After reaching multi-year lows in early 2020 as the global pandemic gripped markets across all asset classes, commodities prices have moved substantially higher. Central bank and government programs to stimulate the economy caused inflation to spike to the highest level in decades, leading to significant U.S. interest rate hikes beginning in March 2022. The Fed Funds Rate rose from zero to a midpoint of 5.375%, and quantitative tightening to reduce the U.S. central bank's swollen balance sheet pushed rates higher further along the yield curve.

Meanwhile, even though the leading inflation indicators improved, commodity prices remained elevated over the past four years.

In late 2024, central banks are adjusting monetary policy to a more accommodative stance. The potential for even higher commodity prices is rising.

The U.S. cuts interest rates

After Fed Chairman Jerome Powell signaled Fed Funds Rate cuts were on the horizon at the annual August Jackson Hole gathering, the FOMC surprised the market with a 50 basis point cut in short-term interest rates at the September meeting. The market had expected a 25-point reduction, but the Fed cited its pivot to accommodative monetary policy to a robust employment picture and inflation heading toward its 2% target. Moreover, the central bank indicated that rates would drop another 50 points by the end of this year, and the dot plot showed a 100-point cut in 2025. Stocks, commodities, and most assets rallied on the monetary policy shift.

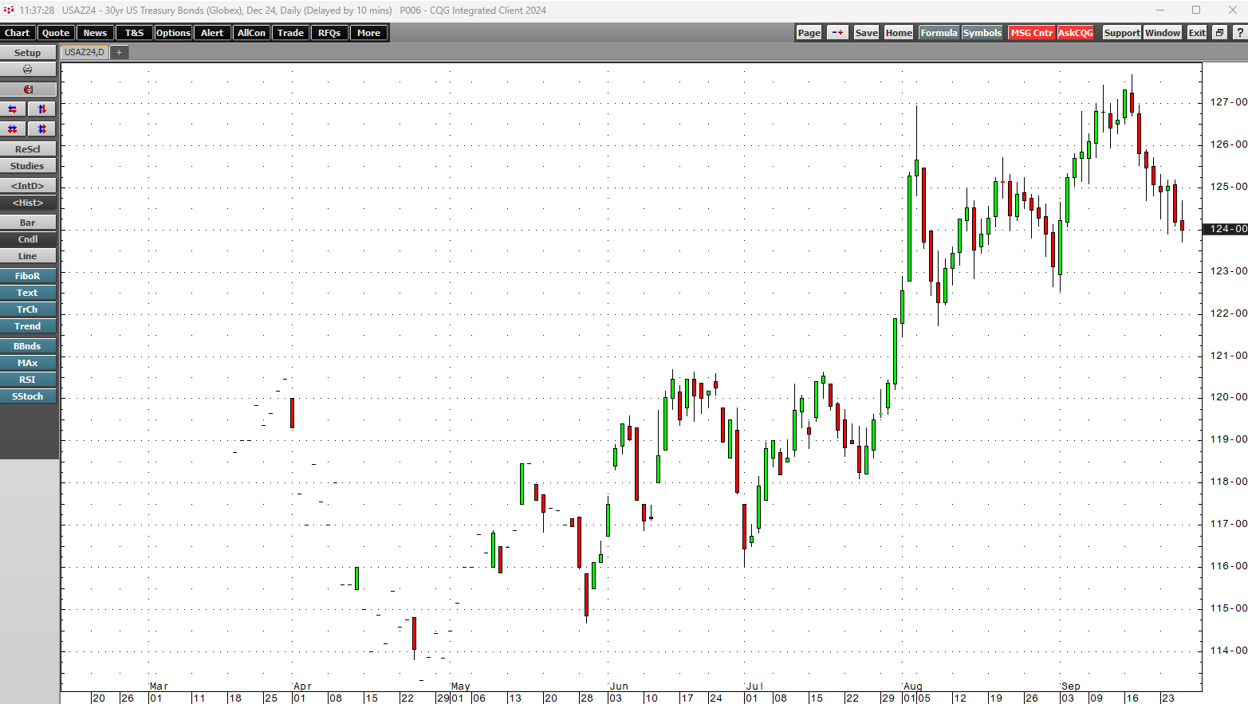

Meanwhile, one market that has remained surprisingly stable has been the long bond futures.

The daily U.S. 30-year Treasury bond futures chart shows the decline since the rate cut. While the central bank uses short-term interest rates as its primary monetary policy tool, market forces determine longer-term rates. The U.S. debt level, declining foreign ownership of U.S. government debt securities, domestic political division, and the geopolitical landscape have weighed on long bond futures, keeping rates higher further along the yield curve.

China cuts interest rates

In late September, China, the world's second-leading economy, cut interest rates and announced other stimulative initiatives to bolster its weak economy. While the Chinese government's GDP growth target for 2024 is 5%, most analysts believe it will fall short of the mark.

China is the world's leading commodities consumer, and weakness in the asset class over the past months has been a function of falling Chinese demand. Stimulus in China could cause raw material demand to rise over the coming months.

China is the world's leading copper consumer. While green energy initiatives lifted copper to a record nearly $5.20 per pound high in May 2024, the Chinese economy's malaise caused the price to correct below the $4 level.

As the monthly chart illustrates, Chinese stimulus ignited a rally in the copper futures market, taking the December COMEX futures contract over the $4.60 per pound level on September 26.

New highs in gold - silver follows

Gold is the world's oldest means of exchange. The precious metal is a hybrid between a commodity and a currency. Central banks worldwide own gold as a reserve asset, validating gold's role in the global financial system. They classify the precious metal as a foreign exchange reserve and have added to gold reserves over the past years.

While some commodities corrected lower over the past months as restrictive monetary policy stifled the demand, gold continued to make higher lows and higher highs, reaching a series of new record peaks.

The monthly chart highlights gold's ascent. The nearby December COMEX gold futures reached another milestone on September 26, trading above the $2,700 per ounce level for the first time.

Silver tends to follow gold, and it has reached a multi-year high.

The monthly chart shows the rally in the COMEX silver futures market, which has taken prices to their highest level since late 2012.

Lots of volatility on the horizon

Crude oil, copper, and gold are leading indicators in the commodities asset class. Crude oil prices have not followed the metals for two reasons. First, the petroleum market tends to experience seasonal weakness as the winter in the northern hemisphere approaches. Second, the November 5 U.S. election will determine energy policy over the coming four years. The U.S. produces 13.2 million barrels of oil daily and consumes nearly 19 million barrels, making it a net importer. The former President and Republican candidate favors a "drill-baby-drill" and "frack-baby-frack" policy to achieve energy independence, increase revenues through exports, and reduce inflation through lower energy prices. The Democrats and Vice President Harris favor addressing climate change by supporting alternative and renewable fuels and inhibiting fossil fuels. The bottom line is that a Republican victory could lead to lower oil prices, while another term for Democrats could cause stable to higher oil prices. The very close race for the White House means we could see lots of volatility in the oil futures market over the coming weeks.

Be cautious in markets as uncertainty will peak over the coming weeks

The U.S. remains the world's leading economy and a top military power. However, the bifurcation of the world's nuclear powers, wars in Ukraine and the Middle East, the uncertainty of the U.S. election, a shift to a more dovish monetary policy approach in the U.S. and China, trade policies that could create barriers, and other factors could cause considerable price variance in markets across all asset classes, and commodities are no exception.

Markets reflect the economic and geopolitical landscape, and commodities. Commodities are global markets. While production occurs in regions where the climate supports growth and geology presents natural resource reserves, consumption is ubiquitous. As the markets head into October and the final quarter of 2024, we could see significant price swings, reflecting the overall environment.