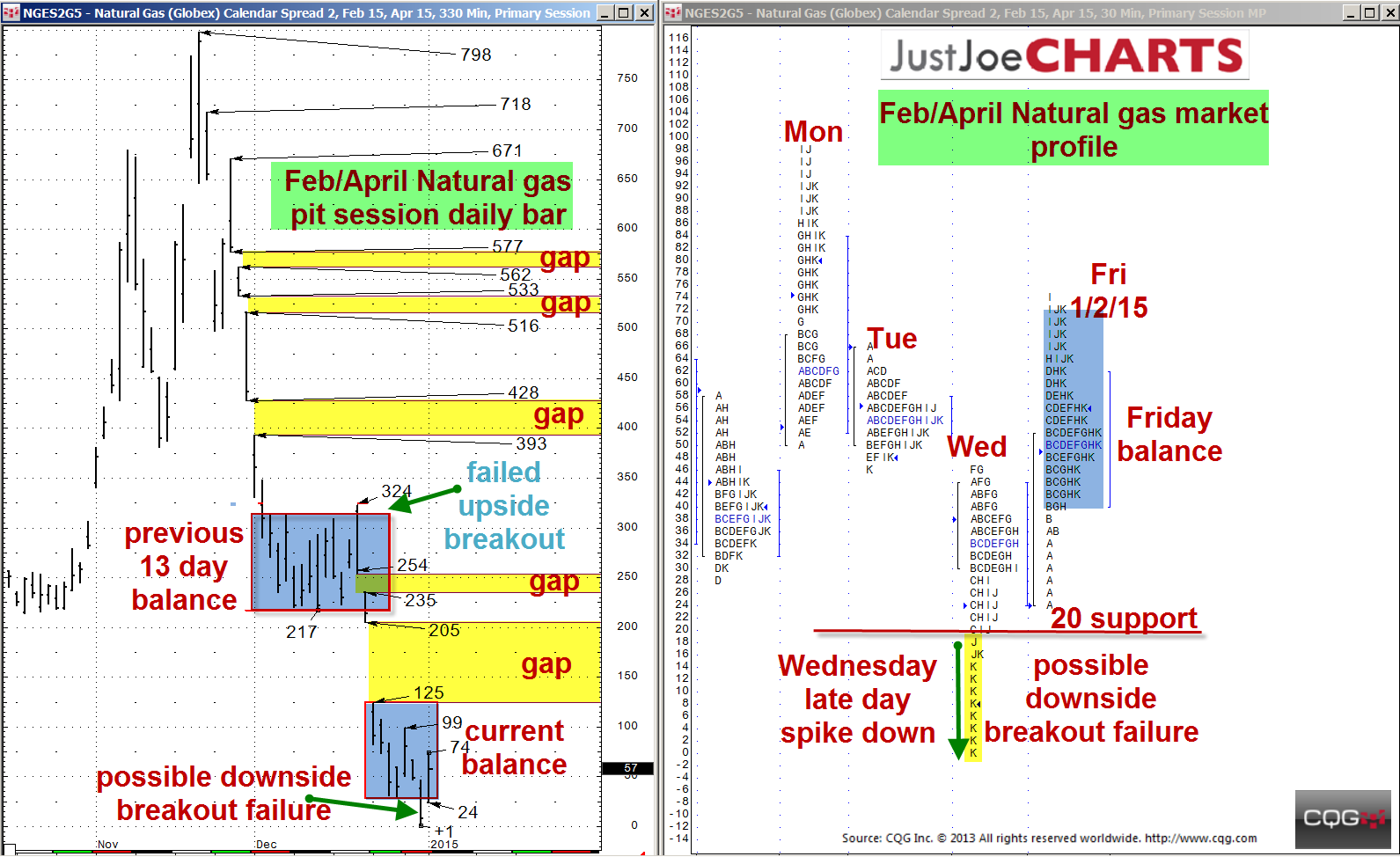

Over the last thirty trading days, the February/April natural gas spread has come off sharply about 800 points, leaving several gaps along the way. A few weeks ago, after the spread fell about 500 points in ten days, the market came into a relatively tight thirteen-day balance. On the twelfth day of that balancing period, the market took out the 313 high of that balance range, but was quickly rejected. That rejection led the market to gap open lower the next two days and decline another 200 points in a three-day span.

When a volatile market is contained within a tight balance range for several days, a significant move usually follows the breakout from balance. However, when a breakout attempt from a tight balance is rejected, a move to the opposite end of that balance range usually follows. Additionally, many times the breakout from the balance range occurs at the opposite end of the rejection.

Over the past several days, the spread came into a 29-to-125 balance range. Late in the day on Wednesday, December 31, 2014, the market came off from 20 down to +1, leaving a late day spike down. That late day spike down took out the 29-balance low. However, when the market reopened on Friday, January 2, 2015, the late day spike was rejected. Additionally, the market reentered the balance range and remained within it for the remainder of the day, leaving the possibility of a downside breakout failure. The 20 top of Wednesday's late-day spike became an important support level.

If the market remains above the 20-support level, it would confirm the downside breakout failure and a rotation to the 125-current-balance-range high could follow. Additionally, if the market gains acceptance above the 125-balance high, it may attempt to fill the 125-to-205 gap. If the market fails to remain above the 20-support level, the downside trend is not over yet.