The 1% Rule

Larry Hite famously posited the 1% rule in Schwager's, "Market Wizards". This risk management rule suggests risking no more than 100 basis points of total assets under management on any particular trade. For example, if a trader had $1,000,000.00 in assets under management (AUM) the one percent rule suggests risking no more than $10,000.00 on a long WTI Crude Oil futures position.

A prudent "add-on" to the 1% rule is the Turtle rule (as taught by Dennis and Eckhardt) of "rounding down". For example, if we have $1,000,000.00 in AUM and our trading model suggests a $4.00/barrel stop loss on a 1,000/barrel futures contract, we would "round down" to a position size of 2 contracts or $8,000.00 in risk.

The Asset Class Risk Ceiling

One potential flaw in the 1% rule is correlation risk. Metrics like VaR automatically address this risk for us but it's worthwhile to cover the augmentation of, "per trade risk" with an "asset class risk ceiling". Returning to our long WTI crude oil trading signal, suppose that we simultaneously get the following buy signals:

- Long Brent Crude Oil - risk is $3.80/bbl

- Long NY Harbor Ultra Low Sulfur Diesel - risk is $0.10/gal (or $4,200.00)

- Long NY Harbor Unleaded Gasoline - risk is $0.09/gal (or $3,780.00)

- Long Gasoil ARA - risk is $30.00/MT or ($3,000.00)

If we risk 1% on each of these buy signals our risk (even with "rounding down") becomes:

- Long WTI Crude Oil - 2 contracts = $8,000.00

- Long Brent Crude Oil - 2 contracts = $7,600.00

- Long NYH ULSD - 2 contracts = $8,400.00

- Long NYH Gasoline - 2 contracts = $7,560.00

- Long Gasoil ARA - 3 contracts = $9,000.00

By ignoring the strong positive correlations between each of these assets in the petroleum and refined product group we would in fact be taking a similar position five times for an asset class risk of $40,560.00 or 4.056% on our $1,000,000.00 AUM (See Figure 1 below). The simplest "fix" for this is to create a second risk ceiling which augments the 1% per trade rule. This second ceiling is what I am calling the, "asset class risk ceiling" and it could be greater than 1%, but probably no more than 2% of AUM. Here's an example:

- Long WTI Crude Oil - 1 contract = $4,000.00

- Long Brent Crude Oil - 1 contract = $3,800.00

- Long NYH ULSD - 1 contract = $4,200.00

- Long NYH Gasoline - 1 contract = $3,780.00

- Long Gasoil ARA - 1 contract = $3,000.00

This modified asset class risk exposure is $18,780.00 or 1.878% of our $1,000,000.00 AUM.

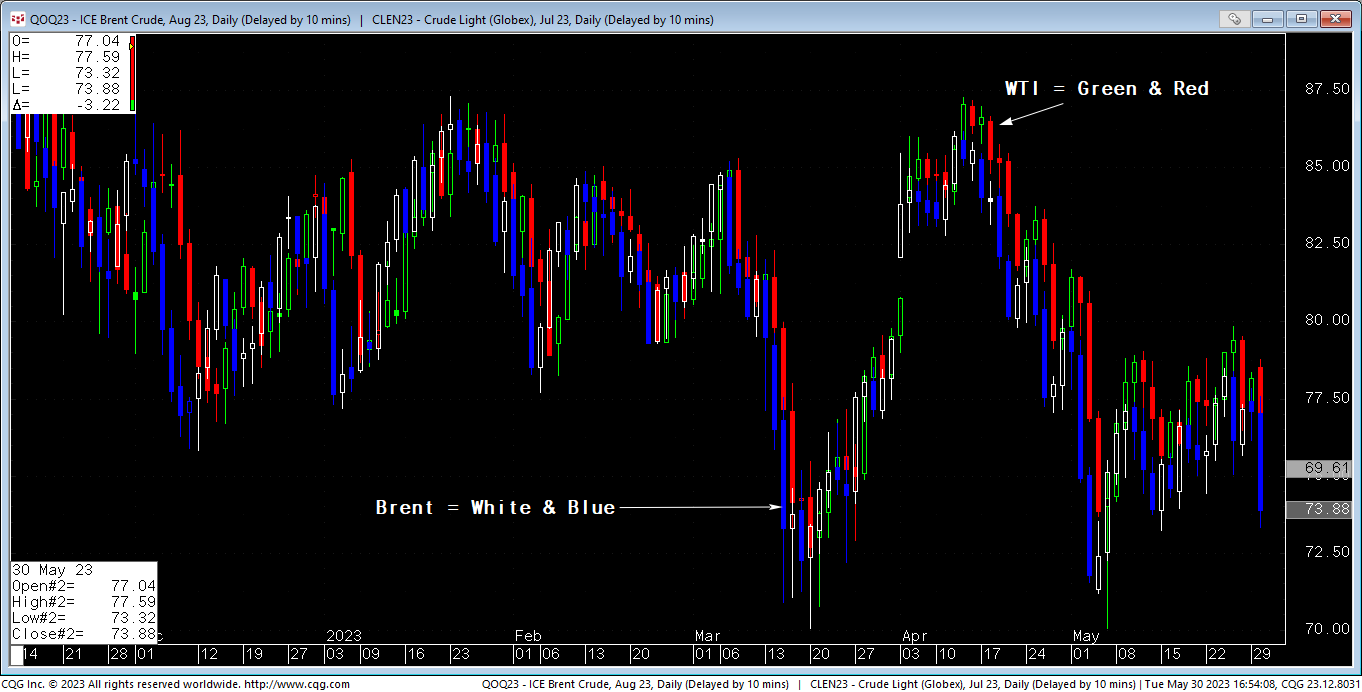

Figure 1 - Shows strong positive correlation between ICE Brent Crude Oil futures and NYMEX WTI Crude Oil futures

Risk On/Risk Off

Finally, we need to consider what is known as the "risk on/risk off" phenomenon in markets. The other cliché for this occurrence is, "When markets are in crisis all correlations go to 1." Restated, the risk on/risk off way of examining markets acknowledges that there will be times when market participants ignore the idiosyncrasies of the particular asset and trade based on whether the asset is "risk seeking" or "risk averse". Recent "crisis" markets include the 2008-2009 Great Recession, Covid during Q1 and Q2 of 2020 and Russia's invasion of Ukraine in 2022. During these crises soybeans, cattle, coffee, cocoa, crude oil, the British Pound, copper and the stock market often dropped on the same day and rose on the same day. This being the case, in such environments I would argue that risk needs to be dampened beyond the 2% per asset class criteria outlined above.

Consequently, I suggest adding a third risk limit of 12.5% of total AUM for the entire portfolio. This ensures that if cocoa, coffee, cattle and the SP 500 all move together our portfolio would not exceed certain extreme levels of risk.

Final Thoughts

Nothing is sacred about any of these percentages and I encourage traders and risk managers to examine thresholds that are more comfortable for their (and/or management's) risk appetites. Disclaimer aside, I do feel that this three-tier approach to position sizing limits can prove more robust than adherence to a simple per trade position sizing limit.