AT A GLANCE

- Where rates go once the Federal Reserve reaches a point of neutral policy will be a key point for the jobs-inflation trade-off

- The Taylor Rule today, and for some time in the past, has been suggesting the Fed needs to start removing accommodation

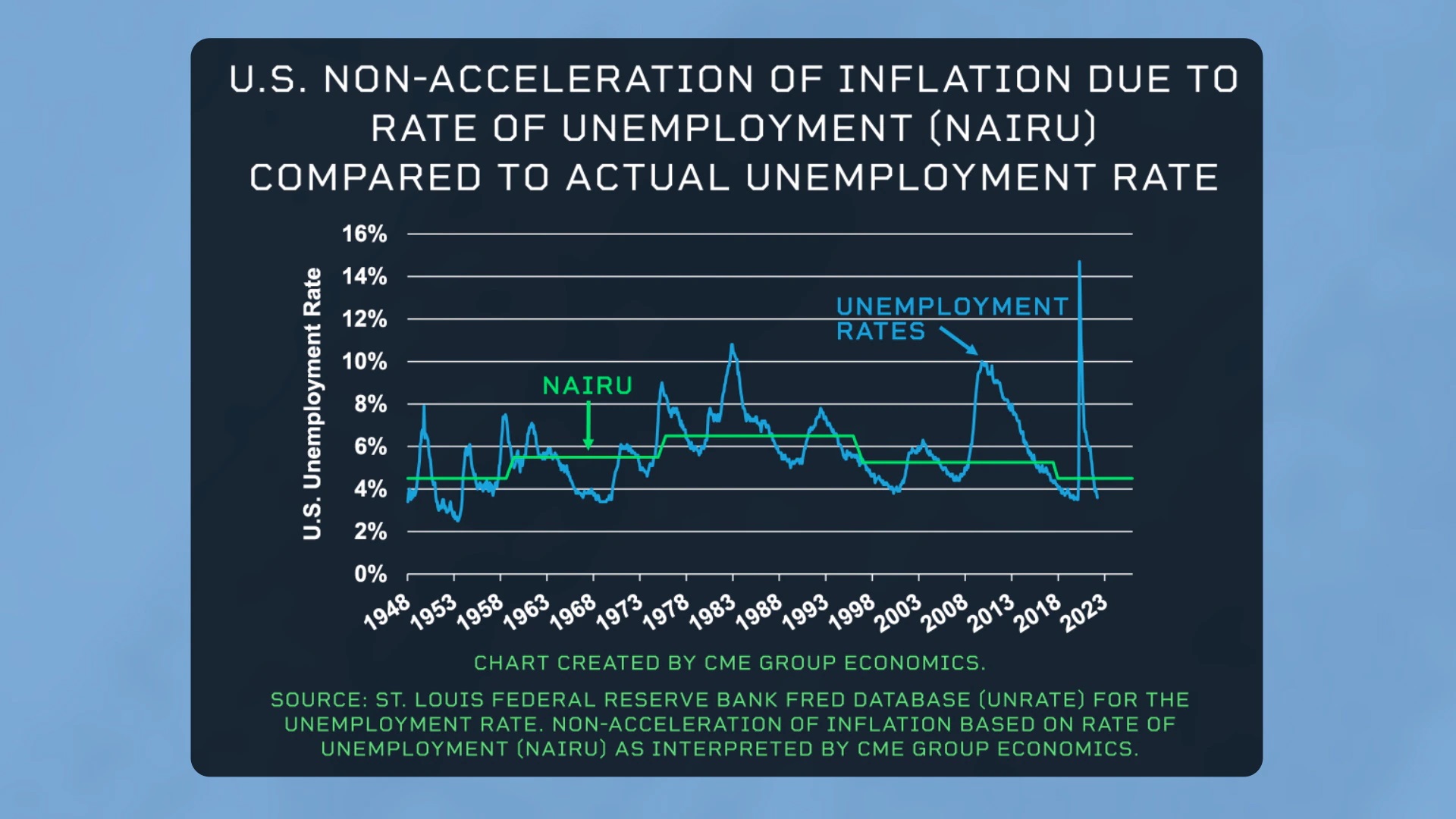

There is considerable talk about the trade-off between inflation and jobs as the Federal Reserve removes policy accommodation. For small changes in short-term interest rates, however, there may be hardly any trade-off at all.

When short-term interest rates are moved aggressively higher, above the prevailing rate of inflation and well-above long-term bond yields, then yes, the economy may enter a recession and unemployment is likely to rise before inflation recedes. This is what happened in 1980-82, 1989-91 and 2006-08 among other periods.

In 2022, in this first stage of raising rates and shrinking its balance sheet, the Fed is still running an accommodative policy. During this phase of accommodation removal, economic conditions are not “tight” just less “loose.” The economy may experience little to any inflation-jobs trade-off, as the economy continues to grow.

What will matter for the jobs-inflation trade-off is where rates go after the Fed reaches a point of neutral policy, and that point is quite far down the road and way too early to tell.

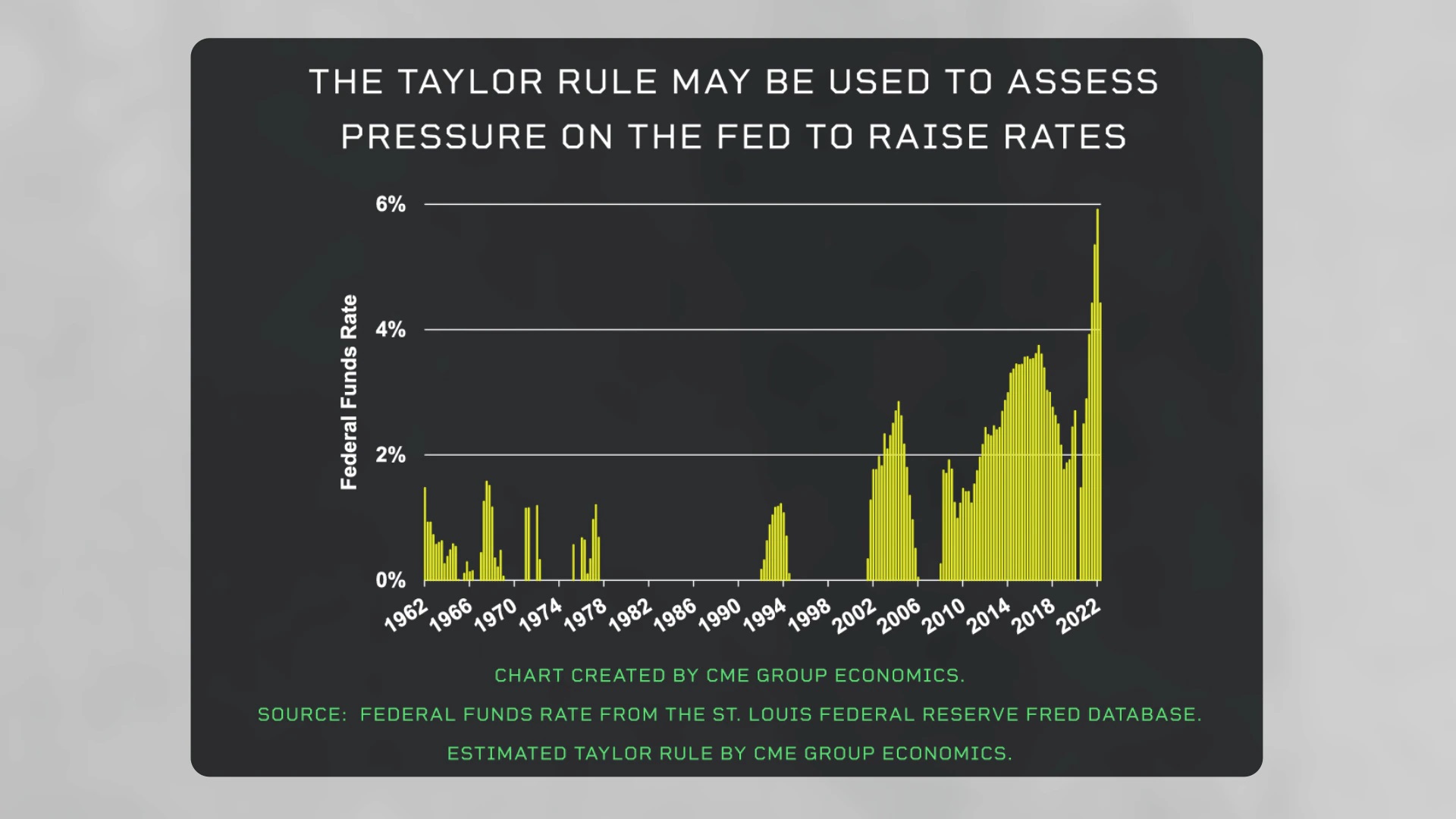

In policy circles this trade-off is embodied in what is known as the Taylor Rule, which argues that the Fed should raise rates in line with a simple formula for an assumed inflation-jobs trade-off. The Fed may once have followed the Taylor Rule, with the last being during the 2008 recession.

The Taylor Rule is now interpreted as only one element guiding the Fed as to the direction, but not necessarily the magnitude, of monetary policy. Of note, the Taylor Rule today, and for some time in the past, has been suggesting the Fed needs to start removing accommodation, which is what the Fed is now doing.

Watch the video discussion above, and watch more Economist Perspective videos here.