The raw material markets moved higher in Q4 and were higher than at the end of 2021 on December 30, 2022. The commodity asset class consisting of 29 primary commodities traded on U.S. and U.K. exchanges moved 4.66% higher in Q4 2022 and was 3.83% higher for the year. The asset class moved 26.79% higher in 2021. In 2020, the asset class moved 9.89% higher. Rising interest rates and a strong U.S. dollar weighed on commodity prices, but 2022 was no ordinary year.

The overall winner of the 29 for the third quarter was the nickel LME forward market, which posted a gain of 42.36% and was 44.76% higher in 2022. Russia is a leading nickel producer, and the war in Ukraine and sanctions supported the price.

Silver futures were in second place with a 26.27% gain. Platinum futures were 23.41% higher in the fourth quarter, and LME tin forwards gained 20.23% over the three months. LME lead, iron ore, soybean meal, and the gasoline crack spread were over 15% higher for the period.

The biggest loser for the fourth quarter was the Rotterdam coal futures market which corrected 39.62% lower. NYMEX natural gas fell 34.44%, and ICE Arabica coffee futures dropped 24.49%. Palladium, rhodium, CBOT and KCBT wheat, the Baltic Dry Index, and lumber futures prices fell over 10% over the past three months.

Base and precious metals lead the commodity asset class higher in Q4

Base metals, or the nonferrous metals traded on the London Metals Exchange, including copper, aluminum, nickel, lead, zinc, and tin, rose 17.28% in Q4, leading the commodities asset class on the upside. All six metals posted gains over the past three months. Base metals still fell 6.16% in 2022 despite the significant Q4 increase.

Precious metals, including gold, silver, platinum, and palladium, rose 10.48% in Q4 and were 1.99% higher for the year that ended on December 30, 2022.

Animal proteins, including live and feeder cattle, and lean hog futures moved 4.66% higher in Q4 and 10.25% higher in 2022. Lean hog futures were lower in Q4, but all three meat futures moved to the upside on the year.

Soft commodities edged 0.97% higher in Q4, with gains in sugar, cocoa, and FCOJ futures, while coffee and cotton futures declined. The softs moved only 0.31% lower in 2022 as coffee and cotton posted double-digit percentage losses, while FCOJ was up over 41%, and sugar and cocoa prices moved higher.

Grains fell 0.66% in Q4 but were 1.72% higher in 2022. In Q4, soybeans were higher, while corn posted a marginal loss and CBOT wheat futures declined.

Finally, energy was the worst-performing commodity sector in Q4, with a 4.62% loss. However, the sector was still the best performing for 2022, with a 15.47% gain on the year. Natural gas weighed on the sector in Q4 as the price plunged 34.4%.

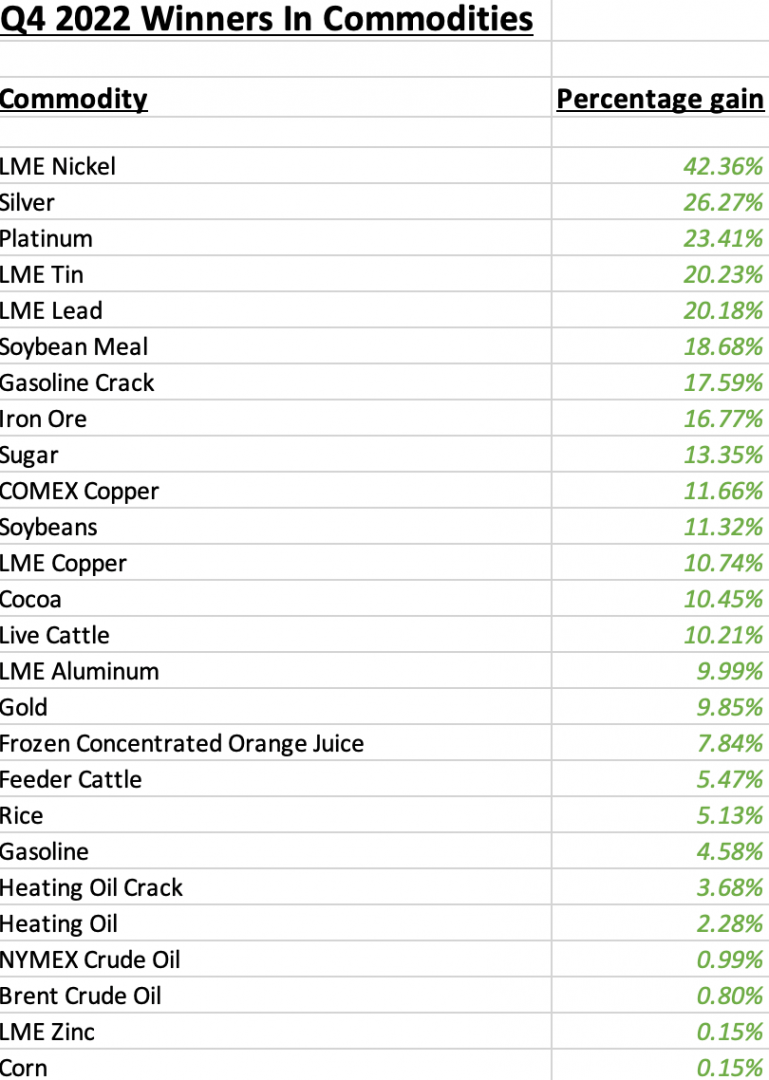

Commodity winners in Q4 and 2022

From October through December 2022, twenty-six products posted gains, with fourteen posting double-digit percentage gains. The list of gains is as follows:

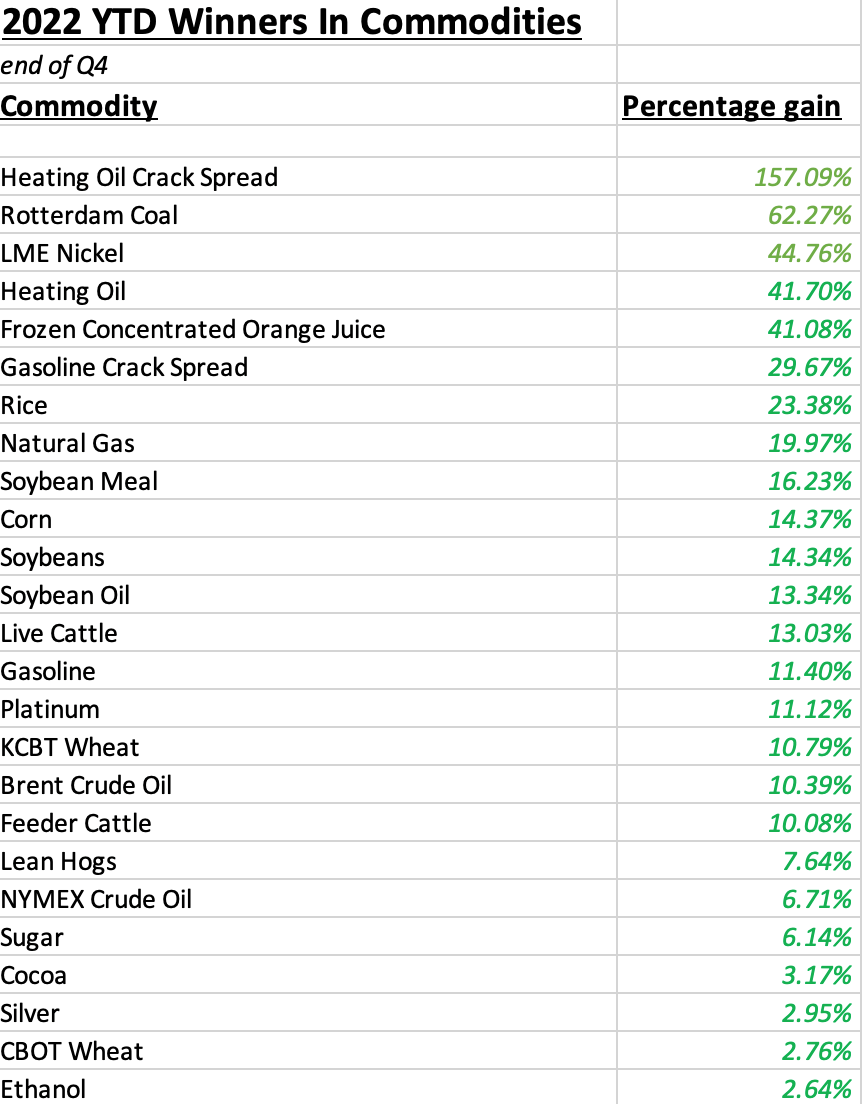

In 2022, twenty-five commodities moved to the upside, with eighteen posting double-digit percentage gains:

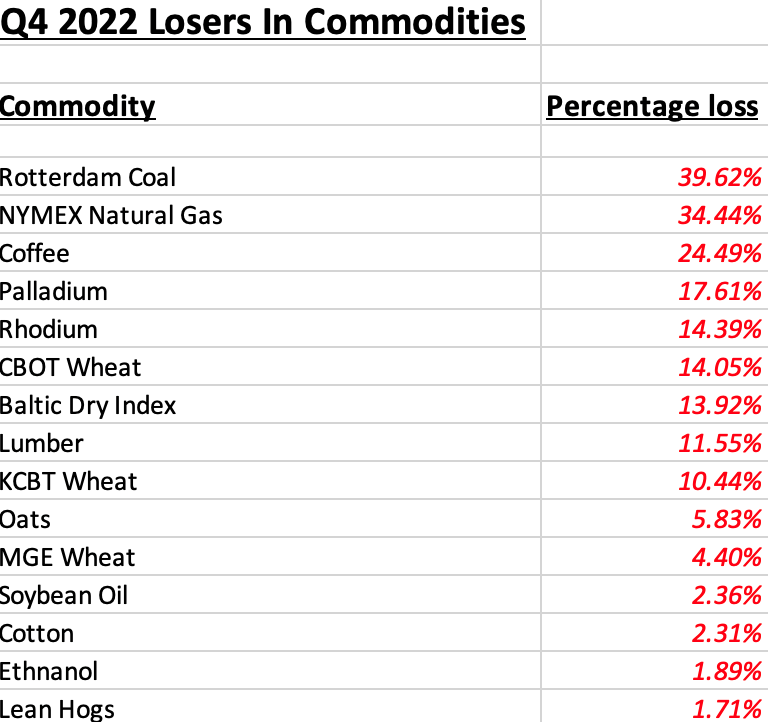

The raw material asset class losers in Q4 and 2022

Sixteen commodities posted losses in the fourth quarter of 2022. There were nine double-digit percentage losers in Q4:

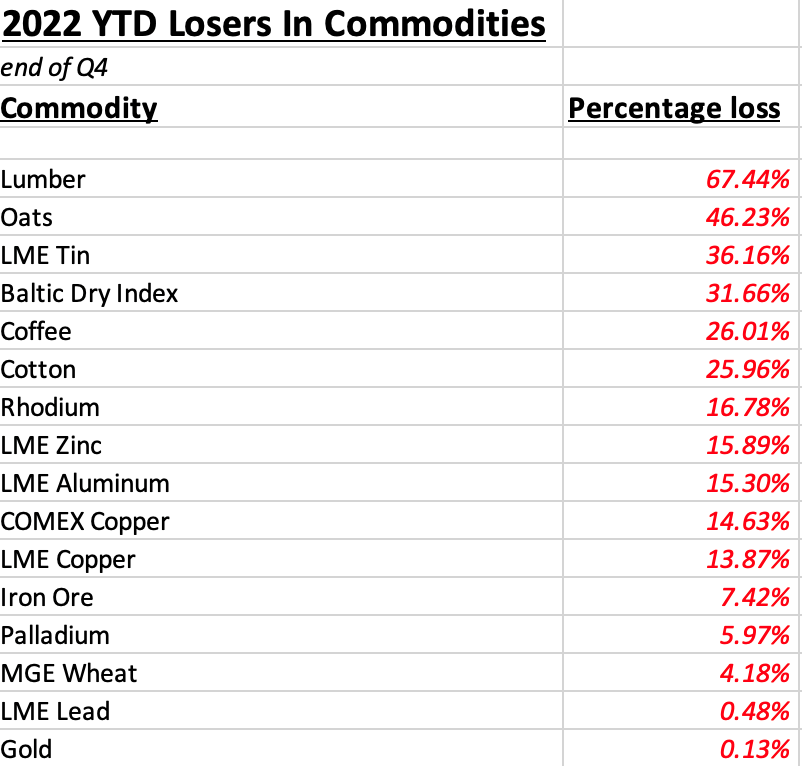

In 2022, eleven commodities posted losses, with twelve moving over 10% lower:

Four factors that will impact prices in Q1 2023 and beyond

At least four issues face the commodities asset class as we move into 2023:

- The ongoing war in Ukraine has supply-side consequences for the worldwide raw material markets. An end to the conflict will likely cause prices to fall, while a continuation will support prices and could create food and energy shortages.

- Global inflation remains at the highest level in decades, causing higher input costs and supporting commodity prices.

- U.S. energy policy supporting alternative and renewable fuels and inhibiting hydrocarbons strengthens OPEC and Russia’s ability to control oil and gas prices.

- An end to COVID-19 lockdowns in China could cause the world’s most populous country with the second-leading economy to increase its commodity demand.

While these issues could determine the path of least resistance of raw material prices, we learned in 2022 that unforeseen events have the most significant impact. Few market participants anticipated the war in Ukraine in early 2022. In 2023, the rising potential of Chinese aggression against Taiwan could cause extreme commodity volatility. Moreover, economic or geopolitical surprises could wreak havoc in markets across all asset classes.

I continue to favor commodities, but bull markets rarely move in straight lines

Bull markets rarely move in straight lines, and commodities have been trending higher since the March 2020 pandemic-inspired lows. I favor higher prices in 2023, but the road to the upside will be bumpy.

I expect the highest level of volatility in the food and energy sectors. Metals prices held up well in the face of rising U.S. interest rates and the strongest dollar in two decades. The U.S. 30-Year Treasury bond futures fell 22.07% in 2022, and the U.S. dollar index rose 8.03%. Rising interest rates and a bullish trend in the U.S. currency weigh on commodity prices. However, 2022 was no ordinary year. Given COVID-19’s legacy, the ongoing war in Ukraine, and the bifurcation between the world’s nuclear powers, I expect that 2023 will continue to defy tradition when it comes to the path of least resistance of raw material prices.