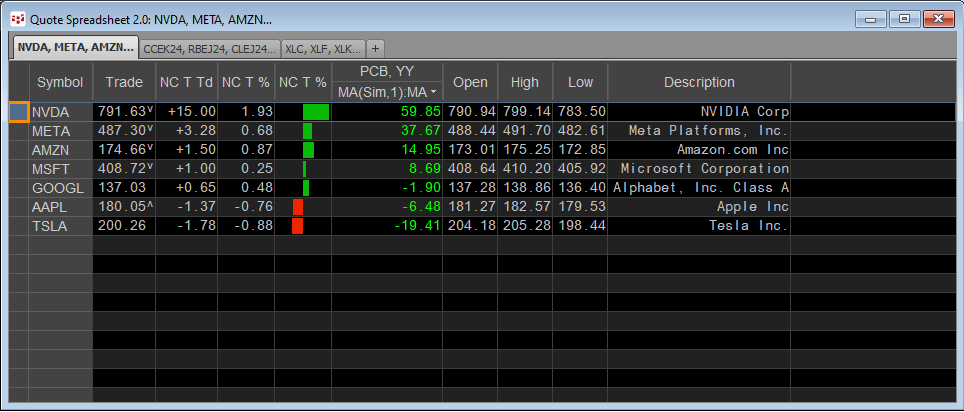

A popular form of market analysis is to maintain a real-time table of market performance based on an annualized basis. For example, the QSS 2.0 displayed below has a sorted column highlighted with… more

Excel/RTD

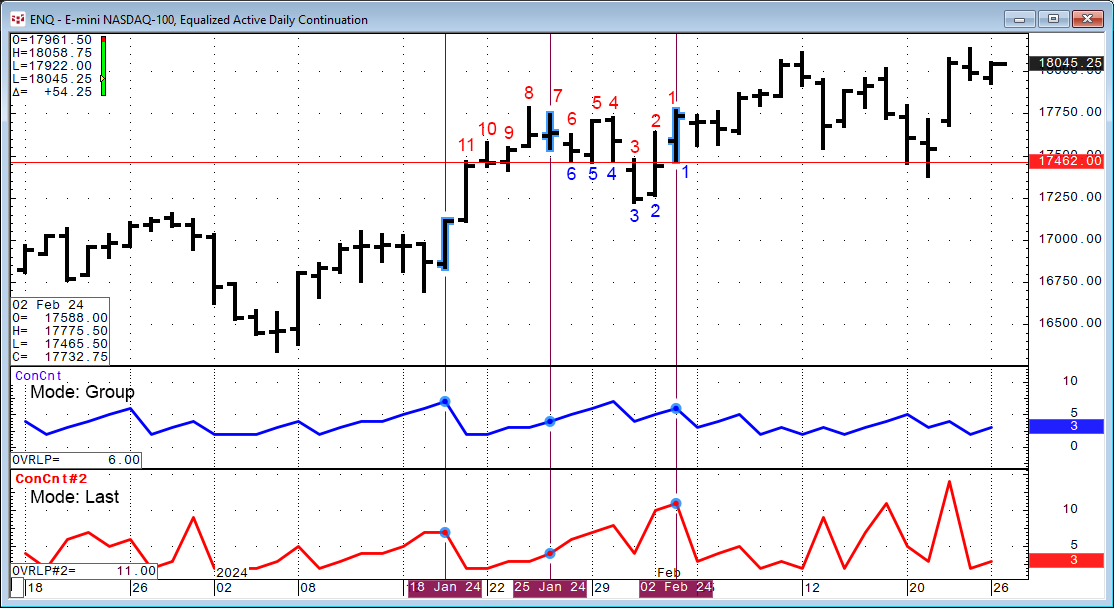

Markets tend to trend up, down, and sideways. Another name for trending sideways is congestion. A period of congestion is when the Open, High, Low, and Close price bars are overlapping. CQG IC and… more

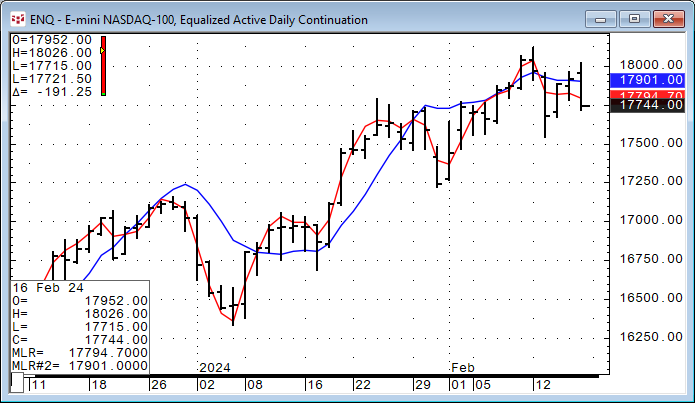

This study goes by a number of other names, including the end point moving average, least squares moving average, moving linear regression, and time series forecast.

To explain this study… more

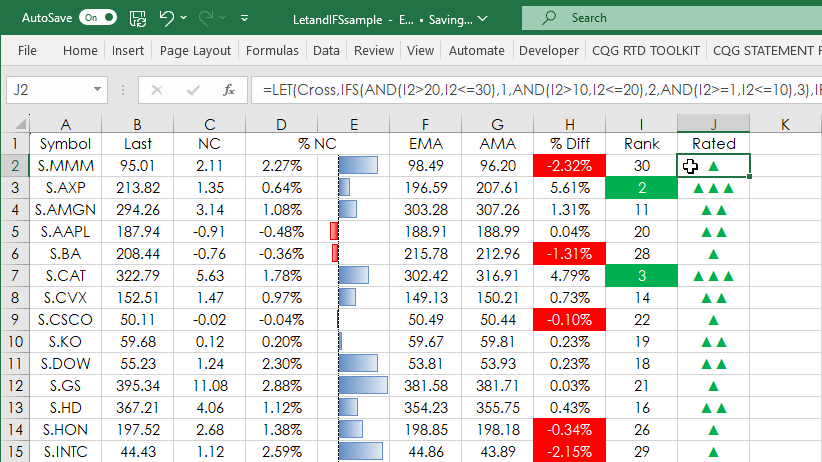

Microsoft Excel 365 introduced the LET Function. Excel 365 or Excel 2016 introduced the IFS function. This post details using the two functions for tracking the performance of the stocks… more

The LAMBDA function is used to create reusable custom functions, which can be called using a "friendly" name. As an introduction to using the LAMBDA function, a previous post detailed using the… more

Microsoft Excel 2016 introduced the IFS function. This function can replace using nested IF functions. Below is an example of nested IF functions:

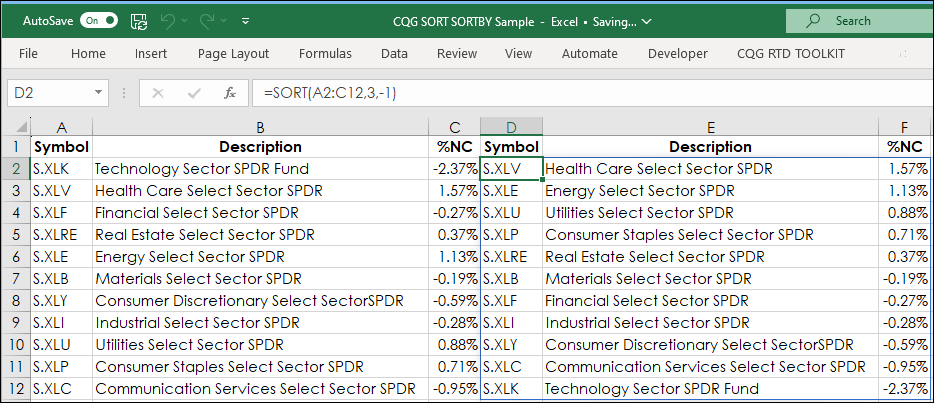

=IF(N2=0,"#",IF(N2=1,"#.0",IF(N2=2,"#.00",IF(… moreExcel 365 includes the SORT and SORTBY functions which provide users with a simple way to dynamically sort data on a real-time basis. A common use would be to dynamically sort market performance… more

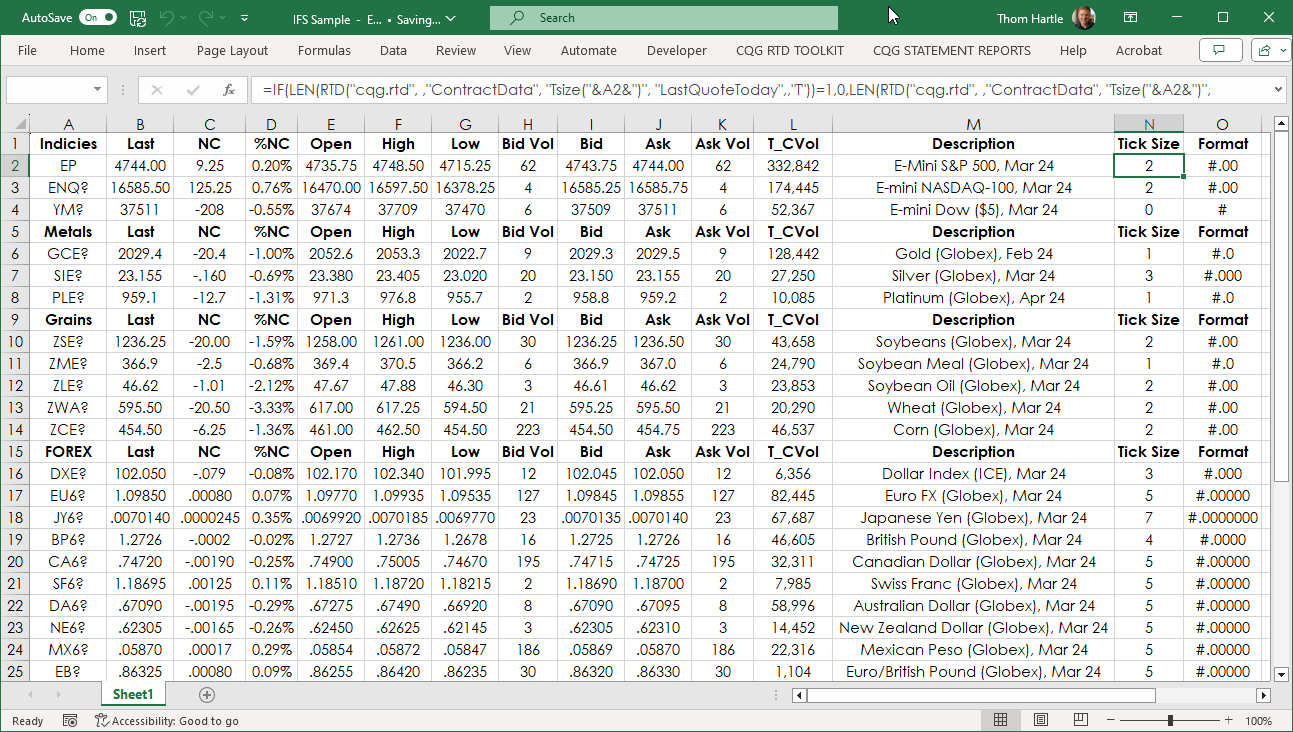

A post titled "Excel Indirect Function and More" was published on February 22, 2022, that detailed using Excel's INDIRECT function, as well as details to automatically format cells for displaying… more

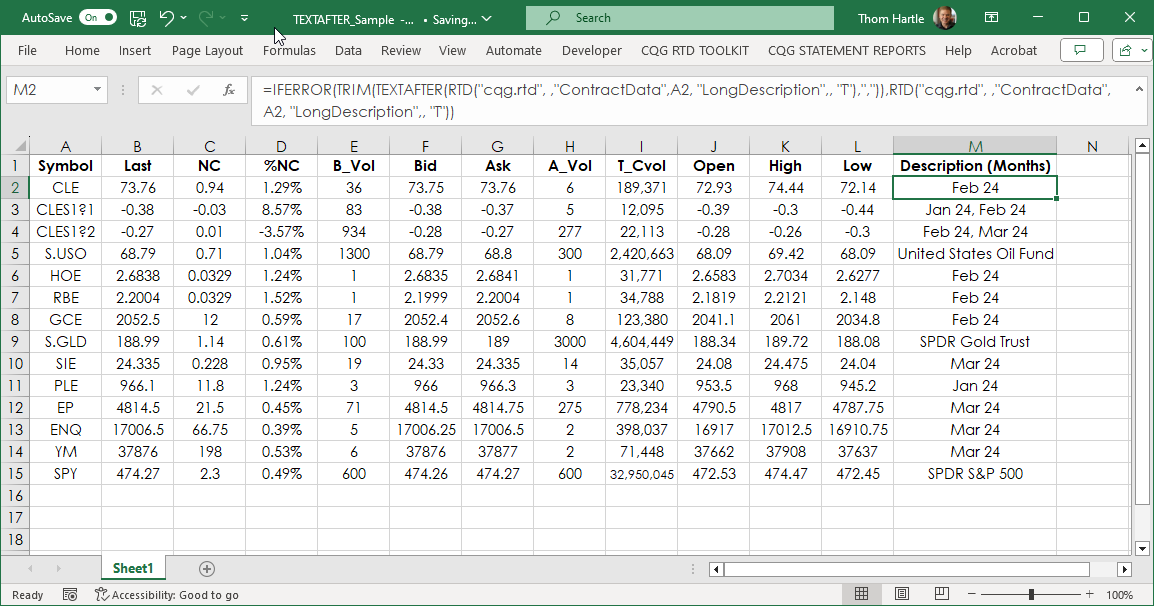

Microsoft® Excel 365 includes a Text function that makes pulling text out of a string much easier than before Excel 365 was released. To illustrate, we will review the steps before Excel 365 was… more

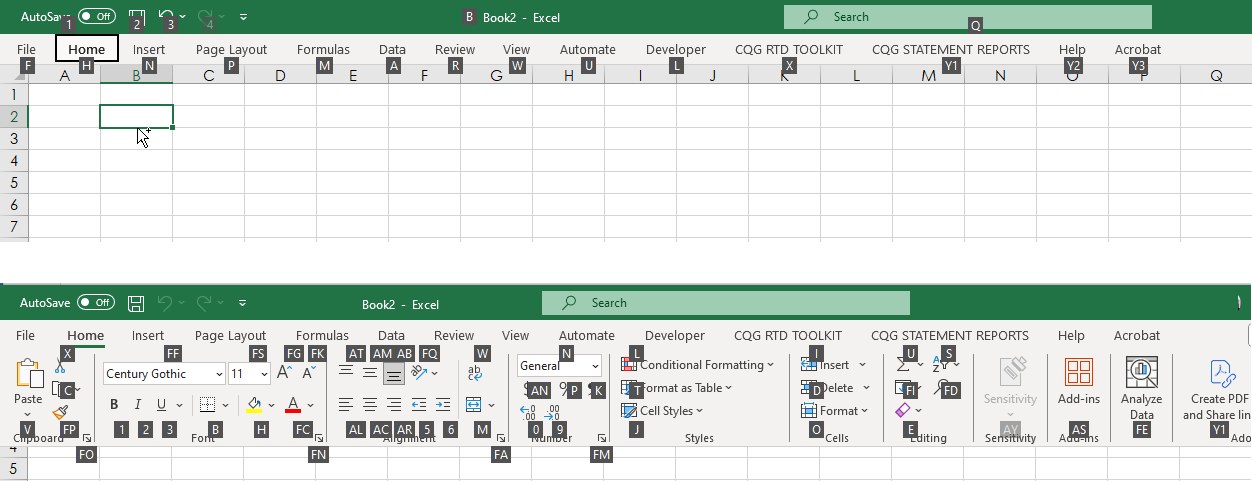

If you use Microsoft® Excel as part of your workflow with CQG IC or QTrader then you may or may not be using Excel keyboard shortcuts. This post details using keyboard shortcuts in Excel 365 to… more