Microsoft Excel 365 offers the TRIMRANGE function which excludes all empty rows and/or columns from the outer edges of a range or array. This post details how this function is useful for designing… more

Excel/RTD

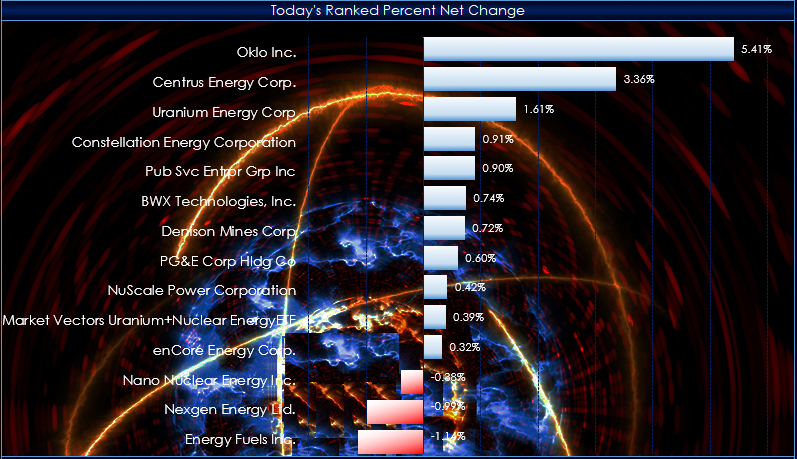

This post details an Excel dashboard for tracking the performance of the US stock holdings of the VanEck Uranium + Nuclear Energy ETF (symbol: NLR).

NLR invests in companies building nuclear… more

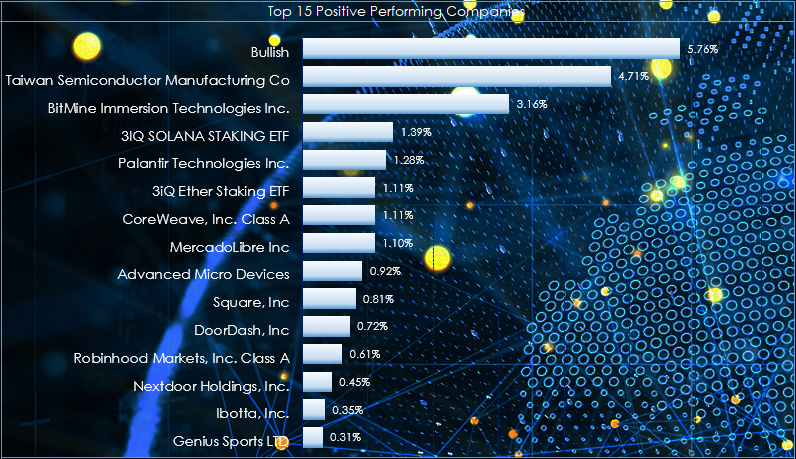

From the ARK website: "Companies within the ARKW are focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services,… more

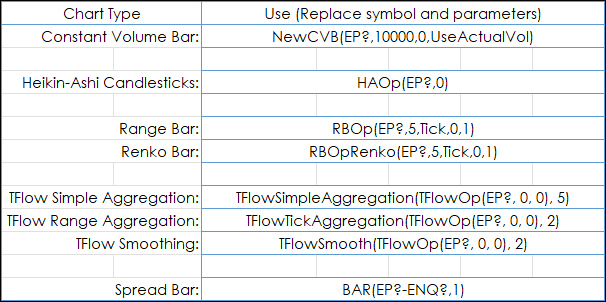

Excel RTD formulas are available for pulling in Trade System Statistics. Below is an image of a Constant Volume chart with the cqg.AMASamp Trade system applied to the chart.

The next… more

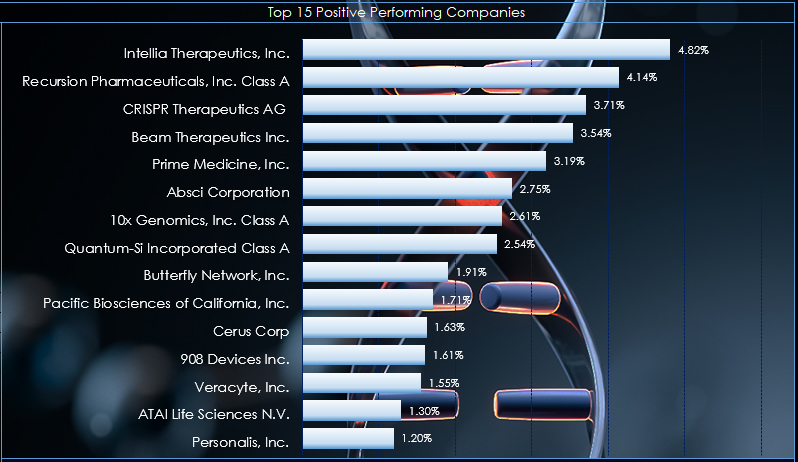

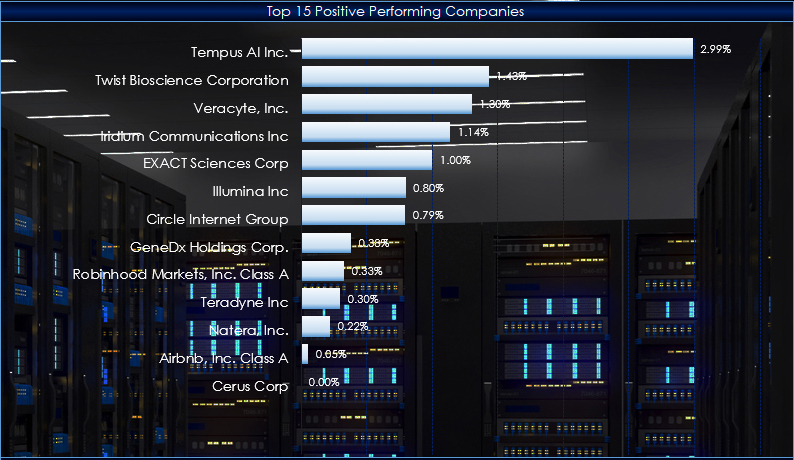

From the ARK website: "Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating… more

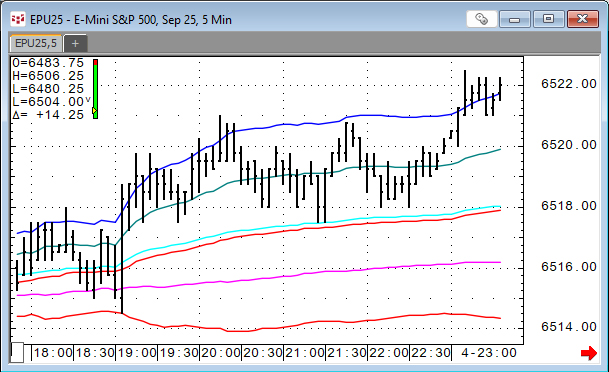

VWAP is the volume weighted average price for a futures contract plotted as a line on the price chart. The calculation is the sum of traded volume times the price divided by the sum of the traded… more

The Ark Innovation ETF (symbol: ARKK) goal is to deliver long-term capital appreciation with low correlation to traditional investment strategies. They invest in the leaders, enablers and… more

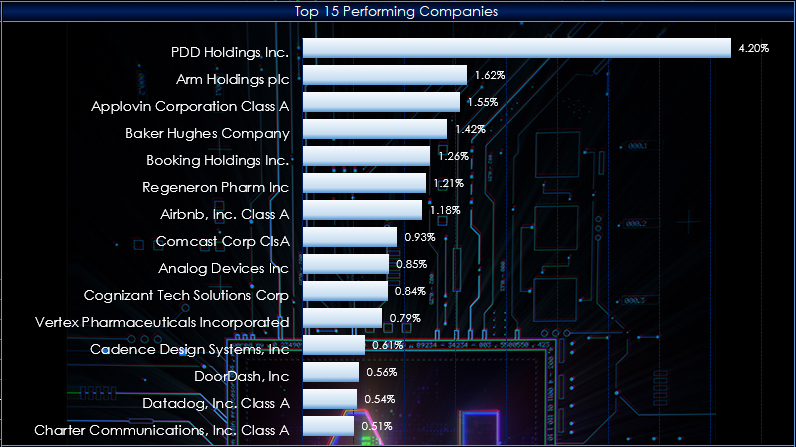

The Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index®. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market… more

A recent YouTube post from the All-In Podcast interviewed NVDIA's Jensen Huang, Advanced Micro Devices' Lisa Su, MP Materials' Jim Litinsky, and Crusoe's Chase Lochmiller.

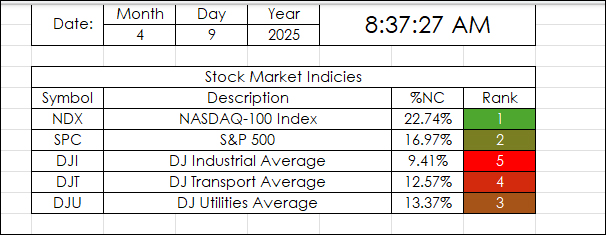

… moreThis Excel Dashboard uses RTD Calls to pull in the Net Percent Change of a collection of markets by a particular date.

For example, April 9, 2025:

"Markets News, April 9, 2025: Dow… more