The stock and bond markets posted gains in Q1 2023 after significant losses in 2022. The cryptocurrency asset class, led by Bitcoin and Ethereum, were the upside leaders after plunging from November 2021 through November 2022.

The commodities asset class turned in a mixed performance in Q1 2023, but the consolidated results of the twenty-nine leading commodities trading on the U.S. and U.K. futures and forwards exchange were a loss. However, the commodity bull market that began in early 2020 remains intact.

Bull markets rarely move in straight lines. In volatile commodity markets, price variance often leads to brutal corrections that can be significant buying opportunities. In late March 2023, Goldman Sachs reiterated its forecast for a commodities supercycle. If Goldman is correct, many raw material markets are at attractive prices at the end of Q1 2023.

Commodities move 1.94% lower in Q1

The raw material markets moved lower in Q1. The commodity asset class consisting of 29 primary commodities traded on U.S. and U.K. exchanges moved 1.94% lower in Q1 2023. The asset class moved 3.83% higher in 2022 and 26.79% higher in 2021.

The overall winner of the 29 for the first quarter after the seasonal rise in the gasoline crack spread was the FCOJ futures market, which posted a gain of 30.57%. The decline in the Floridian crop because of weather and migration that turned groves into homes pushed prices higher.

Cocoa futures was the next winner with a 12.81% gain as soft commodities dominated the price action on the upside. Sugar futures were 11.03% higher in the first quarter, and feeder cattle rose 9.32%. Gasoline moved 8.18% higher, pushing gasoline crack spreads 55.42% to the upside for seasonal reasons as the market prepared for the 2023 peak driving season. Gold futures gained 7.82% over the three months despite losses in the platinum group metals and a marginal gain in silver. LME and COMEX copper and live cattle futures were over 6% higher for the period.

The US dollar is typically a significant factor for commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index fell 1.05% in Q1 after moving 8.03% higher in 2022. US 30-Year Treasury bond futures rose 4.91% in Q1, after a 21.66% decline in 2022. The Fed Funds Rate moved from 0.125% in March 2022 to 4.875% by the end of March 2023. The Fed told markets the target is 5.13% at the end of 2023, which implies only one more 25 basis point hike.

In Q1, the commodities asset class moved lower despite a lower dollar and a decline in the bond market.

Soft commodities are up the most - Energy is the leading loser

Soft commodities were the best-performing sector of the asset class in Q1, posting an 11.12% gain thanks to the over 30% gain in frozen concentrated orange juice futures. Animal proteins edged only 0.58% higher in Q1. Energy commodities led the way on the downside, with an 11.98% loss in Q1. Precious metals fell 4.37% in Q1, and grains fell 4.10% in the first quarter. Base metals moved 2.91% to the downside. LME copper inventories fell 27.2% in Q1, while aluminum stockpiles rose 15.7%. Zinc inventories rose 40.7%, and lead stocks increased 4.9%. Meanwhile, nickel stocks fell 20%, and tin inventories moved 21.6% lower. Metal stocks remain at historically low levels.

Winners and losers in Q1

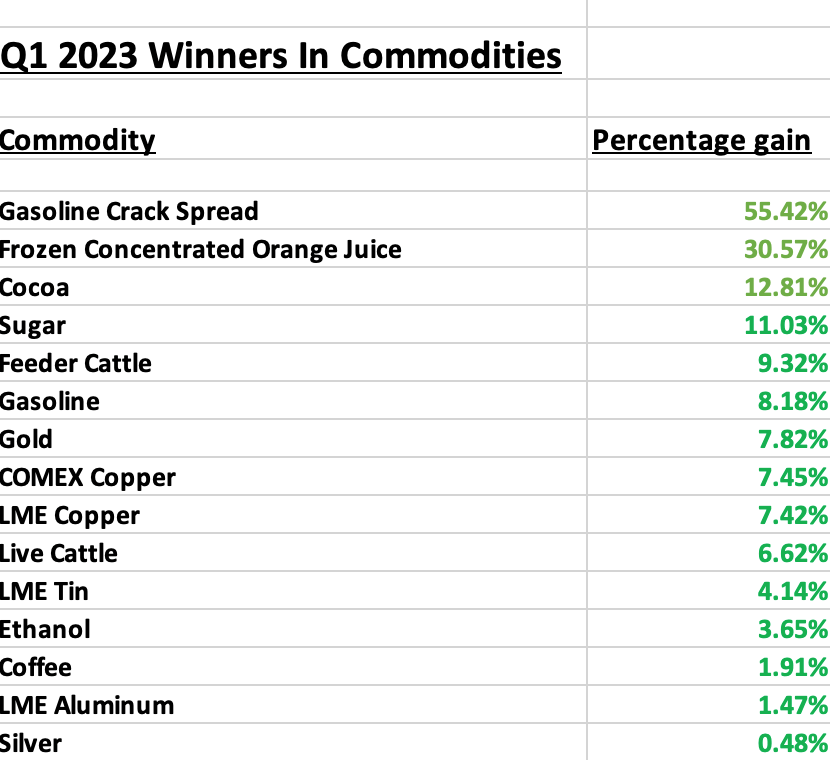

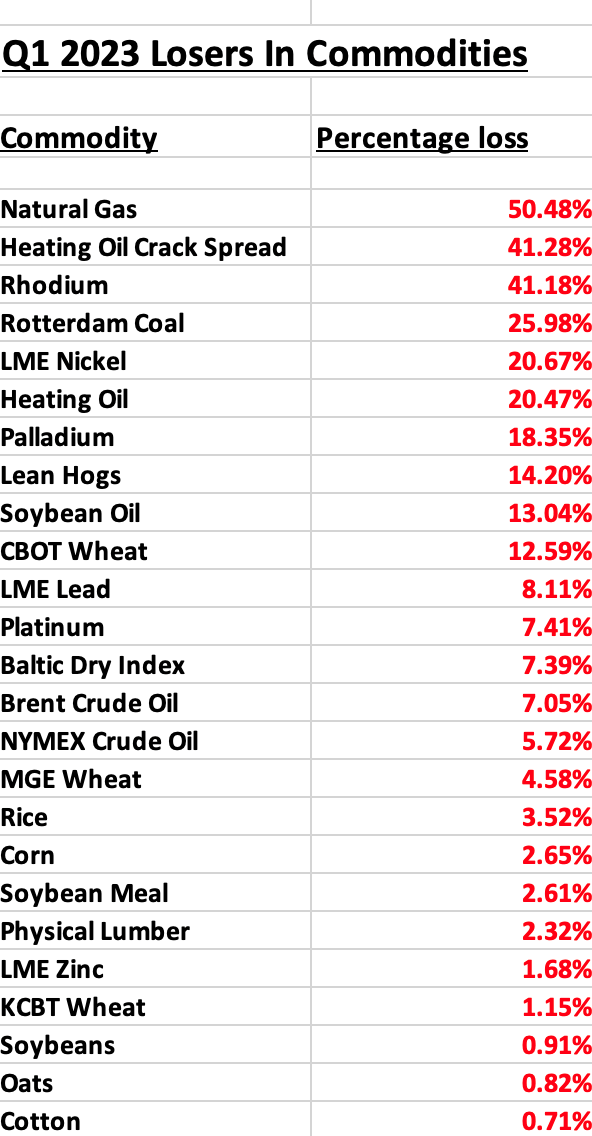

From January through March 2023, fifteen products posted gains, with four posting double-digit percentage gains. The list of gains is as follows:

Twenty-five commodities posted losses in the first quarter of 2023. There were ten double-digit percentage losers in Q1:

The CFTC has defined digital currencies as commodities. The asset class's market cap moved 182.18% higher in 2021 and 63.33% lower in 2022. Bitcoin moved 64.02% lower from the end of 2021 through December 30, 2022, after rising 57.81% in 2021.

In Q1 2023, Ethereum rose 52%. The number of tokens increased from 22,155 at the end of Q4 2022 to 23,128 on March 31, 2023, a rise of 4.39%. Bitcoin and Ethereum outperformed the market cap of the asset class in Q1.

Highlight on gold, copper, and oil

Gold, the leading precious metal, is a commodity and a currency and is an inflation barometer.

The chart highlights gold's bull market that started in 1999. Over the past twenty-four years, every dip in gold has been a buying opportunity. Gold was nearly 8% higher in Q1.

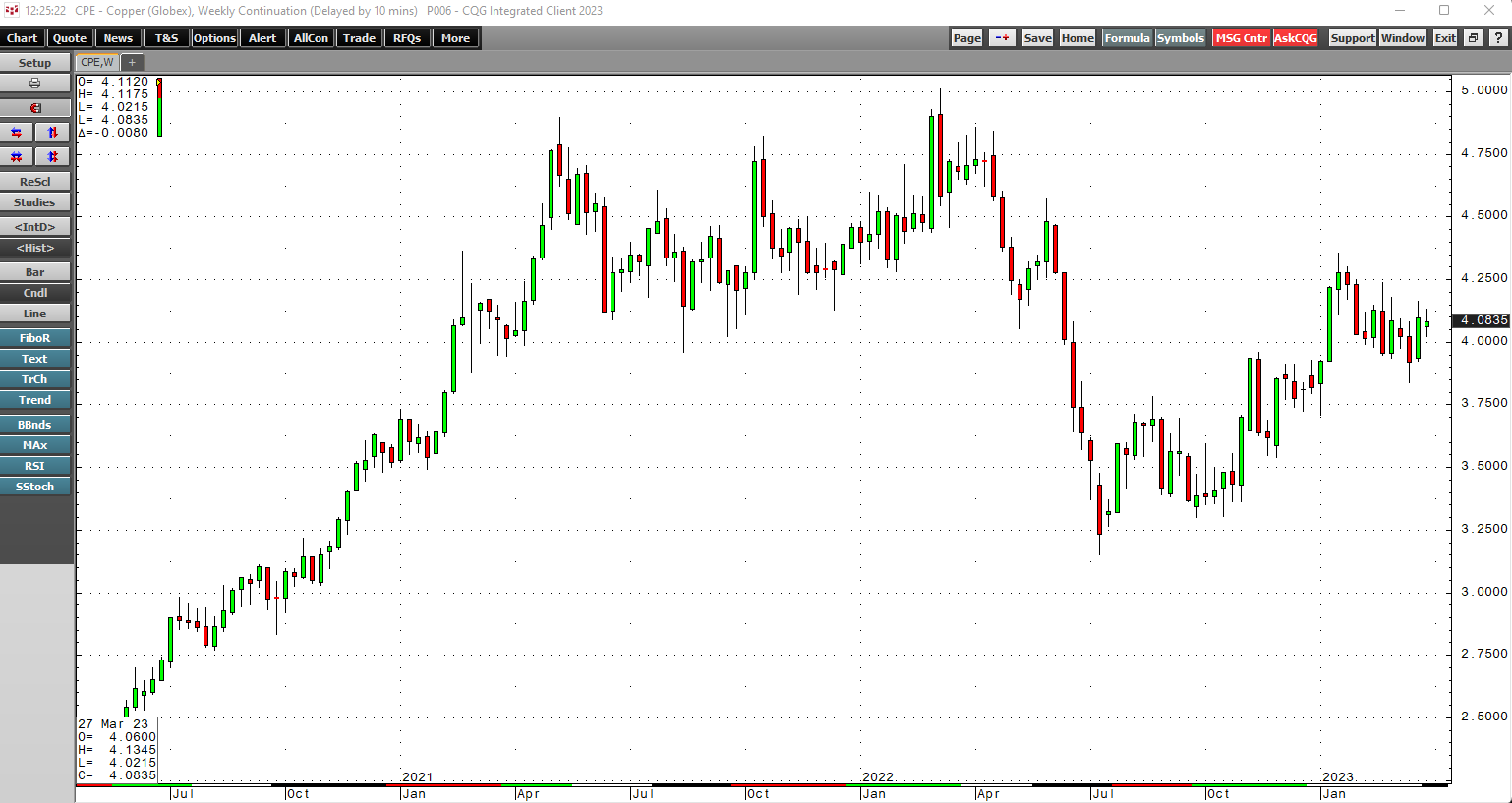

Copper is the leading base metal and a long-term indicator of global economic growth or contraction. COME copper futures reached a record $5.01 per pound in March 2022, corrected to $3.15 in July 2022, and was at the midpoint at over $4 per pound at the end of Q1. Since the July 2022 low, copper's trend has been bullish.

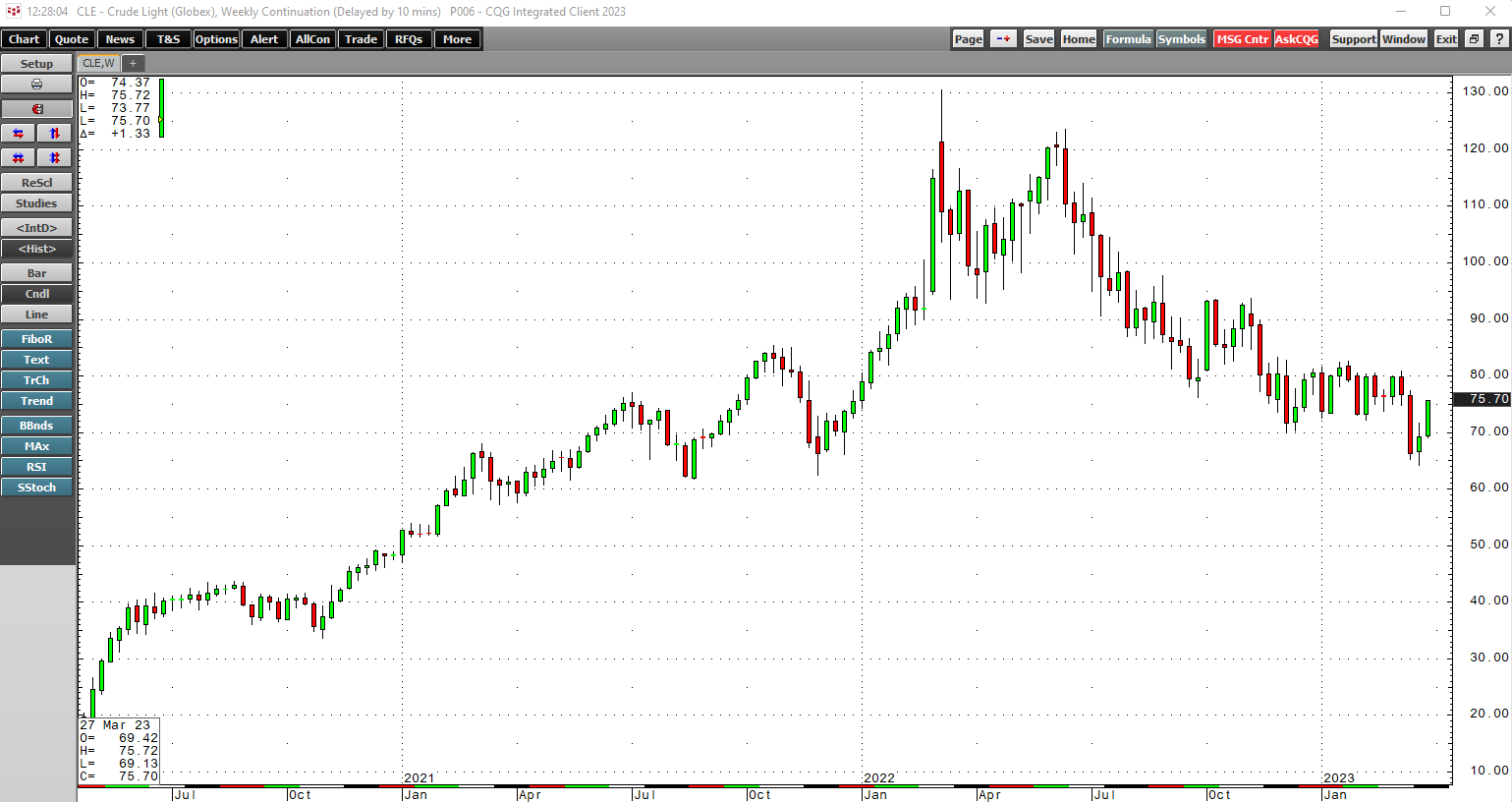

Crude oil is the energy commodity that continues to power the world. While NYMEX crude oil futures fell 5.72% in Q1, the price declined to a $64.12 per barrel low in March and recovered to over the $75 level on March 31. The U.S. administration sold a significant amount of its Strategic Petroleum Reserve, which declined to 371.6 million barrels as of March 24, 2023, the lowest level since December 1983. The administration has indicated it would replace the SPR at prices below $70 per barrel, which could create a floor for petroleum prices over the coming weeks and months. Moreover, as the war in Ukraine continues to rage, Russia is the most influential OPEC member, the peak U.S. driving season begins in Q2, and China is emerging from its COVID-19 lockdowns, the odds of higher oil prices are increasing.

Meanwhile, grains fell in Q1, but the 2023 Northern Hemisphere crop year has begun. The world depends on bumper crops worldwide to replace losses caused by the war in Europe's breadbasket and critical logistical hub in the Black Sea. Any weather-related problems could cause explosive rallies in grain and oilseed futures markets.

What to expect in Q2 and beyond

The economic costs of the global pandemic, its legacy, remain staggering. While monetary policy will impact markets, the war in Europe will continue to turbocharge volatility, making the central bank's actions far less influential in markets. Energy and food markets remain ground zero for war-related price variance.

Expect a continuation of volatility in markets in Q2 2023 and beyond. Discipline, a logical risk-reward approach using stops, and flexibility are critical elements for success in the world of commodities. As we witnessed in 2022, surprises will likely cause the most significant price variance in Q2 and throughout the rest of 2023.