July 2020 was a month where the prices of gold and silver posted significant gains. In what has been almost a perfect bullish storm for the two precious metals, a decline in the value of the US dollar against other world currencies and the unprecedented level of central bank and government stimulus pushed the prices significantly higher.

In mid-March, during the height of the risk-off period in markets across all asset classes, silver traded below $12 per ounce, and gold retreated to the $1450 level. Four months later, the prices were substantially higher. As we head into August, the bull markets in gold and silver are firmly in place. The risk of corrections will rise with the prices, but it is always challenging to pinpoint a top when the trend in a market is higher.

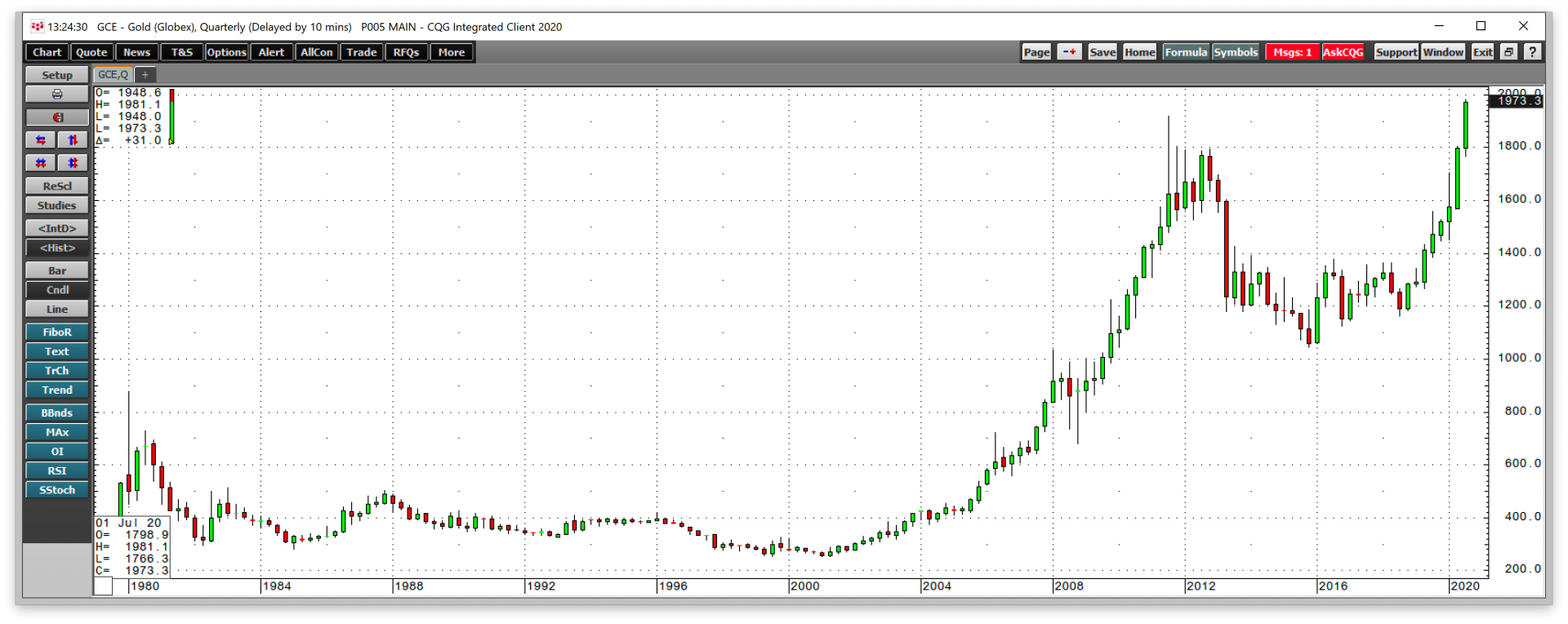

A new all-time high for gold

At the end of July, gold finally took out the all-time high from 2011 at $1920.70 per ounce.

The quarterly chart shows that the yellow metal rose to a high of $1981.10 per ounce. The active month December contract on COMEX reached $2005.40 per ounce. Gold had declined to a low of $1450.90 in mid-March, but the precious metal rallied over 36.5% in four months. December gold futures closed July at $1985.90 per ounce. As August futures rolled to the next active month, the level of deliveries exploded in a sign of continued demand for gold.

Silver more than doubles from the March low

The move in silver has been even more impressive. After risk-off conditions in March took silver to a low of $11.74 per ounce, the price more than doubled.

The weekly chart highlights the move to a high of $26.02 with the active month September contract rising to $26.275 per ounce. Silver took out its critical technical resistance level at the July 2016 high of $21.095 in late July. The price moved to its highest level since 2013 and settled at $24.216 on the September futures contract on July 31.

The dollar is helping the precious metals

A decline in the dollar fostered gains in the gold and silver futures markets. The dollar is the world’s reserve currency and the benchmark pricing mechanism for most commodity prices. Gold and silver tend to be particularly sensitive to moves in the dollar.

Gold moved to a record high in most other currencies in 2019 and 2020. Last year, the euro, pound, Japanese yen, Australian and Canadian dollars, and a host of other foreign exchange instruments fell to new lows against gold. In 2020, the Swiss franc declined to a new low against the yellow metal that central banks hold as a reserve asset. The central banks classify gold as a foreign exchange holding, validating its role in the official sector as a means of exchange.

The dollar index fell below technical support levels in July.

As the chart of the dollar index illustrates, the index declined below the March 2020 low at 94.61 and the September 2018 bottom at 93.395 in July, reaching a low of 92.510 on July 31. The next target on the downside is the February 2018 low of 88.15, which was the lowest level since late 2014. A falling dollar is bullish for gold and silver prices.

The stimulus is bullish rocket fuel

US short-term interest rates are at zero percent. In Europe, they are sitting at negative fifty basis points. The FED, ECB, and other world central banks have addressed the global pandemic with a tidal wave of stimulus, liquidity, and quantitative easing to keep rates low further out along the yield curve. Asset purchases are at unprecedented levels. Meanwhile, government programs amount to bailouts for corporations, small businesses, and individuals. From July through September 2008, following the global financial crisis, the US Treasury borrowed a record $530 billion to fund the stimulus. In May 2020, the Treasury borrowed $3 trillion.

As the Congress and Trump administration negotiate the next stimulus package, the Treasury will need to go back to the well to borrow trillions more. The stimulus weighs on the value, faith, and credit of the US and other countries, pushing currency values lower. At the same time, it has caused deficit levels to swell to record levels.

The impact of the stimulus is highly inflationary, an economic condition that creates an almost perfect bullish storm for commodity prices. The price action in gold and silver is telling us that inflationary pressures are on the horizon.

Get ready for a wild and volatile ride

Before the global pandemic, analysts at Citigroup projected that gold would rise to $2000 per ounce. The price has already achieved that feat. Bank of America analysts predicted that the yellow metal would increase to $3000 per ounce.

The bull market in gold and silver took off to new levels in July. Bull markets can be highly volatile as the risk of price corrections rise with prices. Gold and silver are trending higher, and we could see lots of surprises on the upside over the coming months and years. However, periodic downdrafts are likely to make the ride more than a little bumpy. We already experienced risk-off periods where gold fell to the $1450 level, and silver declined to the lowest price in eleven years. Fasten your seatbelts for a volatile ride in gold and silver.

I am bullish on both metals as we move into August. I believe the prices are heading appreciably higher than the current levels. However, I would only add to existing positions on price weakness, leaving plenty of room to add if prices experience downside spikes.