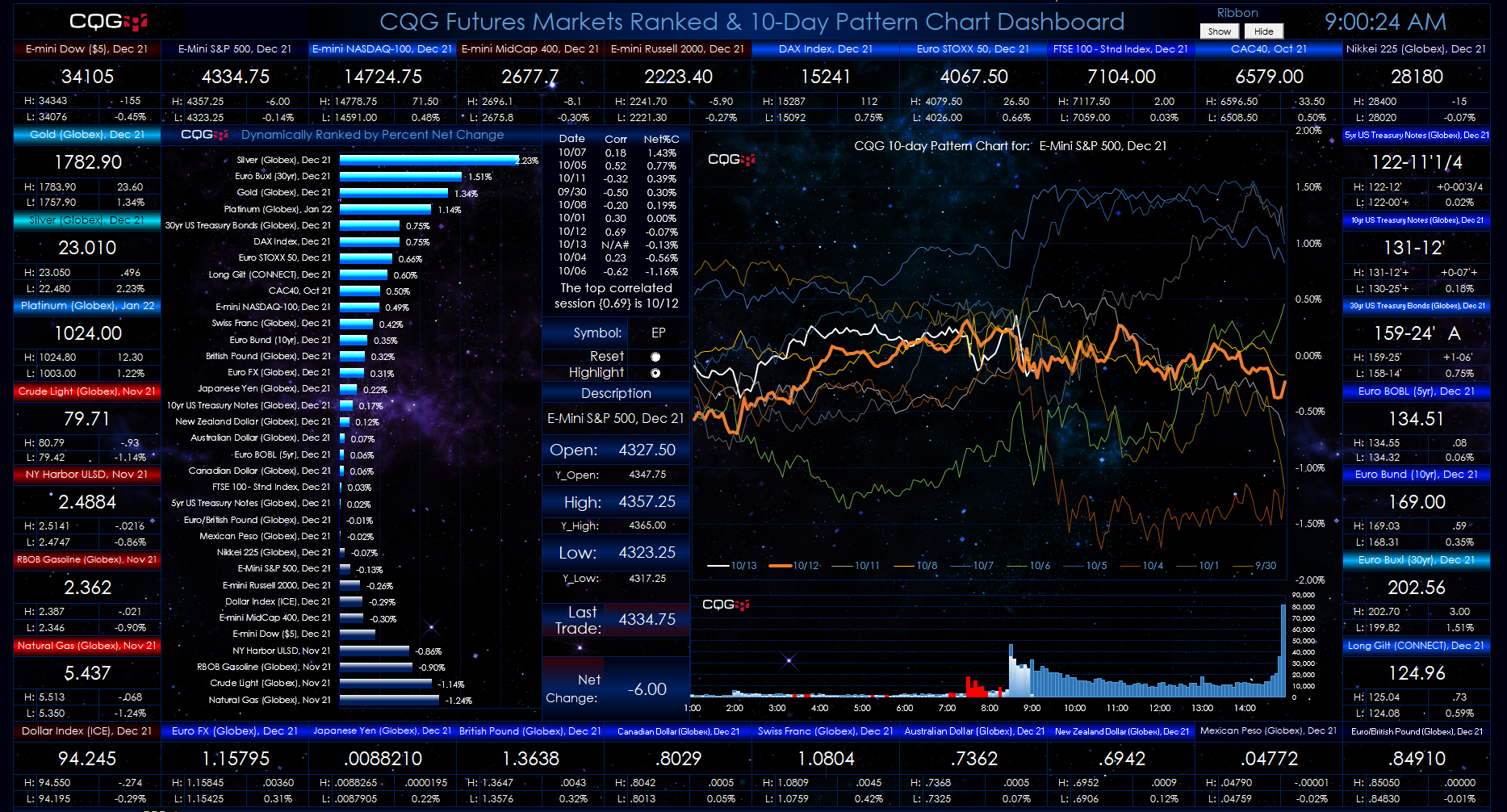

This Microsoft® Excel dashboard has a number of features. The primary feature is the 10-Day Pattern Chart. This chart displays the percent net change on a 5-minute basis for today (the white line… more

Excel/RTD

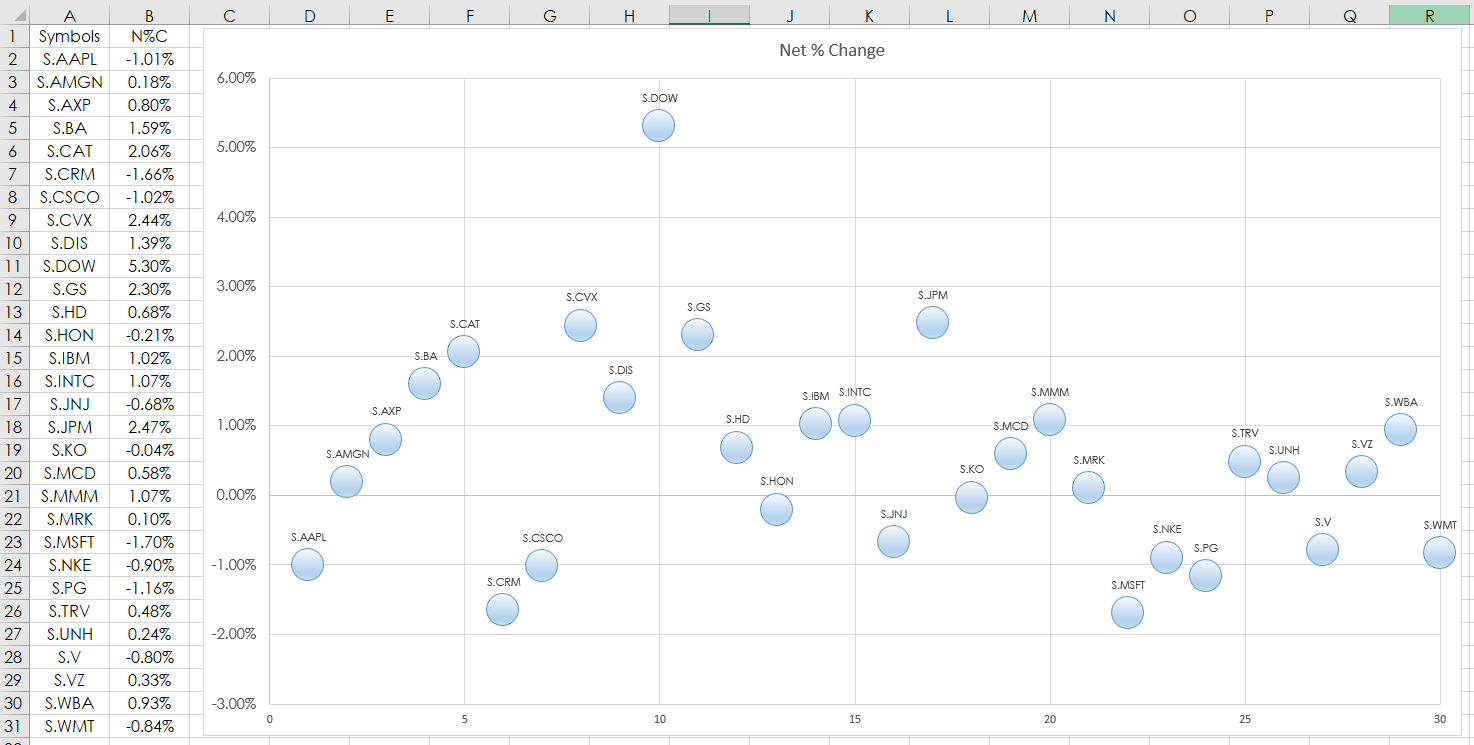

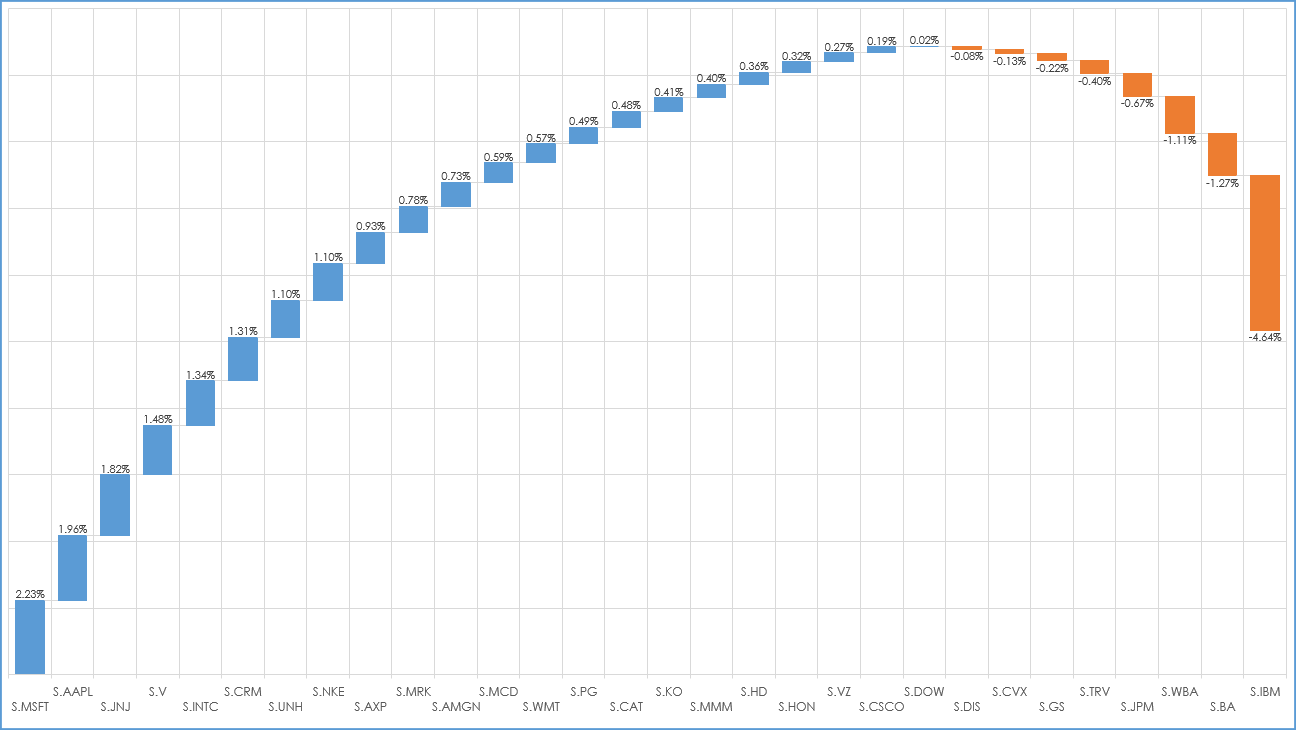

This post details using the Microsoft® Excel “Scatter Plot” Chart to track market performance. In this example, RTD formulas are used to pull in the percent net change of the 30 stocks that are in… more

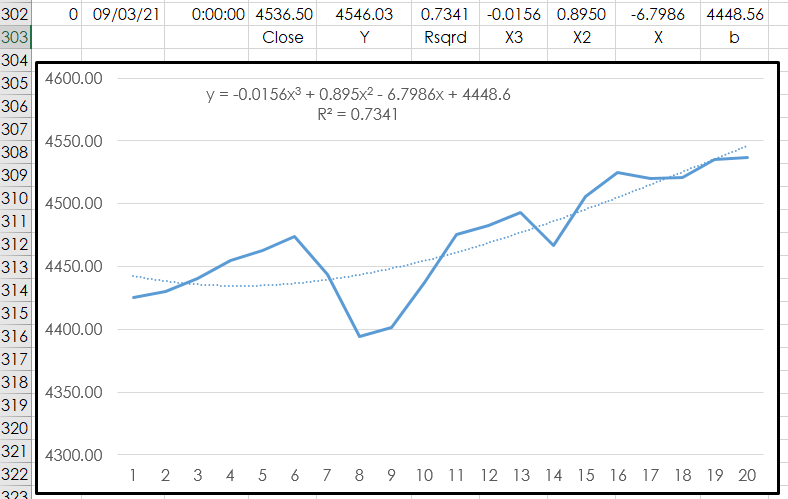

This article walks you through using Microsoft® Excel’s LINEST function to determine the three coefficients and y-intercept of a 3rd order polynomial function over the past 20 bars of closing… more

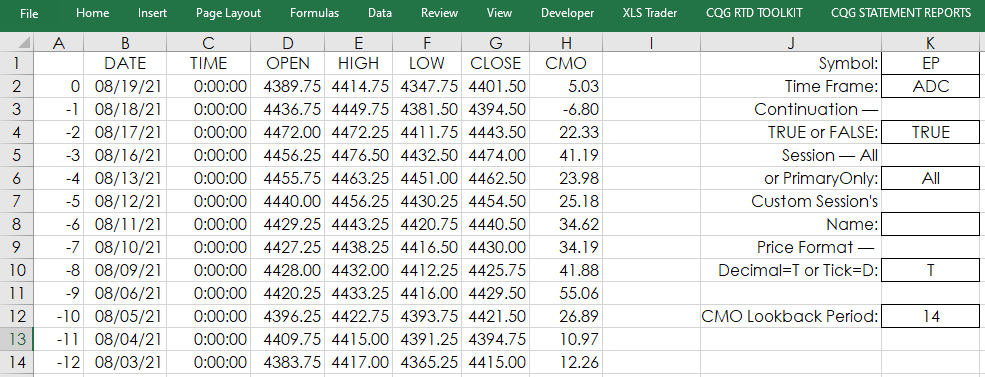

This post builds upon CQG Product Specialist Helmut Mueller's post titled “Most Wanted Seven Studies Plus a Bonus Trading System.” His post provides a PAC with the following studies:

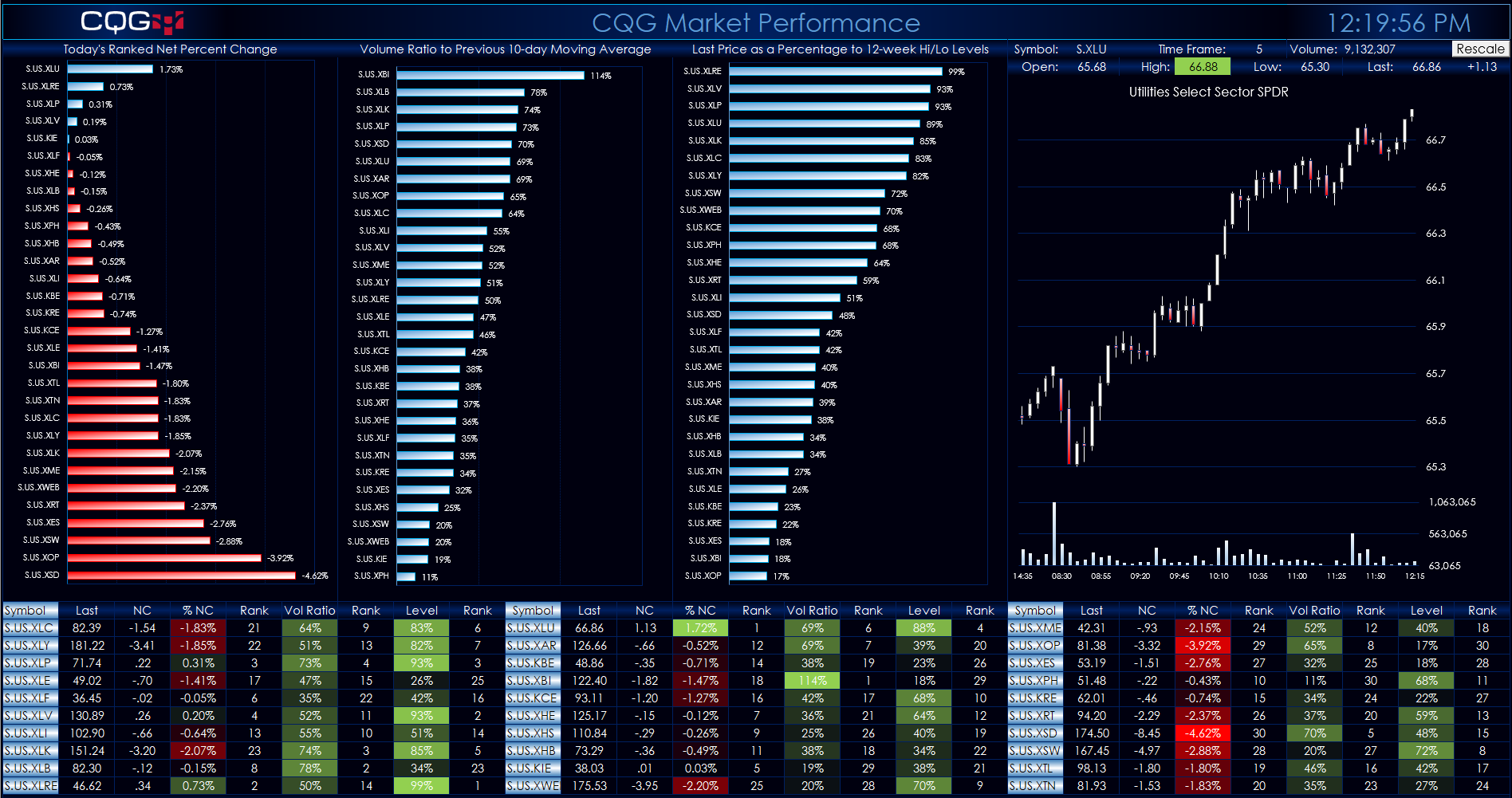

Chande… moreThis Microsoft® Excel Dashboard comes frontloaded with 30 Sector and Industry symbols. However, you can enter in whatever symbols you like using the Symbols tab. The long description of the symbol… more

Microsoft® Excel 2016 and higher offers the Waterfall Chart. The Waterfall Chart is also known as a bridge chart or a cascade chart. Typically, this kind of chart is used to see how positive or… more

CQG comes with 74 functions such as Absolute Value (Abs), Accumulation (Accum), and Bars Since (BarsSince) to name a few. Functions are found in the Formula Toolbox for creating custom studies.… more

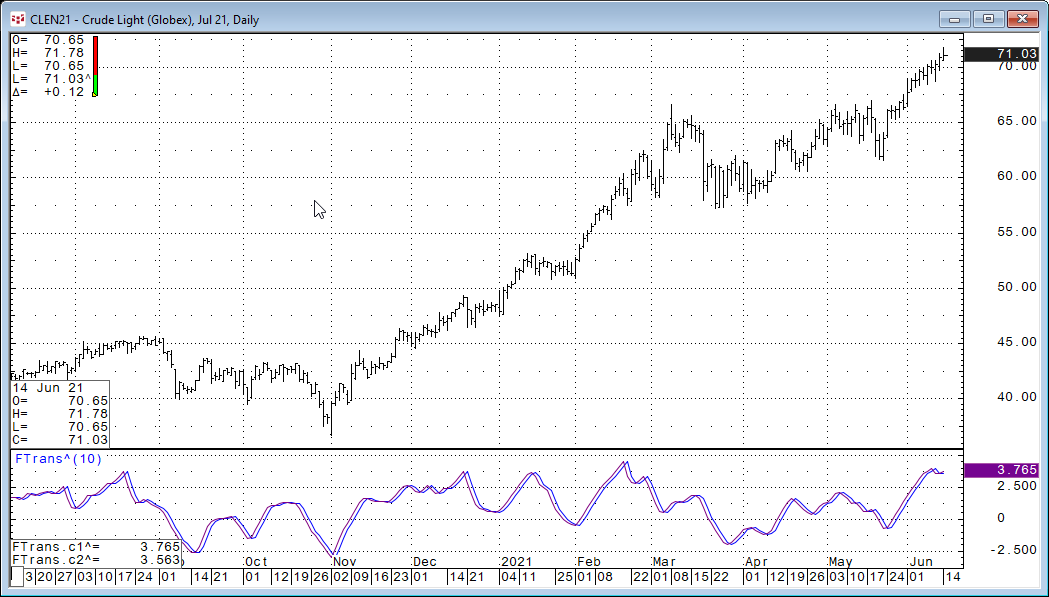

John Ehlers’, President of MESA Software (mesasoftware.com), goal is to bring the science of engineering and Digital Signal Processing to the art of trading. One such endeavor is his publishing of… more

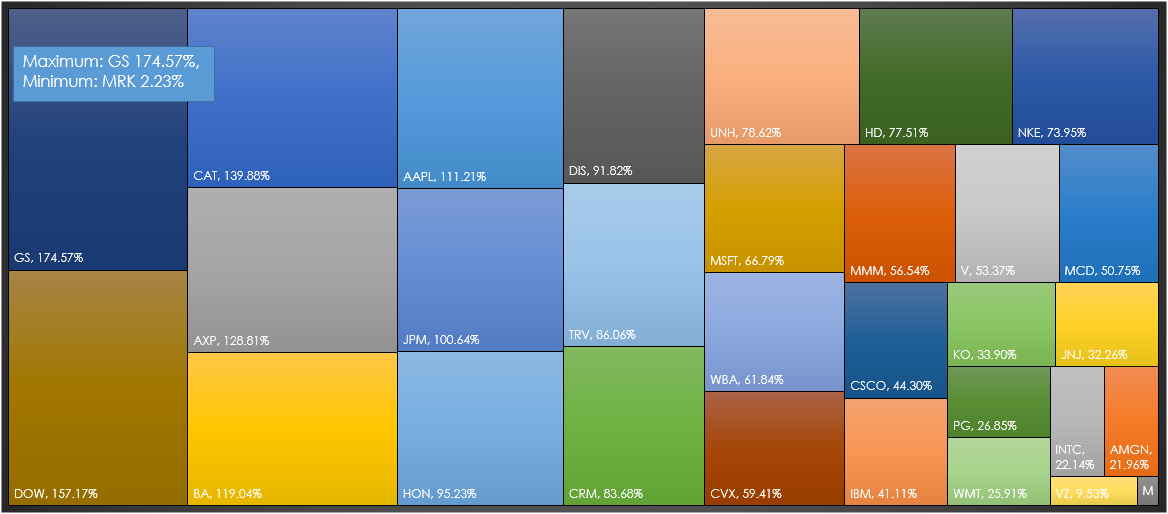

Microsoft® Excel 2016 and higher offer a new chart type: The Treemap. A treemap chart provides a hierarchical view of your data. This view makes it easy to spot patterns, such as which markets are… more

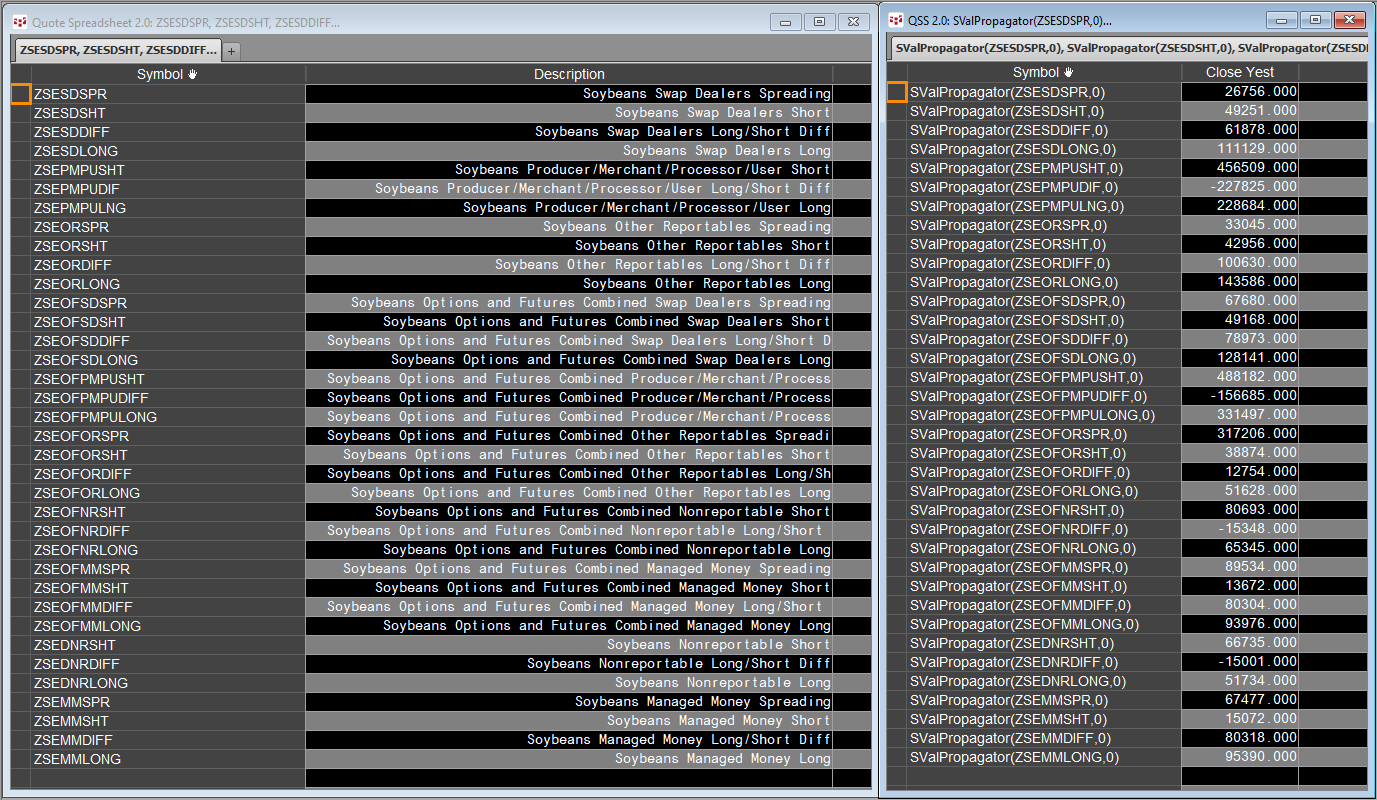

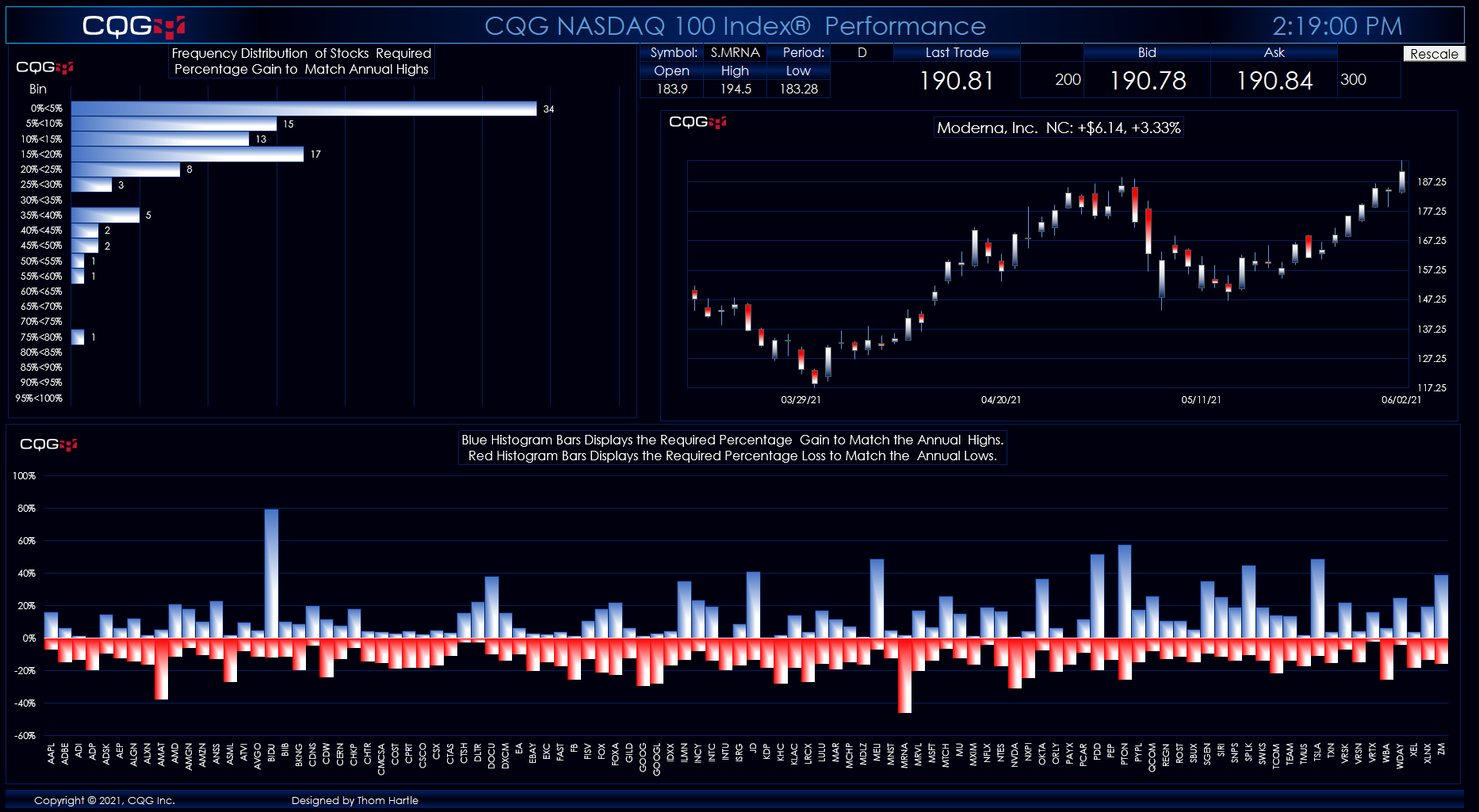

This article builds upon the post titled “Evaluate ETF Constituents Performance Using Excel” that detailed gauging the current price of a stock relative to the high as an indication of relative… more