The ongoing and escalating war in the Middle East between Israel and Iran and its proxies is not bearish for crude oil prices. However, other factors have led crude oil lower. China is the world's leading commodity consumer, and crude oil is no exception. Chinese economic malaise throughout 2024 has weighed on the demand for the leading energy commodity. Meanwhile, OPEC+ announced the cartel's intention to increase output by the end of 2024, weighing on prices. Moreover, U.S. daily output at 13.5 million barrels is at a record high, but the U.S. remains a net importer to meet petroleum demand requirements.

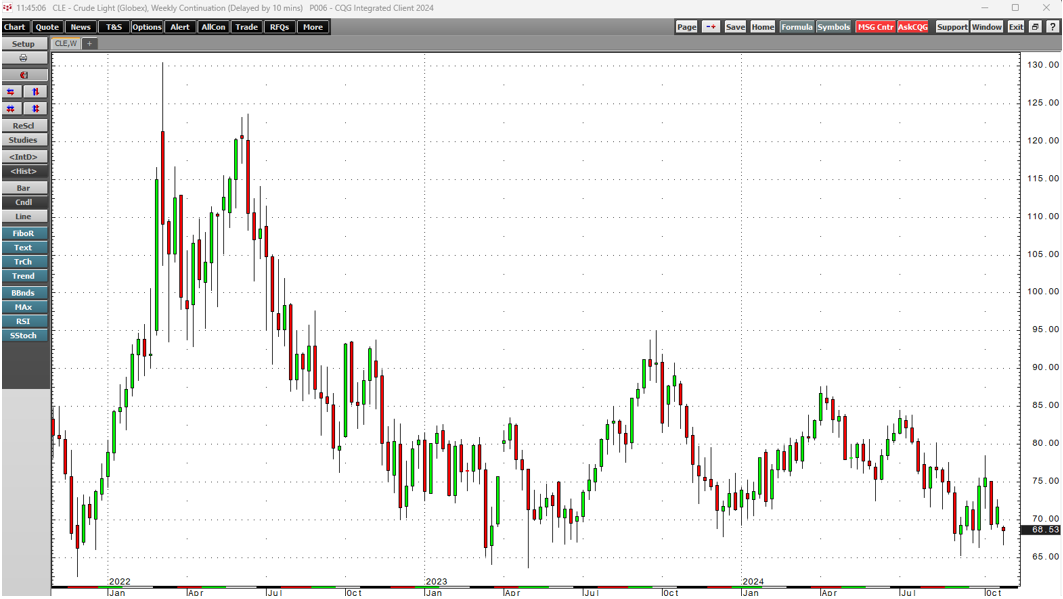

After reaching its highest price since 2008 at $130.50 per barrel in March 2022 when Russia invaded Ukraine, the NYMEX WTI futures price has made lower highs. In 2024, nearby NYMEWX futures reached a $87.67 peak in April and have moved around $20 per barrel lower.

Crude oil prices have trended lower since April

The April 2024 $87.67 high on the nearby crude oil NYMEX futures contract has led to lower highs over the past months.

The weekly chart highlights the bearish pattern in crude oil prices, which were trading below the $69 per barrel level in late October, not far above critical technical support levels at the September 2024 $65.27 and the May 2023 $63.64 per barrel lows.

Crude oil prices dropped in late October after Israel retaliated for Iran's missile attack, as Israel did not target Iranian petroleum production, refining, or logistical infrastructure.

Traditional energy policy is on the November 5 U.S. ballot

U.S. energy policy is one of the most significant factors for the future path of least resistance of the crude oil futures market.

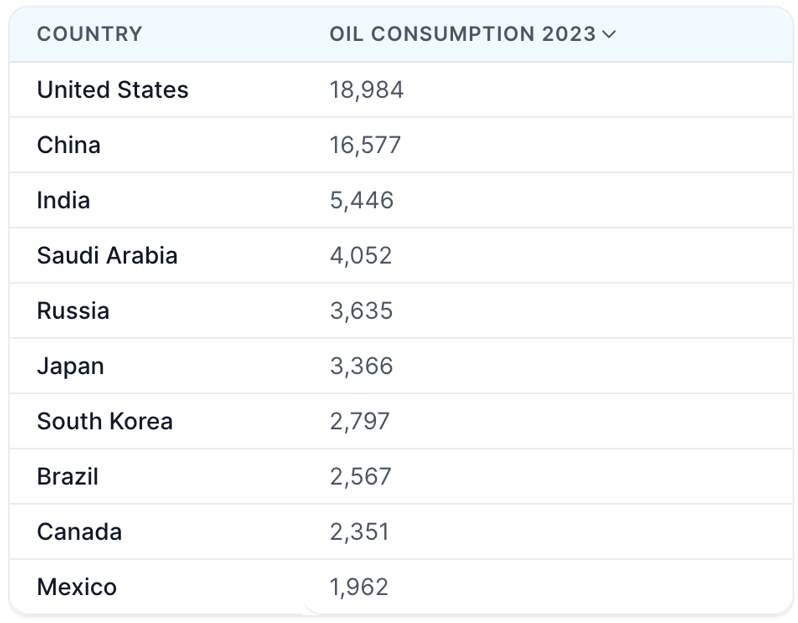

Source: worldpopulationreview.com

The chart shows that the United States is the leading crude oil-consuming country, with nearly 19 million barrels per day in 2023. China is second, but the weak economy has likely weighed on the demand in 2024.

Meanwhile, the U.S. production of 13.5 million barrels per day means that the U.S. is a net importer of the energy commodity.

The future of U.S. crude oil production and consumption is on next week's ballot in the Presidential election.

If the Vice President wins the election, expect stable to higher crude oil prices

If Vice President Harris becomes the 47th President of the United States, we are unlikely to see any significant changes in the Biden administration's energy policy and commitment to climate change initiatives.

The current administration has favored alternative and renewable fuels and inhibited fossil fuel production and consumption. Since crude oil remains the energy commodity that powers the world and most U.S. vehicles require gasoline, continuing U.S. energy policy under a Harris administration will likely keep pricing power with OPEC+, leading to stable to higher oil prices.

If the former President wins, crude oil prices could continue to decline

Former President Trump supports a "drill-baby-drill" and "frack-baby-frack" energy policy to achieve energy independence from OPEC+. Moreover, the former President has pledged to tap the vast U.S. crude oil reserves to make the U.S. the leading oil exporter and supplier. A Trump administration could mean daily crude oil output rises to over 20 million barrels per day, leading to much lower prices in 2025 and beyond.

The Middle East remains the factor that can cause short-term price spikes

Meanwhile, any improvement in China's economy could lead to rising demand, putting upward pressure on petroleum prices. Moreover, escalating hostilities in the Middle East that impact Iranian oil production, refining, and logistics could cause upward price spikes in the oil futures markets.

The bottom line is that crude oil is on the ballot in the November 5 U.S. Presidential election. Time will tell if the recent decline in prices predicted a second term for former President Trump as the polls remain a virtual dead heat.