- ICE cocoa futures rally to a seven-year high, ending the trend of lower highs

- The rally to a multi-year high during the latest contract roll period

- Tight supplies, rising production costs, and producer restrictions

- Cocoa joins sugar, cotton, coffee, and FCOJ

- Levels to watch in the cocoa futures market

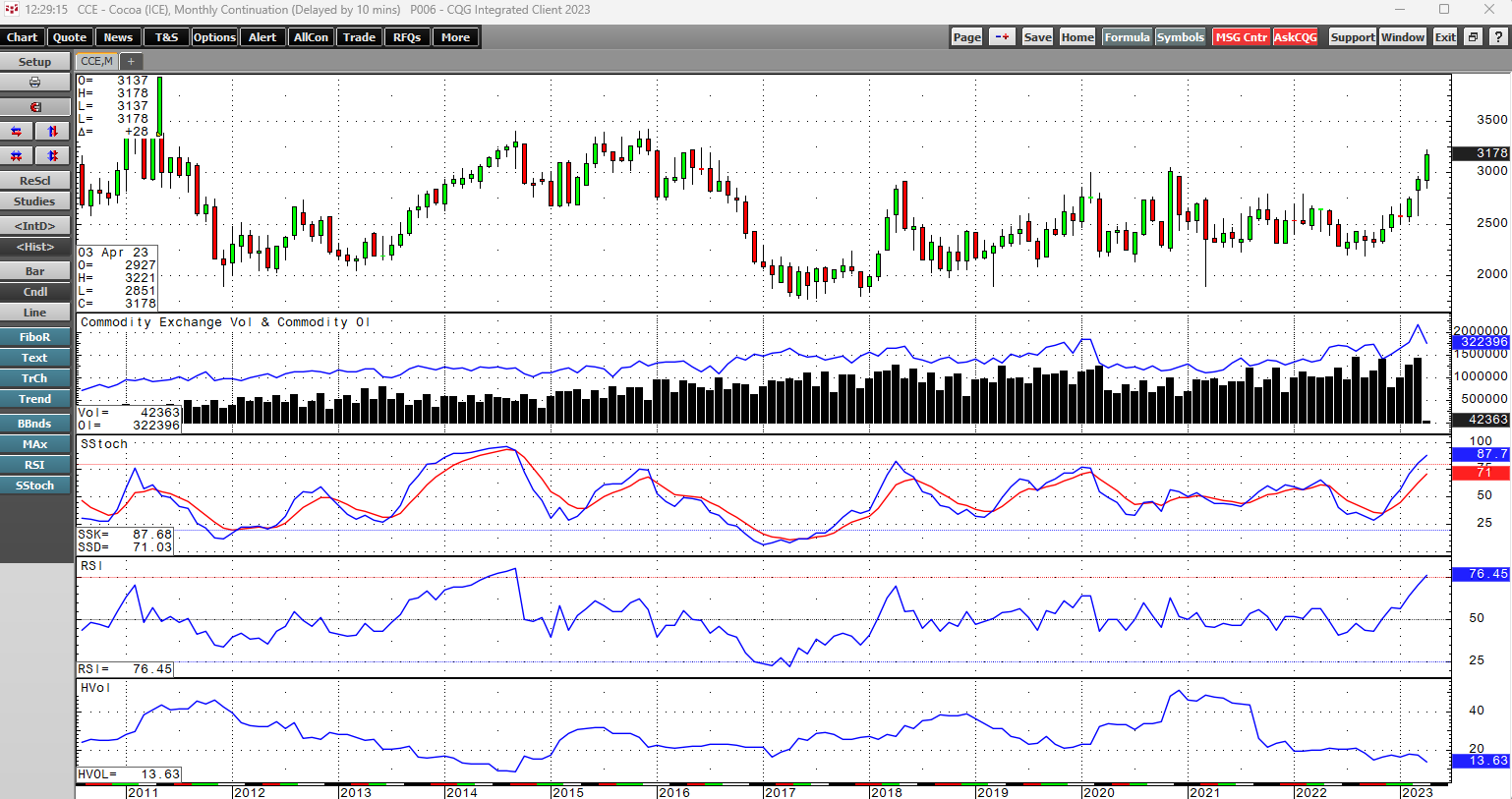

Soft commodities were the top-performing sector of the asset class in Q1 2023, rising 11.98%. In Q1, ICE cocoa futures posted a 12.81% gain, and the bullish price action continued in early Q2. In April, cocoa futures rose to the highest price since June 2016, reaching $3221 per ton.

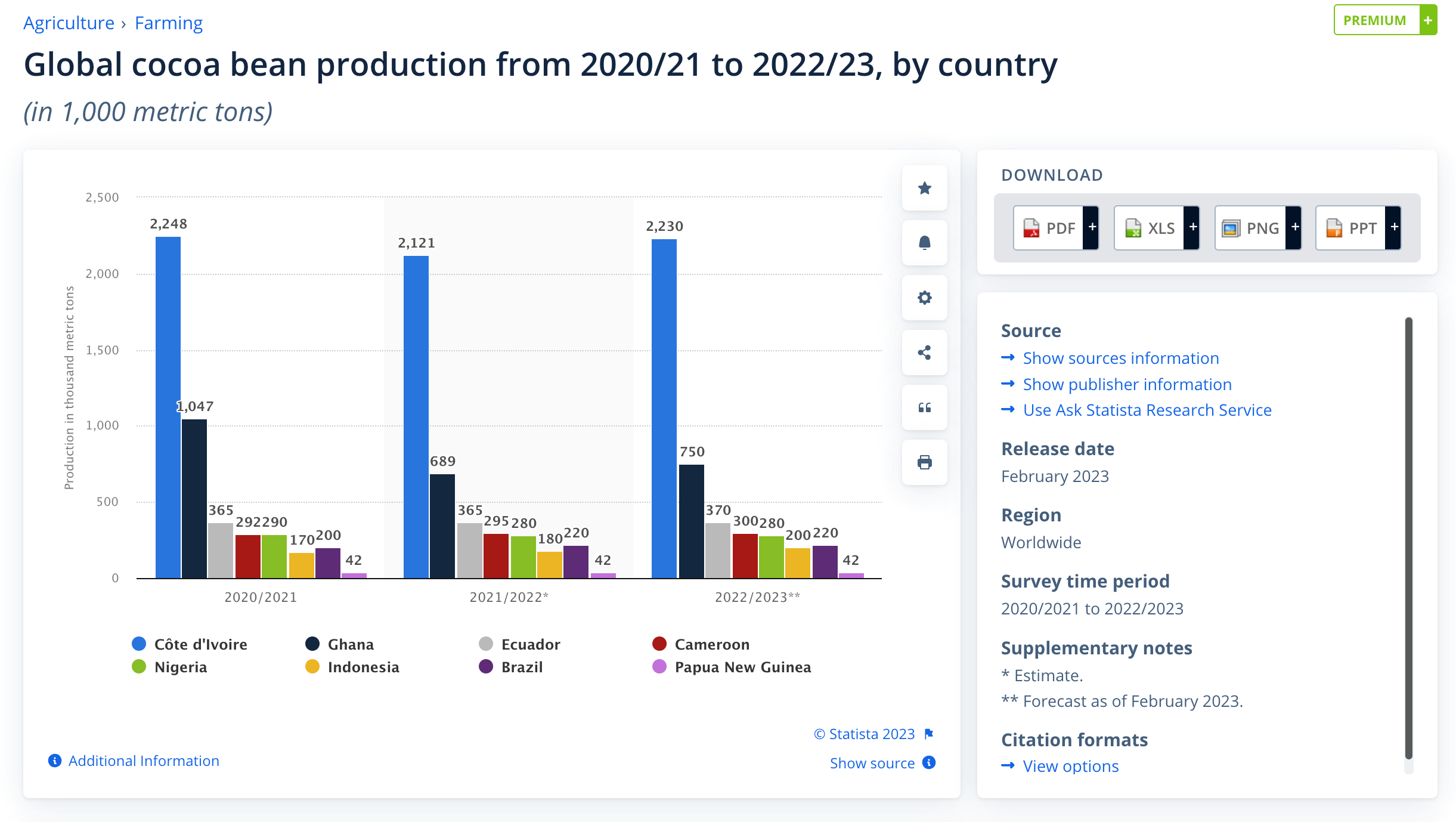

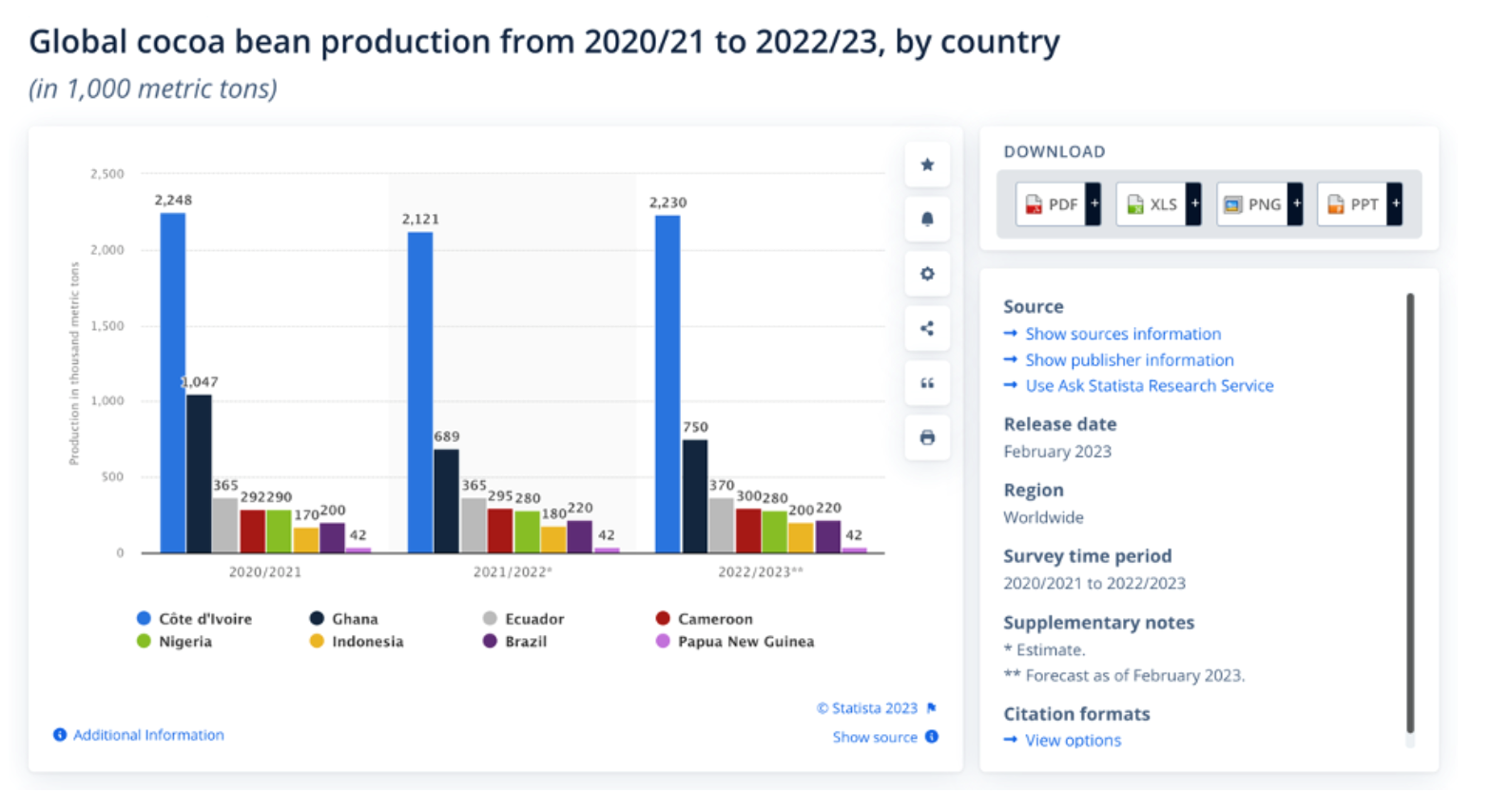

The Ivory Coast and Ghana are the world’s leading cocoa producers, with the IC producing over twice the cocoa beans as second-place Ghana each year.

Source: Statista

The chart highlights the Ivory Coast’s dominance in worldwide cocoa output.

Cocoa is an agricultural product, with annual production depending on the weather, crop diseases, and logistical issues that can impact West Africa. In early 2023, tight supplies pushed the price over $3,000 per ton for the first time since November 2020 and eclipsed a critical technical level that could lead to further gains.

ICE cocoa futures rally to a seven-year high ending the trend of lower highs

In 2022, nearby ICE cocoa futures edged 3.2% higher. In Q1 2023, cocoa futures posted a double-digit percentage gain, rising 12.8%. The bullish price action followed through in April, pushing cocoa to its highest price in seven years.

The monthly chart highlights nearby cocoa futures rising to $3,221 per ton, the highest price since June 2016. Cocoa futures broke out above the first technical resistance level at the November 2020 $3,054 peak. Price momentum and relative strength indicators have been rising, open interest and volume increased with the price, and historical volatility has remained stable, supporting the rally.

The rally ended the pattern of lower highs that had been in place from November 2020 through the September 2022 low.

The rally to a multi-year high during the latest contract roll period

The latest cocoa rally occurred as the May ICE futures contract rolled to July.

The chart of expiring May futures illustrates cocoa’s rise to $3,221 per ton on April 21.

The chart shows July futures did not eclipse the $3,000 per ton level, rising to $2,995 per ton, $226 below the May high. Open interest, the total number of open long and short positions in the cocoa futures market, declined from 402,799 contracts on April 4 to 317,263 contracts on April 20. The 21.2% drop during the roll was a sign that shorts covered and did not roll risk positions and hedges, pushing the expiring May futures through the technical resistance levels on the continuous contract.

Tight supplies, rising production costs, and producer restrictions

The Ivory Coast is, by far, the world’s leading cocoa producer.

Source: Statista

Over the past three years, the IC’s output was more than twice Ghana’s annual production. Ghana is the second-top cocoa producer.

In mid-March 2023, Fitch Solutions reported, “We expect ongoing concerns over tight supplies to continue supporting prices, with reports emerging of the Cote d’Ivoire exporters near to defaulting on contracts due to insufficient cocoa bean supply.”

Global inflation is causing commodity production costs to rise, and cocoa is no exception. Meanwhile, the IC restricted new cocoa purchases from Cargill and Barry Callebaut, two leading chocolate manufacturers, as they already reached amounts stipulated in supply contracts. Cargill sells a range of cocoa and chocolate products, and Barry Callebaut is a leading high-quality chocolate manufacturer. The IC’s supply tightness could impact sales to other leading chocolate companies over the coming weeks and months.

Cocoa joins sugar, cotton, coffee, and FCOJ

The move to a seven-year high has caused cocoa to join the bullish price action across the soft commodities sector that led the commodity asset class with a nearly 12% rise in Q1 2023.

- Frozen concentrated orange juice futures rose over 41% in 2022 and added another 30.5% gain in Q1 2023. FCOJ closed at the $2.6950 level on March 31 and rose to a new $2.8790 per pound record high in April 2023.

- World sugar futures rose over 6% in 2022 and moved more than 11% higher in Q1, closing at 22.25 cents per pound on March 31, 2023. Nearby sugar futures rose to 27.41 cents per pound in April, the highest price since October 2011.

- Nearby Arabica coffee futures reached $2.6045 per pound in February 2022. After a correction to just over the $1.40 level in January 2023, the price probed above the $2 per pound level in April 2023. Meanwhile, nearby ICE Robusta coffee futures rose to $3 shy of the May 2011 record peak in April 2023.

- Nearby cotton futures rose to the highest price since 2011, reaching $1.5802 per pound in March 2022. Cotton corrected after reaching an eleven-year high and was around 80 cents per pound in late April 2023.

Soft commodities prices have been rising since the 2020 pandemic-inspired lows. Cocoa is the latest soft commodity to break out to the upside, and time will tell if the July contract continues the bullish price action.

Levels to watch in the cocoa futures market

Cocoa prices have rallied over the past four consecutive quarters.

The quarterly chart shows minor technical resistance at the April 2016 $3,237 high, with the first critical target at the 2015 $3,422 peak. In 2011, nearby cocoa futures reached $3,826 per ton, an upside milestone. Technical support is now at just below the $2,800 per ton level.

Keep an eye on supplies from the Ivory Coast. A continuation of supply restrictions will tighten the market and could cause the July contract to rally and test the $3,221 May contract high, leading to a potentially explosive move in the cocoa futures arena. Cocoa is the last soft commodity to join the bullish soft commodity price action, and if FCOJ, sugar, coffee, and cotton are guides, a test of the 2011 high could be on the horizon.