In August 2020, the US Federal Reserve made a not-so-subtle change to its inflation policy. The world’s leading central bank shifted from a 2% target to an average of a 2% target for the economic condition.

Inflation is a general increase in prices and a decline in the purchasing value of money. The US central bank controls monetary policy. It sets the short-term Fed Funds rate, which remains at zero percent. The global pandemic caused the Fed to use quantitative easing to push rates lower further out along the yield curve to encourage borrowing and spending and inhibit saving to stimulate the economy. The tidal wave of liquidity and a tsunami of fiscal stimulus from the US government has increased deficits and the money supply. Meanwhile, the Fed continues to tell us that inflation remains below its 2% target rate. Markets are screaming just the opposite at the end of February 2021.

Even though most commodity prices fell, and bonds recovered on Friday, February 26, the trends remain intact, and trends are always your best friends in markets.

Oil hits $60 in February, and bonds fall

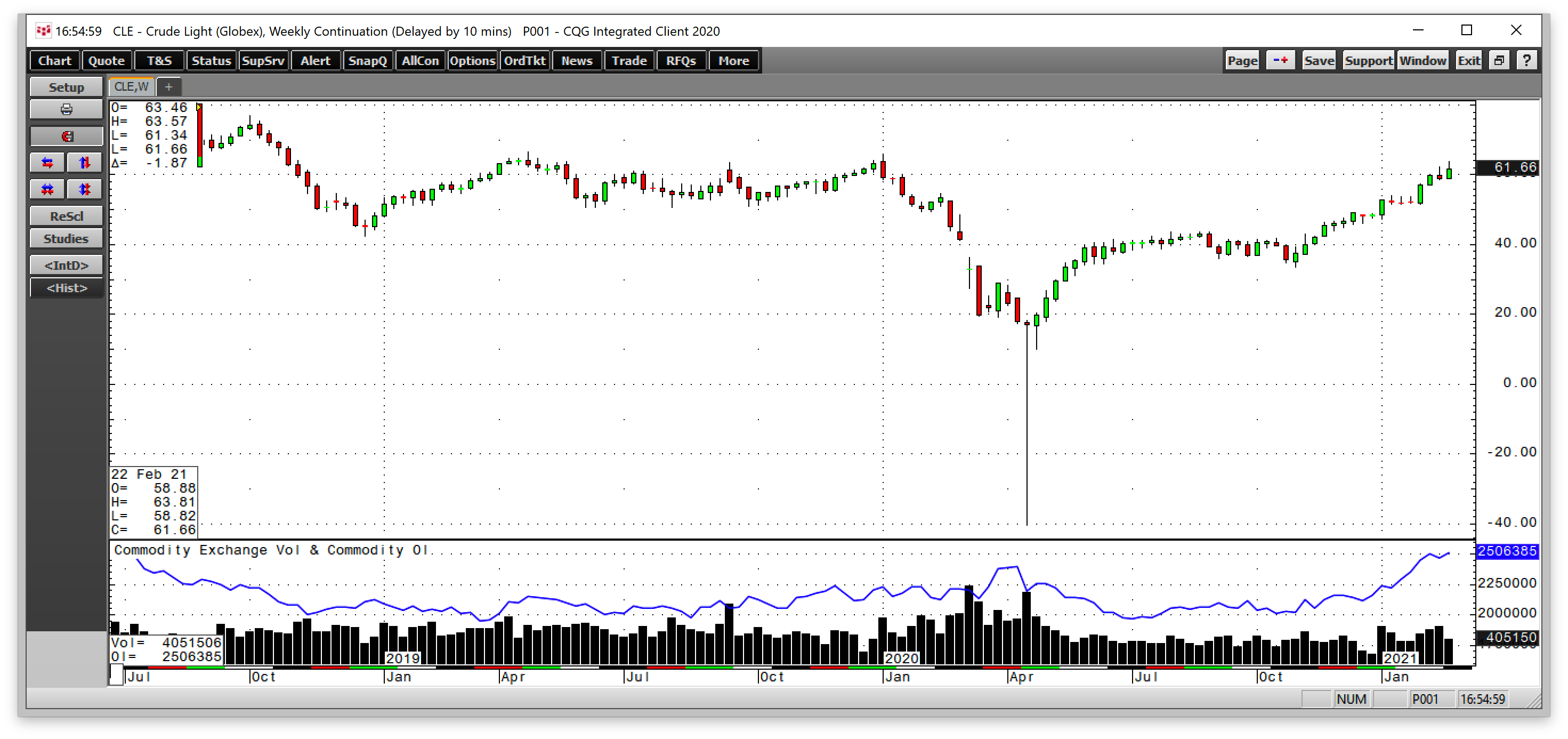

Crude oil has been making higher lows and higher highs since early November after recovering from the price carnage that took the energy commodity below zero for the first time on April 20, 2020.

The weekly chart highlights that NYMEX crude oil futures rose above $50 per barrel in early 2021 and moved over $60 in February. Open interest, the total number of open long and short positions in the NYMEX futures market, rose from the two million level to over 2.5 million contracts at the end of February. Rising price and increasing open interest tend to validate a bullish trend in a futures market. Crude oil is one of the leaders in the commodities asset class.

The weekly chart shows the descent of the US 30-Year Treasury bond futures contract since early August 2020. Even as the US Fed purchases $120 billion per month in debt securities with its quantitative easing program, rates have been heading higher. While the Fed believes inflation remains below its average 2% target level, the bond market tells us they could be wrong. The long bond futures fell to a low of 157-23 on the nearby futures contract in February, below technical support at 169-09. The bonds were trading at the lowest level in over a year at the end of February.

Crude oil rose as US energy policy undergoes a significant shift. On his first day in office, President Joe Biden canceled the Keystone KL pipeline project. A greener path to US energy production and consumption will lead to lower output. As US supplies seem set to decline over the coming years and herd immunity to COVID-19 boosts demand, the path of least resistance of oil appears higher.

Crude oil and the long bond are signaling rising inflationary pressures. They are not alone.

Platinum breaks to a multi-year high

Platinum is a thinly-trading precious metal that has lagged the other precious metals over the past years. Gold reached an all-time high in August at over $2000 per ounce. Silver recently hit $30, a level not seen since 2013. Palladium and rhodium, two of the other platinum group metals, have been soaring. In February, platinum finally broke above a critical technical resistance level from 2016.

The monthly chart shows that platinum rose to $1348.20 in February, surpassing the 2016 peak of $1199.50 per ounce. The precious metal rose to its higher price since September 2014.

New highs in lumber

The lumber futures market suffers from limited liquidity. Meanwhile, the price of wood rose to a new all-time in February 2020.

The quarterly chart shows that lumber futures hit an all-time peak of $1030.40 per 1,000 board feet in February. Increased demand for new homes, low mortgage rates, and the potential for US infrastructure rebuilding have lifted the wood price. Lumber is a critical construction ingredient and a bellwether industrial commodity.

Copper, base metals, and agricultural commodities are exploding

In March 2020, when the global pandemic caused risk-off price action in most markets, copper fell to its lowest price since June 2016, when nearby COMEX futures dropped to $2.0595 per pound.

The chart shows that the bull market in copper took the price to a high of $4.3630 per pound in the continuous futures contract in February. Copper is a metal that is a building block for infrastructure. The red metal also has many industrial applications in technology, car and EV manufacturing, and other areas. Copper is also the leader of the base metals that trade on the London Metals Exchange. Aluminum, nickel, lead, zinc, tin, and even steel prices have moved appreciably higher over the past months.

Metals, energy, and wood prices were not the only surging commodities in early 2021.

Soybean prices reached the highest level since June 2014.

Corn rose to the highest price since 2013.

Wheat peaked at $6.93 in January and was above the $6.50 per bushel level at the end of February, levels not seen since May 2014.

Meanwhile, sugar traded to a high of 18.94 cents per pound, a four-year high. Coffee futures hit a three-and one-half-year peak at the end of February. Cotton rallied to its highest price since June 2018. Bitcoin and digital currencies experienced parabolic moves in February.

The Fed says there is no inflation - commodities disagree

The old saying “never fight the Fed” has been great advice for many years. The power of monetary policy has prevailed over many attempts to take on the central bank. Meanwhile, the accommodative combination of Fed liquidity and government stimulus creates inflationary seeds that continue to bloom.

From 2008 through 2011, monetary and fiscal stimulus tools created a substantial rally in the commodities asset class. While the worldwide pandemic is a far different event than the 2008 global financial crisis, the stimulative toolbox is the same. The only difference is that the amounts in 2020/2021 are far greater than in 2008. The Fed may say there is no inflation, but the bond market and commodity price trends do not agree. Fasten your seatbelts for lots of market volatility in March and the coming months.