Gold has a long history as an alternative asset, while Bitcoin and digital currencies only burst on the scene starting in 2010. Gold has been a low-volatility asset over the past few years, in a bullish trend since the 1999 $252.50 low. Bitcoin is a high-volatility asset that experiences boom and bust price action. Price explosions and implosions have become commonplace for Bitcoin, while gold has not experienced the same price variance level.

Meanwhile, gold and Bitcoin have attracted a lot of speculative and investment interest, which is only rising in the current environment. The economic and geopolitical landscapes have been fertile ground for the world’s oldest currency, gold, and its newest means of exchange, Bitcoin and other cryptos.

Bitcoin on a path to challenge the 2021 high

Bitcoin exploded to a record high in November 2021 when the leading cryptocurrency ran out of upside steam, leading to an implosion that took it to a bottom in November 2022.

The monthly chart of nearby CME Bitcoin futures shows the rise to $69,355 and a 78.5% decline to $14,925. Bitcoin has made higher lows and higher highs since November 2022. In January 2024, the futures rose above long-term technical resistance at the March 2022 $48,475 high. Bitcoin’s bull market is on a path to challenge the November 2021 $69,355 peak, with the price above the $55,000 level in late February 2024.

Gold is holding the $2,000 per ounce level

Gold’s bull market is celebrating its silver twenty-fifth anniversary in 2024.

As the chart highlights, COMEX gold futures have been trending higher since the turn of this century, reaching their latest peak at $2,130.20 in December 2023. While the $2,000 per ounce level was a technical resistance level in 2020-2023, it has become technical support in 2024. As of the end of February 2024, nearby gold futures remain above $2,030 per ounce.

ETFs have increased participation

ETFs have increased the addressable markets for many alternative investments, and gold and Bitcoin are no exceptions. The SPDR Gold Trust (GLD) began trading in November 2004 and was the first U.S.-traded gold ETF and the first U.S.-listed ETF backed by a physical asset. The quarterly chart illustrates that GLD has done an excellent job tracking the gold price action.

At around the $188 level, GLD had over $54 billion in assets under management. GLD trades an average of more than six million shares daily and charges a 0.40% management fee.

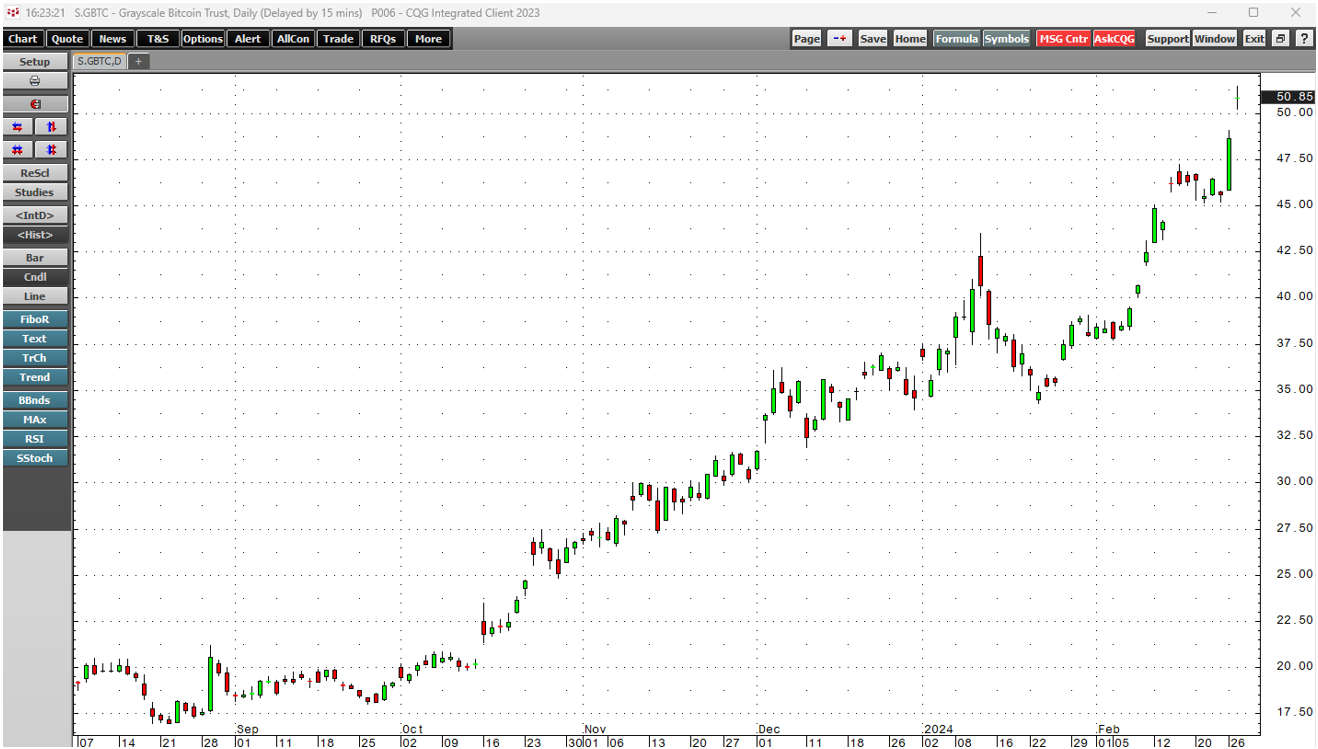

In early 2024, the SEC approved spot Bitcoin ETF products that track the price action in the leading cryptocurrency. The Greyscale Bitcoin Trust (GBTC) is the top spot Bitcoin ETF.

The daily chart highlights GBTC’s high correlation with spot Bitcoin prices. At $50.85 per share in late February 2024, GBTC had over $24 billion in assets under management. GBTC trades an average of more than 10.50 million shares daily and charges a 1.50% management fee.

GLD and GBTC are the leading gold and Bitcoin ETF products. They expand the addressable market for the precious metal and digital currency by providing exposure in standard equity accounts. GLD provides an alternative to the physical market for gold coins and bars, futures, and futures options. GBTC is an alternative to owning physical Bitcoin in computer wallets or on exchanges. While other physical gold and spot Bitcoin ETF products exist, GLD and GBTC are the leaders, providing the highest liquidity. The drawback of both products is that the gold and crypto markets operate around the clock, while the ETFs are only available during U.S. stock market hours.

GLD and GBTC increase the addressable market and add to volume and interest in the physical markets.

Rates and the dollar index are secondary factors

Bullish trends in gold and Bitcoin have occurred in a high interest rate environment where the U.S. dollar index has recovered from the recent low. Ironically, gold and digital currencies tend to do best in low interest rate environments where the U.S. currency is weakening.

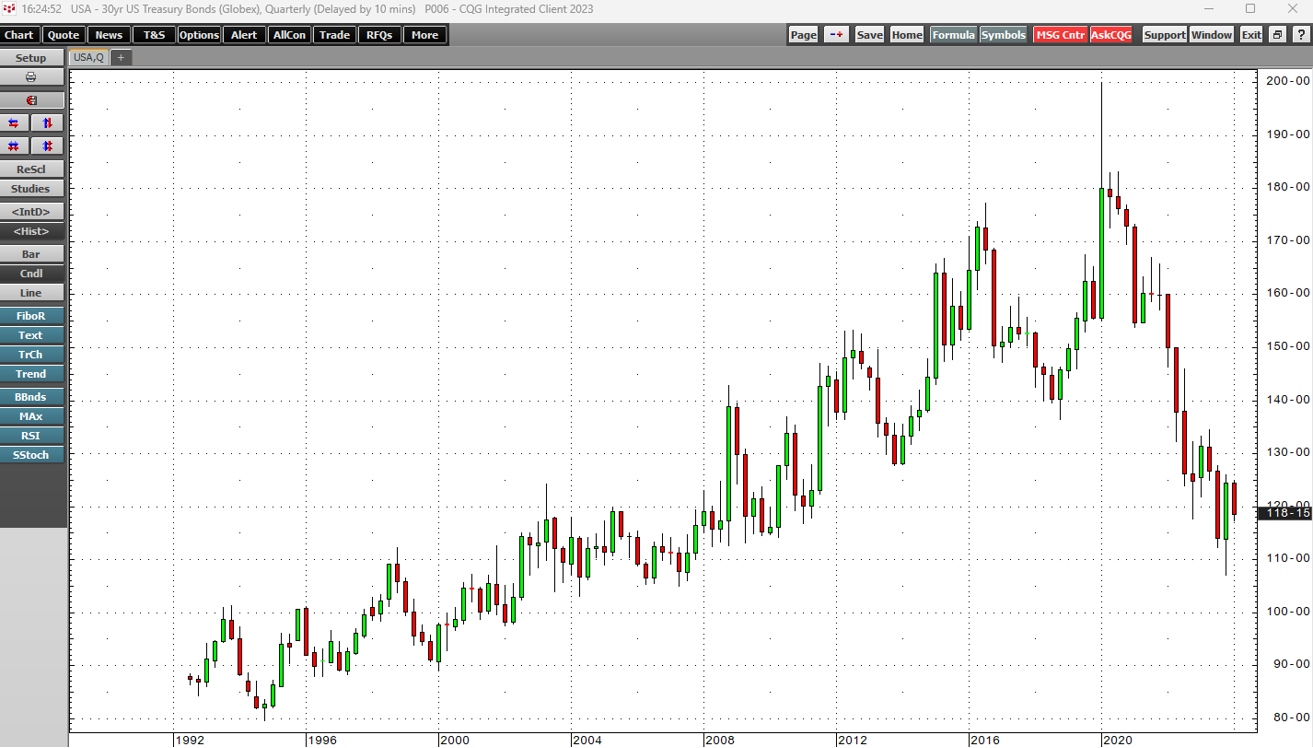

The quarterly chart shows the bearish trend in the U.S. 30-year Treasury bonds as interest rates have risen to the highest level since 2007.

The weekly dollar index futures chart shows the recovery and short-term bullish trend since the late 2023 low. Meanwhile, Bitcoin and gold have done incredibly well in a high interest rate and stronger dollar environment.

Three takeaways from the leading precious metal and the top crypto

The three compelling takeaways from the price action in Bitcoin and gold are:

- The faith and credit of the United States and other fiat currencies have declined, leading to gold and Bitcoin accumulation.

- The rising U.S. debt level at over $34 trillion has increased the demand for alternative assets, benefiting gold and Bitcoin.

- The increasing odds of a BRICS currency with gold backing have caused investors and speculators to increase allocations of alternative assets.

Gold and Bitcoin are sending the markets a significant message in early 2024. Expect higher prices in the leading precious metal and top digital currency, as the trend is always your best friend in any market.