Cocoa was the leading soft commodity in 2023, gaining 61.4% for the year that ended on December 29, 2023. While other soft commodities, including cotton and Arabica coffee futures, rose to multi-year highs in 2022, sugar reached the highest price in over a decade in 2023, and frozen concentrated orange juice futures moved to a record peak at over $4.30 per pound in October 2023. The soft commodities composite that trades on the Intercontinental Exchange rose 24.04% in 2023, leading the raw materials asset class. Soft commodities tend to be tropical agricultural products. While Brazil is the leading producer of sugarcane, Arabica coffee beans, and oranges, West African countries produce the lion’s share of cocoa beans, the primary ingredient in chocolate confectionery products.

The bullish trend in cocoa continues in early 2024.

Cocoa explodes to new highs

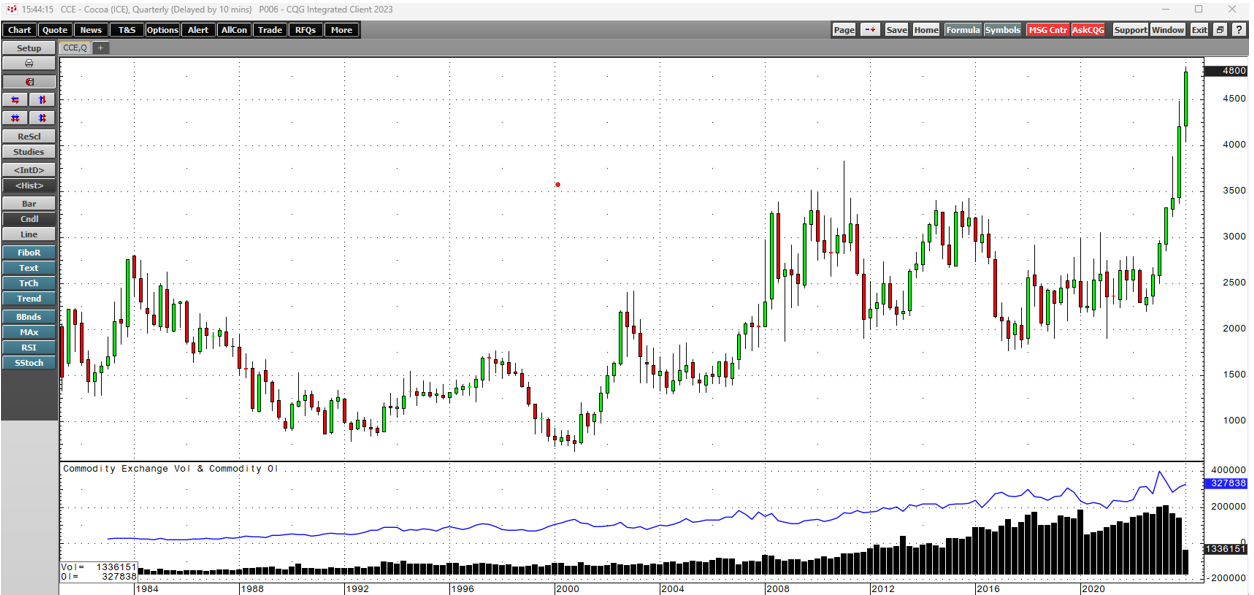

The nearby ICE cocoa futures contract closed 2023 at $4,196 per ton.

As the chart dating back to 1979 highlights, ICE cocoa futures rose to $4,843 per ton in late January. The commodity that led the asset class higher in 2023 continues to vault to higher highs. At last week’s peak, cocoa futures were over 15.4% above the end-of-2023 closing level. Open interest has increased with price, validating the bullish price action.

Weather in the leading producing countries has created shortages

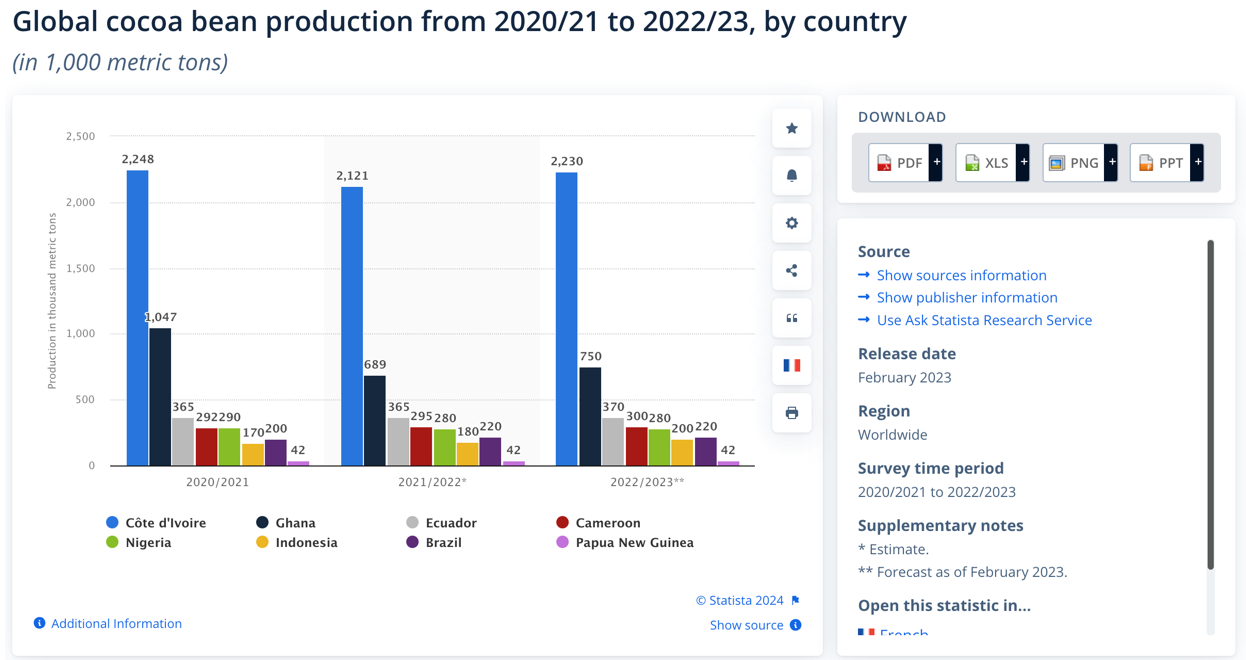

In the mid-1970s, cocoa prices reached record highs at over $5,375 per ton. The Ivory Coast and Ghana lead the world in cocoa production as the equatorial climate supports the soft commodity’s growth.

Source: Statista

The chart shows the Ivory Coast dominates worldwide cocoa production, with neighboring Ghana second. In the mid-1970s, adverse weather conditions lifted cocoa futures to record levels. In 2023 and early 2024, inclement weather in West Africa is also behind the explosive price move. Excessive rain has caused harvest delays and could lead to devastating crop diseases.

The trend is always your best friend

In March 2021, nearby ICE cocoa futures reached a spike $1,900 per ton low.

As the chart illustrates, they have moved over two-and-one-half times higher since the March 2021 low since then. The bullish trend continues in early 2024 and is always your best friend in markets across all asset classes.

Trailing stops as commodity cyclicality will eventually kick in

Commodities are a volatile asset class, with bullish or bearish trends often taking prices to levels that defy logical, reasonable, and rational fundamental and technical analysis.

Cyclical commodity prices tend to fall to levels where producers decrease output, consumers increase buying, and inventories decline, leading to price bottoms. Conversely, they often rise to levels where production increases, buying declines, and inventories grow, leading to significant tops. While cocoa prices could continue to increase over the coming weeks and months as supply deficits widen, they will eventually rise to an unsustainable level. The correction could be fast and furious when prices run out of upside steam. Therefore, market participants holding long positions should use trailing stops to protect profits and capital.

Futures are the only route for cocoa exposure

Cocoa remains in a very bullish trend as we move into 2024’s second month. However, the potential for downdrafts increases with the soft commodity’s price. The only route for a risk position in cocoa is the futures and futures options arena. In 2023, the delisting of the NIB ETF that tracked cocoa prices eliminated an alternative route for cocoa bulls and bears. NIB never achieved the critical mass that fostered liquidity.

Soft commodities led the commodities asset class higher in 2023, and prices have increased in early 2024. Last year’s leader, cocoa, continues to be on fire and could be heading for a challenge of the over $5,375 record peak from nearly half a century ago.