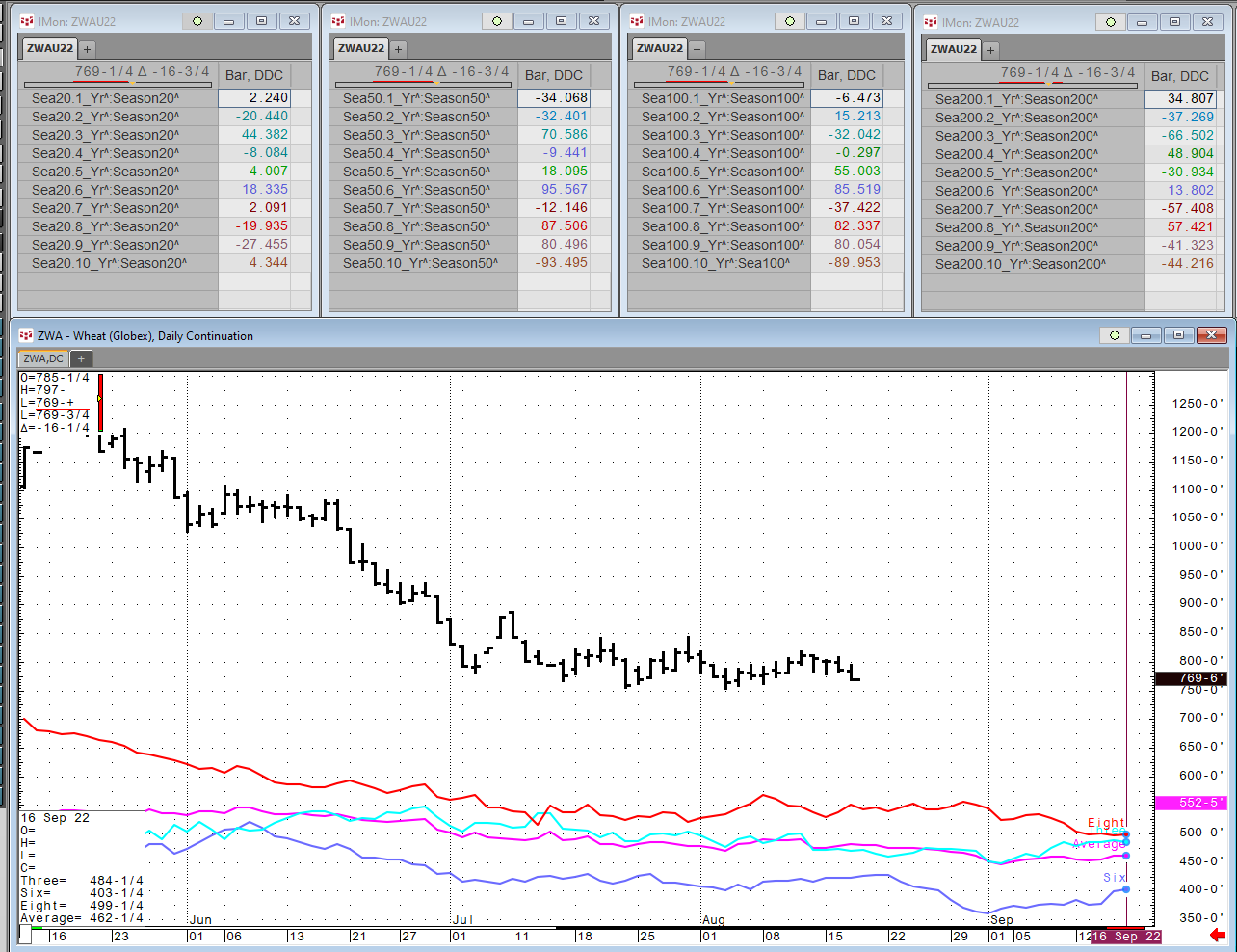

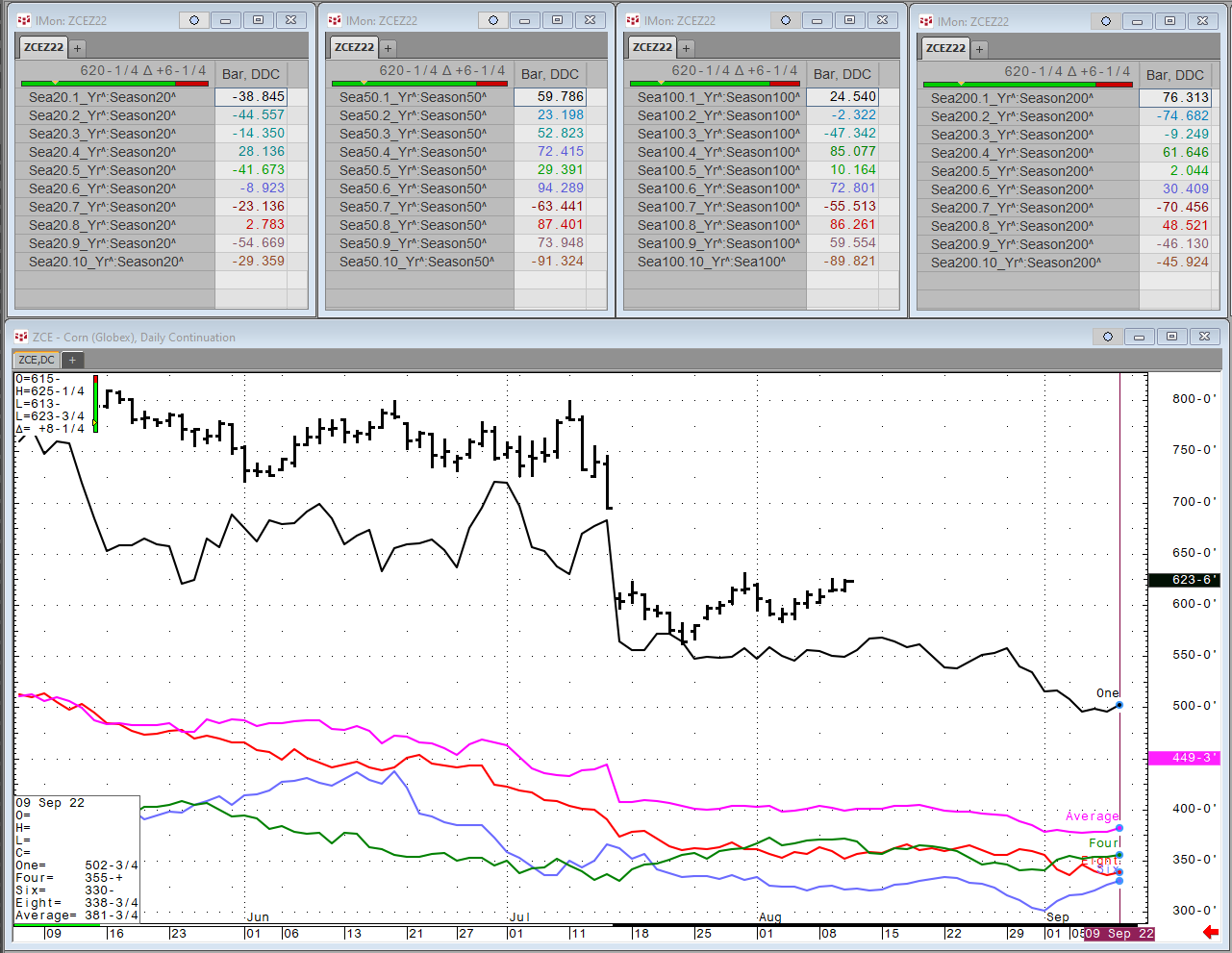

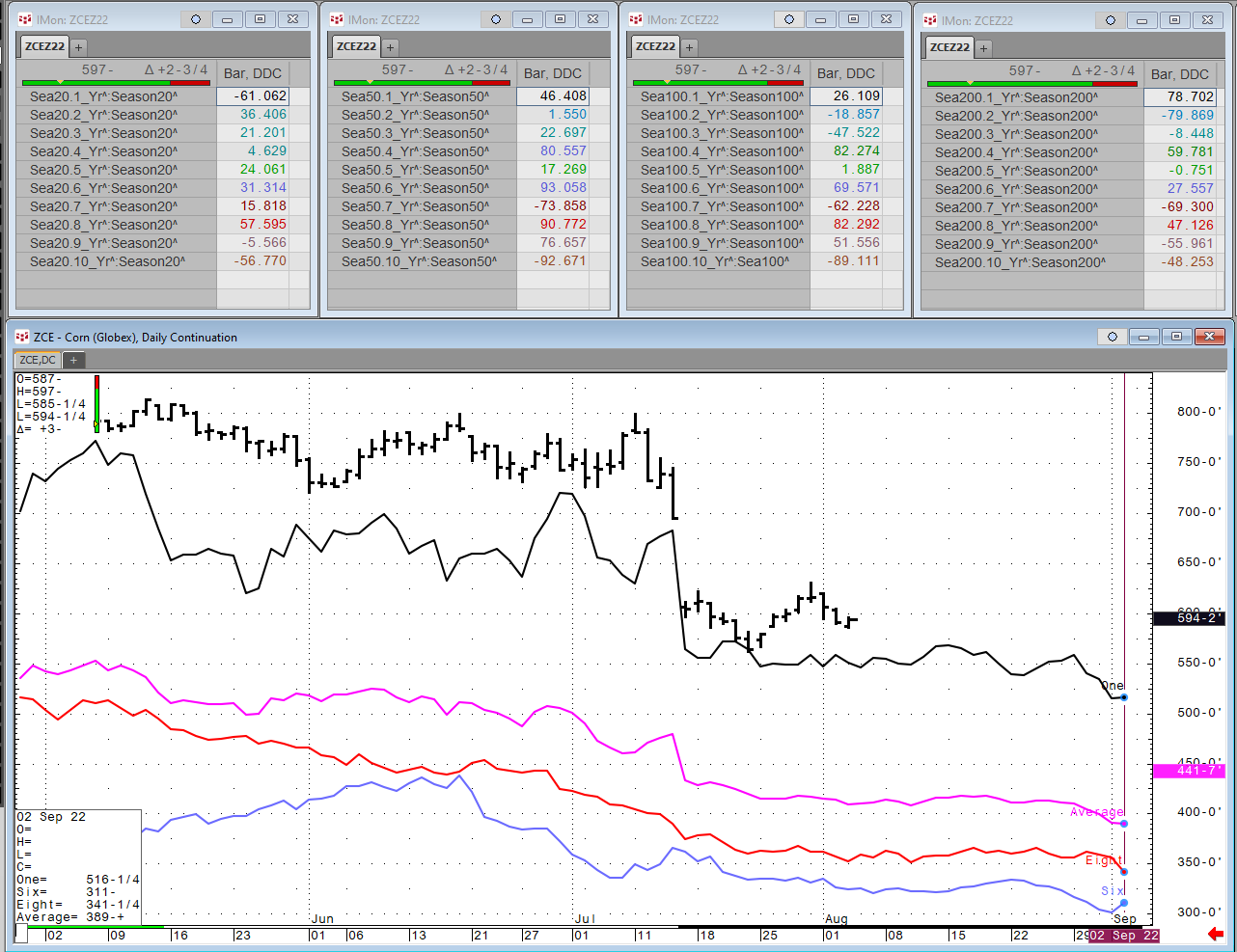

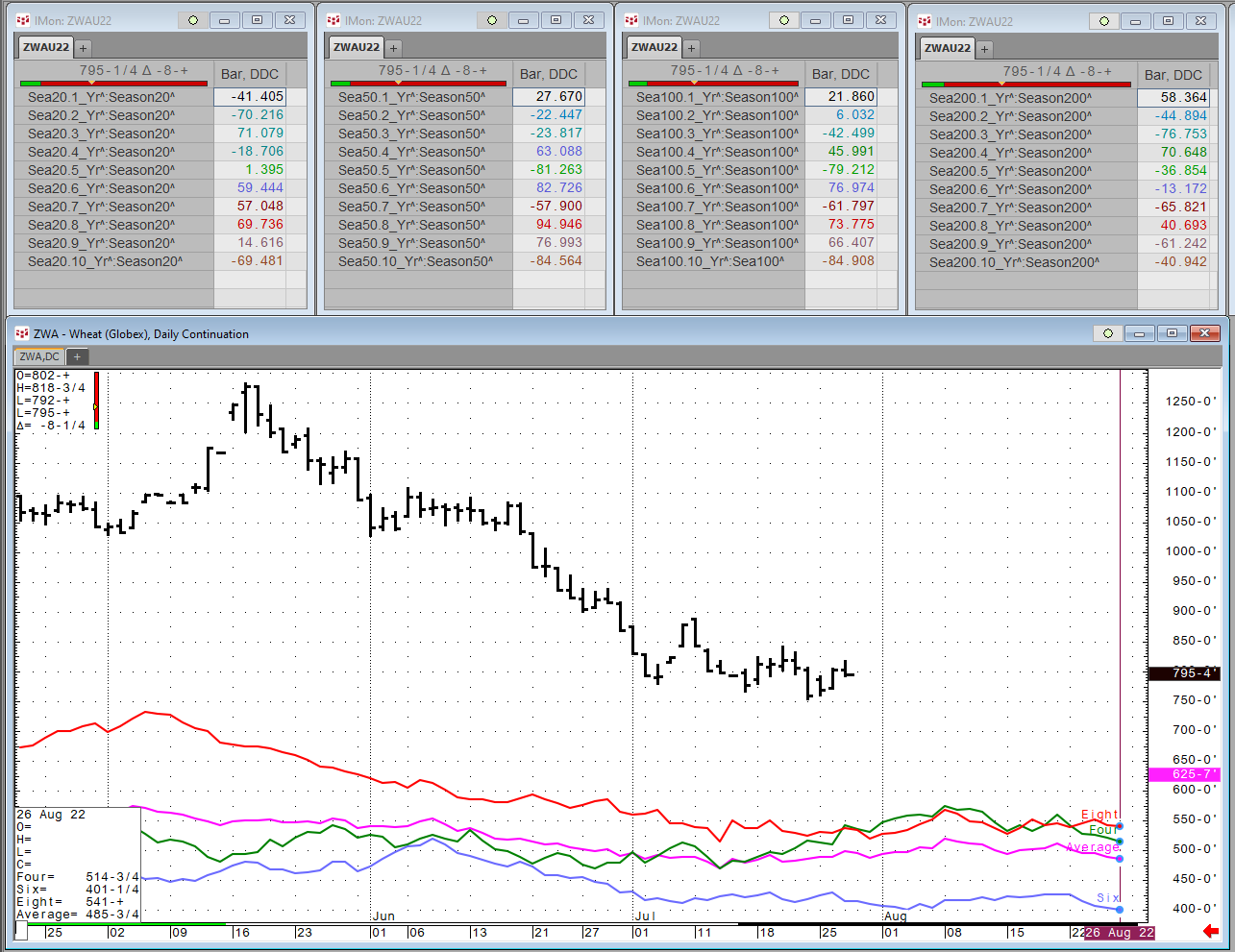

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Blogs

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

I yet another effort to understand where are going with the FED and their so-called NEUTRAL RATE, FRA hosted a podcast with Darius Dale of 42 Macro. It entertains themes familiar to readers of… more

Peter Boockvar: Chief Investment Officer at Bleakley Advisory Group and Editor of The Boock Report

Daniel Lacalle is a PhD in Economy and fund manager. He holds the CIIA… more

It has been quite an extended period since my last post, but now I’m trying to catch up on some reading and relevant research on all things pertinent to GLOBAL MACRO. Following the FEDERAL RESERVE… more

Darius Dale is the Founder… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

COMEX gold futures reached a record high in 2011 at $1,911.60. After a four-year correction, the price reached a bottom at $1046.20 in late 2015. In August 2020, the price eclipsed the 2011 high,… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more