Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Blogs

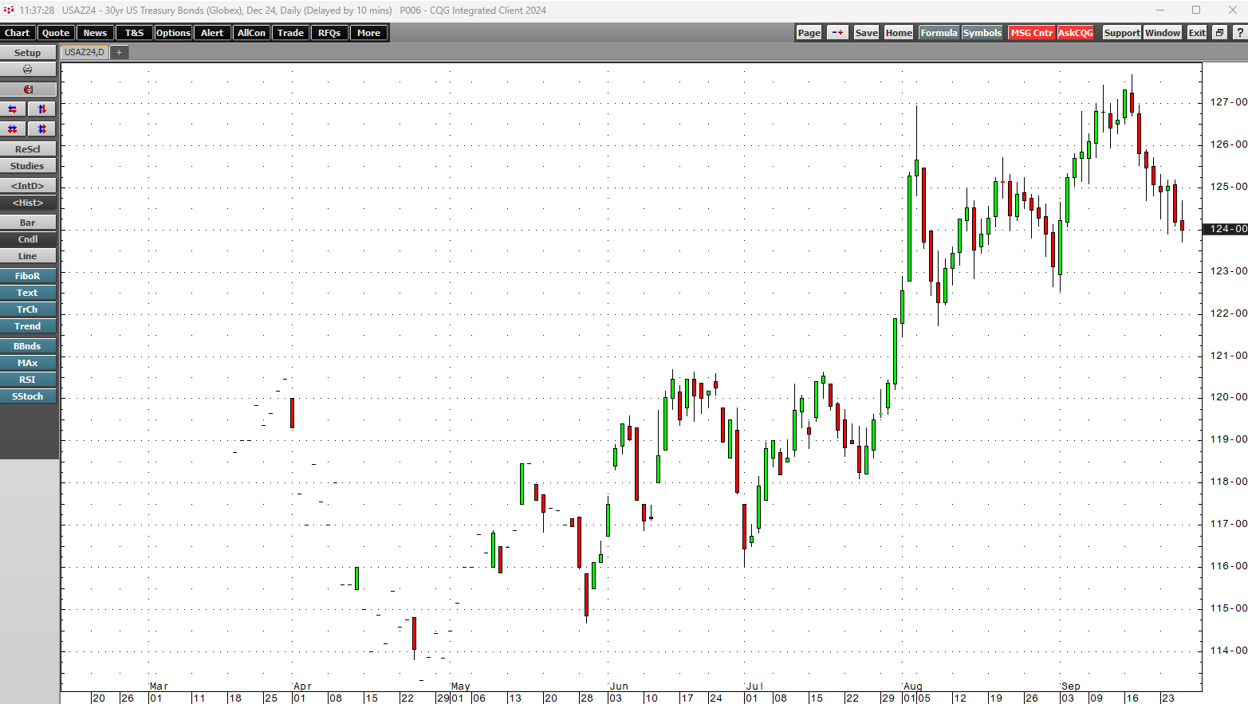

Midweek, the TSE 10 Year JGB, Dec 24 contract is down -0.17%. The best performer in the US market is the 2yr US Treasury Bonds (Globex), Dec 24 contract which is down -0.16%. The best… more

This midweek look shows the best performer in the Japanese market is the JPX Prime 150 Index, Dec 24 contract with a -0.80% loss. The best performer in the US markets is the E-mini Dow ($5… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

After reaching multi-year lows in early 2020 as the global pandemic gripped markets across all asset classes, commodities prices have moved substantially higher. Central bank and government… more

This midweek look shows the best performer in the Japanese market is the TOPIX, Dec 24 contract with a +1.36% gain. The best performer in the US markets is the E-mini NASDAQ-100, Dec 24… more

Midweek, the TSE 10 Year JGB, Dec 24 contract is up +0.28%. The best performer in the US market is the 2yr US Treasury Bonds (Globex), Dec 24 contract which is down -0.06%. The best… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

The TSE 10 Year JGB, Dec 24 contract is down -0.07%. The best performer in the US market is the 2yr US Treasury Bonds (Globex), Dec 24 contract which is down -0.15%. The best performer in… more

This midweek look shows the best performer in the Japanese market is the TOPIX, Dec 24 contract with a +0.55% gain. The best performer in the US markets is the E-mini MidCap 400, Dec 24… more