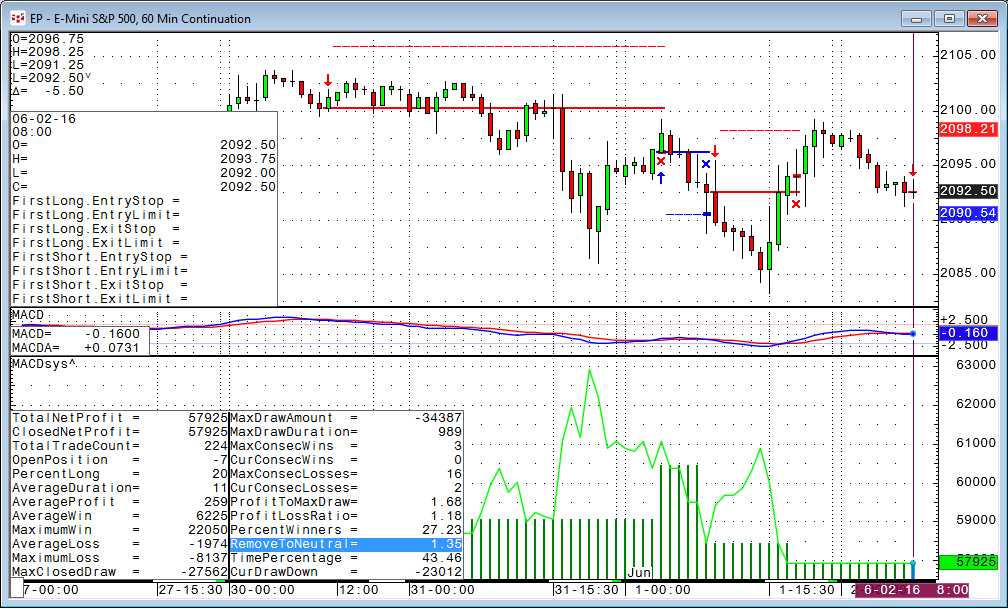

In my last blog post we turned the Super Template AMA trading system into a new trading system using MACD with a few steps. At first glance it seemed to be a losing system, but after we applied a simple $2,000 stop loss, it performed a little bit better.

The interesting question now is: How do we find out what money management is working best for the selected contract and can it be optimized?

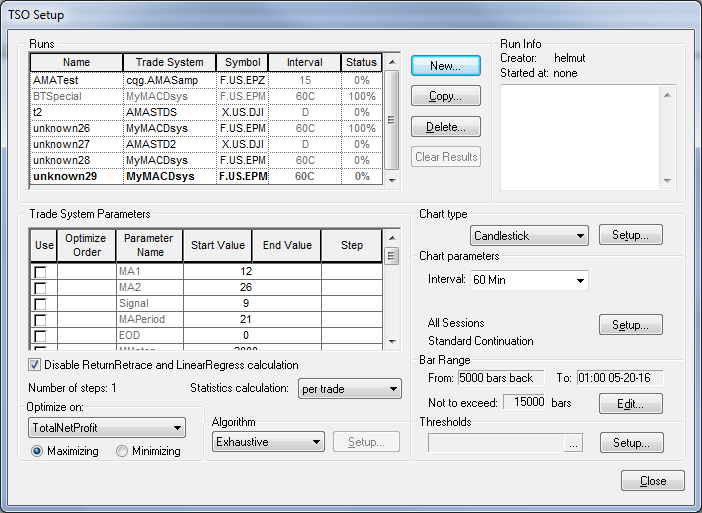

CQG’s backtesting module has a built-in optimization tool, the Trade System Optimizer (TSO). The TSO can optimize all kinds of parameters, including money management. Simply right-click the P&L curve, select Optimize, and then select Specify on the right.

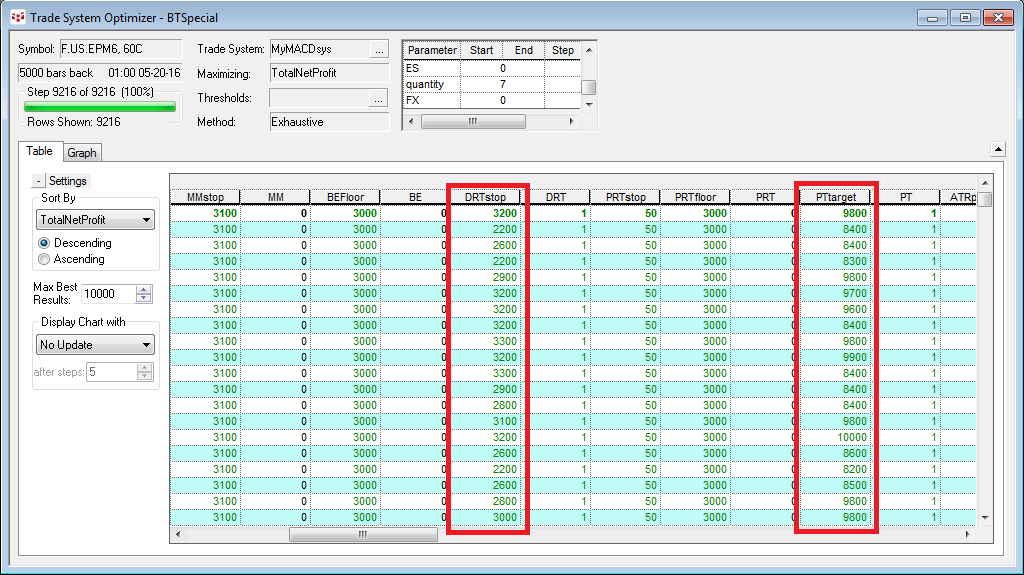

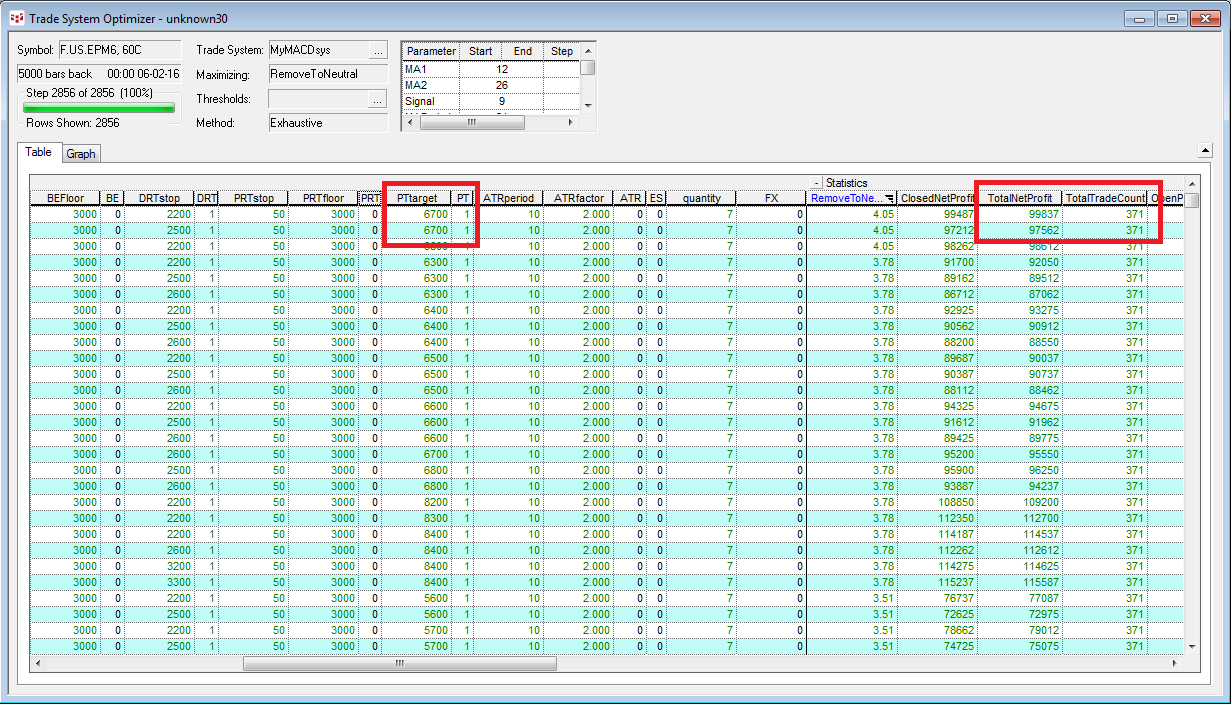

The contract and what trading system and time frame are in use automatically fill in. Now we need to specify the start and end values of the parameters we want to test, and also select the optimization criteria. In this case we only want to use a DRT stop between $500 and 10.000%, as well as a profit target between $500 and 10.000%. The optimization is based on total net profit.

After the calculation is complete, the best result suggests a DRT Stop of $3,200 and a profit target of $9,800. Simply right-click the best result and select Launch Chart with Parameters.

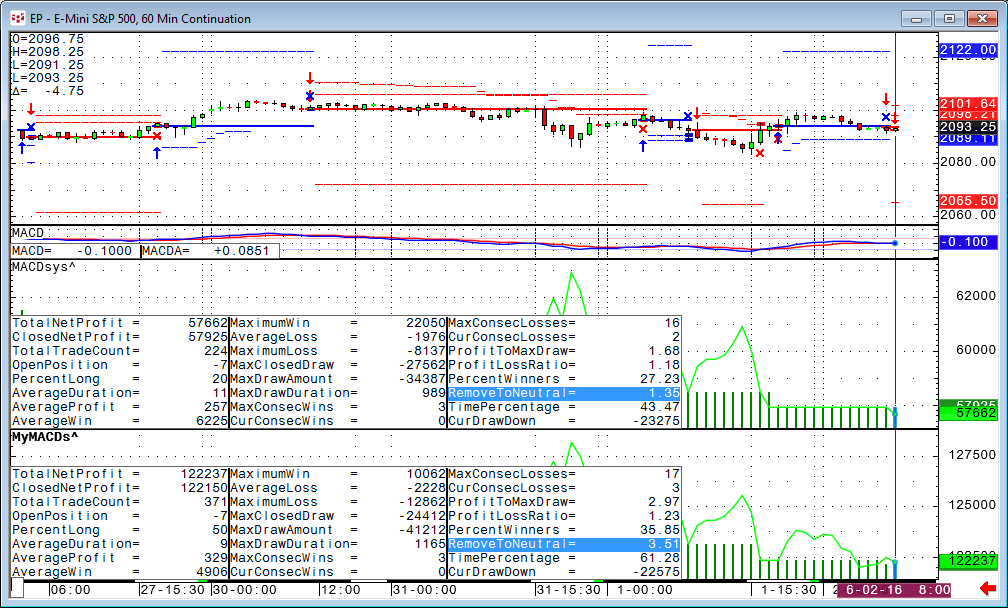

If we compare the two systems on the chart we see immediately that the process worked.

We are turning the theoretical profit of $57,662 into $122,237!

The Remove to Neutral (RTN) figure more than doubled, from 1.35% to 3.51%, although this is still nowhere near a great number.

Let’s decipher the RTN figure:

RTN is the percentage number of our best trades we need to remove until the trading system goes to zero profit. In other words, we delete the best trades summing up to our total net profit. On the initial system this is 1.35% of 224 trades, or three trades. The optimized system is 3.51% of 371 trades, or thirteen trades.

In a nutshell, thirteen trades out of 371 are responsible for the whole profit in our trading system.

Now you might think this is easy, we can just optimize everything for the best RTN factor and we are all set. Yes this is possible generally speaking, but it is strongly recommended to understand the money management rules applied.

After optimizing for RTN the result is still somewhat close to the initial optimization. We ended up with a best result winning $99,487, with 371 trades, and 4.05% RTN. It looks better and you might want to swap 0.5% more “stability” against $20,000 less profit? No - what happened is that the profit target is now slightly lower, and you need exactly two more trades to accomplish a smaller maximum profit.

So money management optimization might not turn an average trading system into a fantastic one, but you can carefully test the mechanics of the rules applied. A small stop loss might help cut losses, but it might also cut winning trades. A higher profit target might not automatically lead to bigger results.

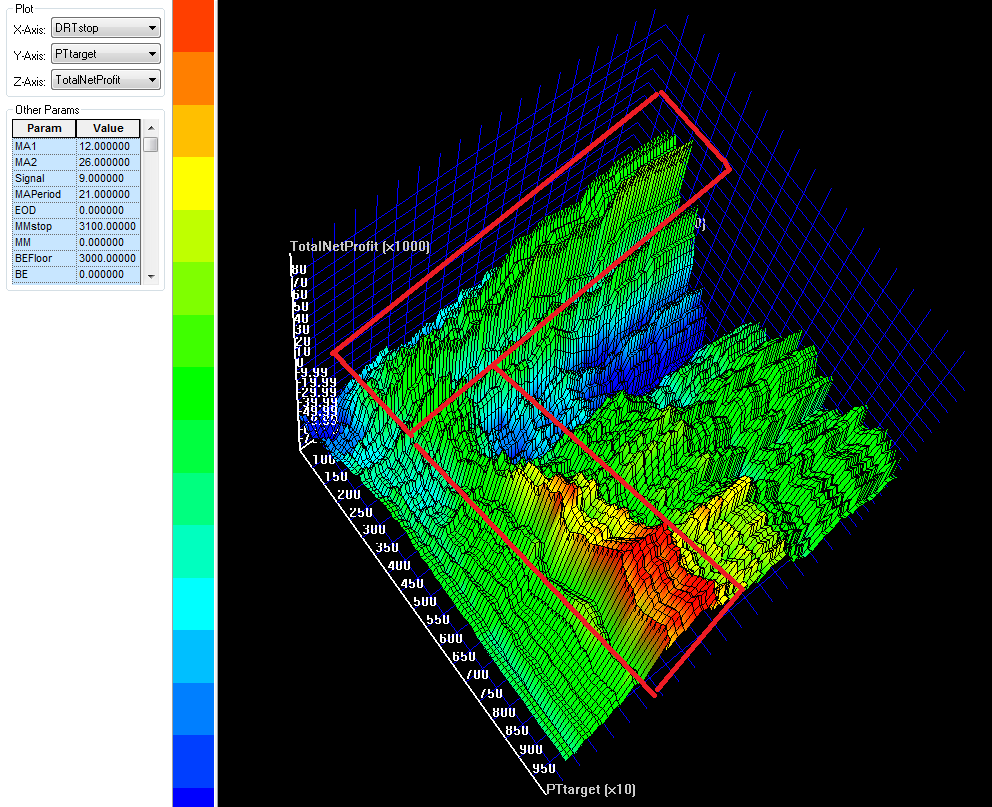

Also have a look at CQG's 3D graphs of your Optimizer results. In our sample case it clearly shows the relations between the different parameters and demonstrates that it is not random.