The Guppy is an indicator used in technical analysis to identify changing trends. The technique is based on combining two groups of moving averages with differing time periods.

One set of moving averages in the Guppy multiple moving average has a relatively short time frame and is used to determine the activity of short-term traders. The number of periods used in the set of short-term averages is usually 3, 5, 8, 10, 12, or 15. The other group of averages is created with longer time periods and is used to gauge the activity of long-term investors. The long-term averages usually use periods of 30, 35, 40, 45, 50, or 60 days.

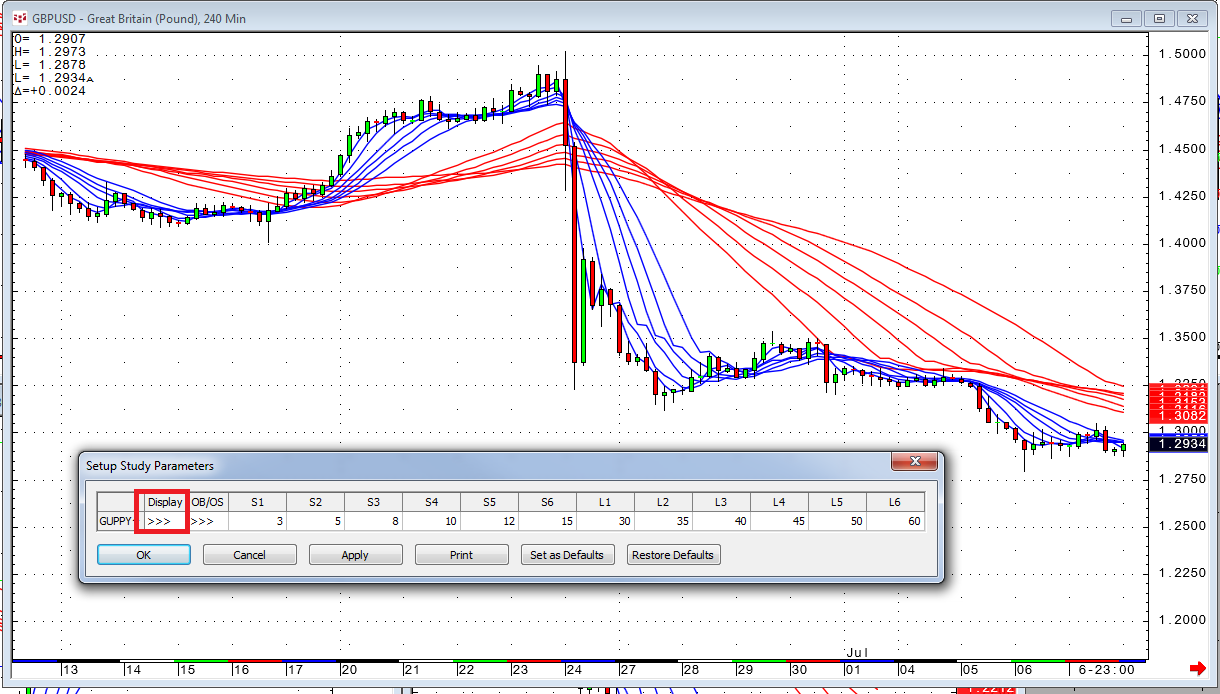

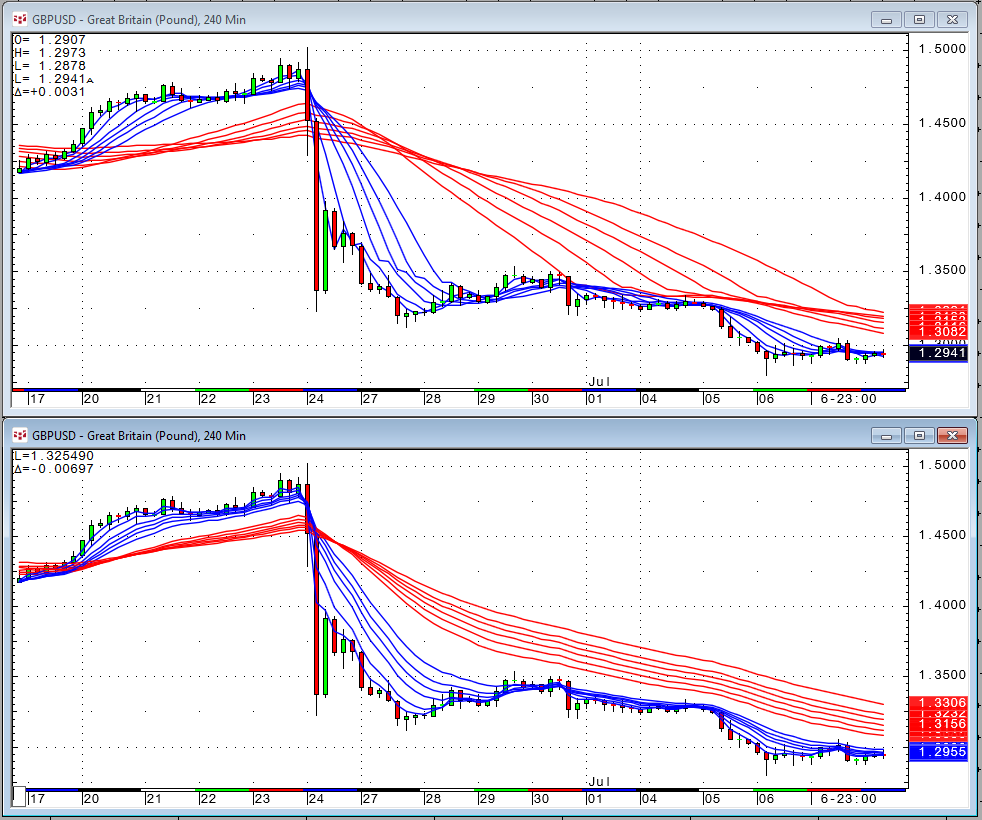

Here is an example in GBPUSD around June 24, 2016 (Brexit):

The Guppy is not included in CQG, but it is very easy to build:

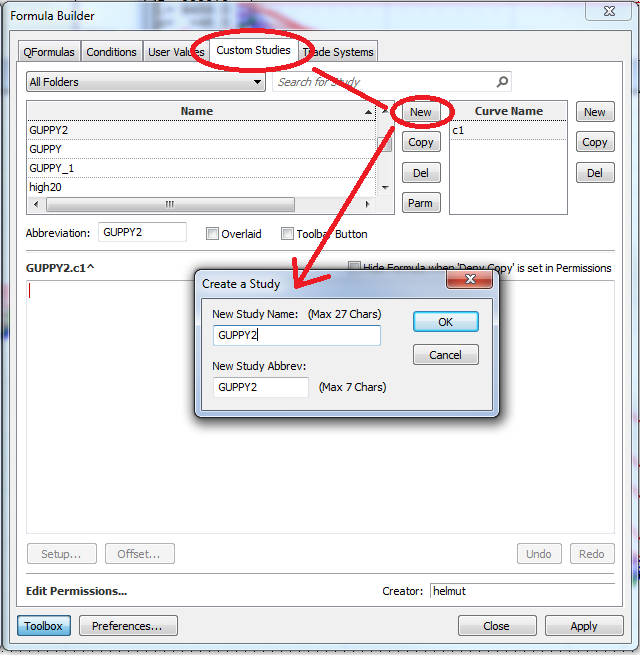

Create a new custom study called GUPPY.

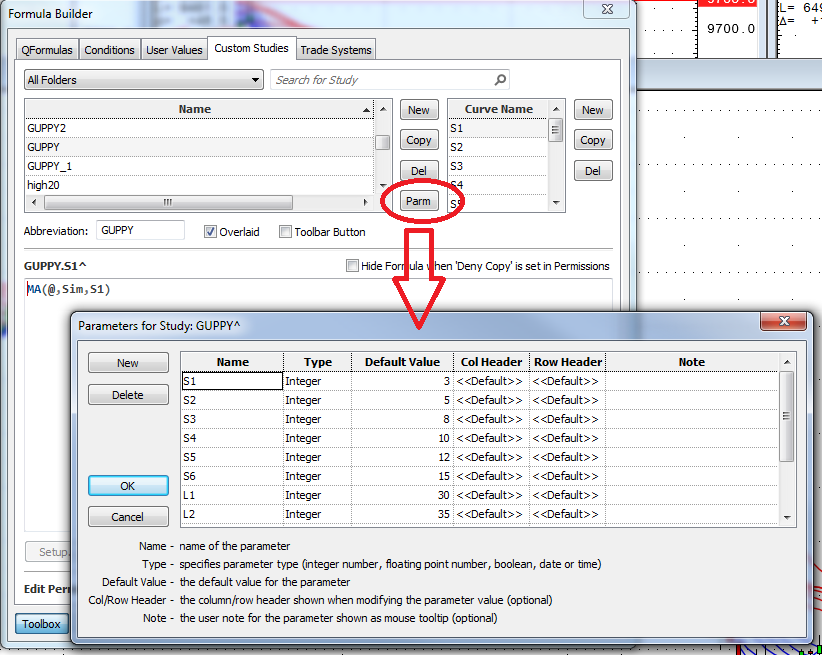

Next, create the parms for the different moving average lengths.

I created six parms (S1 – S6) for the short moving averages: 3, 5, 8, 10, 12, and 15. I also created six parms (L1 – L6) for the long moving averages: 30, 35, 40, 45, 50, and 60.

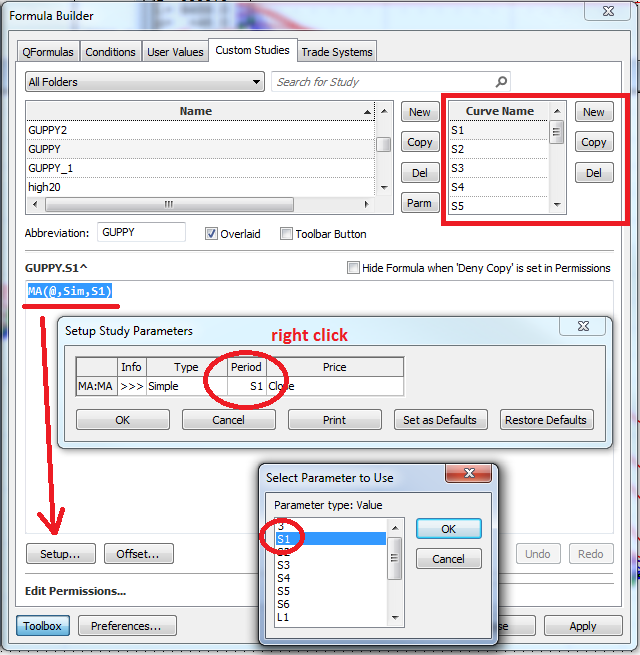

As the next step, I created the first curve S1 (deleting the default c1) with a simple moving average and used the Copy button to copy the curve into S2 – S6 and L1 – L6.

After this, I went from curve to curve and substituted the period for the moving average with the corresponding parm.

By default all curves are red, but after applying the changes above to the chart, I made the S1 – S6 lines blue while leaving the L1 – L6 red by clicking on the three arrows under Display.

The original numbers are the defaults for the moving averages, but of course they can be changed using the Setup Study Parameters dialog.

Another variation of the Guppy is using exponential moving averages instead of simple ones. This gives you more smoothing. I have included both variations in the PAC file below.

The image below shows the Simple MA Guppy on the top and Exponential MA Guppy on the bottom.