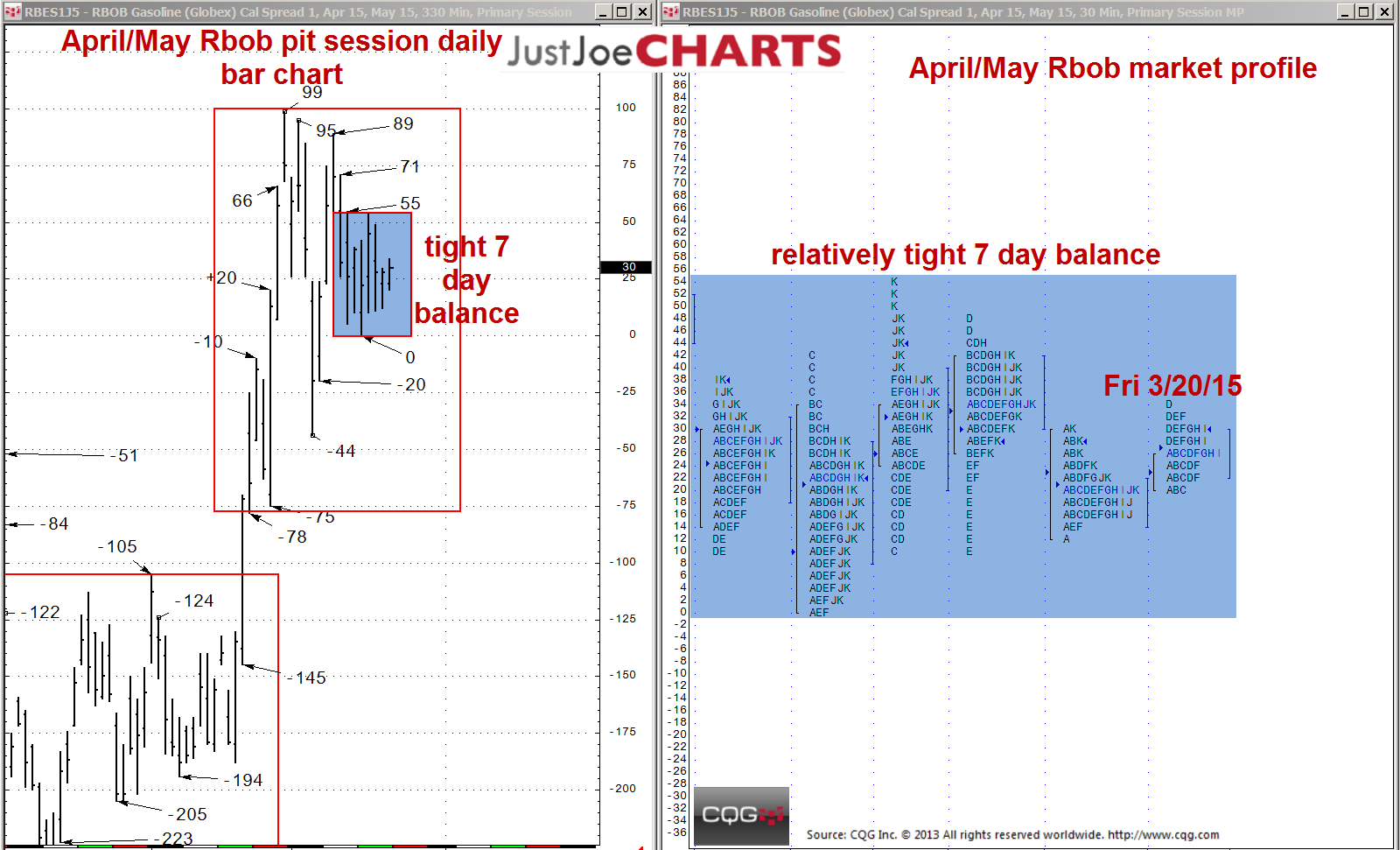

During the last few weeks, the April/May RBOB calendar spread has formed a rotational range of -78 to +99. However, over the past seven trading days, the trading range has shrunk to 0 to +55. A 55-tick range for the spot RBOB spread is very unusual, as the spread could easily cover double that range in a single day. When a volatile market like the RBOB spread is contained within such a relatively tight range for several days, a significant move usually follows.

Upside Breakout

If the market gains acceptance above the +55 balance high, the first target becomes the 99 high of the last several weeks. With acceptance above the 99 reference, the next target becomes the 154 weekly/monthly chart reference.

Downside Breakout

If the market gains acceptance below the 0 seven-day balance low, the market may test the -78 low of the last several weeks.