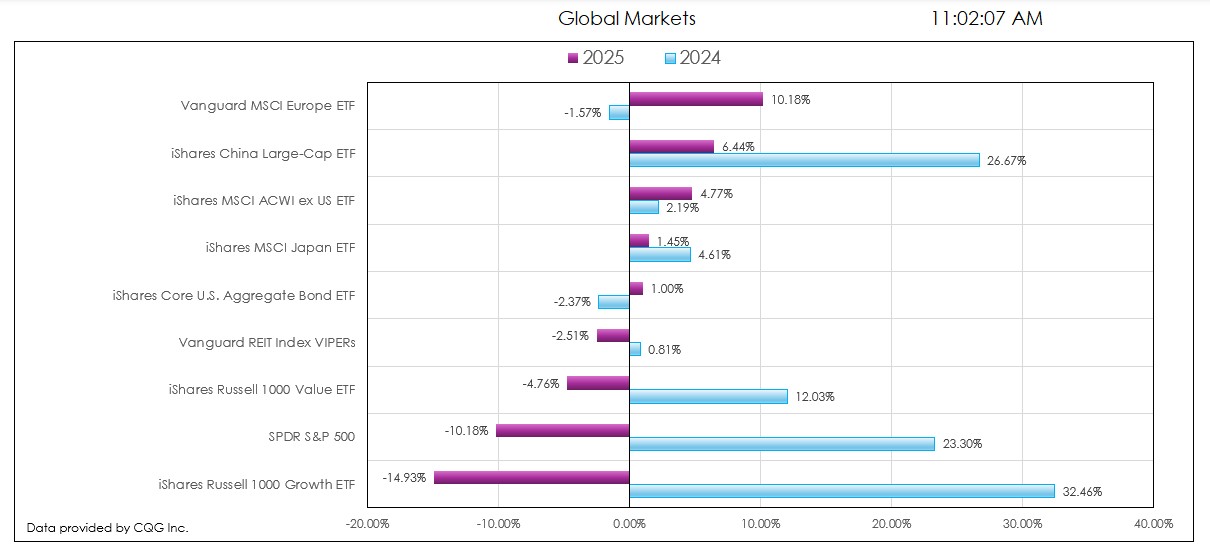

This post details the downloadable Excel Market Performance Dashboard's features and functions. The dashboard has seven tabs (the first is data and the other tabs display a chart and a table of… more

Excel/RTD

Various Exchanges offer market data detailing the current state of a market. This includes the CME Group, the Intercontinental Exchange (ICE), CBOE Futures Exchange (CFE), and others.

For… more

This post details the different techniques for pulling Depth-of-Market (DOM) data into Excel.

There are three ways:

C&P RTD formulas for Level 1 DOM data from the various quote… moreThis macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the iShares Core S&P U.S. Value ETF (symbol: IUSV). The iShares Core S&P U.S. Value ETF seeks to track the investment… more

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the iShares Core S&P U.S. Growth ETF (symbol: IUSG). The iShares Core S&P U.S. Growth ETF seeks to track the… more

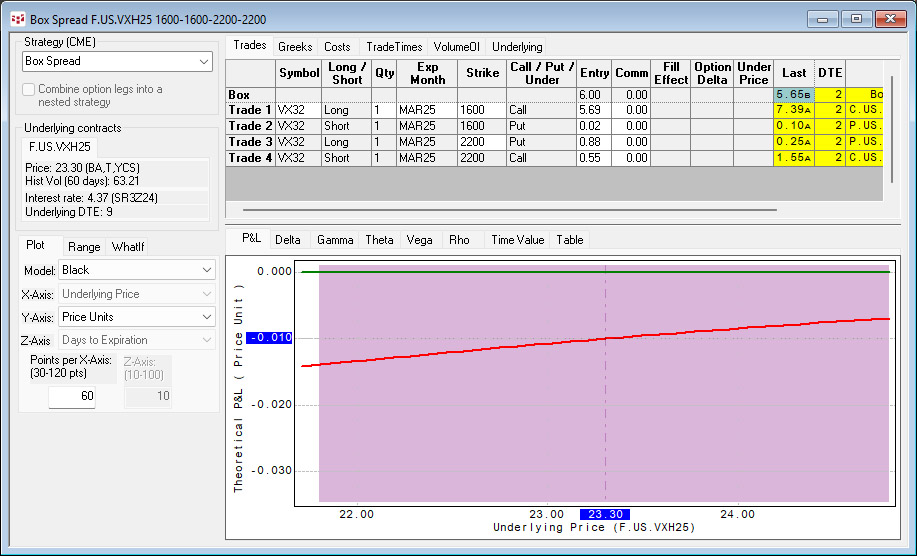

October 14, 2024, the Cboe launched weekly options on the Cboe VIX futures. To find the symbols in IC or QTrader, open the Symbol Search, select Cboe Futures Exchange (CFE), sort the Asset column… more

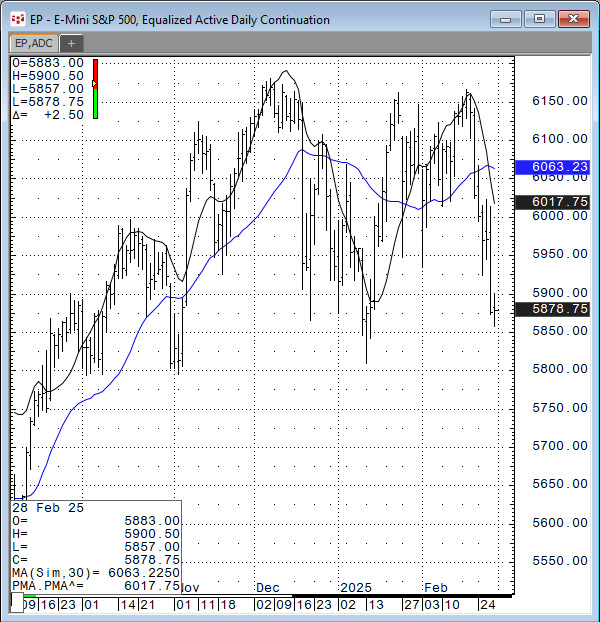

In the March 2025 issue of Technical Analysis of STOCKS & COMMODITIES magazine John Ehlers, President of MESA Software, presented "A New Solution, Removing Moving Average Lag."

The… more

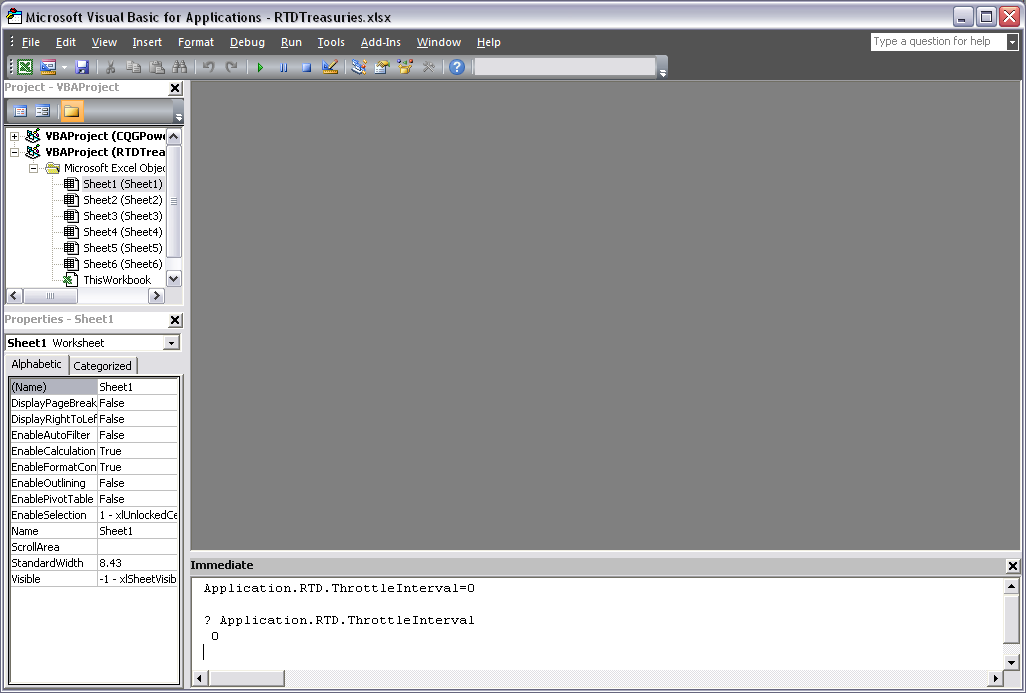

CQG Integrated Client and CQG QTrader support RealTimeData for sending data and other market information to Microsoft Excel®. This feature opens up many opportunities for creating custom displays… more

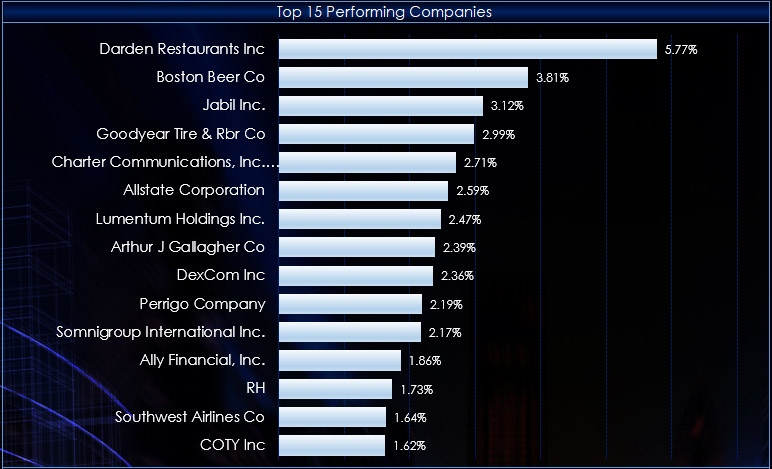

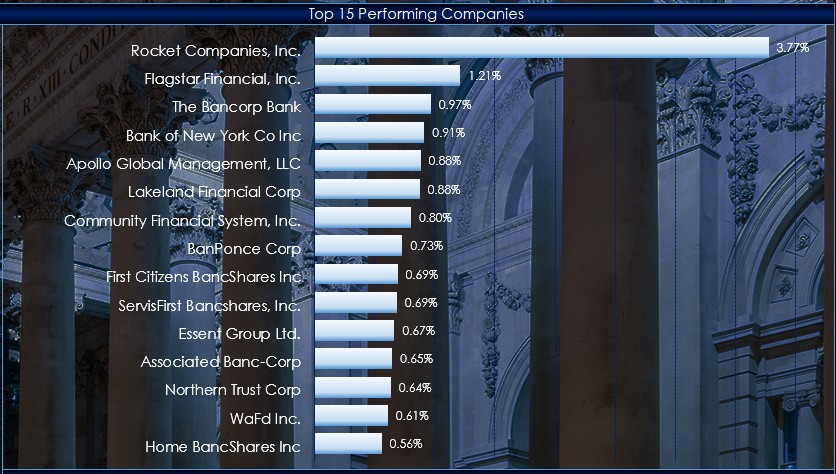

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the SPDR® S&P® Bank ETF (symbol: KBE).

Throughout the trading session, the individual stocks are dynamically ranked… more

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the Financial Select Sector SPDR® ETF (symbol: XLF).

Throughout the trading session, the individual stocks are… more