natural gas futures market, which posted a gain of 25.85% and was 83% higher over the first nine months of 2022. Rising prices in Europe and low inventories in the US pushed the energy commodity higher.

Palladium futures were in second place with a 14.13% gain. Live cattle futures were 8.07% higher in the third quarter, and frozen concentrated orange juice gained 6.54% over the three months. CBOT wheat was over 6% higher for the period.

The biggest loser for the third quarter in the composite was the oats futures market which corrected 41.02% lower. Lumber fell 36.30%, and gasoline futures dropped 32.99%. Brent and WTI crude oil, LME tin forwards, and iron ore prices fell over 20% over the past three months.

There were more losers than winners in Q3, but winners slightly outnumbered losers over the first nine months of 2022.

The US dollar is typically a significant factor for commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index rose 7.29% in Q3 and 17.25% so far in 2022. The dollar rose in Q1, Q2, and Q3 as the bond market declined and the Fed shifted to a hawkish monetary policy stance to battle the highest inflation since the early 1980s. However, GDP declined in Q1, Q2, and likely in Q3, signaling a recession. Inflation and recessions together are the hallmarks of stagflation, a challenge for the US central bank as it requires mutually exclusive monetary policy paths. Battling inflation through increasing interest rates increases recessionary pressures as it slows economic growth. A recession requires a stimulative policy, which tends to lead to lower rates. In Q3, the Fed decided to ignore recession and concentrate on inflation. After ignoring inflation throughout most of 2021, the central bank could be making the same mistake with the recessionary pressures in 2022.

US 30-Year Treasury bond futures fell 8.61% in Q3 and 21.17% over the first nine months of 2022 after moving 7.53% lower in 2021. Rising US interest rates pushed the dollar index higher, but inflation erodes the dollar’s purchasing power. The Fed is fighting inflation with demand-side monetary policy, but the supply-side issues caused by the war in Ukraine pushed food and energy prices higher, fueling inflation. While no sectors posted gains in Q3, energy, grains, and animal proteins were all higher through the first nine months of this year as food and energy are the commodities in the crosshairs of the war in Ukraine.

The war in Ukraine, rising interest rates, and inflation caused the stock market to decline in Q1, Q2, and Q3 2022. In Q2, the DJIA fell 6.66% in Q3 and was 20.95% lower through the first nine months of 2022. The S&P 500 declined 5.28% in Q3 and 24.77% since the end of 2021. The tech-heavy NASDAQ dropped 4.11% in Q3 and 32.40% over the first nine months of this year. In 2021, the DJIA was 18.73% higher. The DJIA rose 7.25% in 2020. The tech-heavy NASDAQ gained 43.64% in 2020 and 21.39% in 2021. The S&P 500 was 16.26% higher in 2020 and 26.89% in 2021.

As we head into Q4 2022, the US Fed and other worldwide central banks are increasing interest rates to battle inflation. Meanwhile, they may eventually need to curb their enthusiasm for rate hikes if GDP levels continue to contract.

Bitcoin and Ethereum stabilized in Q3. The cryptos posted 2.02% and 27.46% respective gains but were 58.26% and 64.48% lower over the first nine months of 2022. Bitcoin was up nearly 58% in 2021, while Ethereum exploded over 390% higher over the period. Ethereum outperformed Bitcoin as the second-leading crypto switched from a proof-of-work to a proof-of-stake protocol, lowering its energy mining requirements.

Precious metals were the best performing sector of the asset class in Q3, posting a 0.70% loss thanks to the over 14% gain in palladium. Precious metals fell 5.85% over the first nine months of this year. Animal proteins fell 3.28% in Q3 but were 5.48% higher so far in 2022. Soft commodities fell 3.64% in Q3 and were 1.67% lower since the end of 2021. Base metals fell 9.17% in Q3 and 20.61% so far this year as of the closing levels on September 30. Grains dropped 11.57% in Q3 and were 2.19% higher over the first nine months, and energy fell 12.89% in Q3 but was still 24.65% higher on the year as of September 30. Supply-side factors support energy and food prices, while a strong dollar and rising interest rates weigh on metals and minerals.

Expect lots of volatility to continue in the energy and food sectors as fighting inflation with monetary policy cannot address the shortages created by the war in Europe’s breadbasket. Moreover, Russia is Europe’s energy supplier, so shortages are likely over the coming months. Russian natural gas flows into Western Europe will be critical over the coming winter season.

Q3 ended on a bearish note for stocks, bonds, and commodities. Expect lots of price swings in markets across all asset classes and protect portfolios. The aftermath of the pandemic and war in Ukraine continues to be a toxic cocktail prompting wild price volatility.

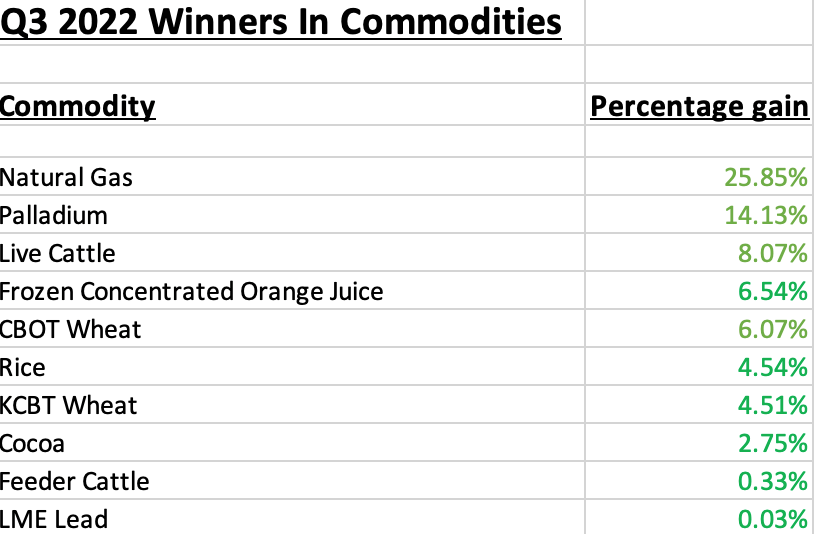

Winners in Q3 and 2022

From July through September 2022, all six commodity sectors posted losses. Ten products posted gains, with two posting double-digit percentage gains. The list of gains is as follows:

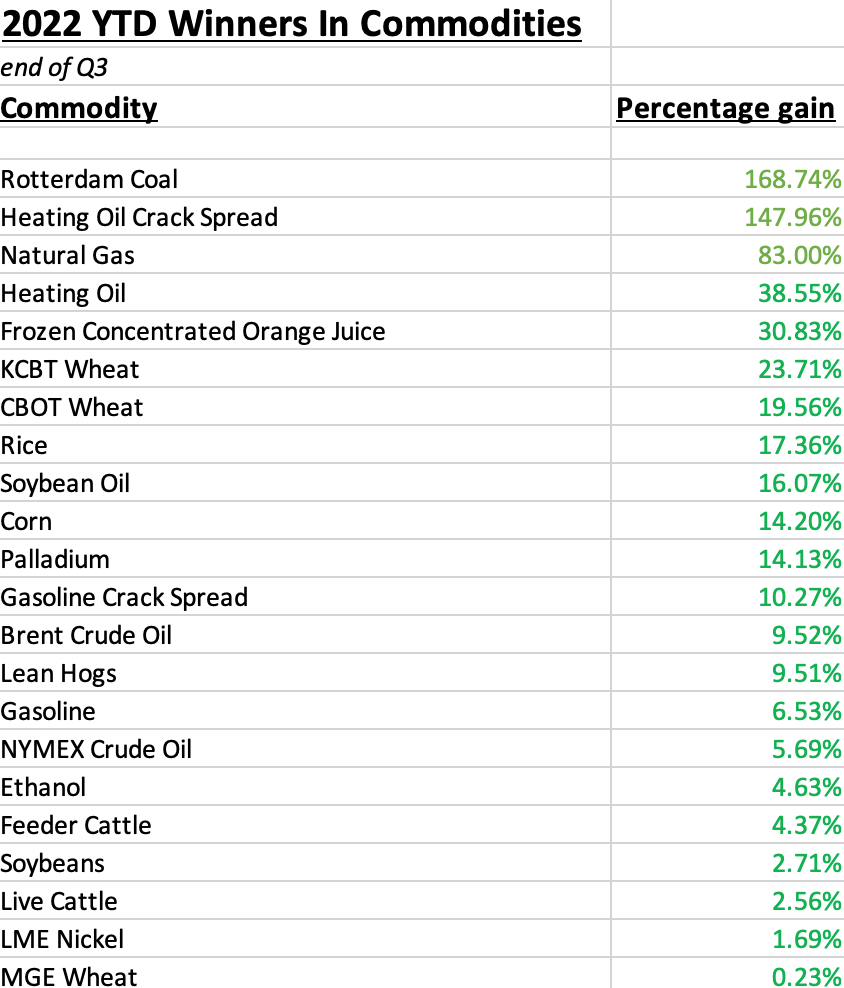

Over the first nine months of 2022, twenty-two commodities moved to the upside, with twelve posting double-digit percentage gains:

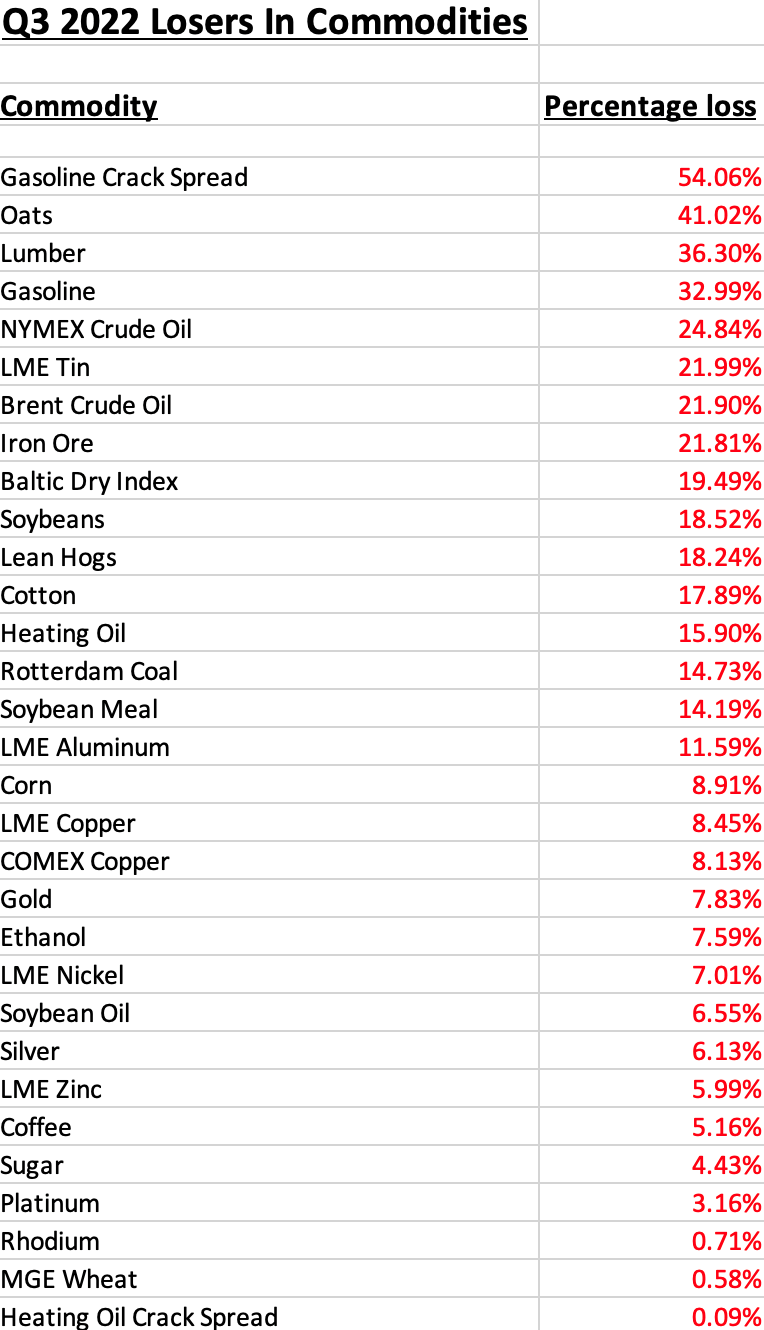

Losers in Q2 and 2022

Thirty-one commodities posted losses in the third quarter of 2022 as losers outnumbered winners by over three to one. There were sixteen double-digit percentage losers in Q3:

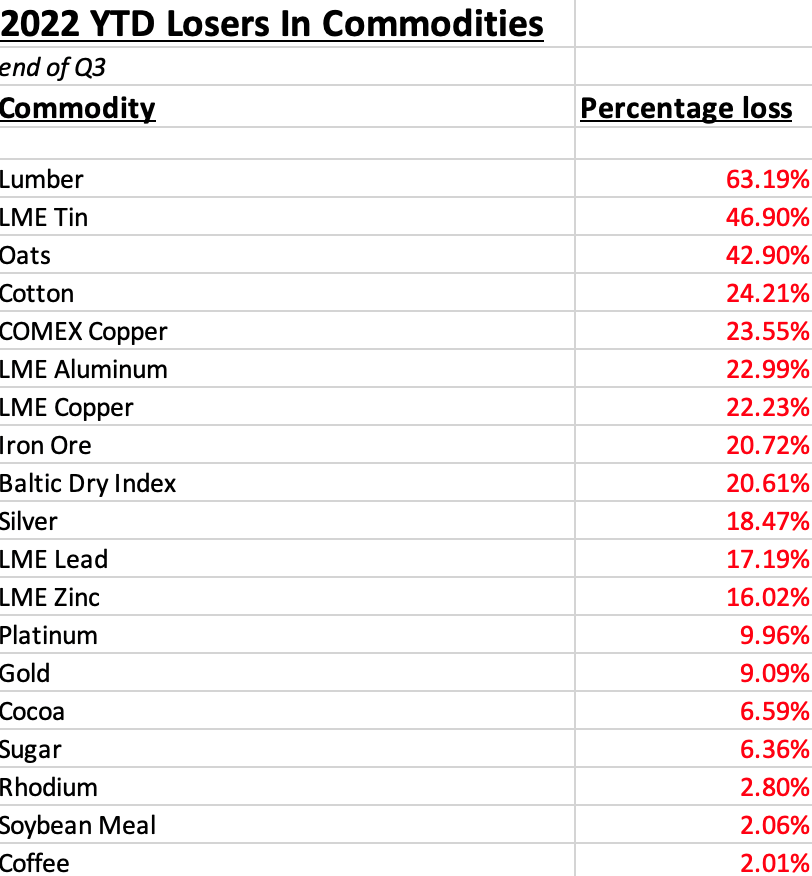

Over the first nine months of the year, nineteen commodities posted losses, with twelve moving over 10% lower:

The CFTC has defined digital currencies as commodities. In Q3 2022, Bitcoin rose 2.02% but was 58.26% lower over the first nine months of 2022. Ethereum rose 27.46% in Q3 but was 64.48% lower over the first nine months of 2022. The number of tokens increased from 20,070 at the end of Q2 2022 to 21,167 on September 30, 2022, a rise of 5.47%. Bitcoin, the leader of the pack, underperformed the market cap in Q2, while Ethereum, the second-leading cryptocurrency, outperformed over the past three months. The number of new tokens coming to market continued to rise despite the correction since late 2021.

Issues to look forward to in Q4 2022

The financial price tag of the global pandemic will be its legacy, and they are staggering. The liquidity and stimulus will influence markets over the coming months and years. The US bond reminded us of that in 2021 and the first nine months of 2022, as interest rates rose. The Fed continued aggressively increasing rates, which chokes economic growth when GDP contracts.

While monetary policy will impact markets, the war in Europe will turbocharge volatility, making the central bank’s actions far less influential in markets. The war and geopolitical bifurcation affect production, trade deals, and logistics, causing shortages in some regions and oversupply in others. Prices are likely to be highly volatile, reflecting significant changes in the supply and demand equations for many raw material markets.

The number of commodity consumers worldwide continues to grow by approximately 20 million each quarter. The 2020/2021 stimulus will weigh on the value of fiat currencies and boost government debt levels worldwide. The decline in the purchasing power of fiat currencies could eventually cause commodity prices to increase after the recent corrections. Most commodity markets have trended higher from Q1 and Q2 2020 lows through Q3 2022, which changed the Fed’s opinion that higher prices were transitory. If the price action after 2008 repeats, we could see a bull market in the raw materials asset class in the coming months and years. Commodity prices were still on bullish paths at the end of Q3 2022 despite the corrections. The war in Europe complicates the supply and demand fundamentals and will likely increase price variance.

In Q1, the Biden administration told markets it would release one million barrels of oil from the SPR daily for up to 180 days, the most significant release in history. The oil price was over the $80 level in early October, with SPR releases scheduled to end this month. Crude oil, natural gas, and coal are critical energy commodities that power the world. The highest prices in years fuel inflation, making the Fed’s job almost impossible. Copper’s decline to the $3.40 per pound level on the nearby futures contract reflects economic contraction.

I expect price variance in markets across all asset classes to remain at very high levels in Q4 2022 and beyond. Trading rather than investing could provide optimal results. Approach all risk positions with a plan, stick to stops, and take profits when they are on the table. Follow market trends as they reflect the herd behavior that drives market prices.

Seasonality in energy commodities could cause significant price volatility over the coming months. Europe’s dependence on Russian natural gas could cause lots of price action in the usually volatile natural gas arena.