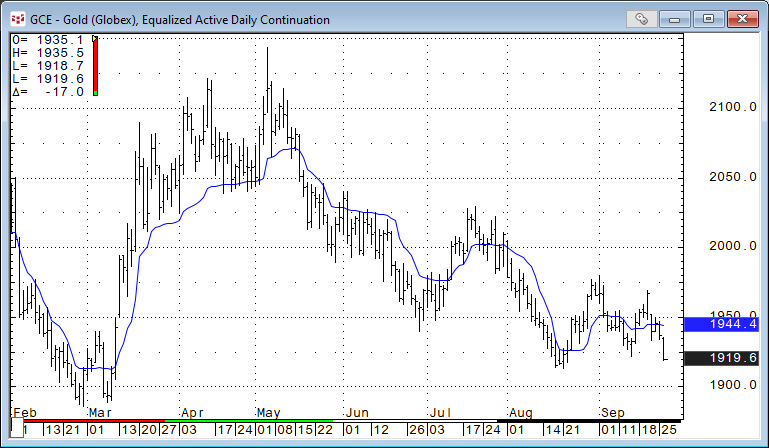

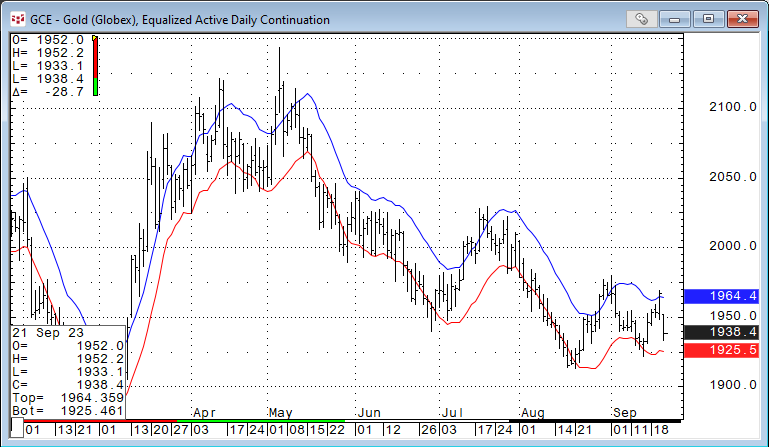

The Adaptive Moving Average (AMA) was developed by American quantitative financial analyst and author Perry J. Kaufman. The AMA study is like the exponential moving average (EMA), except the AMA… more

Workspaces

Certified stocks are bags of coffee that have been graded by the ICE exchange by ICE approved graders and are warehoused in exchange approved warehouses around the world. ICE reports the current… more

Technical analysts and technical based traders apply various studies to price data, such as a moving average, to smooth the price action. The goal is to filter the moment-to-moment price action,… more

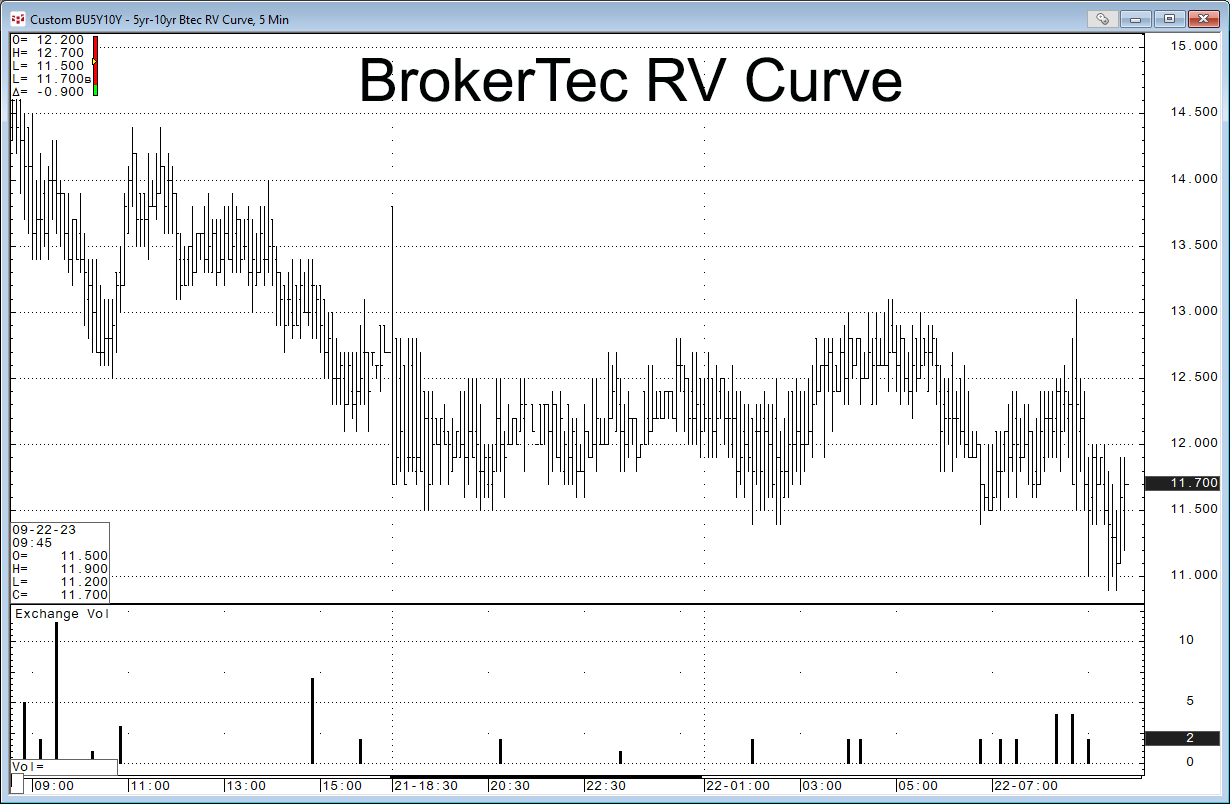

Customers of BrokerTec can now trade the Relative Value (RV) Treasury Spreads. BrokerTec is the price discovery leader for benchmark cash U.S. Treasuries.

RV Curve offers 21 spreads. This… more

Microsoft® Office 365 includes the latest version of Excel which comes with some new functions not available in Excel 2016 or Excel 2019. This post details the XLOOKUP function and its features.… more

This post details how to use Excel’s Index and Matching function to extract data from a table. The example (downloadable sample at the bottom of the post) uses the 30 stocks in the DJIA as a… more

This post details two pages with a general overview of the agriculture markets. These pages are to help you navigate all the possible underlying contracts and data points you may or may not know… more

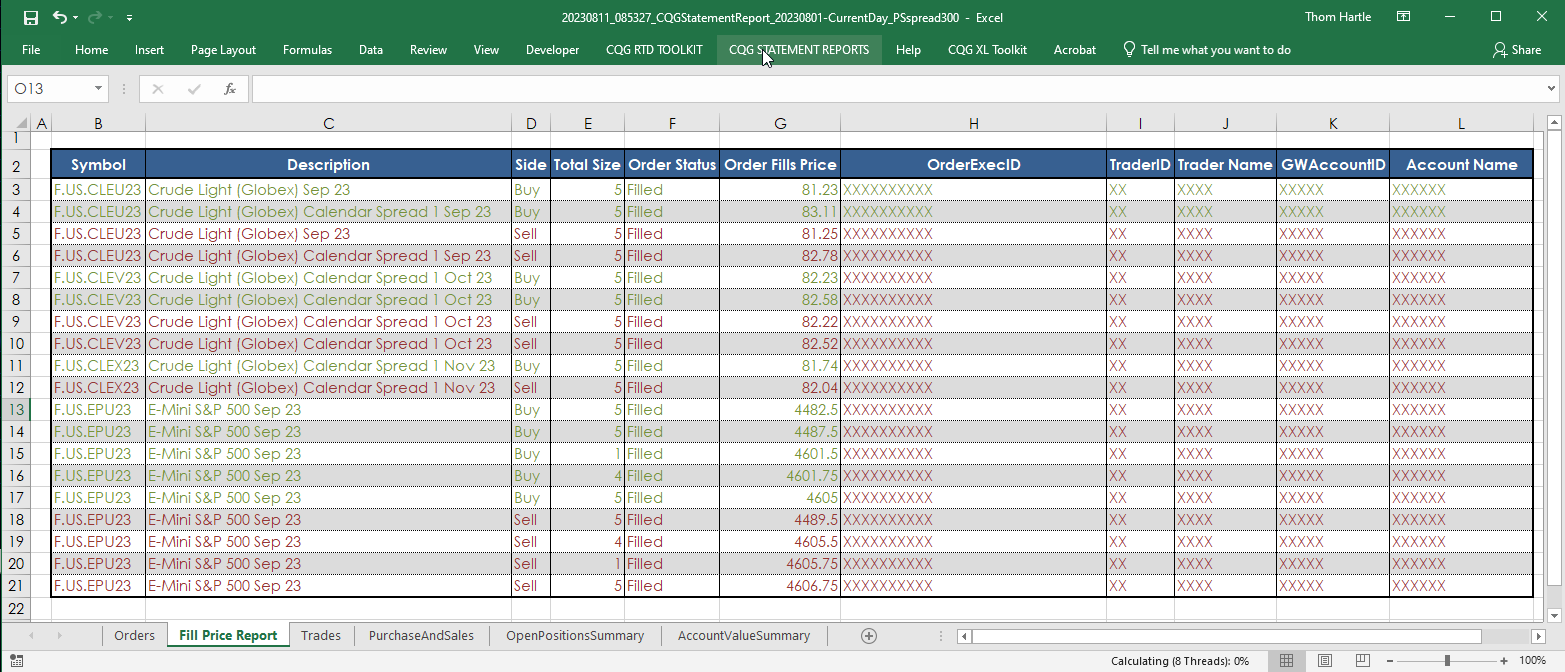

The CQG Statement Reports Add-In is installed with CQG IC and QTrader. This add-in works with CQG’s Statement Report generated from the Orders & Positions window.

Once you… more

Bollinger Bands are included in a group of studies that display price bands surrounding the trading activity.

Here is a list of the group of studies available in CQG:

Bollinger… moreIf you are an analyst, blogger, or simply want to post a screen capture of an IC or QTrader chart on social media then the steps to copying a screen capture to your clipboard are very easy.

… more